Efficiency and security are paramount in today’s business world. Traditional paper-based invoicing processes can be slow, error-prone, and vulnerable to fraud. That’s where electronic invoicing or e-invoicing comes in.

E-invoicing is the digital exchange of invoices between businesses. It streamlines the invoicing process, saving time and money, while also enhancing security and reducing errors.

This article will explore the world of e-invoicing, explaining its benefits, applications across different industries, and how it compares to traditional invoicing methods.

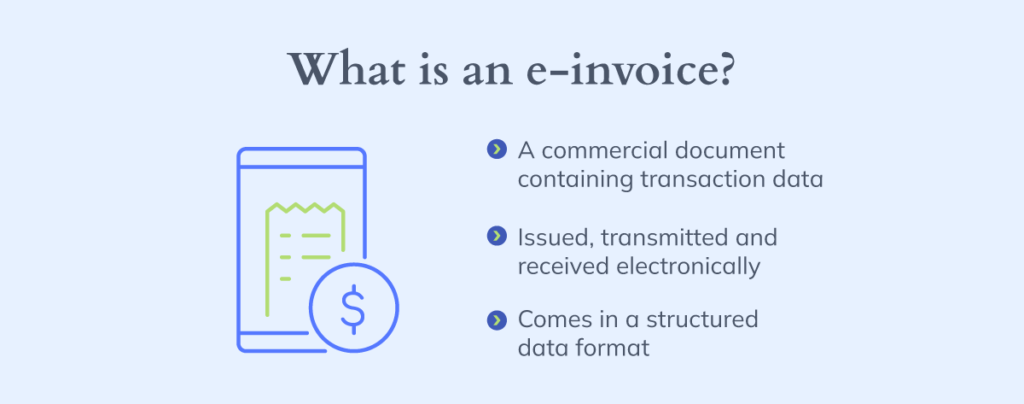

What is Electronic Invoicing?

E-invoicing, or electronic invoicing, is the secure, paperless exchange of invoices in a standardized digital format between businesses.

Unlike traditional paper invoices, e-invoices are transmitted electronically, eliminating the need for physical documents and manual data entry. This leads to a faster, more efficient, and secure invoicing process.

What is the difference between digital invoices and electronic invoices?

Digital and electronic invoices signal a shift from paper to digital formats. Both serve different purposes and offering varied benefits for businesses aiming to modernize their financial operations.

Digital invoicing converts a paper invoice into a digital file, such as a PDF or image, via scanning. These invoices can be shared electronically but are static and do not support automated integration with financial systems. They often lead to inefficiencies due to the required manual input.

In contrast, electronic invoicing provides a more advanced digital solution designed for seamless digital transactions. E-invoices are created in structured formats that allow for automatic integration with various financial systems. Digital banking platforms like Bancoli, enhance business efficiency by streamlining payments and financial reconciliations.

E-invoicing’s main advantage is its use of standardized formats, ensuring compatibility with a wide range of digital financial operations software.

This facilitates smoother transactions and reduces the reliance on manual input. Thereby, it improves data accuracy and offering a robust solution for modernizing financial workflows.

Applications of E-Invoicing

The digital revolution fundamentally changes organizational operations and interactions, with e-invoicing at the heart of this transformation.

It enhances the traditional financial workflow by enabling the digital creation, exchange, and management of invoices.

This evolution goes beyond merely altering invoice transmission methods; it reimagines financial operations, encouraging rapid and precise business activities. E-invoicing’s diverse applications underscore its transformative potential across the modern business landscape:

- Electronic Data Interchange (EDI): EDI facilitates the computer-to-computer exchange of business documents in standardized formats, optimizing supply chain operations and reducing lead times, especially in sectors like retail and manufacturing.

- Emailing PDF invoices: Common among small and medium enterprises, this method represents an initial move toward digitalization. However, due to a lack of standardization, it falls short of achieving full automation.

- E-Invoicing platforms: Cloud-based platforms offer a secure, efficient way to exchange invoices. They incorporate features like invoice tracking, automated matching, and integration with financial tools, enhancing overall transaction efficiency.

When you use Bancoli’s invoicing tool, you access seamless invoicing that integrates with the Global Business Account. This lets you dispatch your electronic invoices directly to your clients, accompanied by supplementary files like PDF, XML, and others. Additionally, you can send your invoices directly to your clients’ Bancoli bank accounts for streamlined electronic invoice processing.

Why is Electronic Invoicing Becoming More Popular?

E-invoicing is becoming increasingly essential in various industries, enhancing business operations and marking a shift towards a modern financial system.

This method streamlines the invoicing process, simplifies the sending and receiving invoices, and integrates seamlessly into existing systems. By adopting e-invoicing, businesses demonstrate a commitment to innovation, ensuring they remain compliant and competitive in the evolving global market.

E-invoicing is becoming increasingly popular for the following reasons:

- Speed: It drastically shortens the invoicing cycle, enabling faster processing, approval and payment. This is crucial for businesses in fast-paced sectors like digital services, manufacturing supply chains, retail, and commodities trading.

- Security: E-invoicing enhances security through strong encryption and compliance with standards, reducing fraud and errors. It is a critical advantage for industries dealing with high-stakes transactions.

- Cost savings: Transitioning from paper to digital invoices allows businesses to cut down on costs associated with conventional paper invoice. Furthermore, it minimizes the need for manual invoice processing, leading to considerable financial savings.

- Efficiency: Automating accounts payable processes liberates staff from administrative tasks, improving accuracy and productivity.

- Environmental benefits: By minimizing paper use, e-invoicing supports sustainability goals, contributing to environmental conservation efforts.

E-Invoicing Across Different Industries

The shift to electronic invoicing presents a flexible solution that caters to the unique needs of various industries.

In digital services or commodities trading, e-invoicing delivers targeted performance benefits, including heightened efficiency, diminished errors, and smoother payment procedures. When implemented effectively, the e-invoicing system can revolutionize accounts payable processes.

By selecting the appropriate e-invoicing solution, businesses can reduce human error, enhance the accuracy of invoice numbers, and reap numerous advantages over traditional invoices through adopting electronic invoices.

Digital Services

In the digital services industry, where transactions occur at the speed of clicks, e-invoicing bridges the gap between service delivery and payment processing. By utilizing the benefits of e-invoicing, businesses can also achieve seamless integration with their financial processes and systems

Example: A digital marketing agency implementing e-invoicing, lets them send e-invoices directly to clients, eliminating mailing delays and manual digitization. Their accounts payable team receives invoices instantly, and integration with financial software speeds up processing. This translates to faster payments for the agency and quicker service delivery for clients.

Manufacturing

The manufacturing industry’s complex supply chains demand precision and timeliness. E-invoicing cuts through the potential clutter of manual processes by providing a clear, structured data trail from purchase orders to payment receipts. By receiving invoices electronically and employing systems that maintain compliance with industry standards, manufacturers can optimize their payment processes, leading to leaner operations and stronger relationships with suppliers.

Example: In the manufacturing industry, a business payments coalition that adopts electronic invoicing benefits from real-time updates and electronic format invoices that integrate with their business systems. For instance, a manufacturer of automotive parts can receive e-invoices from suppliers. This structured data approach enables lean manufacturing practices, minimizing human error and enhancing overall supply chain efficiency.

Retail

In the retail sector, streamlining the supply and distribution chains is crucial. By adopting e-invoicing, retailers can quickly process transactions, efficiently manage returns, and maintain accurate financial data, leading to smoother operational flow.

Example: A retail chain moving to electronic invoices benefits from faster invoice processing and improved supply chain operations, crucial during peak shopping times. This transition optimizes internal workflows and indirectly enhances customer experiences by ensuring efficient restocking and returns handling, showcasing the impact of e-invoicing on retail efficiency and customer satisfaction.

Commodities

With its global scope and strict regulatory requirements, the commodities sector benefits greatly from e-invoicing. It enables quicker transaction processing, facilitating compliance across various markets and reducing paperwork.

Example: E-invoicing allows commodities traders to swiftly exchange invoices in a structured digital format, ensuring rapid and precise processing. A trader can quickly reconcile and process payments upon receiving an e-invoice containing all necessary details, such as invoice numbers and structured data.

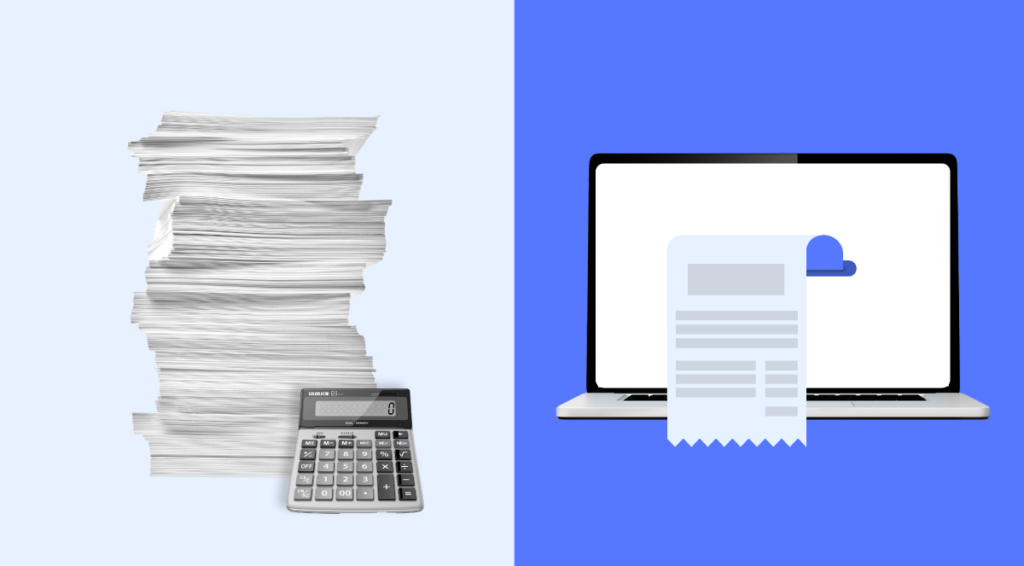

E-Invoicing vs Traditional Invoicing: Embracing Efficiency in the Digital Age

The transition from traditional paper-based invoicing to digital e-invoicing systems marks a significant leap towards operational efficiency for modern businesses.

Traditional invoicing methods, characterized by a labor-intensive sequence of creation, printing, digitizing, sending, and manual processing of paper invoices, are not only time-consuming but also prone to errors.

Conversely, dealing with an electronic invoice represents a significant stride in digital progress within business operations. By embracing e-invoicing, companies benefit from a more streamlined and digital workflow that significantly enhances transaction accuracy, improves security protocols, and increases the speed of financial transactions.

The Shift to Electronic Invoicing

The shift to electronic invoicing represents a significant advancement in business operations, streamlining processes and enhancing efficiency. Here’s how this transformation impacts key aspects of invoicing:

Automation and data entry: E-invoicing eliminates the drudgery of manual processing and the errors it invites by leveraging automation through electronic data interchange (EDI) and structured data formats for accurate data capture.

Standardization of formats: Standardizing e-invoicing formats allows businesses to ensure their electronic invoices integrate seamlessly with various accounting systems, simplifying processing and reconciliation. This facilitates smoother financial operations and reduces the need for manual adjustments often required with paper invoices.

Real-time tracking: E-invoices offer the advantage of monitoring the invoice status in real-time, providing a clear view of the invoicing process from issuance to payment, a feature unavailable with traditional paper invoicing.

Security measures: E-invoicing enhances transaction security with encryption and digital signatures, significantly reducing the risk of fraud and loss inherent in paper-based invoicing.

Financial and Time Efficiency: The Cost-Benefit Analysis

Businesses seeking enhanced operational efficiency and cost savings are increasingly adopting e-invoicing. This shift from the manual, paper-based handling of invoices to a digital approach reduces processing times and cuts costs associated with paper, printing, and postage.

Businesses can enjoy the benefits of e-invoicing, including compliance with standards, the ability to send and receive invoices efficiently, and seamless integration with service providers. Implementing e-invoicing ensures that every digital invoice, marked with a unique invoice number, contributes to maintaining compliance and optimizing financial operations.

Reduced Processing Time

E-invoicing significantly decreases processing time by automating routine tasks, freeing employees to engage in strategic activities that foster business growth.

Lower Paper Costs

Transitioning to e-invoicing eliminates printing, postage, and storage expenses, allowing businesses to allocate resources to innovation and competitiveness.

Minimization of Errors

Automating invoice processing minimizes manual errors, enhancing the accuracy of financial records and reducing the need for corrections.

Faster Payments

E-invoices expedite the processing and payment cycles, granting businesses quicker access to funds and bolstering cash flow, which is vital for financial stability.

Going Global: E-Invoicing in International Commerce

International Standards and Formats

For businesses engaged in international trade, e-invoicing streamlines transactions by standardizing invoice formats, enabling the seamless exchange of invoices across borders without the need to convert paper invoice data into electronic format.

Crucially, multi-currency invoicing enhances international operations by allowing both buyers and sellers to use consistent invoiced amounts, thus minimizing fluctuations. The integration of multi-currency invoicing with multi-currency banking represents an ideal synergy, optimizing transactions and financial flows in global commerce with precision and efficiency.

Paperwork Reduction

E-invoicing significantly diminishes the reliance on physical invoices and customs documentation, facilitating smoother goods movement and diminishing the risk of international shipping delays.

Faster Customs Clearance

The electronic format of e-invoices expedites validation and processing by customs authorities, resulting in quicker clearance and delivery of goods, which is invaluable for maintaining the pace in fast-moving international markets.

Regulatory Compliance

E-invoicing simplifies adherence to international trade regulations and tax fraud prevention measures for businesses. The structured digital format of e-invoices guarantees accurate reporting of all necessary information and its availability for audits, ensuring compliance with global standards.

Getting Started with E-invoicing

The transformation from traditional invoicing methods to electronic invoicing is not merely a change of format but a complete overhaul of the invoice processing system.

Selecting the Ideal E-Invoicing Service Provider

The first step to implement e-invoicing is to select a solution that aligns with your industry’s needs and your company’s technical requirements. Key considerations include:

Supported Data Formats

Selecting an e-invoicing solution that accommodates XML formats and other structured data formats is crucial for ensuring seamless compatibility with existing accounting software and financial systems. This capability facilitates easy integration with current invoicing processes, enhancing operational efficiency and data accuracy.

Industry-Specific Features and Compliance

Different industries have unique e-invoicing standards and requirements. Select a service provider that understands these nuances and offers features such as touchless invoice processing and compliance with business to government, business to business, or business to consumer standards.

Security and Scalability

E-invoicing involves sensitive invoice data. It’s imperative to opt for a solution that prioritizes encrypted file transfer, digital signatures, and is scalable to your business growth.

Given that you will be sending invoices and potentially sensitive financial information electronically, ensure that the chosen e-invoicing solution offers robust data security measures.

E-Invoicing Implementation Guide

Implementing e-invoicing can revolutionize your financial operations, lower costs, and accelerate cash flow. It can also enhance efficiency and streamline transactions with your commercial partners. Here’s a guide to navigating this transition effectively.

Pilot and Full-Scale Implementation

Many businesses decide to initiate their e-invoicing journey with a pilot program. If this is your approach, select a small group of trusted trading partners to deploy and test your business e-invoicing. This controlled start allows you to gather invaluable feedback, identify any issues early, and make necessary adjustments before a full-scale rollout.

Training and Partner Engagement

Staff Education: Ensure a smooth transition by providing comprehensive training to your accounts payable team and all relevant staff. Familiarizing them with the e-invoicing solution will efficiently manage incoming e-invoices and streamline the overall data flow.

Trading Partner Communication: Proactively communicate with your suppliers, business partners, and customers about your move to e-invoicing. Highlight the mutual benefits, such as cost savings, improved cash flow, and simplifying purchase orders and business document exchanges.

Monitoring and Optimization

Track and Enhance: Continuously monitor the performance of your e-invoicing system. Regular assessments help identify and rectify any data entry errors, ensuring touchless invoice processing and seamless integration with your existing invoicing processes.

Integration and Compatibility

Ensure your chosen e-invoicing solutions are compatible with your current financial operations and systems. This compatibility is crucial for minimizing disruptions and leveraging features like early payment discounts, which benefit both your business and your partners.

Access E-invoicing for Global Business Growth

Getting started with e-invoicing for your business is easy with Bancoli’s integrated financial solution with powerful tools to accelerate cash flow, where the invoicing tool is invaluable for businesses of all sizes in all industries.

This solution also integrates directly with the Global Business Account, facilitating operations with unique agility, and is multi-currency for smoother operations between customers and suppliers worldwide.

In addition, Bancoli’s e-invoicing tool has automation capabilities to save time and money on e-invoicing work, and includes tools to offer early payment discounts to customers on each e-invoice, acceleration cash flow like no other solution.