Global Business Account: Your Business Multi-Currency Account

Travel to

close deals,

not to open bank accounts

Let Eric, Bancoli's AI, help you open your new bank accounts with your business name.

Available in over 200 countries.

Eric helps you open bank accounts, issue invoices, and speed up receivables by rewarding your buyers automatically.

Get paid for free and make payouts in 30+ currencies at market-leading conversion rates.

Benefit from outstanding global FX rates and minimal fees on every transaction.

Bank globally with your own account details.

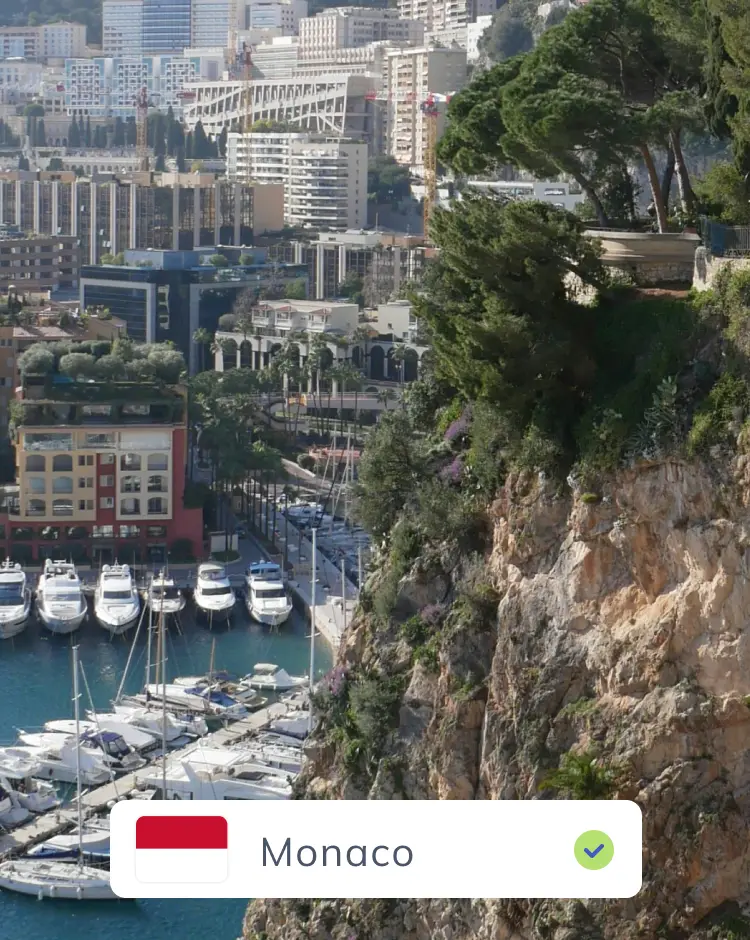

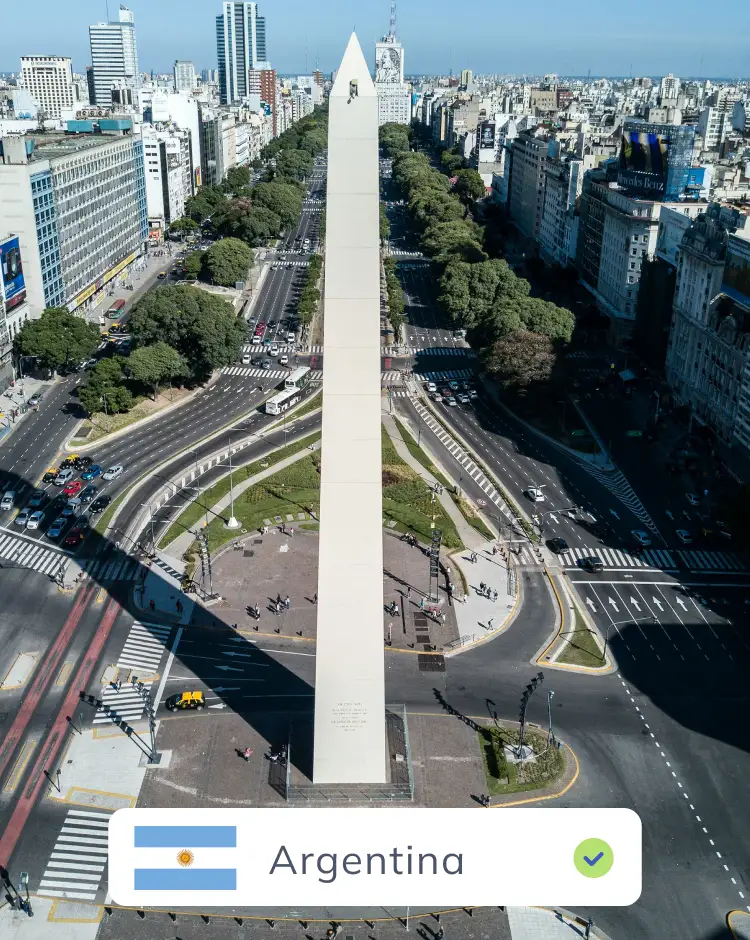

Non-resident accounts available for global movers and shakers

Opening local bank accounts across borders is difficult.

Eric helps you open different bank accounts with local payment details so your buyers can pay you exactly like paying a domestic vendor.

Eric helps you

get paid on time

Eric (Bancoli's AI) assists you with accelerating cash flow by helping you create enticing offers, automatically following up with your clients on due payments, and prioritizing payment methods that settle faster than credit cards. Eric can help you eliminate the need for loans and expensive credit.

Make large global transfers with ease

Dealing with international payments is an undue burden, often plagued by long delays, cumbersome compliance checks, and bad exchange rates hurting businesses globally.

Bancoli is the only provider that can bridge payments in minutes between businesses across 200+ countries. Slow payments cost trillions of dollars in lost output every year. Work with your preferred vendors and suppliers and go faster at the speed of Bancoli.

How does Eric help?

“Excessive conversion costs and processing fees were draining my profits.

I now have the lowest online conversion fees and can do it directly from my Bancoli account. I am saving one of my full-time employees' salary just on the FX fees. Love it!”

Jun Li - Retail Business Owner

Exchange rates up to 10x lower than at legacy banks.

Reduce the amount of costly international wire transfers by 2-5x.

Make buyers happy with automatic rewards, even if you didn't offer a discount for early payments.

Featured in: