A functioning invoicing process can mean maintaining a healthy cash flow and dealing with late payment inconveniences. Implementing an automated invoice processing system mitigates the risks of manual errors and late payments, and it can also offer important insights into your business’s financial health.

So, how can businesses transform their invoice process to bring these benefits? This article will inform Bancoli’s invoicing capabilities and how buyers and sellers can leverage them to their financial advantage.

What is an invoice?

An invoice is a business document that a seller issues to a buyer. The seller provides detailed information about a transaction or sale in this document. The fundamental purpose of an invoice is to request payment for the goods or services that the seller provided, which effectively makes it a bill for the transaction.

An invoice usually includes this information:

- Seller information: The name, address, and contact information of the seller or service provider. This often includes a unique identification number if the jurisdiction requires it (such as a US tax ID or an EU VAT number).

- Buyer information: The buyer’s or client’s name, address, and contact information.

- Invoice number: An identifier for the invoice that helps both parties track payments and correlate them with respective sales.

- Date of issue: The date when the invoice is issued.

- Due date: The date by which the buyer must make the payment.

- Description of services: Detailed information about the seller’s services, including quantities, rates, and totals.

- Total amount: The total amount the buyer needs to pay the seller. This usually includes any shipping fees, taxes, or other additional charges.

- Payment terms: The terms and conditions that the buyer and seller agreed upon for payment, such as the method of payment, early payment discounts, or penalties for late payment.

Invoices are crucial for the financial health of businesses because timely issuance and follow-up of invoice payments ensure smooth cash flow. You can start using Bancoli’s invoicing system after completing your sign-up.

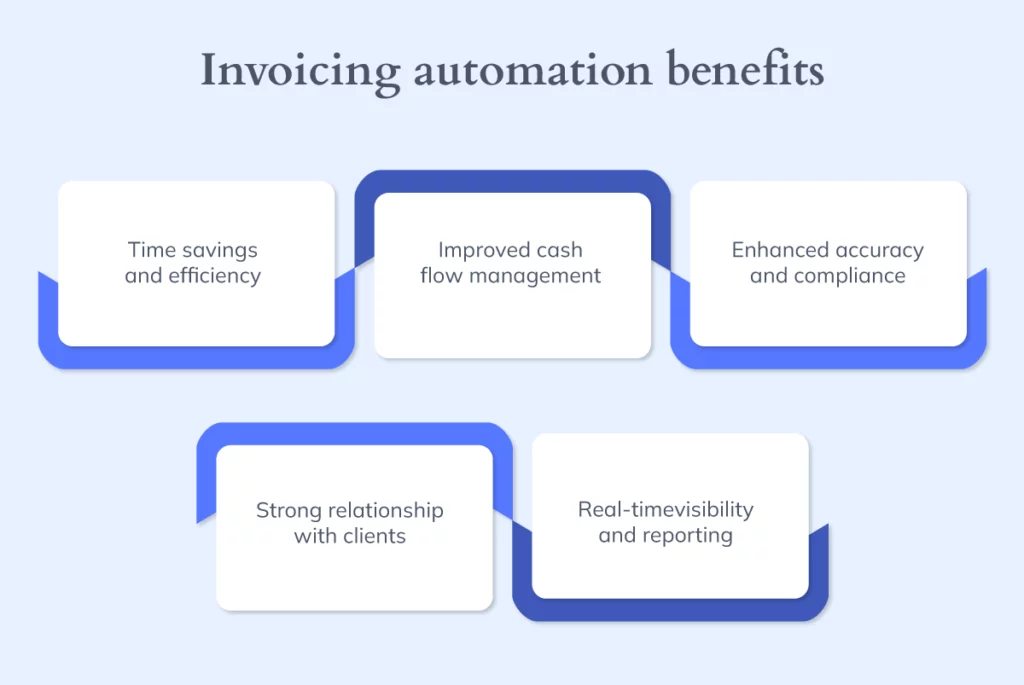

Benefits of automated invoices

Time savings and efficiency

Bancoli’s invoicing automation streamlines the entire invoicing process, from creation to delivery. By eliminating manual data entry and reducing the risk of errors, businesses can save valuable time and allocate resources more efficiently. In extreme cases, businesses spend more than 10 hours every week managing accounts receivable tasks.

Improved cash flow management

Timely and accurate invoicing accelerates payment cycles. Bancoli’s automation ensures invoices are generated promptly, facilitating faster payments and providing businesses with enhanced control over their cash flow.

Enhanced accuracy and compliance

The risk of errors in manual invoicing processes can lead to financial discrepancies and compliance issues. Bancoli’s automation features include built-in checks and balances, reducing the likelihood of errors and ensuring adherence to regulatory standards.

Strong relationship with clients

With Bancoli’s invoicing automation, businesses can personalize invoices, establish professional branding, and deliver a seamless client experience. This attention to detail fosters more robust relationships, as clients appreciate professionalism and consistency in financial transactions.

Real-time visibility and reporting

Bancoli provides:

- Real-time insights into invoicing activities.

- Offering a comprehensive view of outstanding payments.

- Completed transactions.

- Overall financial health.

This transparency empowers businesses to make informed decisions and adapt their strategies proactively.

Best practices of automated invoicing

Customization for Brand Consistency

Utilize Bancoli’s customization options to align your invoicing documents with your brand identity. Consistent branding fosters professionalism and reinforces your company’s image with clients.

Regularly Update and Train Teams

Stay abreast of Bancoli’s updates and features to leverage its full potential. Regular training sessions for your teams ensure they are well-versed in utilizing the platform effectively, maximizing productivity, and minimizing errors.

Implement Security Measures

Safeguard sensitive financial information by implementing security measures provided by Bancoli. This includes setting up user permissions, utilizing secure authentication processes, and staying informed about the platform’s security protocols.

How does invoicing work with Bancoli?

For buyers, early payment discounts

Bancoli introduces a win-win scenario for buyers through its early payment discounts. Sellers can offer a percentage discount on the invoice amount if paid before the maturity date. For buyers, this translates to direct savings while concurrently fostering positive relationships with sellers.

Encouraging sellers to adopt Bancoli and provide early payment incentives can revolutionize expense management, creating a mutually beneficial environment.

For sellers, AI-driven discounting strategies

Bancoli’s AI-driven discounting strategies exemplify how technology can refine financial decision-making. This feature assists sellers in determining the optimal discount rate to encourage early payments, ensuring a swift cash inflow to fuel business operations.

By harnessing AI capabilities, Bancoli empowers sellers to make informed decisions, contributing to more effective financial management.

Automation in invoicing

Recognizing that time is money, Bancoli introduces a suite of automation features. These tools streamline invoicing, from automatic email and SMS follow-ups to invoice scheduling and upcoming features like recurring invoices and scanning. Not only do they alleviate the manual workload, but they also guarantee timely communications and transactions —crucial components for maintaining a healthy cash flow.

Customization

For users on the Grow, Scale, and Enterprise plans, Bancoli offers the ability to customize invoices, use a verified business badge, and attach custom files such as PDFs and XMLs. This enhances the professionalism of invoicing and facilitates the seamless integration of related documents. The result is a more coherent and efficient invoicing process, contributing to an overall streamlined business operation.

Importance of timely payments

Timely payments are foundational to solid business partnerships. Bancoli enhances this aspect by enabling attractive returns on timely or early invoice payments, even without a pre-offered discount. This practice not only safeguards against potential late fees but also nurtures positive business relationships, potentially leading to better prices, terms, fulfillment, and other advantages in the long run.

Security features

Bancoli prioritizes the security of the invoicing process, employing military-grade encryption, ID and liveness checks, multi-factor authentication, and unmatched fund protection. These security measures ensure that every invoice sent or received maintains the highest security standard, providing peace of mind in all business transactions.

In Conclusion

Bancoli’s invoicing feature isn’t just a transactional tool; it’s a strategic asset that can transform the financial landscape of both buyers and sellers. Users unlock possibilities beyond traditional invoicing by delving into the benefits of early payment discounts, embracing AI-driven strategies for sellers, and capitalizing on automation, customization, and security features.

In the fast-paced business world, where efficiency and financial prudence are paramount, Bancoli emerges as a trusted ally. The platform seamlessly integrates with your operations, providing a means of sending or paying invoices and a pathway to building secure and enduring business partnerships.

As businesses navigate the complexities of today’s economic landscape, Bancoli’s invoicing feature stands as a beacon, guiding users toward financial success. By incorporating these features into your invoicing strategy, you’re not just managing finances but setting the stage for sustained growth, strengthened relationships, and a more resilient business future. Embrace the power of Bancoli’s invoicing capabilities and unlock the full potential of your financial endeavors.