What are the effects of late payments on SMBs? How can SMBs address this challenge and ensure financial stability? The success and survival of Small and Medium-sized Enterprises (SMBs) frequently rely on the timely payments of their invoices. Late payments, a chronic issue across many industries, is a significant threat to smaller organizations due to their limited financial resources.

This article explores the impact of late payments on SMBs, offering insights into potential solutions and measures to mitigate this problem.

The Financial Impact of Late Payments

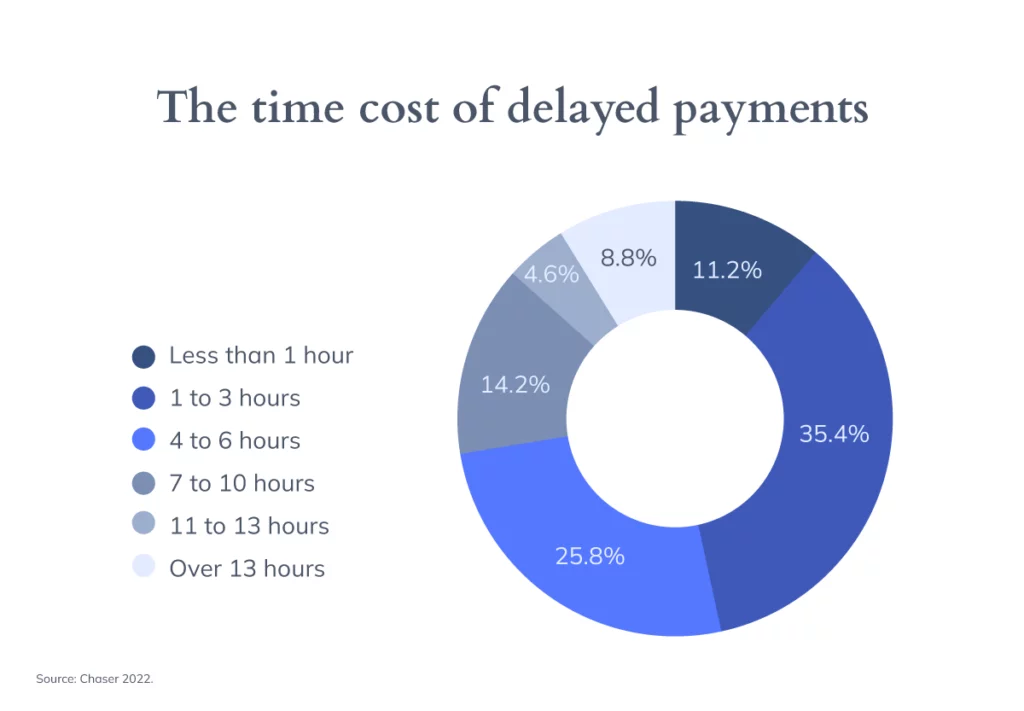

Overdue payments are a significant time challenge for businesses. On average, SMBs dedicate at least 4 hours weekly to chasing overdue invoices. Four hours tally up to 208 hours annually. This equates to approximately five full work weeks (Source: Chaser, 2022).

Given that time is money, the time consumed in managing delayed payments detracts from the valuable time that could be invested in activities that generate revenue. This ripple effect constricts cash flow, compelling businesses to tap into their reserves or resort to loans for survival – both options threatening their long-term financial health. The difficulties that companies face due to late payments are dramatically amplified in challenging economic conditions, leading to problems of access to finance and credit crunch. Typically, SMBs with regular late payments are:

- granted smaller loan mounts;

- subjected to stricter loan terms and conditions, and

- provided with shorter loan maturities from banks.

However, collateral requirements are surprisingly unaffected by late payments. These results stand robust even after accounting for various business-specific controls, macroeconomic factors, and country-specific controls.

Implications and Solutions for Late Payment on SMBs

In the aftermath of the pandemic recession, access to external funding has become critical for SMBs’ investment decisions and sustained recovery. Overdue payments, a stumbling block to this crucial factor, can cause considerable adverse spillovers in the real economy.

To address the challenges posed by late payments and help SMBs maintain a healthy cash flow, Bancoli offers a range of powerful cash flow tools. These tools streamline invoicing, accelerate payments, and provide greater visibility and control over financial operations.

· Automated Invoicing and Payment Reminders

With Bancoli’s cash flow tools, SMBs can automate their invoicing process, ensuring that invoices are sent promptly and accurately. The platform also enables the scheduling of automated payment reminders, significantly reducing the chances of late payments and improving overall cash flow management.

· Early Payment Access

One of the significant advantages of Bancoli’s cash flow tools is the option for early payment access. This feature empowers SMBs with the choice to retrieve their payments sooner. So it helps them bridge the gap between invoicing and receiving funds. This feature is particularly valuable for businesses that depend on timely cash inflows to cover expenses and invest in growth.

· Cash Flow Analysis and Forecasting

Bancoli provides robust cash flow analysis and forecasting capabilities, empowering SMBs to gain deeper insights into their financial position. By accurately projecting future cash flows and identifying potential bottlenecks, businesses can make informed decisions and take proactive measures to optimize their cash flow management.

· Vendor Verification

To minimize the risk of late payments on SMBs caused by unreliable vendors, Bancoli offers vendor verification services. SMBs can validate their suppliers’ credibility and financial stability, thereby reducing the likelihood of payment delays and mitigating potential financial risks.

By leveraging Bancoli’s cash flow tools, SMBs can more effectively navigate the challenges of late payments. These tools optimize cash flow management and enhance the business’s financial health. With a streamlined invoicing process, early payment access, insightful cash flow analysis, and vendor verification, SMBs can overcome the hidden cost of late payments and ensure a smoother path to financial stability.

Conclusion

Late payments represent a severe risk to SMBs, particularly in a post-pandemic era where financial access is paramount. However, with Bancoli’s comprehensive suite of cash flow tools, SMBs can proactively address this challenge and regain control over their financial operations.

By automating invoicing, accessing funds earlier, analyzing cash flow, and verifying vendors, businesses can overcome the negative impacts of late payments. This strategy sets the stage for sustained growth, prosperity, and success.