Independent workers face numerous challenges and opportunities in the dynamic world of freelancing payments. On the one hand, freelancers must look for clients and deliver top-notch work. Conversely, the time and ability to manage cross-border payments can significantly impact their productivity, profitability, and peace of mind.

Whether you’re an experienced freelancer navigating multiple currencies or a rookie stepping into the global market, understanding and utilizing efficient cross-border payment solutions can empower your freelance business. This article delves into the challenges of freelancing payments and innovative fintech functionalities to simplify global transactions.

Understanding the Freelance World: Statistics About Freelancing That You Should Be Aware Of

Independent workers commonly use the term freelancers to describe their job status. Independent workers see themselves as freelancers, self-employed consultants, side hustlers, founders/owners (with or without employees), or something else. Let’s look at relevant statistics to better understand the landscape of freelancing payments.

What is the global population of freelancers and its market worth?

- Approximately 1.57 billion people in the global workforce are freelancers. They represent 46.4% of the total global workforce of 3.38 billion (World Bank).

- In the United States alone, in 2022, freelancers contributed over 1 trillion USD in income to the economy, equivalent to approximately 5% of the country’s GDP. The economic impact of freelancing surpasses industries like construction and transportation and is comparable to the information sector (Upwork).

- By 2027, the global freelance market’s worth is expected to reach $9.19 billion (Absolute Reports).

The Challenges of Freelancing Payments

The concerns of the self-employed are fairly distributed. Recent studies show that the primary concern for 76% of freelancers was their ability to save money, along with worries about setting aside money for retirement (75%) and dealing with an unstable income (72%). Other frequent issues they struggle with encompass receiving fair remuneration, finding affordable healthcare, and navigating high taxation rates (Website Planet).

Freelancers’ concerns go hand in hand with the challenges they face when dealing with international transactions. These include high transaction costs, currency conversion losses, and potential delays. Let’s explore these challenges:

High Transaction Costs

Many financial institutions charge fees for processing international transactions. These fees can significantly affect the freelancer’s earnings, especially for smaller projects or transactions.

Currency Conversion Losses

Exchange rates can vary greatly. A freelancer might lose a significant portion of their earnings due to unfavorable exchange rates. Moreover, financial institutions often charge additional fees for currency conversion.

Transaction Delays

International transactions often take longer to process than domestic ones. This delay can cause cash flow issues for freelancers, especially those dependent on timely payments for their operational expenses.

The Solution: Bancoli

Bancoli is a fintech solution that actively addresses these challenges. With Bancoli, independent workers can manage freelancing payments efficiently, reducing transaction costs, minimizing currency conversion losses, and ensuring timely payments.

- Reduced Transaction Costs. Bancoli offers competitive rates for international transactions, enabling freelancers to retain more of their hard-earned money. This feature is particularly beneficial for freelancers who regularly deal with cross-border payments.

- Minimized Currency Conversion Losses. With Bancoli, freelancers can manage multiple currencies within a single platform. At the same time, this feature allows freelancers to hold their earnings in different currencies and convert them when the exchange rates are good.

- Timely Payments. Bancoli’s platform is designed to process transactions swiftly. This guarantees on-time payment for freelancers, thereby improving their cash flow and financial stability.

Why Choose Bancoli?

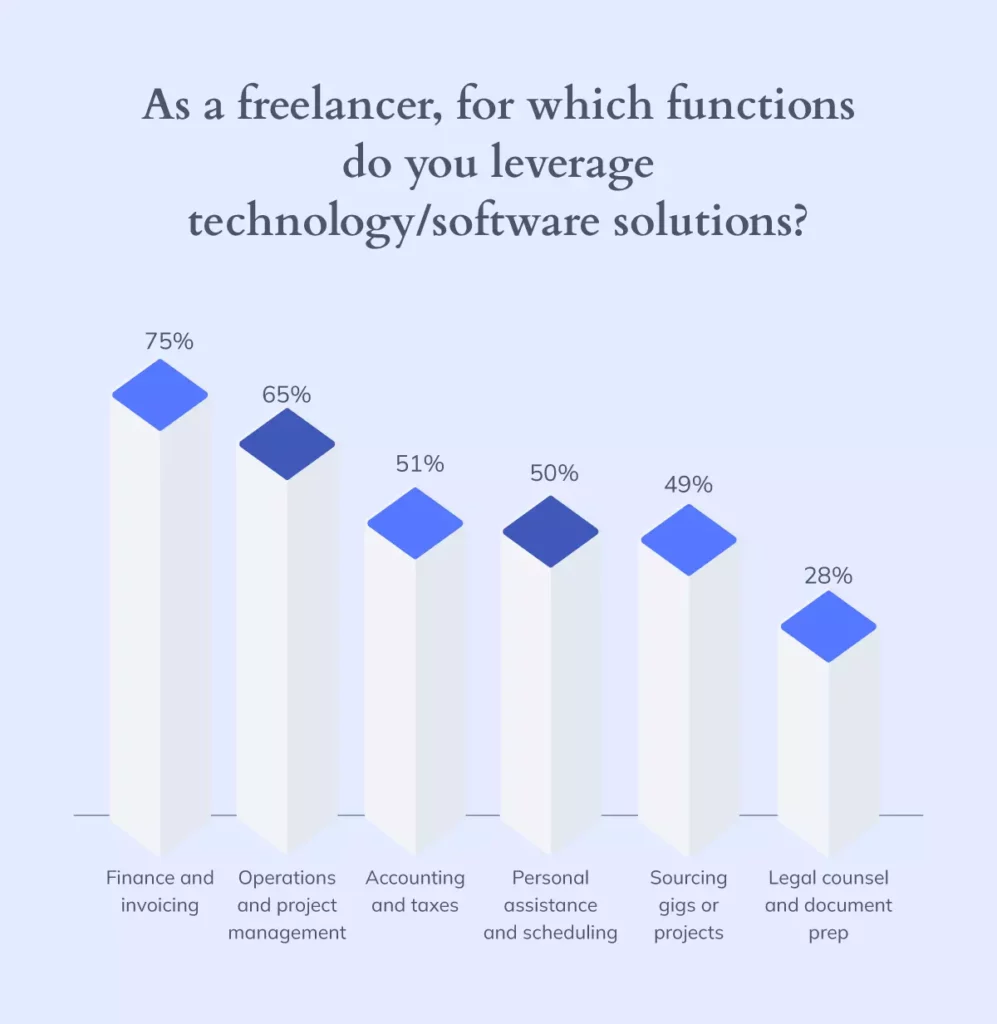

Freelancers need a financial platform that caters to their specific needs. In a study conducted by Fiverr, when freelancers were asked for which functions they leverage technology/software solutions, their top answers were finance and invoicing (75%), operations and project management (65%), and accounting and taxes (51%).

Bancoli provides a comprehensive solution that takes into account the unique challenges of managing a freelance business. Here are a few reasons why freelancers should consider Bancoli:

Global Reach

Bancoli’s platform supports transactions in numerous countries. This enables freelancers to work with clients from around the world without worrying about the logistics of cross-border payments.

Easy Integration

Bancoli can be easily integrated with popular freelance marketplaces and payment systems. This makes it even easier for freelancers to manage their payments.

Transparent Pricing

Bancoli values transparency. The platform clearly outlines its fees, ensuring that freelancers are fully aware of the costs associated with their transactions.

Excellent Customer Support

Bancoli provides reliable customer support to address any issues or concerns. This ensures that freelancers can focus on their work, knowing Bancoli will swiftly handle any financial concerns.

Wrapping Up

In the fast-paced world of freelancing, managing cross-border payments is a critical yet challenging aspect. However, with Bancoli, freelancers can streamline their financial transactions, as a result this enables them to focus more on their creativity and client relationships. By understanding and utilizing these cross-border payment solutions, freelancers can enhance their business growth and productivity.

Join Bancoli today and experience the ease of managing your freelance business’s financial transactions. With Bancoli, the world is your marketplace.