Frequently Asked Questions

Frequently Asked Questions

These are the most commonly asked questions about Bancoli.

Can't find what you're looking for? Chat to our friendly team!

How can I accelerate my cash flow with Bancoli?

Accelerate your cash flow by inviting your business partners to join Bancoli's network. Bancoli rewards your buyers for allocating funds to your invoices early. You may also offer an early allocation discount whenever you like.

Is it mandatory to give discounts to my clients when using Bancoli?

Bancoli's dynamic discounts are a simple way to encourage your clients to allocate funds to your invoices earlier, so whenever you need to speed up a payment you can use them, but they are not mandatory.

What kind of rewards do you get when using Bancoli?

You can get rewards when you allocate funds early to USD-denominated, non-discounted invoices. The reward amount that you receive depends on the invoice amount. These are shown on the dashboard as reward points that you may later use to pay any fees within Bancoli.

Can I get both rewards and discounts on the same invoice?

An invoice is either allocated with a discount, which means there's no early access fee. Or, rewards (Bancoli Reward Points) are earned on allocated USD invoices without a discount. These rewards are then used to waive fees, not to pay the invoice amount itself.

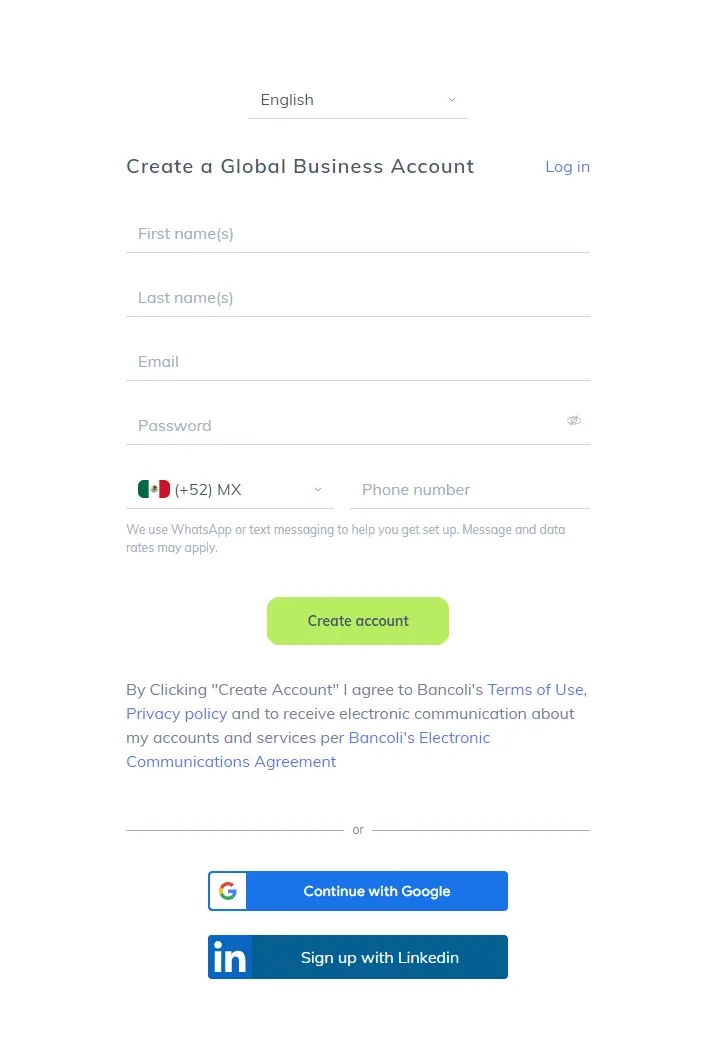

How do I sign up?

To sign up for Bancoli, enter your name and confirm your email address, provide details about your business, and choose a handle. Once you've completed these steps, you will be able to create invoices free of charge.

What am I going to be asked for during the signup process?

Starting to use Bancoli is very easy, and takes less than a minute. For the signup process you will only be asked for:

Step 1: Your name, email address and password. You will be asked to verify your email address to continue your signup process.

Step 2: Once you verify your email, login to your Bancoli account and you will be prompted to start your business verification process.

Why do I need to start the verification process?

This process helps us identify your business and helps to ensure trust between buyers and sellers, so, it is mandatory that you complete this process to transact and manage funds in Bancoli. You may still use Bancoli for invoicing only without completing the verification process.

What is the verification process?

The verification process enables us to validate your identity and the nature of your business. This helps ensure compliance with anti–money laundering laws while doing business internationally and provides additional trust for buyers and sellers.

What am I going to be asked for during the verification process?

Before you start, we strongly recommend that you review which documents will be required so that you have them at hand in order to speed up your verification process. See Guide to Verification Process.

Once you complete your verification process, you can proceed to secure your account.

What documents should I have ready in order to make my verification process faster?

- Legal Formation and Identification Documents

- Operational and Governance Documents

- Proof of Physical Business Address

For detailed information tailored to your specific country, please refer to the links in the Guide for Required Documents for Bancoli Business Verification for further guidance and requirements based on your business location.

Is Bancoli a dynamic discounting platform?

Bancoli is an AI-friendly financial platform that makes complex financial tasks easy. It helps with opening various global bank accounts, creating compelling invoices with multiple payment methods and with or without discounts, and rewards your buyers automatically for paying on time.

Is Bancoli a reverse factoring platform?

Bancoli encourages buyers through rewards in exchange for making funds available to their suppliers as early as possible. Bancoli does not provide third-party financing.

Can I use Bancoli if I'm a solopreneur or freelancer?

Yes, Bancoli is a great option for solopreneurs and freelancers.

What happens if a buyer doesn't want to pay me through Bancoli? Can I still use it?

Yes, your buyer does not need to be in your Bancoli network to make a payment to you. You can send the invoice, and your client can make the transfer to your Bancoli account. However, to enjoy all the benefits Bancoli has to offer, including rewards, we recommend you encourage your clients to join Bancoli.

What are Bancoli's focus countries?

Bancoli focuses on and is optimized for the following countries for account opening:

- Andorra

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Azerbaijan

- Bahamas

- Bahrain

- Barbados

- Belize

- Bermuda

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei Darussalam

- Burundi

- Canada

- Chile

- Colombia

- Coook Island

- Costa Rica

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Fiji

- Gambia

- Ghana

- Grenada

- Guatemala

- Guyana

- Honduras

- India

- Indonesia

- Israel

- Jamaica

- Jordan

- Kazakhstan

- Liechtenstein

- Macedonia

- Malawi

- Malaysia

- Marshall Islands

- Mauritius

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Namibia

- Nauru

- New Zealand

- Oman

- Palau

- Panama

- Paraguay

- Peru

- Philippines

- Rwanda

- Saint Lucia

- Saint Vincent and the Grenadines

- Samoa

- San Marino

- Saudi Arabia

- Serbia

- Seychelles

- South Africa

- Sri Lanka

- Switzerland

- Taiwan

- Timor-Leste

- Trinidad and Tobago

- Tunisia

- Türkiye (Turkey)

- Turks and Caicos Islands

- Uganda

- United Kingdom

- United States (excluding New York, Florida, Louisiana, Alaska and Puerto Rico)

- Uruguay

- Uzbekistan

- Vanuatu

- Zambia

How does Bancoli secure my funds?

Bancoli secures your funds by operating as a US Qualified Custodian. This designation means your Bancoli account and its funds are held under the stringent oversight of U.S. financial regulations.

Who can use Bancoli?

Bancoli provides a solution for businesses in more than 85 countries around the world that want to grow their business through improved cash flow and stronger business relationships.

Can I accept credit card payments?

We are working on enabling card payments in the near future. Stay tuned!

How many e-invoices can I create per month?

With Bancoli, you can create unlimited e-invoices per day/month.

What is a guaranteed invoice?

A guaranteed invoice is an invoice that your buyer has already agreed to pay by the due date and has allocated funds to cover the invoice in Bancoli. You may access the funds early if needed.

Does Bancoli integrate via API with other platforms: CRMs, ERPs, etc.?

We are currently working on having this feature available for our clients. Please submit a ticket with more details regarding the integration.

Who can I request payments from?

You can request payments by sending an invoice to your clients whenever selling a product or service.

Who pays the withdrawal fees?

Fees for currency conversion and transactions are paid by the Bancoli client who makes the withdrawal. These fees can also be paid using Bancoli Reward Points.

How many invoices can I create per month?

Bancoli provides unlimited invoicing per month at no charge.

Does Bancoli charge an additional fee per e-invoice?

Invoice creation within Bancoli is free of charge. You may upgrade your account for additional features by increasing the total funds held in your Smart USD account. Please see our pricing page for more information.

Is there a limit to the number of team members I can have on my Bancoli account?

Businesses using the Vault plan are limited to one team member. If you use the Vault Plus plan, up to five team members are available. Using the Vault Premium plan, up to 10 team members are available. Upgrading to the Vault Enterprise plan allows unlimited team members. Please see our pricing page for more information.

Do I have to pay an annual or monthly fee?

Bancoli plans are charged monthly.

Can I get additional team members?

Yes, you may include additional team members by upgrading your Bancoli membership plan. Please see our pricing page for more information.

What currencies are supported to receive money?

Every Bancoli client can receive funds from other Bancoli clients or external clients (through the Bancoli-issued bank account details). Please visit our Pricing page to see current rails and currencies.