What is working capital?

Working capital, often called net working capital, represents a company’s operational liquidity and short-term financial health. It is a financial metric that calculates the difference between a company’s assets and liabilities.

Current assets include anything that can be converted into cash within a year, such as accounts receivable, inventory, and cash itself. Current liabilities, on the other hand, are debts and obligations due within the same period, such as accounts payable, short-term loans, and similar liabilities.

Significance in Business Operations

This metric is more than just a number; it indicates how well a company can meet its short-term obligations with its short-term assets. A positive working capital indicates that a company can quickly pay off its short-term liabilities, while negative working capital might suggest financial troubles on the horizon.

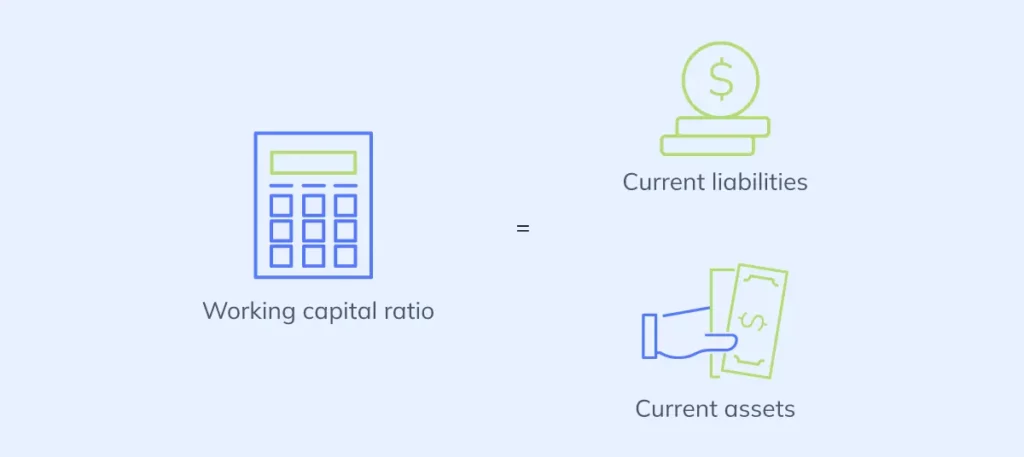

Net Working Capital Formula

The working capital of a business is pivotal for financial management, and anyone can get a general idea of this vital figure using a simple formula. To calculate working capital, follow this formula:

Current assets – Current liabilities = Net working capital

This working capital calculation is often referred to as the net working capital. It involves adding readily available assets like cash, accounts receivable, and marketable securities and subtracting liabilities such as accounts payable and short-term debt. This formula provides a clear picture of a business’s ability to meet its short-term obligations and is an essential financial planning and analysis tool.

An example to illustrate the impact of fees

Imagine a furniture manufacturer sourcing materials from various countries; let’s say the business has $150,000 in cash and fixed assets.

Assets can include equipment such as materials and heavy machinery. However, the business has a $20,000 loan on the company’s means of transportation and a $15,000 outstanding business loan. This means that the business has $115,000 in working capital to continue operations.

When calculating working capital for your business, consider the following for each category:

Assets

Effective management of a company’s current assets, including cash availability, is crucial for maintaining healthy finances. Understanding what constitutes a current asset, from cash to receivables, and identifying exclusions like project-related expenses is key.

- Cash and cash equivalents: These are highly liquid assets crucial for meeting immediate operational expenses and unforeseen financial demands. They represent the core component of a company’s net current assets, including bank balances, short-term investments, and treasury bills.

- Accounts receivable: This term refers to the money owed to the company for goods or services delivered but not yet paid for. Efficient accounts receivable management is vital for maintaining healthy cash flows and is a key aspect of a firm’s business strategy.

- Prepaid expenses: These are payments made for services or goods to be received in the future. As a current asset, they represent an advanced outflow of cash, offering the benefit of future use without immediate monetary charge during the period of use.

- Equipment: This category includes assets like machinery, computers, and vehicles used in operations.

- Business materials: These encompass all the raw materials used in the manufacturing or production process.

- Product inventory: Inventory consists of products either manufactured or purchased for resale. It is a current asset that directly impacts sales and profitability, requiring strategic inventory management to balance between excess stock and stockouts.

- Intellectual property: Includes non-tangible assets like brand names, copyrights, and trade secrets. Intellectual property can significantly enhance a company’s market value and competitive edge.

- Patents: Patents are legal rights granted for inventions, allowing exclusivity in commercial exploitation.

- Royalties: Royalties are payments received for using a company’s intellectual property, such as patents or copyrights. They represent an ongoing source of income and are a testament to a company’s innovative capabilities and market influence.

Liabilities

Understanding liabilities is as crucial as assets, particularly the difference between current assets and current liabilities. This knowledge is essential for a business’s ability to raise cash quickly to pay suppliers and meet other short-term financial obligations.

- Short-term business loans: Businesses take these loans to address immediate financial needs or opportunities.

- Accrued payroll: This refers to wages, salaries, bonuses, and commissions earned by employees but not yet paid. Managing accrued payroll efficiently is vital for maintaining employee satisfaction and fulfilling legal obligations, and it forms a significant component of a company’s operating expenses.

- Payable bills: Payable bills, often categorized as accounts payable, represent the company’s obligations to pay off short-term debts to its creditors or suppliers.

- Accrued expenses: These expenses have been incurred but not yet paid, including utilities, services, and interest payments.

- Operating costs: Also known as operating expenses, include all costs associated with running the day-to-day operations of a business. This includes rent, utilities, payroll, and raw materials, and effectively managing these costs is crucial for maintaining profitability and financial stability.

- Business taxes: Business taxes include various forms of taxation a business must pay, such as income taxes, sales taxes, and property taxes.

Why Does Working Capital Matter?

Ensuring Operational Efficiency

Effective management of a company’s working capital ensures that a business can continue its operations and meet its obligations without interruption. It’s about having the cash flow to support day-to-day operations, manage inventory, pay employees, and handle other immediate expenses.

Example of Working Capital Impact on Operational Efficiency

Consider a scenario where a business faces a shortage in working capital due to a significant amount of short-term debt or underperforming gross working capital. This situation can lead to challenges in replenishing inventory or paying staff on time, directly impacting the efficiency of operations.

For instance, if a retail store does not have sufficient working capital, it may struggle to restock popular items, leading to missed sales opportunities and customer dissatisfaction.

In another case, a manufacturing firm with inadequate working capital might find it difficult to procure necessary materials, causing delays in production and potentially harming client relationships.

Risk Management

Adequate working capital acts as a buffer against financial uncertainty and operational risks. It provides the flexibility to navigate market fluctuations, unexpected expenses, and business downturns.

Example of Working Capital as a Risk Management Tool

For example, during raw material price volatility periods, sufficient working capital allows a company to purchase materials in advance, thus avoiding potential cost increases. This proactive approach can be a significant advantage, ensuring steady production despite market uncertainties.

Additionally, during economic downturns, when customer orders might decrease, a healthy level of working capital enables the manufacturer to maintain operations, meet existing obligations, and invest in process improvements without resorting to drastic measures like layoffs or production halts.

Growth Opportunities

With healthy working capital, businesses can seize growth opportunities without the need for external financing. It allows for investments in new projects, expansion into new markets, and improvements in production or services.

Example of Working Capital with Growth Opportunities

Consider a digital marketing agency that spots an emerging trend in the market, such as the rising demand for social media management services.

With a robust working capital, the agency can quickly capitalize on this opportunity by internally funding the development of a new social media service division. This could involve short-term internal investments in training existing staff, hiring new talent, or purchasing necessary software tools.

Working capital is the foundation of any business, and a lack of discipline in this area can lead to trouble. Even with a large order book, lacking the resources to service that demand and/or your expenses can cause serious problems.

Dedicated work in managing resources to operate is a crucial part of running a successful business.

Working Capital Ratio: A Key Indicator

Understanding the Working Capital Ratio

The working capital ratio, calculated by dividing current assets by current liabilities, provides insight into a company’s financial health.

A ratio between 1.2 and 2.0 is typically considered healthy, indicating the company has enough current assets to cover its current liabilities. A ratio below 1.0 suggests negative working capital, signaling potential liquidity issues.

Utilizing the Working Capital Ratio for Business Analysis

This ratio helps businesses analyze their short-term financial position. By regularly monitoring the ratio, companies can make informed decisions to adjust their strategies, ensuring they maintain an optimal level of liquidity.

Strategies for Optimizing Working Capital

Seamlessly integrating several strategies ensures healthy business cash flow and operational efficiency. Improving receivables is a crucial step.

This involves tightening credit terms to mitigate the risk of late payments while offering incentives like early payment discounts to encourage customers to clear their dues promptly.

Deploying robust invoice tracking systems, which ensure that receivables are consistently monitored and efficiently collected, further enhances the effectiveness of this approach.

Simultaneously, smart payables management plays an equally important role. This includes negotiating extended payment terms with suppliers to better align with the company’s cash flow cycles and ensuring that payments are made during periods of higher liquidity.

Moreover, capitalizing on supplier discounts where possible can yield substantial cost savings, further strengthening the company’s financial standing.

Complementing these traditional financial strategies is the strategic leverage of financial technology. The advent of sophisticated financial software has revolutionized working capital management. These tools facilitate real-time tracking of financial metrics, automated invoice processing, and streamlined digital payment systems.

The Impact of Poor Working Capital Management

Poor management of working capital can have far-reaching negative consequences for a business.

Inadequate control over this critical aspect often leads to cash flow issues, hindering a company’s ability to fulfill financial commitments promptly, potentially incurring late fees, damaging supplier relationships, and adversely affecting creditworthiness.

Such financial strain can also disrupt regular operations, manifesting as challenges in inventory procurement, delays in project completion, or even inability to pay employees, which in turn can damage the company’s reputation and future viability.

Insufficient working capital restricts a business’s ability to seize growth opportunities. A lack of readily available funds can mean missed chances for expansion or investment, stunting potential business development.

The Role of Technology in Enhancing Working Capital Management

Technology significantly impacts financial management, particularly in optimizing and managing a company’s cash flows.

Bancoli’s advanced solutions are at the forefront of this technological revolution, increasing fund efficiency and ensuring businesses can efficiently manage their resources and maintain robust economic health.

Automation and Efficiency

Automation tools can streamline processes like invoicing, bill payments, and tracking receivables and payables, leading to more efficient management.

Data-Driven Decision Making

Advanced analytics tools provide valuable insights into cash flow patterns, enabling businesses to make informed decisions regarding their strategies.

Integrating with Fintech Solutions

Partnering with fintech companies like Bancoli can offer innovative solutions for optimizing working capital, from streamlined payment processing to securing your company’s liquidity.

How Do You Manage Your Working Capital?

There are a variety of actions that you can take to improve your management, depending on your specific circumstances. But here are some to think about:

1. Track it and measure the impact

You can’t do anything until you have the necessary data to understand and calculate your needs. Part of this process involves analyzing your cash conversion cycle, which is critical in understanding how efficiently your business turns its inventory and other inputs into cash.

So, take some time to evaluate your current operations, including how you manage your receivables, inventory, and payables, and assess your ideal working capital level.

Remember that your requirements can change as your business grows and evolves, necessitating regular reviews to ensure optimal financial health.

2. Improve your payment terms

By negotiating favorable payment terms with suppliers and clients, you can effectively increase cash flow and minimize potential problems, leading to a healthier financial position in the long term.

Skillfully managing these terms can help you meet payment obligations, including taxes payable. However, achieving this regularly can be challenging, as it requires convincing stakeholders of the benefits.

Bancoli offers a solution that incentivizes customer payments through rewards for early settlement. When clients pay early, they can receive benefits like early payment discounts or yield, enhancing their motivation to fulfill their financial commitments promptly.

3. Invoice Financing

You can address the issue of having too much cash tied up in unpaid invoices through an invoice financing product. This service purchases your outstanding invoices, allowing you to generate cash immediately, net of a small fee.

In conclusion

Mastering the art of working capital management is essential for any business aiming for long-term success and stability. By understanding what is, why it matters, and how to effectively manage it, businesses can ensure operational efficiency, minimize financial risks, and unlock growth opportunities.

In an evolving business environment, embracing technology and innovative financial solutions is key to staying ahead in working capital management.

Bancoli is a fintech-first international payment, invoicing, and banking platform that enhances a company’s ability to optimize supply chain efficiencies through guaranteed invoices, thereby maximizing your working capital.

Our innovative approach streamlines financial processes and significantly boosts your business’s operational effectiveness. Take your business to the next level with Bancoli’s comprehensive solutions designed to elevate your financial management.