International payments for digital agencies can be simple with the right platform. In an era where geographical boundaries are fading, digital media has the golden opportunity to conquer the international market. You can grow your business beyond your local area as a digital agency owner or service provider. With global reach, you can:

- Tap into a vast customer base, increase revenue, and diversify your offerings.

- Collaborate with international talent and solve challenges on a global scale.

However, expanding your digital agency into the global market presents unique challenges, particularly when managing international payments and cash flow. This guide will discuss overcoming these challenges and unlocking your business potential.

The Allure of Going Global

There are many reasons why digital agencies should consider expanding into the global market. Here are just a few:

- Access to a vast customer base. Global reach gives you access to a much larger customer beyond the local boundaries. This means you can generate more revenue and grow your business faster.

- Diversification of offerings. Working with clients from different countries can help you learn new skills and techniques. Apply these to expand the services you provide to your local clientele.

- Innovation. Collaborating with international talent can help you stay ahead of the curve regarding digital marketing trends and strategies.

- Resilience. Facing and overcoming global challenges can help your agency become more resilient in the face of change.

Challenges of International Payments for Digital Agencies

Managing cross-border transactions and cash flow is one of the biggest challenges of expanding your digital agency into the global market. This can be a complex and time-consuming process, and if not managed properly, it can eat into your profits.

There are several factors to consider when managing international payments for digital agencies, such as:

- Currency exchange rates. When you receive payments in a foreign currency, you must convert them into your local currency. This can be costly, as you will typically be charged a conversion fee.

- Payment processing fees. There are often fees associated with processing global transactions. These fees can vary depending on the payment method and the country from which the payment is sent.

- Bank transfer fees. You will typically be charged a fee if you send or receive money internationally via bank transfer. These fees can be significant, so factoring them into your budget is important.

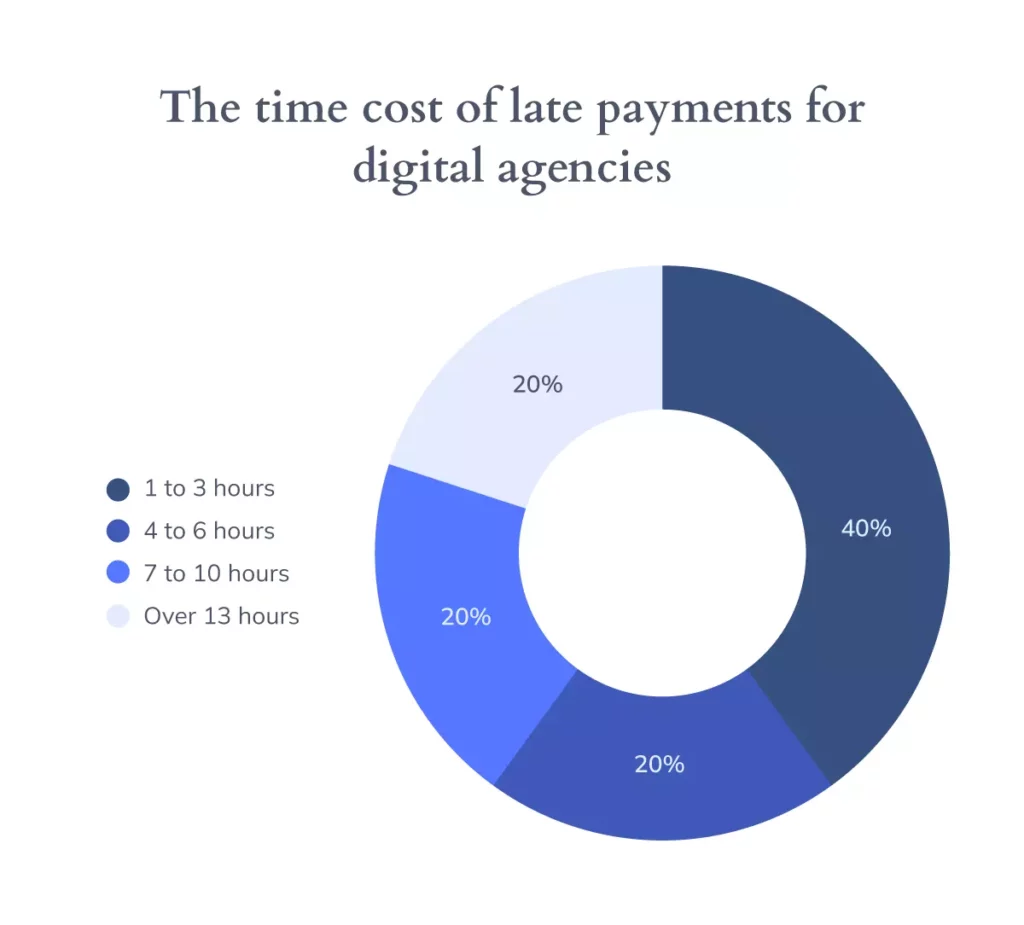

In addition, late payments can strain your cash flow, so it’s essential to be prepared for delays. Stats show that in many cases, payments in the digital industry are received around 45 days later than the invoice due date, which can generate significant cash flow problems and limitations to leverage new projects that require capital.

To avoid or reduce the impact of payment delays, you can:

- Establish transparent payment terms, ensuring your clients understand when and how they need to pay you.

- Use a payment gateway that offers low or no fees for cross-border payments.

- Prepare yourself for delays and build them into your cash flow planning.

Bancoli is a global B2B banking, payments, and invoicing solution that can alleviate the payment challenges faced by digital agencies. The platform offers comprehensive features to streamline operations and boost business success. For instance, with fees as low as zero on incoming transfers to your Bancoli account, the platform provides a cost-effective international payment method for digital agencies. However, take into account that intermediaries may charge a fee. Discover Bancoli’s rates here.

Moreover, Bancoli’s invoicing system revolutionizes managing international payments, providing unparalleled convenience to its users. It offers a unique feature to make your invoice your client’s priority. Bancoli’s guaranteed invoices increase your chances of getting paid faster and significantly enhance your cash flow. By incentivizing early payment, Bancoli creates a win-win situation where the clients can avail attractive discounts through early settlement and businesses can maintain a steady cash flow. Essentially, Bancoli’s invoicing solution offers a practical, effective, and user-friendly way to manage your finances globally.

Embrace Time Management

Another critical factor to consider when expanding your digital agency into the global market is time management. Staying on top of things can be difficult when working with clients in different time zones.

Here are a few tips for managing your time effectively when working with international clients:

- Set expectations. When you start working with a client in a different time zone, set clear expectations about communication and deadlines.

- Be flexible. Be prepared for flexibility, as client collaborations across various time zones may sometimes unfold differently than planned.

- Use tools and business solutions. Several tools can help you manage your time more effectively when working with international clients. For example, you can use project management tools to track deadlines and communicate with clients and financial solutions to manage your payments.

Select Your Payment Platform Wisely

Finally, selecting the right platform to help you manage your international payments and cash flow is important. Several platforms are available, so choosing one that meets your business-specific needs is essential. Some factor to consider include:

- The fees associated with it. Bancoli offers clear, transparent, and competitive fees, ensuring that businesses of all sizes can afford to use the platform without feeling the financial strain.

- The features and functionalities. Bancoli is designed to meet the unique needs of B2B transactions, from early payment access to support for multi-currency transactions.

- The ease of use of the solution. With an intuitive user interface and clear and simple instructions, managing international payments becomes a seamless process with Bancoli.

- The security of your funds. Bancoli prioritizes your funds’ safety by employing robust platform and banking features to safeguard your money and sensitive information—giving you peace of mind with every transaction.

By carefully selecting the right solution, cash flow and international payments for digital agencies can be easier and ultimately help your business thrive in the global market.

Conclusion

The global digital media landscape is filled with opportunities. While international growth can present unique challenges, these can be easily navigated with the right tools and solutions.

Bancoli, focusing on trust, security, and reliability, aligns with your needs, helping you confidently navigate the global digital media landscape. As your business evolves, Bancoli is your partner, helping you seize international opportunities and achieve your business goals.