The electronic industry pulsates with innovation, constantly pushing the boundaries of what’s possible for electronic devices. Yet, this relentless march of progress has encountered a formidable roadblock: a global component shortage.

Securing these vital building blocks is a complex and unpredictable challenge. This includes everything from the microscopic transistors that power our smartphones to the capacitors that regulate current flow.

In this labyrinth of scarcity, a single factor can illuminate the path forward: the power of swift payments. This seemingly mundane aspect of business, securing the necessary components, is vital to unlocking production flow.

Ensuring manufacturers can navigate the component shortage labyrinth and emerge victorious depends on it.

Payment Delays: A Bottleneck in the Flow of Materials

The consumer electronics industry is grappling with a complex issue: component shortages are causing production delays. While limited supply is a contributing factor, a lesser-known culprit is hindering the smooth flow of materials – delayed payments.

A recent study by the Semiconductor Industry Association (SIA) found a significant disruption in electronics manufacturing. Over 60% of electronics producers have experienced production delays due to component shortages. Limited supply only partially causes this disruption; payment delays often exacerbate the issue.

When manufacturers fall behind on settling invoices, component suppliers are forced to make tough choices. They prioritize customers who offer faster payment terms, leaving those with delayed payments waiting in a queue.

A 2023 study by the Institute of Electrical and Electronics Engineers (IEEE) confirms this correlation. A key finding of the study was the link between payment speed and component access. Electronics companies with faster average payment turnaround times were 25% more successful in securing essential elements during periods of scarcity.

Swift Payments: The Key to Unlocking Production Flow

Prompt and efficient payment solutions enable real-time cross-border transactions and instant invoice settlement, empowering electronics manufacturers and electrical components producers to:

Secure Critical Components

Immediate access to funds upon invoice approval allows manufacturers to compete effectively for scarce components, even when facing stiff competition from slower-paying rivals. This agility can differ between securing enough chips to maintain production or facing costly delays.

Optimize Inventory Management

Consistent access to components enables manufacturers to maintain predictable production schedules and optimize inventory levels. This reduces the risk of overstocking slow-moving items and ensures a steady flow of finished products to meet consumer demand.

Enhance Brand Reputation

Manufacturers across various industry sectors can leverage swift payments to suppliers to ensure a smooth flow of critical materials and supplies. This, in turn, helps avoid production disruptions and enables on-time product delivery.

Consistently meeting customer expectations strengthens brand reputation and cultivates strong customer loyalty.

Strategies for Swift Payments in Electronics Manufacturing

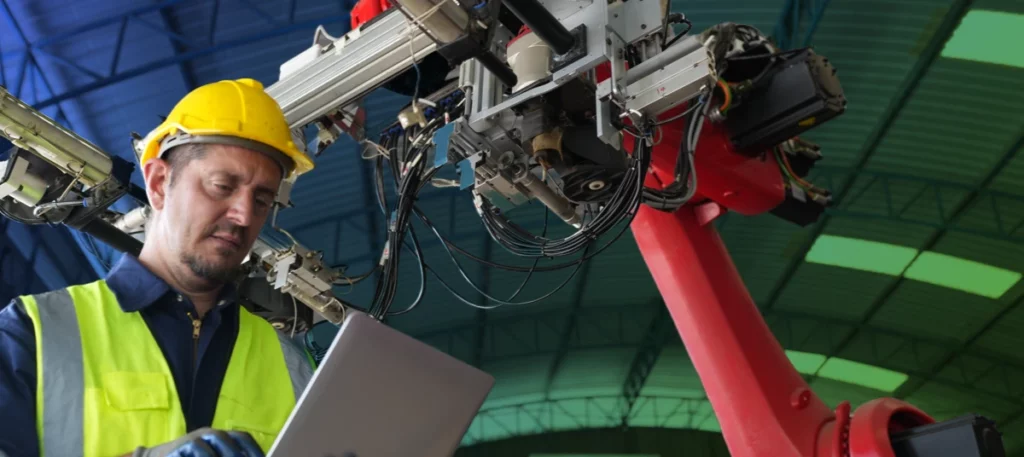

Electronics manufacturers rely heavily on efficient cross-border payments in today’s globalized electronics industry. Timely settlements are crucial for maintaining strong supplier relationships and ensuring smooth production flow. Let’s explore some strategies for swift payments in international transactions.

Real-time Payment Systems

Real-time payment systems are crucial in increasingly digital economies, particularly emerging markets. They offer faster transactions and settlements, potentially benefiting businesses and consumers.

Bancoli’s Global Business Account executes cross-border payments, supports transactions in over 25 currencies across more than 200 countries, and settles invoices in real time.

Digitized and Automated Payments

Digitized and automated payments are transforming the industrial electronics industry by streamlining financial processes and enhancing efficiency.

Digital invoicing and payment platforms minimize manual processes and errors, expedite company transactions, and streamline financial operations. Automating payment schedules for recurring invoices further streamlines transactions and avoids delays, ensuring suppliers are paid predictably and on time.

These advancements are particularly beneficial for manufacturers in the industrial electronics industry, often sourcing parts from various countries.

Early Payment Discounts and Incentives

Companies in the industrial electronics industry can improve their financial health by implementing strategies that encourage early customer payments and foster strong relationships with suppliers.

- Early Payment Programs: Offering discounts or flexible financing options encourage customers to pay invoices sooner, improving cash flow that can be used to make faster payments to component suppliers. Bancoli has an integrated cash flow acceleration tool is perfect for this purpose.

- Strong Supplier Relationships: Close communication with suppliers is essential for ensuring transparency regarding payment timelines and exploring potential flexibility. Developing longer-term partnerships with key suppliers can also lead to more favorable negotiated payment terms, such as terms based on purchase volume or guaranteed offtake agreements.

Supply Chain Finance Strategies

Companies developing, producing, and fabricating electronic products face challenges managing cash flow throughout their supply chains.

Supply chain finance (SCF) strategies offer a range of solutions to address these challenges and ensure smooth operations.

These strategies help businesses secure funding and bridge potential payment gaps. For instance, companies can utilize solutions like reverse factoring, where manufacturers receive early payment from lenders in exchange for invoices. The lender then collects the full payment from the customer at the original invoice due date.

Additionally, SCF programs can offer inventory financing, providing capital to facilitate the purchase of raw materials and elements needed for electronic product development and production. This can be particularly beneficial for companies facing high upfront costs for materials or experiencing extended lead times.

These strategies must be combined with proactive forecasting and open communication with suppliers and customers to manage expectations and create a collaborative mindset throughout the supply chain.

Bancoli: Fueling Agility in a Competitive Race

Bancoli’s Global Business Account goes beyond the speed of transactions; it provides strategic tools specifically designed to navigate the electronics industry’s complexities:

- Real-Time International Payments: Secure components seamlessly from global suppliers, regardless of their location or currency, ensuring access to the broadest pool of resources during times of scarcity.

- Dynamic Payment Scheduling: Tailor payment terms to specific supplier relationships and optimize cash flow based on projected component availability and production schedules.

- Enhanced Fund Security: This system offers unparalleled fund security and reliability, safeguarding up to US$125 million per account holder. This backing exceeds the coverage provided by FDIC-insured bank accounts and traditional European banks, providing clients with enhanced protection.

Conclusion: Payment Efficiency – The Winning Formula in Electronics Manufacturing

In the face of ongoing electronic component shortages, efficient payment solutions are no longer a mere convenience but a strategic necessity for the electronics industry’s survival and success.

By embracing tools like Bancoli’s Global Business Account, you can ensure uninterrupted production of electronic equipment, satisfied customers, and a competitive edge in this ever-evolving landscape.

Bancoli’s contribution goes beyond facilitating transactions; it empowers electronics manufacturers to unlock the full potential of their production lines and write their own success stories in the face of industry challenges.