Regarding payment solutions, international freelancers often prioritize banking platforms with minimal commissions and fees. As freelancers and independent contractors expand their reach globally, the challenge of managing international payments arises.

This guide will navigate international and foreign freelancers from selecting a remote work platform to choosing the best payment solutions, ensuring timely and efficient compensation.

What is a freelancer?

A freelancer is an independent professional who provides specialized services to diverse clients on a project-by-project basis.

Freelancing has become a favored career path for many, offering unparalleled flexibility and the freedom to operate from anywhere. This modern work style fosters creativity and empowers individuals to tailor their schedules around personal commitments, promoting a balanced work-life dynamic.

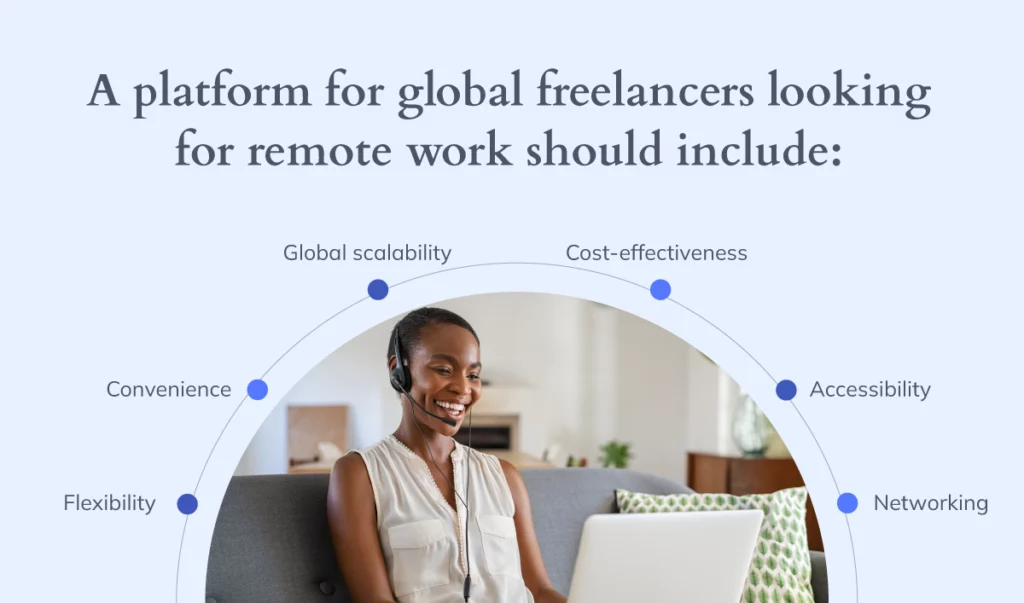

What should a platform for international freelancers looking for remote work include?

There are many options available online for freelancers looking for remote work or clients from other countries. The most common reasons for using them tend to be:

- Convenience: Work opportunities from anywhere, without mobility restrictions.

- Scalability: Find areas for professional development by connecting with industries of different fields and levels of expertise.

- Flexibility: Access full-time and part-time contract opportunities and independent projects.

However, fees and commissions on several platforms can significantly reduce your net income.

What to consider when selecting the right platform to work with international clients?

Working independently gives you the freedom to choose which clients you work with and which platforms you get paid on. Use this freedom to maximize your income and minimize cross-border transaction fees. Here are some tips to help you become part of the international freelance community:

- Research and compare platforms

Finding remote work opportunities, whether they be remote jobs or freelance projects, means choosing the best option for you. Consider factors such as:

- Fees and commissions. Analyze the commissions they charge both you and your potential clients. Choose a platform that charges less to increase your revenue while minimizing costs.

- Quality of available clients. Consider which platform has a broader and more diverse client base to increase your work opportunities. Also consider their reputation for fraud prevention.

- User Experience. Some platforms are more intuitive and user-friendly than others, making it easier to promote services and get found by potential clients.

- Read reviews and testimonials from other freelancers

Reviews and opinions can be an excellent source of information about the different platforms available. Read both positive and negative reviews to get a balanced view of each.

- Ask your colleagues

Feel free to ask your colleagues about their experiences with international payments and which platforms they have used. It’s a great way to get recommendations and advice from those who have been through the process you’re starting.

- Use alternative payment platforms

Some platforms offer alternative payment options, such as direct deposits to a bank account or payments through e-wallets. These options can be more convenient and save you money on transaction fees. Try Bancoli.

The Major Challenges of Receiving International Payments as a Freelancer

For freelancers working with international clients, receiving payments from a foreign country should be straightforward. However, the reality often presents various challenges impacting their earnings and cash flow. Let’s delve into some of the most common obstacles freelancers face when dealing with cross-border transactions and overseas payments:

Exchange fees

When converting payments from one currency to another, freelancers often encounter significant exchange fees, which can eat into their earnings. Therefore, sending money to pay freelancers overseas also involves monitoring foreign currency exchange rates.

Receiving payments

Not all platforms are prompt with their payouts. Some might impose delays, additional fees, or set minimum withdrawal limits, causing inconvenience.

Payment times

Due to various banking processes and intermediaries, money transfers can sometimes be time-consuming, leading to longer waiting periods for funds.

Multi-currency payments

Managing multiple currencies requires careful tracking and can become complicated, especially when dealing with fluctuating exchange rates and more than one bank account.

Payment terms

Understanding and negotiating payment terms is crucial to ensure timely payments and avoid potential disputes or misunderstandings.

How to Receive Payment as a Freelancer?

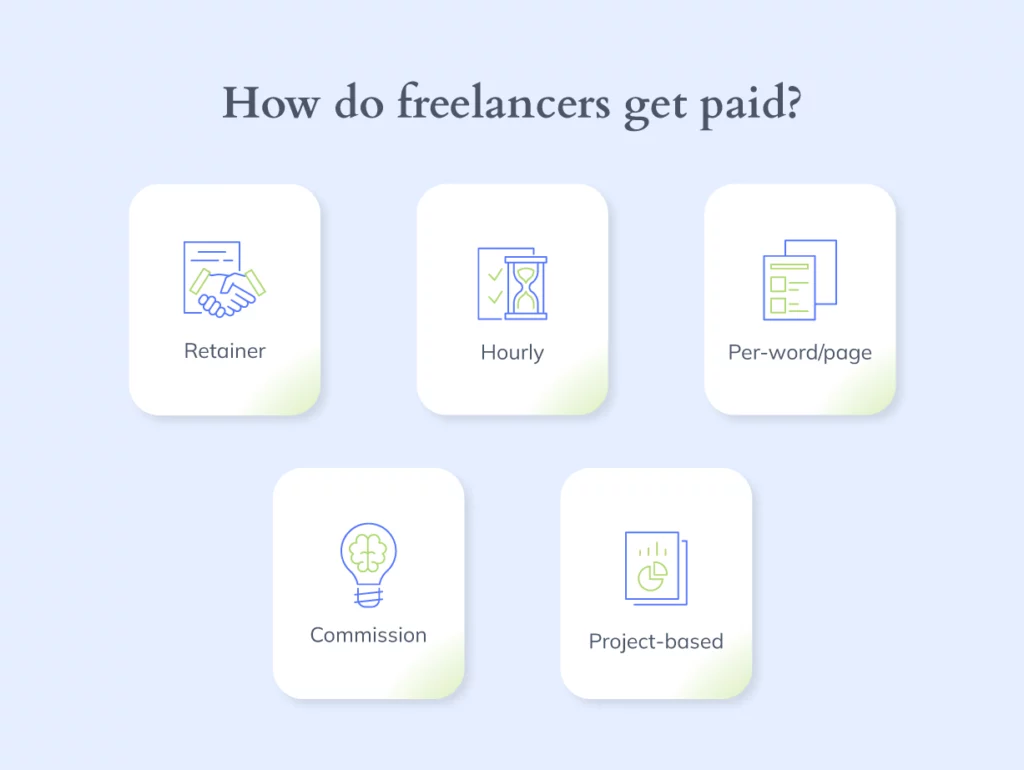

Diverse Payment Structures: Freelancers Payment Models

In the dynamic world of freelancing, professionals can choose how to be compensated for their services. Depending on the nature of the work, the client’s preferences, and the freelancer’s expertise, several payment structures are available to pay freelancers. Here’s a closer look at the most common payment models adopted by freelancers:

- Hourly: Freelancers are paid for the hours they work. It’s especially suitable for unpredictable tasks or evolving long-term projects.

- Project-based: A fixed amount is decided based on the project’s scope. It’s best for well-defined projects, allowing freelancers to work at their own pace.

- Retainer: Freelancers receive consistent payments for clients needing regular services, ensuring their ongoing availability.

- Per-word/page: Common in the writing and editing industry. Freelancers are paid based on the content’s length, making it a quantifiable payment method.

- Commission: Freelancers in sales or affiliate roles earn a percentage of their sales or profits, potentially yielding high returns.

Choosing a suitable payment model is crucial for both freelancers and clients. It ensures fair compensation for the freelancer while providing value and clarity to the client.

6 Payment Methods for International and Foreign Freelancers

International freelancers often work with clients from different countries, necessitating various payment methods to ensure smooth transactions. Here’s a closer look at six popular payment methods that international freelancers can consider:

Wire transfers

A wire transfer is a secure payment method for handling large amounts—you need to have the SEPA or SWIFT code handy to schedule bank transfers. However, they often come with high currency conversion fees, transfer fees, and unexpected costs, especially for international transfers.

ACH (Automated Clearing House)

Ideal for affordable, direct, and regular payments, ACH transfers are efficient for paying foreign contractors and overseas freelancers. However, they might not be the preferred payment method due to speed and availability.

Paper checks

Some clients still use a traditional payment method, paper checks, to pay freelancers overseas. While simple, they can process slowly, especially when sent internationally.

P2P payments

Platforms like PayPal offer quick and easy transactions. They’re great for small amounts, but freelancers should be aware of potential transaction limits and fees.

Card payments

Accepting credit card or debit card payments is convenient for both freelancers and clients. However, processing fees can add up, especially for large invoice payments.

Freelance marketplaces

Platforms like Upwork and Fiverr provide a secure environment for freelancers to find work and receive payments. While these freelance marketplaces offer payment protection, they also take a commission from the freelancer’s earnings.

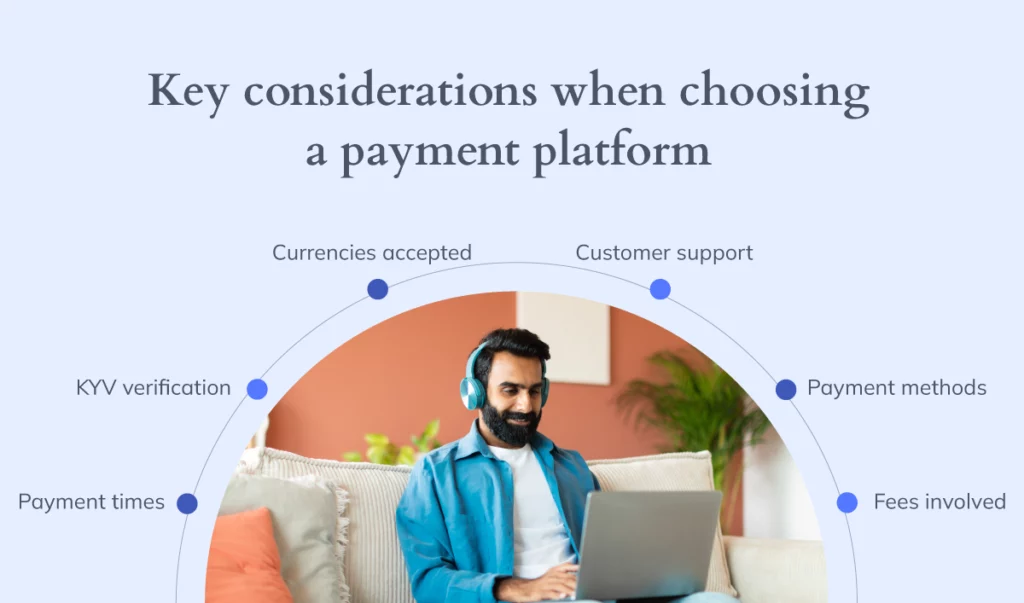

What to consider when selecting the right payment solution as a freelancer

- Currencies accepted: Can the platform handle multiple currencies?

- Processing times: Do you have instant access to your funds? How long before you receive your money?

- Fees involved: Are there hidden charges, minimum balance requirements, or a monthly maintenance fee?

- Payment methods: Does it offer your preferred method?

- KYV verification: Are you confident about the authenticity of your vendor/client?

- Customer support: Can you rely on their support in case of issues?

6 Best Practices for Choosing the Best Way to Accept Payments

1. Assess your services and clientele

Understanding your client’s needs and preferences will guide you toward a payment solution that ensures client satisfaction.

2. Analyze your business framework

Whether a freelancer or an independent contractor, choose a solution that aligns with your business model.

3. Weigh transaction size and regularity

Some methods are better for frequent small transactions, while others are suited for larger, less recurring payments. Evaluate your transaction patterns to make an informed decision.

4. Consider user experience

Selecting a user-friendly payment method and solution boosts client trust and ensures smooth invoice settlements.

5. Familiarize yourself with fees

Know all costs, including the exchange rate and transfer fees, to avoid surprises and protect your earnings.

6. Prioritize security

Choose a payment solution like Bancoli that prioritizes the safety of your funds and includes Know Your Vendor verifications.

Bancoli: Streamlining Global Payments for Freelancers

Bancoli is a B2B invoicing, banking, and payment solution tailored for freelancers. It ensures swift, hassle-free transactions for all parties involved.

Born from the shared experience of dealing with complex transactions and high fees, Bancoli presents a transparent, secure, and immediate international money transfer solution, emphasizing flexibility and scalability.

With a focus on enhancing profitability for both buyers and sellers, Bancoli provides cost-effective financial services without compromising business gains.

How does Bancoli work for freelancers?

Bancoli is designed with freelancers in mind, offering a seamless solution for international operations. With its user-friendly interface and robust features, it stands out as a preferred payment solution for many.

Bancoli is a banking platform for:

- The global community of professionals, SMBs, overseas freelancers, digital nomads, and entrepreneurs who want to manage their finances efficiently.

- Those who want to save on payments and receive full amounts when working with foreign business partners.

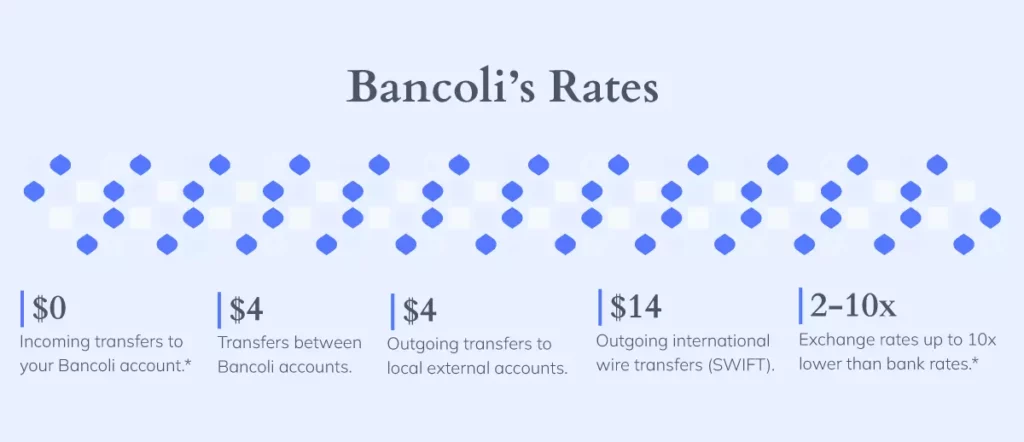

- Optimization of cross-border payments. Unlike traditional banks, Bancoli charges low fees and offers global currency coverage.

Features of Bancoli’s Global Business Account

- Multi-currency account with local details for USD, EUR, GBP, HKD, and SGD.

- Business account capabilities to transact in 25+ currencies across 200+ countries, including accepting debit and credit card payments in any currency.

- Receive and send money globally, taking advantage of instant transactions between Bancoli accounts.

- Multi-currency e-invoicing to send invoices directly to your client’s account and secure payments with minimal fees.

- Competitive currency exchange rates and the best transfer fees in the market.

- U.S. bank-grade KYV verifications and security.

- 4 membership plans: Vault, Vault Plus, Vault Premium, and Vault Entreprise.

Final Thoughts: Collect Payments as a Freelancer

Navigating international transactions as a freelancer can be daunting. However, it becomes a breeze with the right knowledge and bank account.

Platforms like Bancoli are more than online payment platforms. They are transforming how freelancers handle their finances, making it easier than ever to work with clients worldwide.