Transfer money to a bank account with fewer steps and greater reach. For global businesses, quickly moving funds in and out of financial accounts is essential. When you make payouts from your USD account in Bancoli’s Global Business Account, your business benefits from Zero FX fees on transfers to 30+ countries.

This guide explains how to transfer money to a bank account, how the process works with Bancoli, and why it’s a game-changer for international business operations.

Why Choose Bancoli for International Transfers?

Modern businesses need a flexible way to receive funds. Bancoli’s infrastructure allows you to transfer money into a Bancoli account using multiple methods, including:

- Cards (credit or debit)

- ACH transfers

- Wire transfers

- Stablecoins

- Bancoli-to-Bancoli payments

This makes it easier to centralize funds from different regions or counterparties. Once received, you can hold, convert, or transfer money to a bank account anywhere your business operates.

Additionally, Bancoli gives you a practical way to save more on international payouts by sending USD to over 20 countries with Zero FX fees using your Global Business Account.

How to Transfer Money to a Bank Account Using Bancoli

To transfer money to a bank account from your Bancoli account, your business first needs to complete a short onboarding process. Once verified, you’ll have access to a full suite of tools designed to make global financial operations simpler.

Here’s how it works:

1. Sign up and access your dashboard

Opening a Bancoli account is the first step. After signing up with your business email, you’ll get access to your dashboard, where you can manage your profile and begin the verification process.

2. Complete your business verification

This step is required before you can use Bancoli for live transactions. You’ll upload your business details and documents through a guided flow.

Once approved, your account becomes fully operational. You can receive payments from multiple sources and transfer money to a bank account, all in a single dashboard.

3. Start using Bancoli to transfer money

With your verified account, you can:

- Receive payments via cards, ACH, wire transfers, stablecoins, or Bancoli-to-Bancoli

- Hold balances in major currencies and transact in over 30 currencies in more than 85 countries, and you can benefit from Zero FX fees when making payments from your USD account

- Send and transfer money to a bank account in your preferred country

Instead of managing multiple providers, everything is available on one platform. For example, you can receive a payment in EUR, hold the balance, and then later send USD to a supplier’s bank account in Mexico. This is all possible from the same interface.

What You Need for an International Wire Transfer?

When you transfer money to a bank account in another country, you’ll need a few key details to make sure it arrives correctly. Whether you’re paying a vendor, contractor, or business partner, accuracy matters.

Here’s what to prepare before you send funds through Bancoli:

- Recipient details: Full name, business or professional email, and billing address.

- Recipient’s bank: Name of the bank, the country, and the city where it’s located.

- Bank account info: IBAN (if applicable), SWIFT/BIC code, and local routing number where required.

- Amount: Confirm any sending or receiving limits with the recipient if applicable.

These are the standard data points most banks or payment platforms use for international bank transfers. Entering them correctly helps prevent delays or rejections.

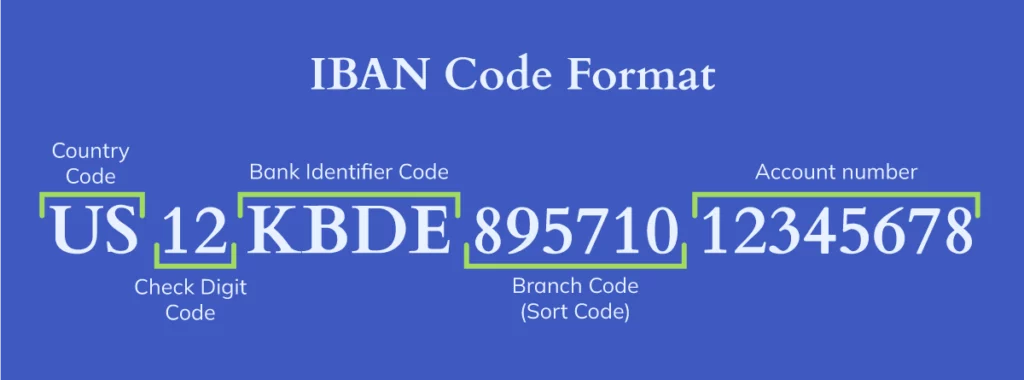

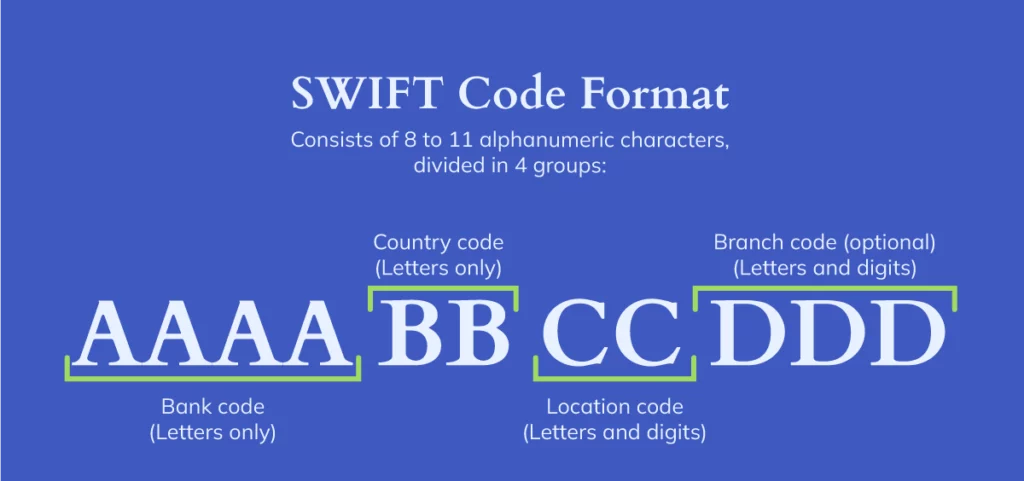

What Are IBAN and SWIFT/BIC Codes?

Two codes are often used to route international payments accurately:

- IBAN (International Bank Account Number): Identifies the destination account with a standardized format that includes country, bank, and account details.

- SWIFT/BIC Code: Identifies the receiving bank and its location so the payment can be routed to the right institution.

You may not need both codes, as it often depends on the destination country. For example, a transfer to Germany usually requires an IBAN and a SWIFT code. In contrast, a US-based transfer might only need an account and routing number. Bancoli guides you through the required fields for your destination.

Using the right details helps your payment reach the intended account without delays. This is important because a small typo in the SWIFT or IBAN can delay the process or even result in the funds being returned.

How Do IBAN And SWIFT/BIC Participate In International Wire Transfers?

Using the correct recipient details ensures your payment reaches the intended account without manual intervention. When handling international transactions, a minor typo in the SWIFT or IBAN can delay processing or result in a return of funds.

That’s why Bancoli’s interface helps validate recipient information as you input it, so you can transfer money to a bank account smoothly, even across borders.

The SWIFT/BIC code is a unique code banks use to process international transactions. It identifies the financial institution and branch, ensuring your money is deposited into the correct bank account.

What Should I Know About Transactional Limits?

When you transfer money to a bank account, limits may apply. This is especially true for cross-border transactions. These limits are based on the destination country or the receiving bank’s policies.

Bancoli does not impose limits on your business activity. However, other banks or counterparties in the transaction may have their own thresholds. Therefore, it’s good practice to check with your recipient before sending large amounts. Your Bancoli account is designed to scale with your business.

Choose the Right Rail for Each Transfer

Bancoli accepts payments via cards, ACH, wire transfers, stablecoins, and Bancoli-to-Bancoli payments. This multi-rail setup lets you choose the method that best fits your specific transaction, based on speed, cost, or location.

- Use ACH for domestic recurring payments in the US.

- Use stablecoins for near-instant settlement over weekends or holidays.

- Use cards for client payments from non-business senders.

- Use wire transfers when large sums need to be moved between financial institutions.

Example:

A marketing firm in Singapore may receive a EUR card payment from a client in Spain, and then send an SGD wire transfer to a bank account in Singapore.

This flexibility allows you to transfer money to a bank account in the way that works best for each use case, without juggling multiple platforms.

How Does Bancoli Secure Bank Transfers?

Bancoli is a US-Qualified Custodian, operating under bank-grade compliance frameworks. When you transfer money to a bank account from your Bancoli balance, the transaction is protected by:

- Military-grade encryption

- Two-factor authentication

- Real-time fraud monitoring

- Know Your Vendor (KYV) verification to help screen counterparties

These safeguards help keep your funds and accounts protected across every transfer, whether you’re sending funds to your own account or paying a third-party vendor.

More Than Just Payments: Accelerate Cash Flow

Bancoli helps you get paid faster. The Global Payment Gateway makes it easy to receive funds from anywhere using cards, ACH, wire transfers, stablecoins, and Bancoli-to-Bancoli transfers.

But getting paid isn’t only about receiving funds. Bancoli’s multi-currency invoicing tool includes a built-in acceleration feature that lets you offer early payment incentives. You decide the terms, and your buyers can choose to pay faster in exchange for a small discount or benefit.

This is especially useful for businesses that manage multiple currencies across markets. You can invoice in EUR, settle in USD, and transfer money to a bank account in MXN without setting up multiple systems.

Conclusion

The ability to transfer money to a bank account is essential for managing global operations. Businesses often need to move funds between partners, vendors, or internal accounts in different currencies and locations. Getting this process right improves liquidity, reduces friction, and supports growth.

Accurate recipient details, the right transfer method, and a platform that adapts to your workflow can make a real difference. From small recurring payments to large international transfers, choosing the right setup saves time and avoids unnecessary errors.

Some platforms, like Bancoli, combine these tools in one place to simplify the way businesses manage transfers across accounts and borders.

Frequently Asked Questions

What are the fees to transfer money to a bank account with Bancoli

Bancoli offers Zero FX fees on payouts from your USD Global Business Account to over 30 countries. Other transfer fees may vary based on the payment rail (e.g., wire, ACH) you choose.

What currencies and countries does Bancoli support?

Bancoli works in over 85 countries and supports transactions in more than 30 currencies, allowing you to manage global finances from a single platform.

What information do I need to send an international bank transfer?

You will typically need the recipient’s full name and address, their bank’s name and country, and their bank account information, which may include an IBAN, SWIFT/BIC code, or a local routing number, depending on the destination.

How do I get started with Bancoli?

You can start by signing up with your business email on the Bancoli website. You will then need to complete a simple business verification process to activate your account for live transactions.

What payment methods can I use to receive funds into my Bancoli account?

You can receive funds into your Bancoli account via multiple methods, including credit/debit cards, ACH transfers, wire transfers, stablecoins, and Bancoli-to-Bancoli payments.