Business Banking and Payment Gateway

Global money movement without the headaches

Pay and get paid easily in stablecoins and on your new, dedicated local payment details issued by Bancoli, a fully licensed and chartered US Bank.

You are in safe hands, surrounded by a trusted team

Bring funds

home faster in

40+ currencies

Start with sending your clients an enticing offer or just an easy low cost local payment rail. Get paid on your dedicated named account and bring funds home in 40+ currencies.

Get real interbank FX rates on 25+ currencies and use local rails to make withdrawals fast and efficient.

0% FX Fees

Convert 25+ currencies with the real interbank rate and use local rails to make payouts fast and efficient.

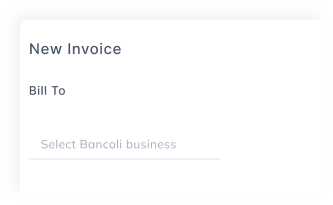

Yield Generation

Generate attractive returns through instant discounts and rewards by simply paying invoices.

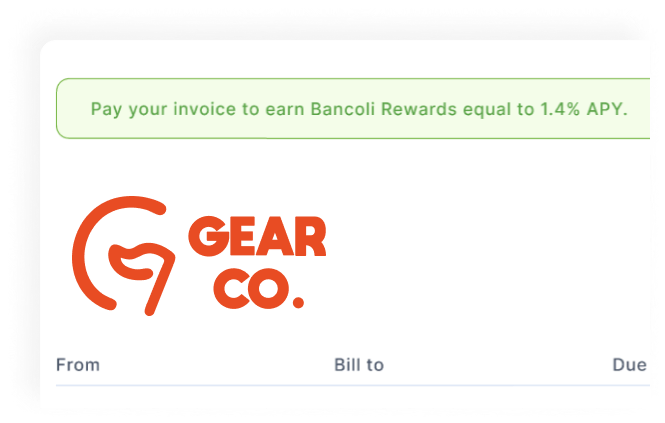

Global Banking

Get local bank account details for your business. Make seamless global payouts in 40+ currencies.

Transact globally, collect locally

Get real interbank FX rates and send or receive payments with Bancoli's trusted and verified business network.

Automatic rewards for timely payments

Make buyers happy with automatic rewards, even if you didn't offer a discount for early payments.

Get paid from abroad

Make and receive payments in multiple currencies and increase liquidity with Bancoli.

Our passion is

safe and efficient

global payments

Bancoli was born out of our own needs, as we were paying our global suppliers over the years. We've found that enabling direct and timely payments improved not only both parties' financial results but also the overall relationship.

Today, Bancoli automatically streamlines and accelerates payments between businesses, with the opportunity to generate meaningful benefits for both parties in international transactions.

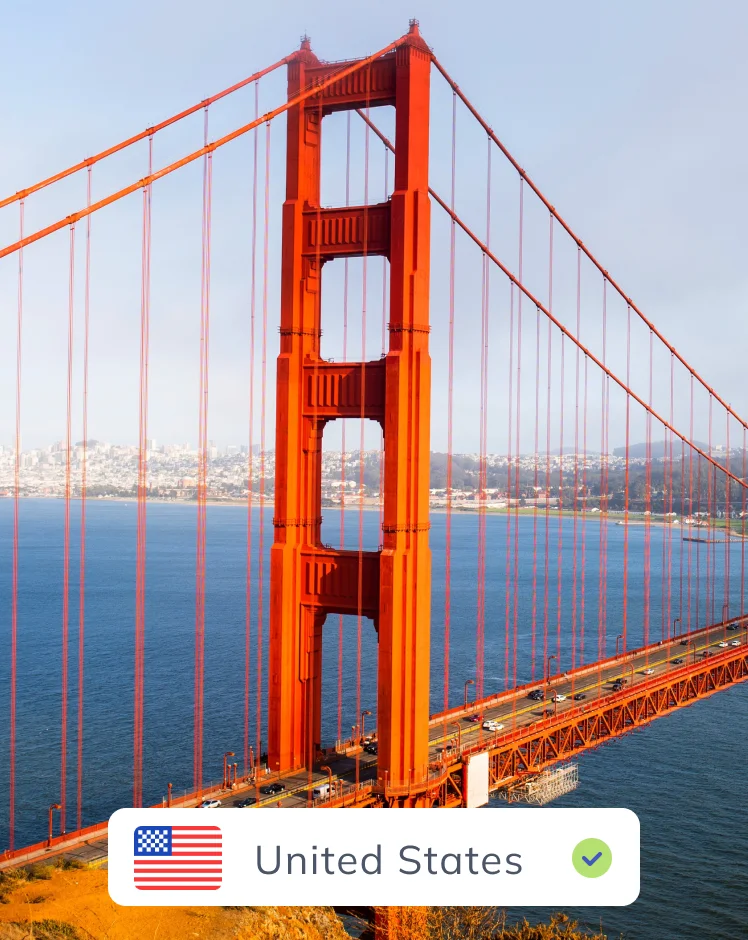

Focus on growth instead of collections

74%

of businesses reported a cash flow issue during the past 24 months.

Over 37%

of U.S. businesses report that their need for liquidity has increased.

25%

of SMBs cannot access business funding due to poor cash flow and earnings.

Only 38%

of businesses with revenue less than $5 million are approved for bank loans.

40%

of SMBs would have to close if their cash flow got disrupted due to unforeseen circumstances.

Featured in