A global money transfer, or an international or wire transfer, is a crucial aspect of international business.

Whether you’re paying a supplier overseas, sending funds to a subsidiary, or facilitating international payroll, understanding the process and choosing the most suitable service can significantly impact your bottom line.

This guide simplifies the complexities of international money transfers, empowering businesses to navigate this essential financial process confidently.

Understanding Global Money Transfers

A global money transfer allows you to send money from one country to another through a network of banks or money transfer services.

These transactions can be completed online, via phone, or in person, providing flexibility and convenience for users worldwide.

Global money transfers are utilized in various business scenarios. They can pay international suppliers for goods or services, send funds to establish or maintain overseas offices or facilitate cross-border employee payroll.

Best Currency Transfer Services

Finding the right service depends on several components that impact how much money reaches your recipient.

Here’s a breakdown of key considerations to ensure you get the best deal in the foreign exchange market.

Exchange Rate

Currency transfer services offer varying exchange rates, directly affecting the money your recipient receives.

Transfer Fees

Look out for any upfront fees or hidden charges associated with the transfer. Some services offer transparent, low fees, while others might have margins built into their rates.

Beyond the Basics

Consider additional factors like transfer speed – do you need the funds to arrive instantly, or can you wait a few days? What payment options are available (direct debit, debit card, etc.), and how can your recipient receive the funds (bank deposit, wire transfer, etc.)?

By comparing these elements alongside transfer limits and the quality of customer support, you can choose the most suitable currency transfer service for your international money transfer needs.

Easiest Ways to Transfer Money Globally

Businesses offer various methods for sending money internationally, each with benefits and considerations.

- Bank-to-Bank Transfers: Directly transfer money from your bank account to the recipient’s, which can be arranged online, over the phone, or in person at the bank. Businesses should be aware of transfer fees charged by banks or money transfer services. These fees vary depending on the transfer method, amount, and destination country.

- Wire Transfers: Send large sums of money from one bank account to another through a bank officer at the delivering bank, with protection from both banks involved. Online banking and B2B financial solutions like Bancoli offer convenient and fast options. One critical factor in global transfers is the exchange rate, which determines how much of the recipient’s currency you receive for your sending currency.

- Automated Clearing House (ACH) Transactions: Electronic transactions that require both banks to be linked together, with no fees but specific bank instructions needed.

- Cash-to-Cash Transfers: Transfer physical cash through money transfer centers, converting the domestic currency to the destination country’s currency.

- Prepaid Debit Cards: Send funds via a prepaid debit card, where the sender loads the card with cash funds for the recipient to withdraw or use as a debit card.

Comparing fees from different payment method providers ensures you get the most competitive option according to your needs. Beyond fees, some institutions might charge additional costs for services like currency conversion or recipient notification.

Transferring Money Between Currencies

Transferring money between currencies involves converting your local currency into the currency used by the recipient’s country.

These rates fluctuate constantly based on global economic factors like supply and demand. The interbank rate is the benchmark rate at which banks exchange currencies amongst themselves, and it serves as a baseline for other currency exchange services.

When sending money internationally, transfer speeds can vary depending on the chosen method. Bank wire transfers are generally fast, but traditional banks often have less competitive exchange rates and higher fees.

Additionally, consider transferring larger amounts simultaneously, as some services have fixed fees that become less significant with a higher transfer value.

Understanding How Currency Transfers Work

Currency transfer moves funds from the sender’s account to the recipient’s in another country and currency.

Banks or specialized money transfer services can facilitate this process, offering various payment options and transfer methods.

Getting started with Bancoli: Step-to-step guide

1. Create your Global Business Account

You can transfer money and receive payments with Bancoli by registering and completing the business verification process to apply for a Global Business Account. If you already have an account, log in to your dashboard and go to step 3.

This multi-currency account is part of Bancoli’s integrated financial solution and cash flow tool suite, designed to enhance your financial management experience.

Setting up your Global Business Account marks your entry into a world of global financial opportunities, where managing money across borders becomes as simple as a few clicks.

2. Complete the verification process

Completing Bancoli’s verification process is equivalent to completing an online bank account application. Once completed, your application will be reviewed, and once it is approved, you will gain immediate access to your Global Business Account.

Remember, your USD funds allocated in Bancoli are secured with Bancoli USD Custody.

3. Activate currency accounts

Bancoli’s Global Business Account (GBA) offers a distinctive feature of activating multiple currency accounts. With just a few clicks, you can activate one or more accounts in USD, EUR, GBP, SGD, and HKD to trade in more than 200 countries globally.

The possibility of having multiple currency bank accounts is especially beneficial for managing different aspects of your business finances separately within the same currency.

For instance, you could have multiple USD accounts dedicated to specific purposes like operational expenses or incoming payments from distinct clients or regions.

Ensure a Smooth Transfer: Preparing for International Wire Transfers

Wire transfers in foreign currency are secure for sending large international money transfers.

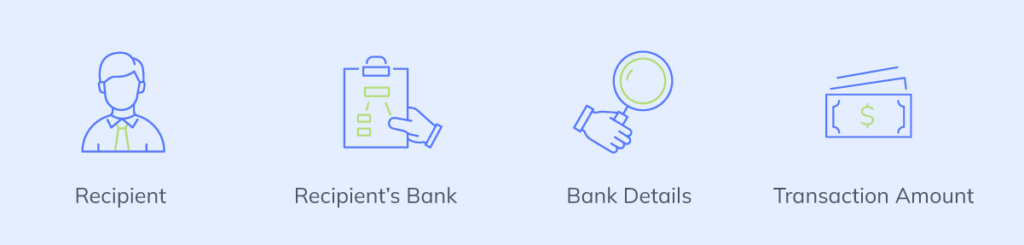

When preparing for an international wire transfer, make sure you have the following information ready:

- Recipient details: Full name, mailing address, and professional or business email address.

- Recipient’s Bank: The name of the bank, the country, and the city where it is located.

- Bank Details: The IBAN Code and SWIFT/BIC Code of the recipient’s bank account, also known as the routing number.

- Transaction Amount: Be aware of the transfer limits imposed by each banking institution involved.

When transferring funds, be mindful of your recipient’s banking details, such as the account’s routing number, to avoid errors.

Best Practices for Foreign Currency Transfers

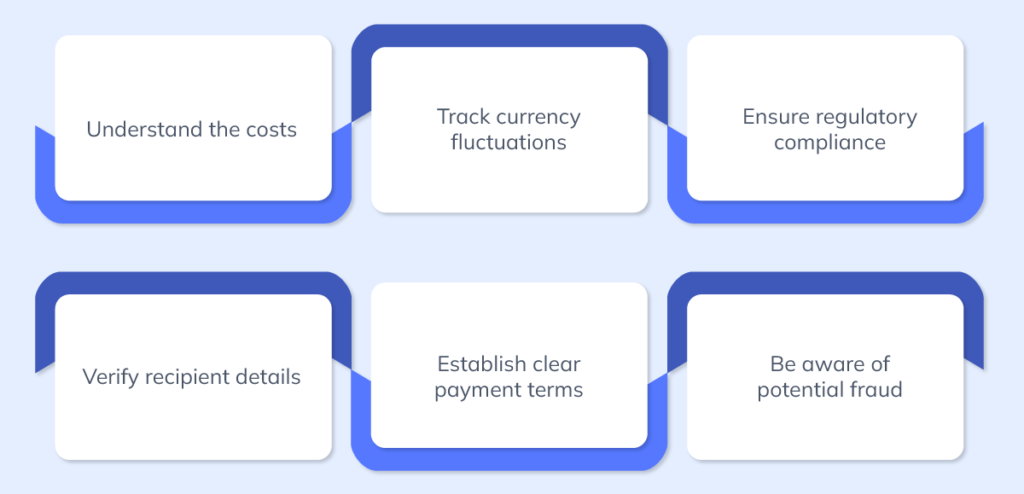

Managing international payments can be complex. Fortunately, there are strategies you can employ to optimize your payments.

Certain businesses provide rate alerts, enabling you to make transfers when conditions are most advantageous.

Here are some best practices to follow:

Understand the costs

Before choosing a method for international payments, understand the total costs involved. This includes transaction fees, currency conversion fees, and any potential intermediary bank fees.

Track currency fluctuations

Currency exchange rates may fluctuate constantly and can significantly impact the cost of international payments. Monitor these rates to understand their impact and consider covering strategies to manage exchange rate risk. This way, you can ensure you’re getting the best deal.

Ensure regulatory compliance

Different countries have different regulations for financial transactions. Noncompliance can lead to legal consequences and costly fines, not to mention damage to your company’s reputation. Understanding and complying with the regulations in sending and receiving countries and other pertinent jurisdictions is important.

Verify recipient details

Always double-check the recipient’s details before sending an international payment. Small errors in account numbers, routing numbers, or addresses can lead to delays, additional fees, or the payment sent to the wrong account.

Establish clear payment terms

When dealing with international clients or suppliers, clearly outline contract payment terms. This includes the currency of payment, who is responsible for transaction fees, payment deadlines, and any potential late payment penalties.

Be aware of potential fraud

Unfortunately, international payments can be a target for fraud. Be aware of common scams, such as phishing attempts or fake invoice scams, and train your staff to recognize and respond to them. Always verify any changes to payment details and consider using secure payment methods that offer fraud protection.

Remember to provide accurate recipient information; understanding the destination country’s regulations can streamline the process.

Ensuring Trust and Protection: Secure Money Transfers

Regarding international money transfers, reputable providers operate within stringent regulatory frameworks to ensure the safety and security of transactions.

These providers have robust safeguards to prevent fraud and protect customer funds, giving users peace of mind when transferring money.

It is crucial to only send money to individuals or businesses you know and trust to avoid falling victim to scams or fraudulent activities. If you suspect any fraudulent behavior or encounter issues with a transfer method, it is essential to act promptly.

Contact the money transfer provider’s customer support immediately to report concerns and seek guidance on the necessary steps to address the situation effectively.

Being aware of safeguarding your assets can help mitigate risks and ensure a secure money transfer experience.

Safeguarding Your Funds: Security in Global Transfers

Ensuring the security of international payments requires a multi-layered approach. Here are some key strategies for businesses and individuals to safeguard money when receiving and sending an international money transfer:

- Platform Features: Utilize platforms like Bancoli that provide features like USD Custody for enhanced financial information protection.

- Multi-Factor Authentication (MFA): Implement MFA to require more than just a password for transactions, adding a critical security layer. Many platforms, including Bancoli, offer MFA.

- Regular Updates: Keep all payment-related software and systems updated with the latest security patches to eliminate vulnerabilities exploited by fraudsters.

Building Internal Defenses

- Educating and Training Staff:

- Fraud Awareness Training: Regularly educate employees on the latest fraud schemes and the importance of security protocols.

- Compliance Training: Ensure staff involved in international payments are knowledgeable about AML (Anti-Money Laundering), sanctions, and other relevant regulations.

- Best Practices Training: Train employees on secure payment using trusted platforms and verification procedures.

Enhancing Invoice and Payment Verification

- Verify Payment Details: Always confirm invoice details and payment instructions directly with the business partner, preferably through a secure and independent communication channel.

- Use Electronic Invoices: Electronic invoicing systems reduce the risk of invoice manipulation and ensure accurate, timely payments. Bancoli’s e-invoicing tool has automation capabilities to save time and money on e-invoicing work. It includes tools to offer early payment discounts to customers on each e-invoice, accelerating cash flow like no other solution.

Simplifying International Payments with Bancoli

Bancoli’s Global Business Account includes unparalleled fund security and reliability, safeguarding up to US$125 million per account holder. This backing exceeds the coverage provided by FDIC-insured bank accounts and traditional European banks, providing clients with enhanced protection.

With its multi-currency bank account, your details are to transact in USD, EUR, GBP, SGD, and HKD, plus MXN, BRL, JPY, CNY, PHP, and INR payouts. It also facilitates global payments in more than 200 countries.

It distinguishes itself by offering competitive transaction fees that are notably lower—up to 10 times—than those typically offered by conventional banking institutions.

This includes generating yield and accelerating cash flow on every USD invoice issued and a comprehensive verification process for bank-level supplier verification.

Our accelerated cash flow feature streamlines global B2B payments, offering a complete suite of solutions for modern businesses.

Key Takeaways: Navigating Global Transfers

Understanding the available transfer methods, fees, and rates is crucial for money transfers. This will help ensure that your money reaches its destination safely and cost-effectively.

Whether you send money internationally to a family member or manage international transactions for your business, global transfers can be the solution to meet your needs.