Businesses engaged in global trade must understand the intricacies of international transactions. SWIFT payments are a linchpin for these financial exchanges, offering a secure and standardized method for cross-border transfers.

Whether paying an overseas supplier or managing international payroll, understanding SWIFT payments and the factors affecting their processing times is essential for efficient financial management.

We’ll explore the dynamics of SWIFT payments, including how they operate, their significance in the banking sector, and the variables that influence the duration of a bank transfer.

What is a SWIFT Payment?

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. It’s a secure messaging network banks and financial institutions use to send standardized instructions for international money transfers.

SWIFT payments are a secure way to send money overseas through the SWIFT network, which banks use to communicate. Businesses commonly use SWIFT payments for international trade, investments, and foreign worker payments.

Advantages of Choosing SWIFT for Your Transfer Needs

Sending money internationally can be daunting, but choosing the right method is crucial. SWIFT offers a secure and reliable solution for your international money transfers. Here are the key advantages of your global transactions.

- Secure and Reliable: SWIFT offers a secure way to send money overseas. The SWIFT network is renowned for its high level of security, ensuring your transfers are completed safely and reliably. Encrypted messages and robust security measures minimize the risk of fraud or interception.

- Global Reach: With over 11,000 member institutions in more than 200 countries, SWIFT is the leading method for international payments. This vast network allows businesses of all sizes to participate in the global marketplace. For instance, a small company in Mexico can easily sell products to customers in Europe or Australia by accepting SWIFT payments.

- Simplified Transfers: SWIFT uses standardized codes (BIC codes) that uniquely identify every bank involved in a transaction. This streamlines the transfer process by eliminating the need to understand specific foreign bank account number formats. Having the recipient’s bank’s SWIFT code (BIC) ensures your transfer is routed correctly.

How Long Do SWIFT Payments Take and Why?

Understanding the factors that affect processing times can help you set expectations for your SWIFT transfer. Here’s a breakdown of why SWIFT payments can take time:

Intermediary Banks

SWIFT transfers involving banks without a direct connection may route to the final destination bank through intermediary banks, such as a major US bank or a European clearinghouse. This can happen for transactions like sending money from a US bank to a rural bank in India.

Compliance Checks

Banks perform AML and KYC checks on all SWIFT transfers to prevent fraud, which can cause delays. Larger transfers may also receive extra scrutiny to ensure their legitimacy.

Time Zones

The transfer’s processing can be delayed if the sending and receiving banks are in different time zones.

Due to the time difference with a recipient bank in Tokyo, a SWIFT payment initiated late in the business day in New York might not be processed until the following day.

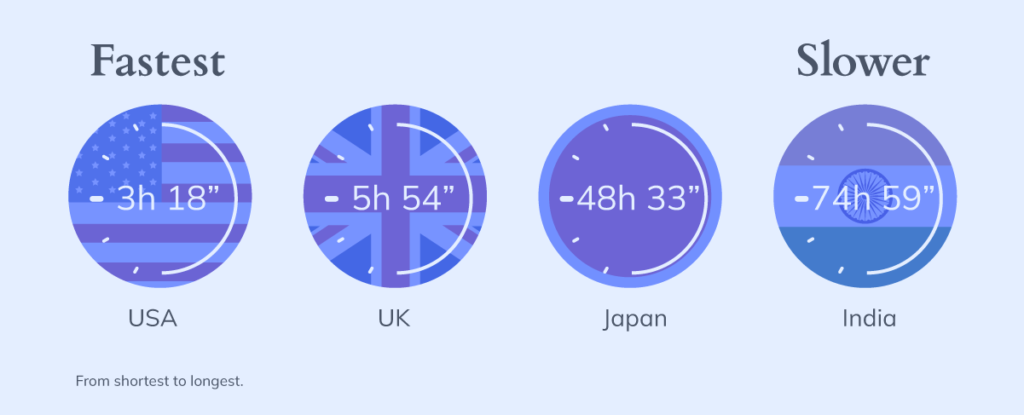

Destination Country

Some countries have stricter regulations or less developed banking systems, slowing the transfer process.

Differences in SWIFT Payment Durations

Currency

Transfers involving major currencies like the USD, EUR, or GBP are generally faster due to higher transaction volumes and established infrastructure. Less common currencies may take longer.

SWIFT transfers within the EU can often be completed on the same day for USD to EUR conversions, but transfers involving the less common Thai Baht (THB) might take several days.

Transaction Size

Large transfers may trigger additional scrutiny and checks, potentially increasing the processing time. For example, a large multinational corporation transferring millions of dollars may have its SWIFT payment flagged for a more thorough review.

Factors Affecting SWIFT Payment Speed

The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, facilitates a vast network of global financial transactions, and speed is a critical component for businesses and individuals alike.

Accelerators of SWIFT Payments

Banking Relationships and Group Networks

One of the primary accelerators of SWIFT payment speed is the relationship between the banks involved. Payments are generally processed more swiftly when they occur within the identical banking group or between banks that have a well-established relationship.

This is due to the streamlined communication and trust already established, which can significantly reduce processing times.

Timing of Transactions

The timing of the transfer can also play a significant role. Transfers initiated early in the business day are more likely to be processed on the same day.

This is because they are queued for processing well before the cut-off times that banks typically have for same-day transactions.

For example, a transfer sent at 9 AM on a business day stands a better chance of being completed that day than one sent at 4 PM, which might miss the day’s processing window.

Utilization of Internal Banking Networks

International banks can speed up SWIFT payments for companies with a global presence. Companies can streamline international payments like payroll and internal transfers by using an identical international bank for all their subsidiaries.

This is especially beneficial for multinational corporations making quick transactions across different countries.

Decelerators of SWIFT Payments

Timing and Compliance Checks

Conversely, several factors can hinder the speed of SWIFT payments. Payments initiated close to weekends or holidays are prone to delays.

For instance, a SWIFT payment sent on a Friday before a long weekend in the receiving country might not be processed until the following business day, which could be as late as Tuesday.

Additionally, transactions that raise compliance red flags require additional scrutiny and can significantly delay processing as banks perform the necessary due diligence to mitigate risk.

Complex Transactions

Several factors can impact how long it takes to transfer money through a SWIFT payment. The complexity of the transaction itself is a significant one. Involving multiple currency exchanges or relying on several intermediary banks lengthens the process.

Each institution requires additional steps and verifications, which adds time. For instance, payments involving less common currencies or traveling through multiple banks will likely experience longer delays than simpler transactions.

By understanding these factors that can slow down payments, businesses and individuals can optimize their use of SWIFT and improve the efficiency of their international financial activities.

SWIFT Payment Options for Businesses

Traditional Bank Transfers: Most banks offer SWIFT transfer services. However, fees can be high.

Money Transfer Specialists: Companies like PayPal or Western Union often specialize in international transfers. They generally provide faster processing times and lower fees than traditional banks. However, there are associated transaction and withdrawal fees.

Innovative Global Payments Solutions: Offering the best global banking and fintech solutions like Bancoli with its Global Business Account, a multi-currency account designed to facilitate payments in more than 200 countries, saves you time and money in every international payment.

Understanding SWIFT Payment Costs: From One Bank to Another

While SWIFT offers a secure and reliable network for international money transfers, it is important to consider the associated costs. Here are some of the various fees that can add up throughout the process:

- Transfer Fees: Both the sending and receiving banks may charge a fee. For example, a bank might charge a flat fee of $25 to send a SWIFT payment and another $15 to receive it. Sometimes, these fees can be as high as $75 or even $100.

- Intermediary Bank Fees: Each intermediary bank involved may deduct charges. Each intermediary bank in the payment chain might charge a $10-$20 fee.

- Exchange Rate Margins: Banks often add a markup to the exchange rate, which is an additional cost to consider. For example, a bank may quote an exchange rate that includes a hidden margin of 1-2%, increasing the overall cost of the transfer.

Bancoli offers competitively low rates and fees, dramatically undercutting those typically associated with traditional financial institutions.

Our Global Business Account is a multi-currency business bank account that supports USD, EUR, GBP, MXN, CAD, AUD, HKD, SGD, NZD, PLN, and CNY, and payouts in 50+ currencies in 200+ countries.

Wire Transfers vs. SWIFT Transfers: Understanding the Options for International Payments

When sending money internationally, businesses have a few options available. Wire transfers, often called electronic or telegraphic transfers, are popular for quickly and securely moving funds.

However, there are two main categories of wire transfers: domestic and international. Domestic wire transfers move funds electronically between banks within the same country, while international wire transfers involve sending money from one bank to another in a different country.

The SWIFT network is crucial for international transactions. Let’s explore the key differences between wire transfers and SWIFT transfers to help you choose the most suitable option for your business needs.

What is a Wire Transfer?

Wire transfers are the broad category of electronic fund transfers between financial institutions. Different networks exist for these transfers, depending on whether they happen within a country (like Fedwire in the US) or internationally.

How long does a wire transfer take?

If transfers occur between accounts at the same financial institution, they can take less than 24 hours.

Wire transfers via a non-bank money transfer service may happen within minutes. If you send money to another country, however, it may take as many as five days for the recipient to receive their funds.

What information do you need to send a SWIFT transfer?

To initiate a business SWIFT transfer, you must provide specific information about yourself, the recipient, and the transaction. Accuracy is critical, so it’s best to double-check everything with the recipient and your bank to avoid delays or issues.

Case 1: Sending a SWIFT Payment

If you are sending a SWIFT payment, these are the details you will need:

- Your full business name and address

- Your bank account number

- Recipient’s full name and address

- Recipient’s bank name and address

- Recipient’s account number (or IBAN)

- Recipient’s bank SWIFT code (BIC)

- Amount and currency of the transfer

- Reason for the payment (brief description)

Key factors to consider before initiating your SWIFT payment

Initiating a SWIFT payment takes one business day at most. The transfer then travels through the SWIFT network (potentially with intermediary banks), which can take 1-3 days. In total, expect the recipient to receive the funds within 1-4 business days after you start the transfer.

Case 2: Receiving a SWIFT Payment

If you are receiving a SWIFT payment, these are the details you will need:

- Your full business name and address

- Your bank name and address

- Your bank account number (or IBAN)

- Your bank’s SWIFT code (BIC)

Key factors to consider when receiving a SWIFT payment

When you receive a SWIFT payment, your bank will likely notify you once the payment has been initiated. Your bank then processes the incoming payment, which includes any necessary compliance checks. Finally, the funds are credited to your account within that day or the next business day after your bank receives them.

In Conclusion

SWIFT payments are a secure and widely used method of transferring money internationally. Depending on the specific circumstances, SWIFT bank transfers can take 1 to 4 business days.

The processing times can vary due to several factors, including the number of intermediary banks involved, the currencies being exchanged, compliance checks, and the specific banks involved in the transaction.