International payments play a vital role in the global business landscape. Optimizing these transactions can significantly impact a company’s financial well-being and operational efficiency.

Implementing strategic measures can help businesses save up to 2% on international payments, and using efficient and cost-effective solutions can lead to even greater savings.

Reducing transaction costs allows businesses to allocate more resources to growth and innovation. Simplified international payments also result in faster processing and better cash flow management.

How do you save on international payments?

Here are 5 tips to help you execute efficient and cost-effective international payments or collections and speed up your transactions.

Tip 1: Learn How Your Industry Handles International Payments

Familiarize yourself with common payment methods in your industry, such as international bank transfers, credit card payments, and electronic payments. Understanding the pros and cons of each method helps you make informed decisions.

International Bank Transfers

An international bank transfer, or wire transfer, is a secure and reliable method for sending funds across borders.

It involves transferring money from one bank account to another, either within the same financial institution or between different banks. Businesses often use this method for high-value transactions, as it offers a direct and traceable way to send money internationally.

However, international bank transfers may be subject to higher fees and longer processing times than domestic transfers.

Credit Card Payments

Credit card payments provide a convenient and flexible option for international B2B transactions.

This method allows businesses to make and receive payments quickly without complex setup processes. Credit cards also offer buyer protection and the ability to dispute fraudulent charges.

However, businesses should be aware of the potential for high transaction fees, currency conversion costs, and the risk of chargebacks. Additionally, some suppliers may not accept credit card payments due to these associated costs and risks.

Electronic Payments

Electronic payment platforms like PayPal and Stripe have gained popularity for international B2B transactions. These services enable businesses to send and receive payments electronically, often with lower fees and faster processing times than traditional bank transfers.

Electronic payment providers typically offer secure transactions, built-in currency conversion, and dispute resolution services. However, businesses should carefully review the terms and conditions of each platform, as some may have transaction limits or restrict certain types of transactions.

Innovative International Payments Solutions

Comprehensive solutions for international B2B payments combine the benefits of traditional bank transfers, credit card payments, and electronic payment methods.

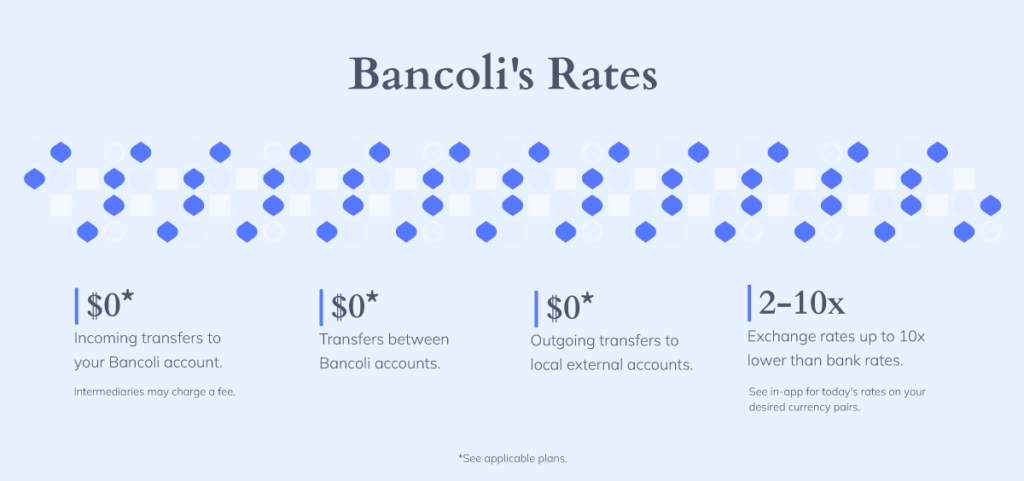

Key features include seamless management of cross-border transactions, access to competitive exchange rates, reduced fees, and a user-friendly platform that consolidates all these services. Bancoli’s Global Business Account offers companies a streamlined way to handle their international payment needs within a single, efficient system.

Tip 2: Optimize Your International Payment Services

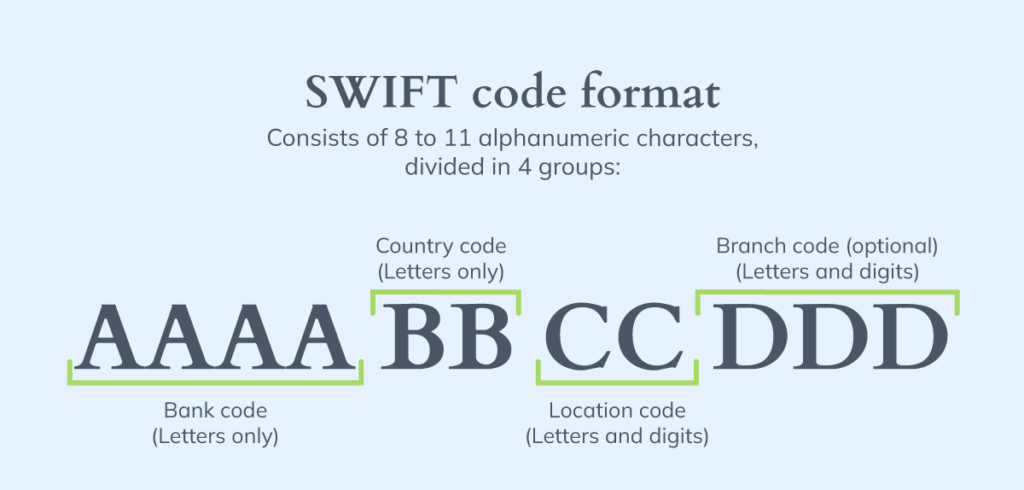

Electronic payment systems like SWIFT streamline international transfers by reducing intermediary involvement. This efficiency cuts transaction costs, leading to significant savings on global payments.

To choose the best electronic payment service, understand its market reach. For example, SWIFT is effective for bank transactions in different countries, while ACH is suited for domestic payments.

It’s essential to analyze the fee structure of your chosen service to ensure it meets your specific needs and fits your budget.

Every SWIFT transaction uses a unique code to identify the recipient’s bank, enhancing the security of international transfers.

Tip 3: Strategically Choose the Right Currencies for Your International Payments

Currency exchange rates significantly influence the cost of international payments. Monitoring these rates lets you choose the most favorable currencies, optimizing transaction costs. This strategy identifies the best transfer times and ensures cost-effective operations, especially when preferred rates are less favorable.

It’s wise to compare exchange rates across various financial institutions to make informed decisions. Maintaining an account in a stable currency like the U.S. dollar increases financial security.

For enhanced flexibility and competitive rates, consider Bancoli’s Global Business Account. This account gives you currency accounts in USD, EUR, GBP, HKD, and SGD and access to real interbank exchange rates up to 10 times lower than those traditional banks offer.

Tip 4: Negotiate with Business Partners

One of the easiest ways to save on international payments is to negotiate with your buyer or supplier at the beginning of the business agreement. It is advisable to calculate the transactional amounts according to the agreed payment method and make agreements so that neither party is affected.

Remember that conducting transactions through Bancoli offers you and your business partners the most competitive rates in the market. If you both have a Bancoli account, you can access all the benefits designed to boost your returns, from early payment discounts to Bancoli Reward Points (BRP) to waive certain fees. This way, the platform provides functionalities to enhance your business relationship.

Tip 5: Forecast International Payment Costs

One of the most effective strategies for reducing international payment costs is to create estimates before executing a transaction. By forecasting exchange rates and associated fees, businesses can gain valuable insights into the expected costs for each payment method.

This knowledge allows companies to budget accordingly and make informed decisions about when and how to transfer funds internationally. To accurately forecast international payment costs, consider the following factors:

- Currency exchange rates: Regularly monitor exchange rates to identify trends and fluctuations. This will help you determine the most favorable times to execute transactions and choose the most cost-effective currencies.

- Transaction fees: Research the fees associated with different payment methods, such as wire transfers, credit card payments, and electronic payment services. Compare these costs across various financial institutions to find the most competitive rates.

- Market volatility: Monitor global economic events and geopolitical factors impacting currency values. This will help you anticipate potential fluctuations and adjust your payment strategies accordingly.

- Historical data: Analyze your company’s past international payment transactions to identify patterns and trends. This information can help you refine your forecasting models and make more accurate predictions about future costs.

By dedicating time and resources to forecasting international payment costs, businesses can make more informed decisions, optimize payment processes, and save money on cross-border transactions.

What’s next…?

Many businesses aim to conduct international business, but not all manage to make their cross-border transactions cost-effective. Our shared information will help you make informed decisions to save on each international transaction.

Bancoli’s Global Business Account offers a comprehensive solution for businesses looking to streamline their international payment processes. With multi-currency accounts, competitive exchange rates, and minimal transaction fees, Bancoli empowers companies to optimize their cross-border payments and increase their financial returns.