The SWIFT code is a key piece of required information when a person or business needs to make international payments.

Specifically, this article explains the SWIFT code and when it is used, and provides some recommended practices to facilitate international transfers.

What is a SWIFT code?

Financial institutions use a unique alphanumeric SWIFT code, or BIC code, to identify a specific bank within the worldwide interbank financial telecommunication network.

Indeed, banks worldwide have widely adopted SWIFT because it connects them with a wide range of reach, volume, and capacity.

Consequently, these codes facilitate secure and efficient money transfers for global transactions, making them crucial to financial institutions’ worldwide operations.

What is the SWIFT Code Format?

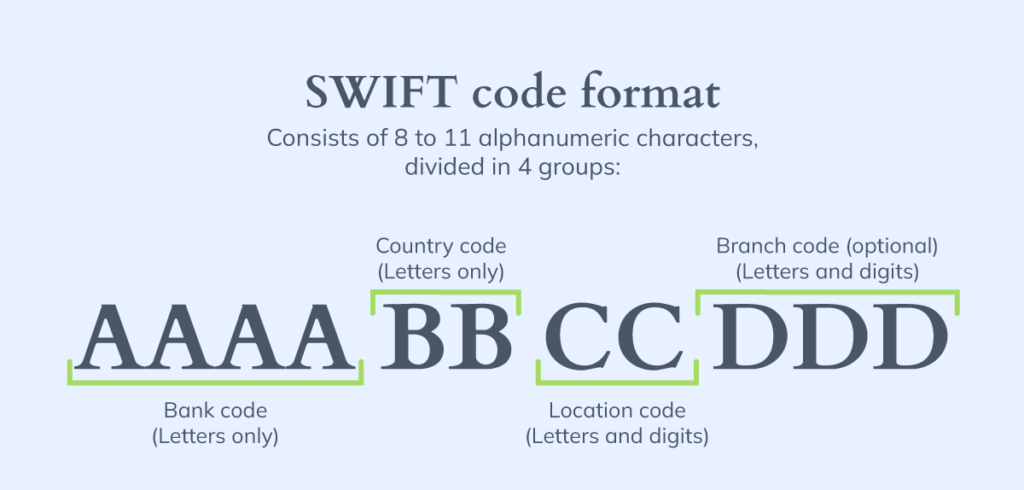

The SWIFT/BIC code has a specific format to uniquely identify different banking institutions. It consists of 8 to 11 alphanumeric characters, divided into four groups, as follows:

- Bank Code | 4 letters A-Z

- Country code | 2 letters A-Z

- Location code | 2 alphanumeric characters 0-9 or A-Z

- Branch code | 3 alphanumeric characters (optional) 0-9 or A-Z

The ‘Location code’ block indicates the bank’s head office. This information is crucial for identifying the specific branch or where a money transfer should be directed.

This code identifies the receiving bank of an international transfer to ensure the security of the transaction.

Initiating International Transactions: Time to Use the Code

You’ll require this code when involved in international transactions or dealing with financial institutions outside your home country. Here are some common scenarios where you might need to use one:

Sending Money Internationally

For example, when making international transfers or payments between banks in different countries, a BIC/SWIFT code is crucial to ensure the money transfer arrives at the intended location.

Receiving Money Internationally

In addition, if you’re expecting payments from international clients or customers, providing your bank’s SWIFT or BIC code is essential for them to initiate the transfer.

Moreover, the SWIFT or BIC code is particularly useful when you need:

- Connectivity: Identifying counterparties facilitates efficient transfers and ensures funds reach the right recipient.

- Compliance: Furthermore, transfers must comply with the financial laws of the countries sending or receiving funds, reducing the risk of fraud and eliminating errors.

Benefits of Using BIC/SWIFT Codes

Doing international business today can mean paying suppliers in other regions and hiring talent from different countries.

This global trend has also led to more frequent international transactions, especially through online banking.

Consequently, security systems must be incorporated into all banking transactions to ensure secure payments to business partners and employees.

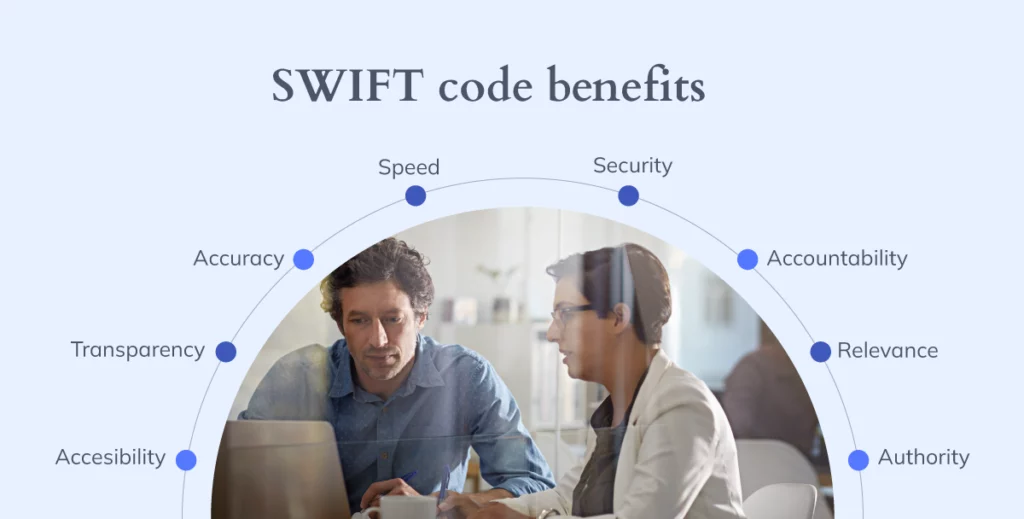

Using this code for international payments offers many benefits:

- Accessibility. Smooth communication between global enterprises.

- Transparency. Detailed information about the exact amount of the transaction.

- Accuracy and Speed. This can potentially reduce the risk of delays or misdirected payments, making sure your funds end up exactly where they should be.

- Relevance and Authority. Accepts more than 150 currencies.

How to Find Your SWIFT Code?

Locating a SWIFT code for your bank is relatively simple. Here are some ways to find it:

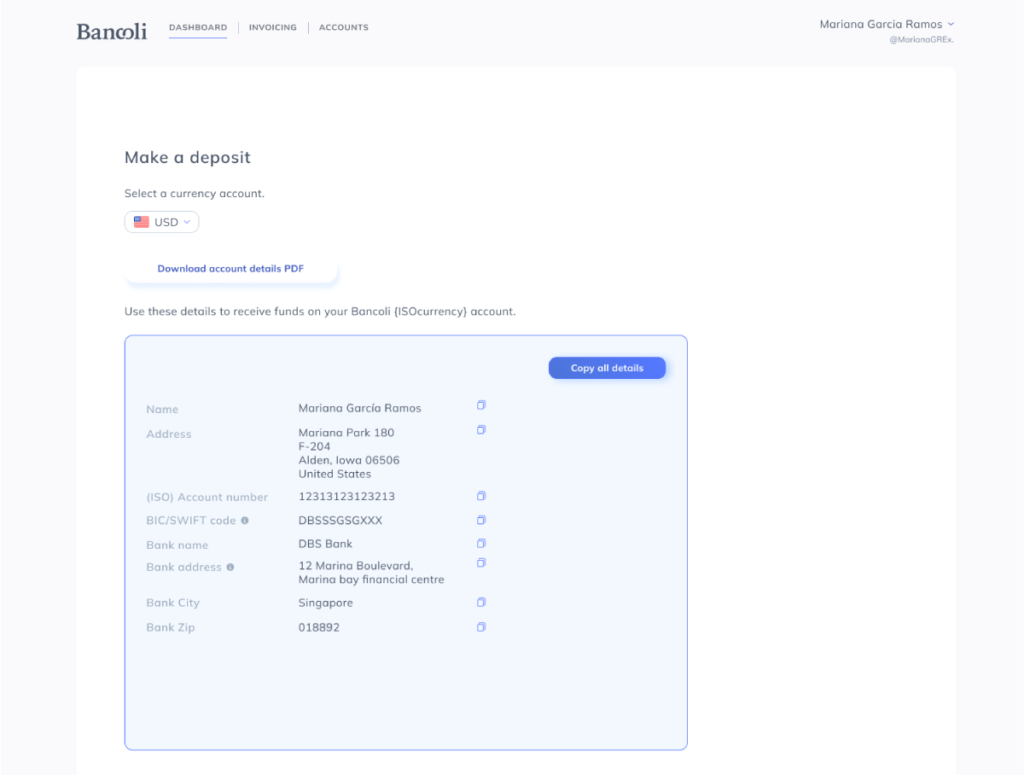

- If you already have your Global Business Account, access your Bancoli account, go to your desired currency account, and click on Account Details to access your information.

- You can often find this code in your bank account statements if you use a different bank, usually near your account and routing numbers, or by downloading a recent bank statement from your online bank account.

Verify the SWIFT code before initiating a transfer

Using the correct SWIFT/BIC code is crucial when sending money internationally through the SWIFT network.

However, providing the incorrect code can delay the transfer, incur additional fees, or fail to reach the intended recipient’s account.

Double-check your complete information when entering the SWIFT code for your transfer.

Additionally, consider the SWIFT code format mentioned before: specifically, the 4-character bank code, 2-character country code, 2-character location code, and a 3-character branch code, if applicable.

Some other tips to ensure accuracy:

- Copy and paste the SWIFT code, if possible, to avoid typos

- Confirm the code with the recipient and the receiving bank

- Provide your bank’s SWIFT code to anyone sending you money from abroad

- For extra security, consider registering your recipient’s details with your bank so the SWIFT code is saved for future transfers

Global Business Account: The perfect solution for international payments

A Bancoli Global Business Account is a multi-currency account with local bank details in USD, EUR, and more. This way, businesses can easily send and receive funds like local entities in major global markets.

Moreover, the platform supports payouts to global partners in over 50 currencies with unbeatable FX conversion rates and competitive fees.

Indeed, multi-currency options, an extensive payment network, and a consolidated platform for international transactions are essential for companies looking to streamline their global banking.

Consequently, Bancoli aims to provide an internal financial solution for businesses seeking to optimize their global payment flows.

Frequently Asked Questions

What’s the difference between BIC and SWIFT codes?

In other words, both terms are often used interchangeably; they refer to the same essential element in international banking. These codes serve as unique identifiers for financial institutions, ensuring that your money reaches the correct destination securely and swiftly.

What’s the difference between SEPA and SWIFT/BIC codes?

SEPA (Single Euro Payments Area) codes are specific to European countries and are used for euro-denominated transactions within the SEPA region. SWIFT/BIC codes, on the other hand, are used globally for various currencies and cross-border transactions.

Are IBAN and SWIFT codes the same thing?

No, IBAN (International Bank Account Number) and SWIFT codes are different. While both are used in international banking, IBANs identify individual bank accounts, while SWIFT codes identify the banks themselves.

Do US banks have SWIFT codes?

Yes, most US banks have SWIFT codes, especially if they engage in international transactions or have correspondent relationships with foreign banks.

What is a BIC code?

A Bank Identifier Code (BIC) serves to identify banks worldwide. This code represents a bank branch for international money transfers.