A cash flow feature can be the solution to streamline B2B cross-border payments and reduce costs and processing times.

The world is becoming increasingly interconnected, and that means it is essential to rethink cash flow strategies. Businesses of all sizes are expanding beyond their borders to reach new customers and markets. With this expansion comes the need for efficient and secure cross-border payments. But also the need to have sufficient funds to operate.

Bancoli’s cash flow feature is an innovative way to streamline B2B global payments because it enables businesses to forecast their cash flow, which is essential for managing their finances effectively. Discover how Bancoli’s cash flow feature can increase business’s liquidity and cash flow, significantly reducing the need for loans and credits.

Understanding B2B Cross-Border Payments Needs

Choosing the right international payments platform solution for your business depends on its needs and requirements. Understanding them can help you improve business operations and take steps to mitigate risk.

B2B cross-border payments are essential for global businesses, and the challenges associated with these transactions are significant. For example, an international business may need to pay suppliers, service providers, or employees in other countries. It is critical that they have control over their cash flow. Global payments can be more complex than domestic transactions, involving multiple currencies, regulations, and banking systems. This complexity can lead to higher costs, longer processing times, and more errors. However, when it comes to paying suppliers or getting paid by clients, timely payments are essential.

The importance of cash flow in business operations

Cash flow is a critical aspect of any business operation. It refers to the inflow and outflow of money in a business. Maintaining positive cash flow is essential to ensure the smooth operation of the business.

- Positive cash flow. Cash inflows are greater than outflows, indicating that the business is generating enough revenue to meet its financial obligations.

- Negative cash flow. This means that cash outflow is greater than inflow. Under these circumstances, many business owners turn to credit or loans, which can lead to financial difficulties due to high interest rates.

As a leading financial institution, Bancoli understands the importance of cash flow in maintaining the financial health of a business. Understanding and managing cash flow is critical to the success of any business, regardless of its size or industry. By effectively managing cash flow, businesses can ensure that they have sufficient funds to pay their bills and meet payroll. It also allows businesses to make informed decisions about their operations, invest in new opportunities, and identify opportunities for growth and expansion.

How can Bancoli help me avoid asking for financial help in the form of loans and credits?

It is a common concern among business owners to seek ways to secure credit for their ventures in order to maintain cash flow or prepare for expansion. However, the prevailing practice of relying on commercial loans and credit can often result in businesses being charged high interest rates, causing them to overpay for borrowed funds. This can create a vicious cycle for many businesses.

To avoid having to apply for loans or credit, Bancoli offers an alternative solution. Cash flow management and a streamlined invoicing process can help reduce late payments. This is a strategy that offers multiple benefits without the above mentioned drawbacks.

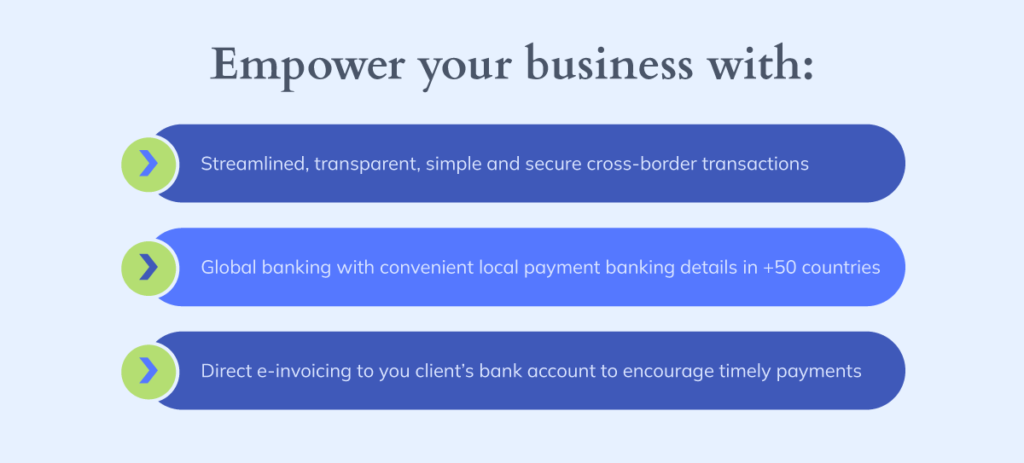

Bancoli’s innovative cash flow feature will help you:

- Make your invoice a priority for your customers to maximize cash flow without the need for credit or loans.

- Create guaranteed invoices for increased cash flow and immediate liquidity.

- Schedule invoice delivery for precise delivery dates.

- Set due dates with or without dynamically adjusted late payment penalties.

- Encourage early and on-time settlements to secure receivables and minimize costs.

- Reduce fees and complexity.

Bancoli’s cash flow feature serves the dual purpose of invoicing and providing immediate liquidity by creating guaranteed invoices and accelerating payment processing. This innovative approach helps businesses increase cash flow, secure receivables, and minimize costs without the need for loans and credit. By choosing this strategy businesses can maintain financial stability and grow their businesses sustainably while avoiding financial assistance in the form of loans or credits, late fees, overdraft fees, and other penalties. It is an effective way to manage cash flow and is highly recommended for businesses looking to improve their financial health.

Encourage your clients to prioritize early payment of your invoice

Bancoli simplifies the invoice payment process for buyers and sellers alike. With Bancoli, buyers can earn yield on every invoice they settle, even without any early payment discount. By making the settlement process more efficient, Bancoli guarantees timely payments, which in turn helps sellers improve their cash flow and reduces their reliance on external financing. On the other hand, buyers benefit from a return on investment.

Streamlined schedule invoicing

Scheduling invoice delivery can be a game-changer for businesses looking to simplify their invoicing process and minimize late payments. Bancoli’s invoicing feature allows users to:

- Create invoices in advance and set a specific date for their delivery.

- Set due dates with or without payment penalties, giving them flexibility in managing their cash flow.

- Schedule invoice delivery to stay organized and ensure that payments are made on time, regardless of the size of your business.

From invoice to funding

Bancoli’s invoicing process simplifies the financing process for your business. The financing process can be challenging for businesses, as traditional financing options like asset-based lending, reverse factoring, and lines of credit are often challenging to obtain due to their high costs and strict qualifications.

However, Bancoli Invoicing reduces fees and complexity while encouraging prompt and early payments. This secure platform simplifies invoicing, secures receivables, increases cash flow, and minimizes unnecessary costs and intermediaries. Compared to other financing options, Bancoli Invoicing is less complicated to acquire and comes with fewer conditions, making it a viable option for businesses of all sizes and industries.

Takeaways

Cash flow management is critical to the success of any business. Therefore, it’s imperative to plan how and when you will pay your vendors and employees and manage that cash flow accordingly.

The Bancoli team is committed to providing businesses globally with the tools to successfully manage their finances. Bancoli’s cash flow feature is an innovative way to streamline global B2B payments because it allows businesses to forecast and accelerate their cash flow, which is essential for effective financial management, with the added benefit of reducing their operating costs.

Bancoli’s B2B invoicing for international payments is a solution designed to make your business globally competitive and to help you obtain the funding you need in a timely manner. This feature allows businesses to achieve sustainable financial success with minimal reliance on external financing.