In the ever-evolving landscape of global finance, SEPA (Single Euro Payments Area) payments are emerging as a pivotal force, transforming how businesses manage their finances.

This innovative approach, adopted by many financial institutions, redefines the efficiency of cross-border payments. SEPA stands out as a streamlined platform, bridging the gap between the complexity of international transactions and the simplicity of domestic payments.

Gone are the days when businesses grappled with hefty currency conversion fees and convoluted cross-border payment options. SEPA payments empower businesses to easily transfer funds across borders akin to domestic electronic payments. This not only helps save money but also simplifies the financial processes.

This article delves into how SEPA is revolutionizing the financial world for businesses. We’ll explore the basic steps in making a SEPA payment and how businesses can leverage this platform to enhance their financial operations.

What is SEPA?

SEPA is an initiative of the European Union that standardizes payments to facilitate easier, faster, and more efficient transactions across European nations. This streamlined process encompasses various payment methods, including credit transfers, direct debits, and card payments.

The Single Euro Payments Area (SEPA) stands as a monumental development in the realm of European finance. It represents a unifying force, harmonizing how payments are processed across Europe. SEPA’s inception and evolution have significantly influenced how businesses and individuals handle financial transactions within countries and across European borders.

By simplifying and unifying payment methods, SEPA has effectively erased the financial borders within the EU, enabling businesses and consumers to make and receive payments under the same basic conditions, rights, and obligations, irrespective of their location.

How do SEPA transactions work?

SEPA works with transactions involving the euro, regardless of where the sender and receiver are located. While most SEPA member states are in Europe, some non-European countries also participate.

Here’s a breakdown:

Transactions supported by SEPA

- Within the SEPA zone: This includes all EU member states (except Denmark) and several non-EU countries like Iceland, Norway, Switzerland, and Liechtenstein. Transactions in euro between accounts in these countries are treated as domestic payments, regardless of the location.

- Between the SEPA zone and non-SEPA countries: Some non-SEPA countries have agreements with SEPA members, allowing euro payments to be processed through the SEPA network. However, these transactions might incur additional fees and take longer to process.

Transactions not supported by SEPA

- Non-euro transactions: SEPA only works with euro payments. If you make a payment in another currency, it will not be processed through the SEPA network.

- Transactions within non-SEPA countries: SEPA does not directly cover transactions within non-SEPA countries, even if they use the euro.

The Emergence of The Single Euro Payments Area: A New Banking Standard

The journey of SEPA began in the early 2000s, with the European Payments Council (EPC) playing a pivotal role. The fragmented nature of European financial systems, where each country had its own set of rules and standards for processing payments, posed significant challenges for cross-border trade and economic integration.

The EPC, in conjunction with the European Central Bank and the European Commission, initiated SEPA as a means to unify payment structures across the European Union (EU). This initiative was a response to the growing need for an efficient, cost-effective, and seamless payment system that could support the dynamic economic environment of the EU.

The Aim and Purpose of SEPA in the European Financial System

The primary aim of SEPA is to create a single market for euro payments within the EU. By doing so, it not only simplifies the payment process but also enhances the efficiency of border payments. SEPA’s role extends beyond mere transactional convenience; it’s an essential component in the broader objective of the EU to foster economic and financial integration among its member states.

The right payment methods – those that are quick, reliable, and uniform across countries – are crucial in achieving this goal. SEPA aligns with the EU’s vision of a barrier-free payment area, where consumers and businesses can make cashless payments across Europe as effortlessly as they would within their own countries.

The Role of the European Central Bank and European Commission

The European Central Bank (ECB) and the European Commission have been instrumental in elevating SEPA as a premier cross-border payments platform, significantly boosting cross-border payments efficiency.

Their collaborative efforts have streamlined the process of sending cross-border payments, making international money transfers more accessible and user-friendly. By fostering cooperation among European banks, they have facilitated various payment options, ensuring that money transfers occur smoothly within the SEPA framework.

This synergy has enabled businesses and individuals to transact in their own currency, enhancing trade across global markets. The ECB’s role extends beyond facilitation; it diligently oversees SEPA’s performance. It also ensures that this single platform consistently adheres to the high standards set by these regulatory bodies. Maintaining the integrity and efficiency of cross-border transactions within the SEPA system.

The Geographical Reach of SEPA

As of January 2022, SEPA has 36 member-states: Andorra, Austria, Belgium, Britain, Bulgaria, Cyprus, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Republic of Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Poland, Portugal, Romania, San Marino, Slovenia, Slovakia, Spain, Sweden, Switzerland, Vatican City & the 3 EEA countries of Norway, Liechtenstein, Iceland.

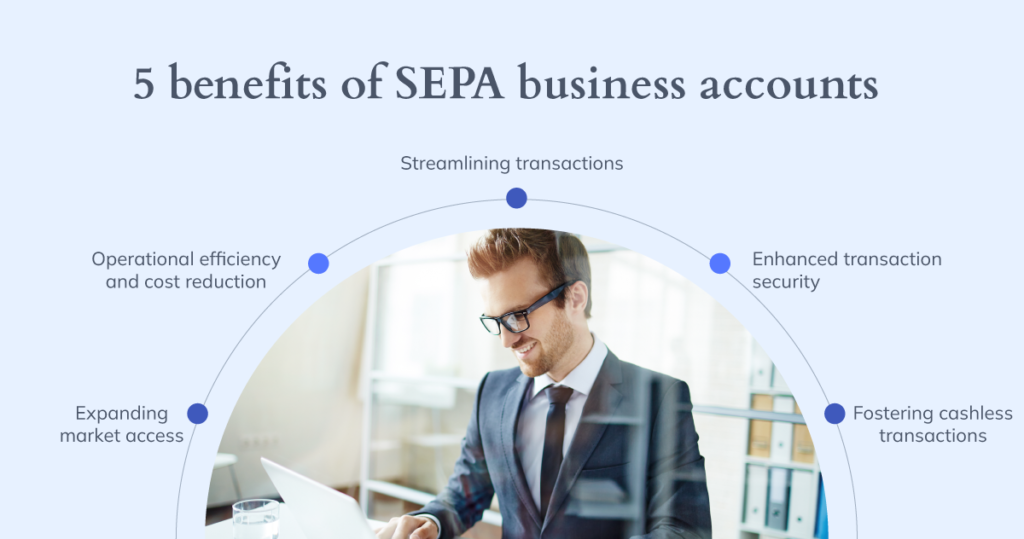

Advantages of SEPA Accounts for Businesses

Implementing the Single Euro Payments Area (SEPA) accounts has revolutionized the dynamics of financial transactions for businesses across Europe.

The most notable aspect of the SEPA is the ability to make Global ACH payments. This payment method allows you to make cross-border payments on time without high transaction fees associated with international wire transfers. It also eliminates the hassle of using paper checks.

You can achieve optimal tracking with a payments platform that automates global ACH payments. This gives you a view of each payment, including payment status updates, invoice due dates, and failed payments.

Streamlining Transactions

SEPA has significantly enhanced the speed and efficiency of cross-border payments within the EU. By standardizing the payment methods, SEPA allows businesses to accept payments more swiftly than traditional methods. This streamlined approach eliminates the delays often experienced in international trade, particularly in wire transfers and dealing with varying exchange rates.

The harmonization of transactions means that businesses can expect the same level of efficiency in cross-border payments as they do with domestic and international payments now, ultimately improving the overall payment experience for both businesses and consumers.

Operational Efficiency and Cost Reduction

SEPA creates a single market for euro payments, boosting economic activity and cross-border trade. By unifying the payment methods across the EU, transaction fees are significantly reduced, especially when compared to the fees associated with traditional cross-border payment methods. This uniformity in transaction fees simplifies the payment process and helps businesses with better financial planning and management.

Consolidating multiple bank accounts into a single SEPA account reduces administrative burden and overheads. This allows businesses to focus more on growth and less on managing financial logistics.

Enhanced Transaction Security

Security remains a paramount concern in the payments industry. SEPA requires strong authentication and fraud prevention measures, offering better protection against financial crime. The standardized format and centralized infrastructure of SEPA facilitates monitoring and analysis of payment activity.

SEPA regulations provide robust consumer protection mechanisms, including dispute resolution procedures.

Fostering Cashless Transactions

SEPA plays a pivotal role in promoting digital payments across the European Union. SEPA customers can make cashless euro payments – via credit transfer and direct debit – to anywhere in the European Union, as well as a number of non-EU countries, in a fast, safe, and efficient way, just like national payments.

Expanding Market Access

One of the most significant impacts of SEPA is its role in expanding market access for businesses within the European Union. SEPA’s unified payment system breaks down the financial barriers that previously hindered international trade.

Thanks to standardized payment processes, businesses can now easily tap into new markets. This access to a broader market drives growth and fosters competition and innovation within the European business landscape.

Navigating SEPA Payments: A Step-by-Step Guide

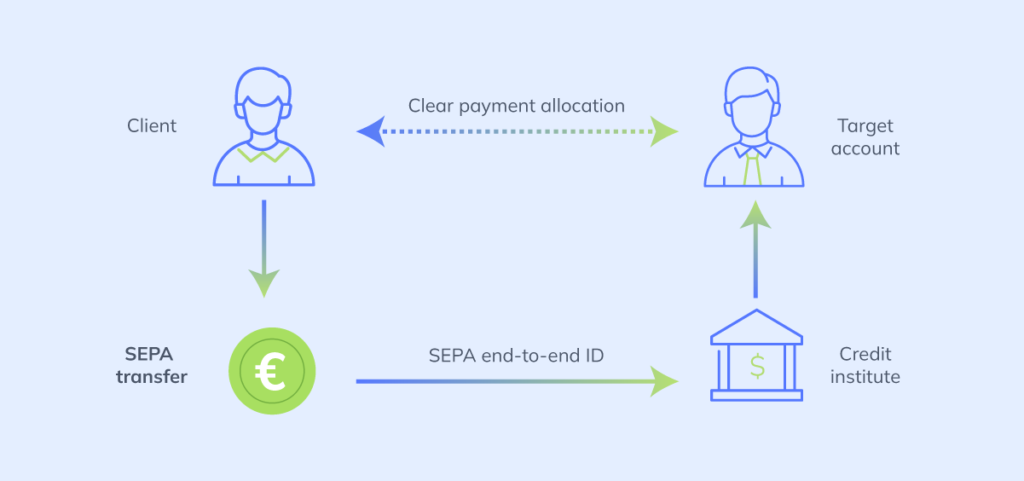

Every bank account in the SEPA area is assigned an International Bank Account Number (IBAN), the European equivalent of a US account number.

Like domestic bank transfers made using the ACH and Fedwire networks require both parties’ bank account and routing numbers to complete a funds transfer, SEPA transfers require the IBAN identification codes of all European accounts involved in the transaction.

Here’s an overview of how different types of SEPA transfers work:

SEPA Credit Transfer

SEPA Credit Transfers are one-time funds transfers between banks with IBAN codes. These transfers are conducted in euros and are commonly used for consumer purchases in SEPA countries.

If you’re a business that is not based within the SEPA area, you wouldn’t use this type of transfer since both the issuing and receiving financial institutions must be located in SEPA countries.

SEPA Instant Credit Transfer

Whereas most transfers between accounts require submitting a transfer request and waiting anywhere from hours to days for it to be settled, SEPA Instant facilitates real-time transfers in amounts up to €100,000.

Using this method, euro-based transactions can be completed by any two account holders in the SEPA area at any time, on any day, and will be processed immediately. Ninety-nine percent of SEPA Instant Credit Transfers are completed within five seconds and can be made using smartphones.

SEPA Direct Debit

Direct Debit is not exclusively for non-EU businesses to interact with accounts within SEPA. SEPA Direct Debit is a reusable notification payment method, which means payment data from it can be internally associated with the customer and reused by the business in authorized capacities.

It’s also a delayed notification payment method, meaning the success or failure of the transaction is only known after the transaction has finished processing, which can take several days.

The Global Business Account: Unlock the Potential of SEPA

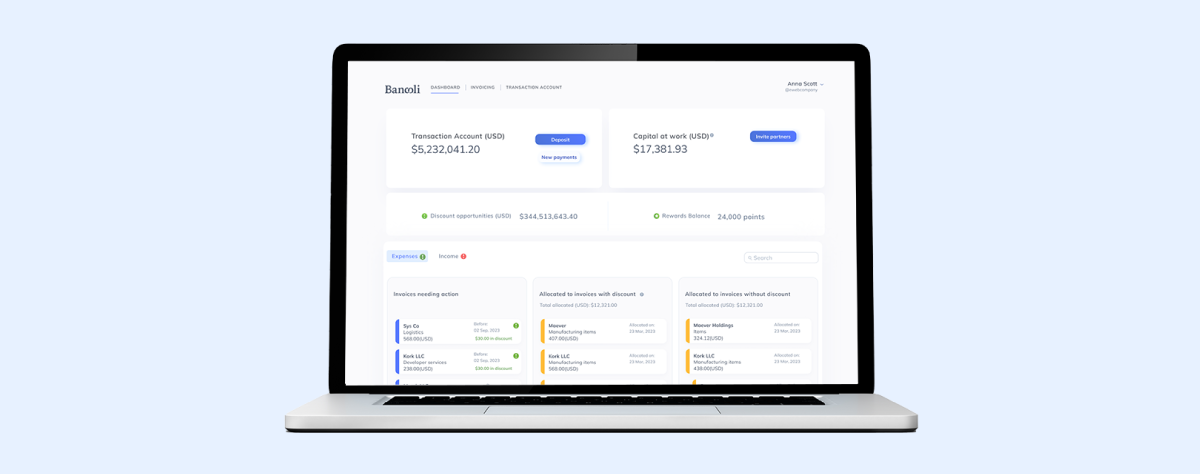

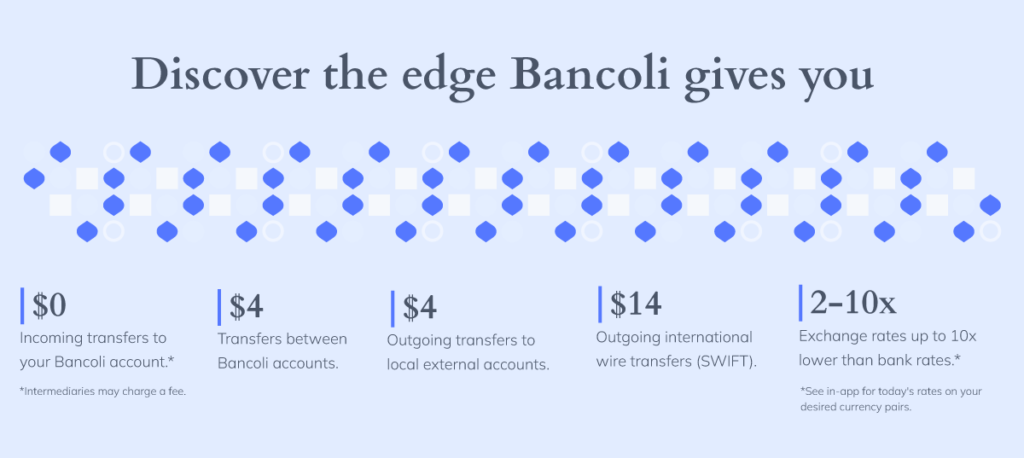

Bancoli’s Global Business Account, which supports SEPA cross-border transactions, is designed to fuel your business growth. This multi-currency account, equipped with real-time tracking, streamlines your financial operations and positions your business for global success.

Features and Benefits of Bancoli’s Global Business Account

Bancoli’s Global Business Account is a comprehensive financial tool designed to cater to the multifaceted needs of modern businesses. Below is an in-depth look at its features and benefits:

1. SEPA Integration for Efficient Cross-Border Payments:

- The account seamlessly supports SEPA cross-border transactions, allowing for efficient and cost-effective cross-border payments within the European Union. This integration means lower transaction fees and simplified regulatory compliance, crucial for businesses engaged in European markets.

2. Multi-Currency Capabilities:

- Designed for global trade, the account allows transactions in multiple currencies, such as EUR, GBP, and USD. This feature is invaluable for businesses operating in different countries, reducing the impact of fluctuating exchange rates.

3. Real-Time Tracking and Reporting:

- Bancoli provides real-time tracking of transactions, giving businesses a clear view of their financial activities. This feature is crucial for effective cash flow management, enabling businesses to make informed financial decisions promptly.

4. Robust Security Measures:

- The account incorporates advanced security protocols, including end-to-end encryption and two-factor authentication (2FA). Its unmatched fund protection for up to $125 million dollars (USD) is up to 500 times greater than traditional U.S. FDIC insurance and more than 1000 times greater than European bank insurance. These measures ensure the safety and confidentiality of financial transactions, which is essential in today’s digital age.

5. Streamlined International Trade:

- The account is an asset for businesses engaged in international trade. It simplifies wire transfers and other cross-border payment methods, making international transactions more straightforward and less time-consuming.

Empowering Global Business Operations

The efficacy of Bancoli’s Global Business Account (GBA) is best illustrated through real-world examples. Here, we explore case studies of diverse businesses that have harnessed the power of GBA to thrive in the global market.

Case Study 1: Expanding E-Commerce Boundaries

Business Background: A rapidly growing e-commerce platform specializing in bespoke apparel, with suppliers in Asia and a customer base spread across Europe and North America.

Challenge: The business faced challenges in managing multi-currency transactions, grappling with high transaction fees, and delays in cross-border payments, which affected their cash flow and supplier relationships.

Solution with GBA: By switching to Bancoli’s GBA, the e-commerce platform streamlined its payment processes. The multi-currency feature allowed for easy handling of transactions in different currencies, significantly reducing exchange rate losses.

The seamless SEPA integration facilitated efficient payments to European customers, faciitating and elevating the commercial relationship.

Outcome: The business saw a 30% reduction in transaction costs and a significant improvement in payment processing times.

This efficiency led to stronger supplier relationships and an enhanced customer experience, contributing to a 25% increase in sales within six months.

Case Study 2: Tech Startup Leverages Global Reach

Business Background: An innovative tech startup based in Germany, developing AI-driven software solutions for international clients, primarily in the EU and North America.

Challenge: The startup struggled with managing its international transactions, especially the high fees associated with cross-border payments and managing multiple accounts in different currencies.

Solution with GBA: Bancoli’s GBA provided a unified solution for the startup’s financial transactions. The account’s real-time tracking feature enabled the startup to monitor its finances accurately, aiding in better financial planning and decision-making.

Outcome: The tech startup experienced a streamlined financial workflow, reducing the time spent on managing finances by 40%.

The ease of international transactions through GBA played a pivotal role in the startup’s expansion, enabling it to secure two significant contracts in new markets.

Case Study 3: Manufacturing Firm Enhances Efficiency

Business Background: A mid-sized manufacturing firm in Spain, exporting goods to various European countries and dealing with a network of suppliers worldwide.

Challenge: The firm faced operational inefficiencies due to varied local payment methods and the need to meet diverse regulatory requirements. Additionally, the fluctuating exchange rates were a constant concern.

Solution with GBA: Adopting the Global Business Account allowed the firm to centralize its payment processes. Compliance with SEPA’s regulatory requirements eased the burden of cross-border payments within the EU. The firm also leveraged GBA’s robust security measures to ensure the safety of its transactions.

Outcome: There was a noticeable improvement in operational efficiency, with a 35% reduction in the time spent on financial administration. The firm also benefited from improved security and compliance, reinforcing its reputation as a reliable and efficient business partner.

These case studies underscore the transformative impact of Bancoli’s Global Business Account in various business contexts.

By providing a versatile, secure, and efficient financial platform, our GBA empowers businesses to navigate the complexities of global operations, fostering growth and success in the competitive international landscape.

In conclusion

The Single Euro Payments Area (SEPA) has revolutionized the European financial landscape, marking a significant leap in how the global economy handles payments, particularly international payments. SEPA’s streamlined approach to transactions fosters innovation in financial services and enhances the efficiency of operations, playing a crucial role in shaping the future of European and global finance.

The introduction of SEPA has opened up new revenue streams and enabled real-time payments, altering the time perspective in which these transactions are processed quickly and efficiently. As SEPA continues to gain traction, its influence on both the international and European economies is set to grow, offering businesses an undeniable competitive edge.

In this evolving economic climate, leveraging SEPA through platforms like Bancoli’s GBA positions businesses to confidently navigate and thrive in the international financial landscape.

Frequently Asked Questions

1. What types of transactions does SEPA support?

The Single Euro Payments Area supports three primary transaction types: credit transfers (SCT), direct debits (SDD), and card payments. All transactions are processed in Euros and cover various financial activities, such as bill payments, salary deposits, and online purchases.

2. How does SEPA differ from SWIFT?

While both SEPA and SWIFT facilitate cross-border transactions, they serve different purposes. SEPA is focused on cross border transactions, specifically on harmonizing and simplifying Euro payments within Europe. On the other hand, SWIFT is a global messaging network that enables financial institutions to exchange information across borders securely.

3. What security measures are in place for SEPA transactions?

SEPA adheres to strict security guidelines and employs robust measures such as end-to-end encryption, two-factor authentication (2FA), and secure communication protocols to protect sensitive data and prevent fraud.

4. Can non-European businesses benefit from SEPA?

Yes. Non-European businesses can take advantage of SEPA’s streamlined processes and reduced transaction costs by opening a SEPA-compliant account, using payment providers such as Bancoli’s Global Business Account.