The first lesson that every business person learns is the importance of cash flow. Businesses have four potential sources of capital to invest in the growth of their business. These are: equity, debt, existing cash balances and operating capital.

Equity, debt, and existing cash balances are typically finite, difficult to increase, and dependent on third parties such as shareholders, banks, and other lenders. Operating capital is the primary source of consistent cash flow to an organization.

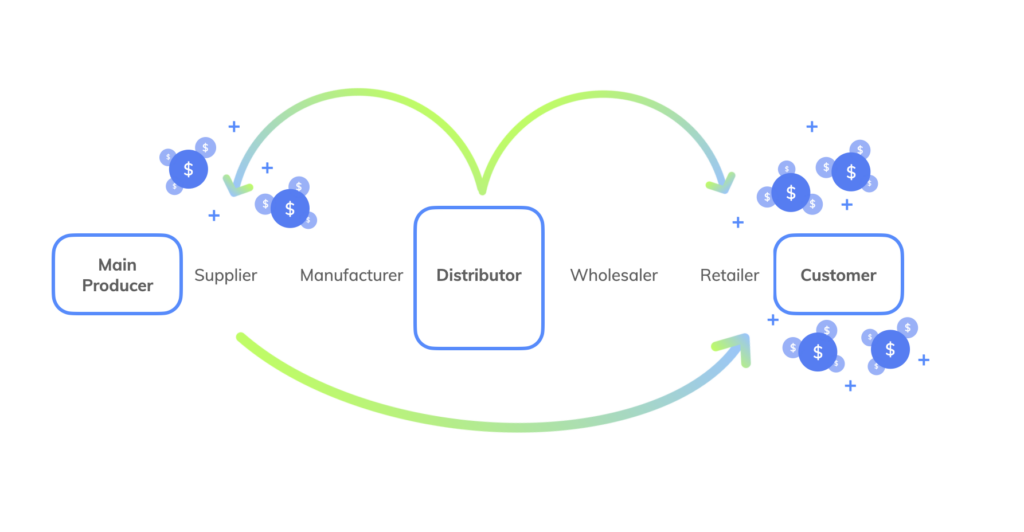

It is possible to accelerate cash flow within a supply chain by fostering a cooperative alliance between buyer and supplier. This way both parties receive financial advantage from the relationship along with their results.

Traditional cash flow management

A supply chain represents the most extensive use and source of business capital. The supply chain is the network of all entities involved in producing and delivering a finished product or service to the final customer.

Companies need funds to buy supplies, finance production and operation, maintain inventory levels, and finance delayed customer payments. As companies scale, funding growth and investment become increasingly complex and complicated. Therefore organizations that maximize supply chain capital use have a distinct competitive advantage.

For example, expanding the physical distance between supplier and buyer inevitably increases the cash flow cycle time between outflow and inflow. Supplies in transit and excess inventory to compensate for potential interruptions tie up corporate funds.

This traditional approach to managing cash flow responsibilities has very limited efficiency and is usually harmful for supplier-customer relationships. Historically, senior management has delegated invoicing and payments to accounting departments and required the CFO or Treasurer. They need to find ways to augment cash balances using inventory and accounts receivable assets.

To help your supplier is to help your supply chain

Small and medium-sized (SMB) suppliers cannot generally enforce payment terms with large companies. This is usually due to the power imbalance between the parties. As a consequence, it is common for large companies to pay 120 days after invoicing to “maximize the use of their capital”. In some cases companies stretch supplier payments to 150 days. Of course, additional financing costs that suppliers incur due to delayed payments are absorbed by the supplier.

This practice weakens the supplier by reducing their profits and limiting their ability to invest in resources or technology; or they are passed along to the buyers, raising the market price for the ultimate consumer. Either outcome is detrimental to the buyer.

First steps towards a win-win cash flow strategy

A balanced approach plan is based on the premise that for both parties should benefit in a transaction. Such strategy comes from a financial philosophy that emphasizes the long-term success of businesses.

Long-term success vision leads toward a direction where a company and its clients work together toward a common goal: the success of your business and their business.

Implementation of this strategy can be simple if you pay attention to the these success factors:

• Make sure that your customers know it is a win-win business relationship

Your suppliers should feel like they are part of something bigger than just providing products/services to you. You can also be helping them achieve their goals, and what better way to win than to get paid early. Bancoli’s payment system helps you strengthen your supply chain by approving invoices as early as possible while providing you with higher yields on cash balances every time you do so.

If you are a supplier, providing early payment discounts can also strengthen your supply chain. By receiving immediate cash flow, you can pay for inventory and other supplies before the goods are delivered. It’s a win-win strategy because your buyer also gets something in return for that early payment.

• Minimize error and supply chain disruptions with invoicing automation

Bancoli’s automated invoice and payment system eliminates the need for manual data entry.

Once you register you can begin to schedule invoices and create your business network. When you complete your verification process you can also use your Global Business Account to make and receive worldwide payments without friction.

• Empower your supply chain

The available amount of capital you have to invest in your supply chain is a huge factor in determining success. Many companies don’t realize this, so they end up doing nothing, and their business suffers as a result.

A supply chain’s ability to manage cash flow is an important indicator of future profitability. Cost-effective supply chain financing can help a business smoothly manage its working capital. It can also be helpful to improve cash flow and reduce the overall cost of financing. The more efficient you are at this, the more value you can capture in your supply chain and the better overall health of your organization.

Takeaways

Bancoli is a fintech-first international invoice, payment, and banking platform that optimizes efficiency across multiple businesses and industries. Learn more on how Bancoli can help you benefit your business relationships through early payments.