The debate between traditional banks and fintech companies is intensifying in the ever-evolving financial services industry. As the banking sector undergoes significant transformation, businesses worldwide are left pondering: “fintech or traditional banks?”

Rethinking global B2B payments is a smart strategy for businesses constantly seeking the most efficient and cost-effective methods for cross-border transactions. With market volatility impacting foreign exchange rates, the cost of these transactions can significantly increase, straining company budgets.

Given the complexities of cross-border B2B transactions, a payment platform that uncomplicates and refines this process is paramount. But the question arises – Are traditional banks the best options for B2B currency exchanges? Or do digital payment providers offer a better solution? The choice between banks and fintech can seem daunting.

This article explores the distinct differences between traditional banking and innovative fintech solutions in the B2B currency exchange arena.

What are Banks?

Banks, especially corporate banks and retail banks, are legacy financial institutions that accept deposits, offer business loans, and provide other financial services. They operate within a strict regulatory framework, ensuring the stability of the overall financial system.

What are the Benefits of Traditional Banking?

1. Prestigious standing and extensive network

Traditional banks have established a reputation over the years, backed by a vast network of branches globally.

2. Credibility and comprehensive services

Traditional banks provide a more comprehensive range of financial products, ensuring customers have diverse options tailored to their needs.

3. Personal interaction

The ability to walk into a branch allows customers to engage directly with bank representatives, fostering a personal touch.

4. Trust-building

Their longstanding presence and consistent service enhance trust among clients and suppliers alike.

5. Cash transactions

The convenience of physical branches simplifies cash deposits and withdrawals, providing immediacy in transactions.

What is Fintech?

Fintech, short for financial technology, represents the emerging technologies that aim to improve and automate the delivery of financial services. Fintech companies have revolutionized the way we perceive and interact with money.

B2B Fintech Solutions

Fintech encompasses diverse solutions, particularly in the business-to-business (B2B) sector, providing a more efficient approach than conventional methods. As businesses increasingly seek to optimize their operations, B2B fintech companies emerge as the cornerstone of this evolution. Here are some B2B fintech innovations that are reshaping the financial services sector.

Digital banking

Online banking has transformed how businesses manage their finances in the digital age. By offering many online services, from account management to funds transfer, digital banking platforms allow businesses to operate smoothly and efficiently from any location.

Bancoli is a comprehensive fintech platform that provides banking, payment, and invoicing solutions. It assists businesses in quickly accessing their funds, boosting revenue, and enhancing cash flow.

Payment solutions

The essence of any business lies in transactions, and fintech companies present powerful payment solutions that guarantee seamless and safe financial exchanges.

Platforms like Bancoli lead the charge, providing businesses with hassle-free methods to send and receive payments. By opening a Bancoli Global Business Account online, companies can simplify B2B payments across over 200 countries and in more than 25 currencies.

International Money Transfers

In our ever-globalizing world, businesses frequently need to transfer funds internationally. Financial technology addresses this need, ensuring that international money transfers are swift, secure, and cost-effective.

With Bancoli, account holders benefit from immediate global transactions between Bancoli accounts, minimizing the costs associated with international wire transfers.

Accounting Innovations

The realm of accounting isn’t untouched by the fintech industry. Modern financial technology and software have drastically reduced accountants’ time on tasks like invoice management and cash flow forecasting, allowing businesses to get real-time insights into their financial health.

Bancoli’s cash flow management tools combine invoicing and accounts receivable financing, allowing businesses to reduce late payments and maximize cash flow potentially.

Trading

Trading, a vital component of the business world, is being transformed by fintech. Traditional banking methods are giving way to more efficient stock-trading applications, enabling businesses to buy and sell assets more efficiently and precisely.

Regulatory

With the rapid integration of technology in finance, there’s a growing need for regulatory frameworks that can keep pace. RegTech, or Regulatory Technology, addresses this by standardizing and promoting transparent regulatory processes. It automates compliance systems, ensuring businesses remain within legal boundaries while also benefiting from technological advancements.

Lending

Access to capital is crucial for any business, and financial technology is simplifying complex financial processes, making loans more accessible, even for those with a poor financial history. By leveraging technology, these platforms can predict income expectations, evaluate borrowers’ history, assess collateral value, and anticipate market fluctuations, ensuring businesses get the financial support they need.

What are the Benefits of Fintech?

They offer innovative financial technology solutions, from remote account opening to digital banking, reshaping the financial system.

1. Technological edge

The fintech industry leverages the latest technologies, including cloud computing, machine learning, artificial intelligence, and big data. This tech-driven approach enhances customer experience, surpassing conventional banking tools.

2. User-centric

Unlike traditional banks that offer a wide array of services to a broad audience, fintech firms focus on niche, specific needs—like B2B cross-border transactions. This specialization means each fintech entity can concentrate on a distinct purpose, offering more targeted solutions.

3. Growth potential

The simplicity of opening a business bank account online, competitive costs, and global accessibility are factors financial technologies can leverage to streamline business expansion in new markets potentially.

4. Data-driven

Fintech companies use data analytics to gain insights into customer behavior and preferences, allowing them to offer tailored services.

5. Agility

Fintech companies are agile and can quickly adapt to customer expectations and emerging technologies.

6. Digital-first approach

Fintech companies prioritize digital platforms, offering secure payments, greater convenience, and industry needs.

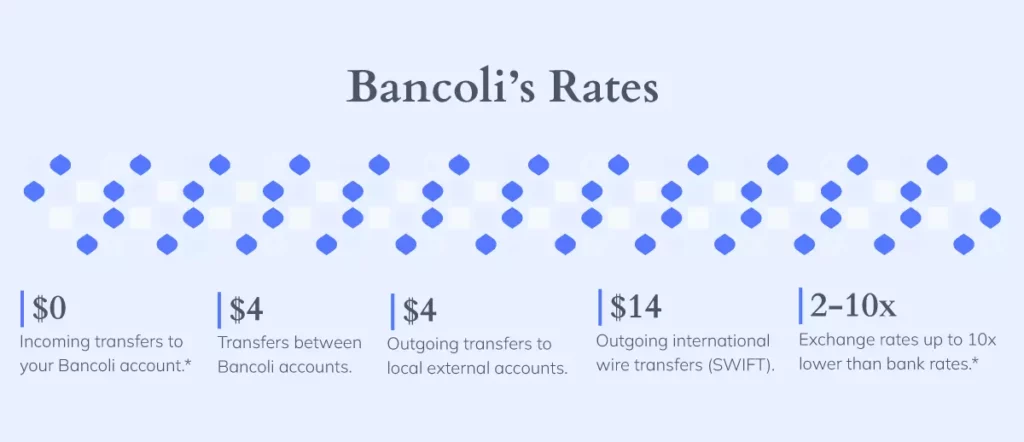

7. Competitive fees

Unlike many traditional financial institutions, Bancoli uses a fixed-cost structure for its outgoing international transfers (SWIFT). Conventional methods typically charge transaction fees based on a percentage of the amount being transferred, meaning the larger the sum, the higher the fee. Bancoli’s approach offers notable cost savings, promoting the financial well-being of businesses.

Fintech vs Traditional Banking: What’s the Difference?

The distinctions between fintech and traditional banks can be segmented into three primary categories.

1. The way of doing business

- Structure and function. Traditional banks rely on legacy infrastructure, making them less agile. On the other hand, fintech businesses leverage new technologies, simplifying complex financial processes and providing a seamless and user-friendly experience.

- Customer experience. Fintech vs traditional banks reveals a stark contrast in customer-centric approaches. The evolution of fintech has ushered in a new era of banking facilities that prioritize the user experience. From mobile banking to chatbots and high-speed internet, fintech ensures that users can conduct financial transactions with just a click. Traditional banks, recognizing the potential of fintech, are now enhancing their digital capabilities.

- Technology. Digital banking in fintech companies offers more agile solutions compared to the banking industry’s legacy systems. While fintech companies are at the forefront of adopting the latest technologies, traditional banks often lag due to their entrenched systems. However, the push for digital transformation is compelling this financial sector to innovate and integrate new tech solutions.

2. Growth potential

The global fintech market showcases a higher annual growth rate, indicating the fintech sector’s potential to reshape the finance industry.

The fintech market has witnessed exponential growth, especially post-pandemic. The rapid digital transformation in the sector introduces new trends regularly, promising sustainability and expansive growth. Traditional banks, while having sustained the financial market for years, are now integrating fintech features to cater to evolving customer needs.

3. Risk factors

While fintech services innovate, they also face challenges like financial fraud. However, the sector’s robust, cost-effective, user-friendly, and innovative nature often outweighs these risks, making it a preferred choice for many.

In contrast, with their established regulatory framework, traditional banks provide a sense of security, but to remain competitive, they must embrace fintech innovations.

Are banks the best places to exchange currency for B2B payments?

For a considerable time, traditional banks have been a favored choice for currency exchange despite certain limitations. While they offer a sense of familiarity and reputation, their transaction times can be slower and costs higher, with exchange rates occasionally lacking transparency. Nevertheless, their extensive reach and longstanding presence have led many enterprises to continue choosing them.

Conversely, fintech companies have emerged as a viable alternative, offering potential benefits like competitive rates. However, not all of them are created equal. Bancoli is a three-in-one B2B platform that provides invoicing, payments, and banking services. The platform improves cash flow and liquidity, offers the best exchange rates and conversion fees in the market, and includes features for seamless B2B payment processes, such as lower costs, faster transactions, real-time exchange rates, global reach, competitive fees, automated invoicing, early payment incentives, convenience, security, and excellent customer service. Therefore, solutions like Bancoli may be a better choice for B2B payments for many businesses.

This explains why digital payments are in demand and how important it is for businesses to find the right payment platform to simplify their cross-border B2B transactions.

Why is fintech growing in B2B Cross-Border Transactions?

The surge in fintech’s role in B2B cross-border transactions isn’t just a trend; it’s a response to the evolving needs of global businesses. Moreover, when comparing fintech vs traditional banking in B2B transactions, it becomes evident that fintech’s growth in international payments stems from its efficiency in currency exchange, its ability to offer competitive rates, and its commitment to transparency.

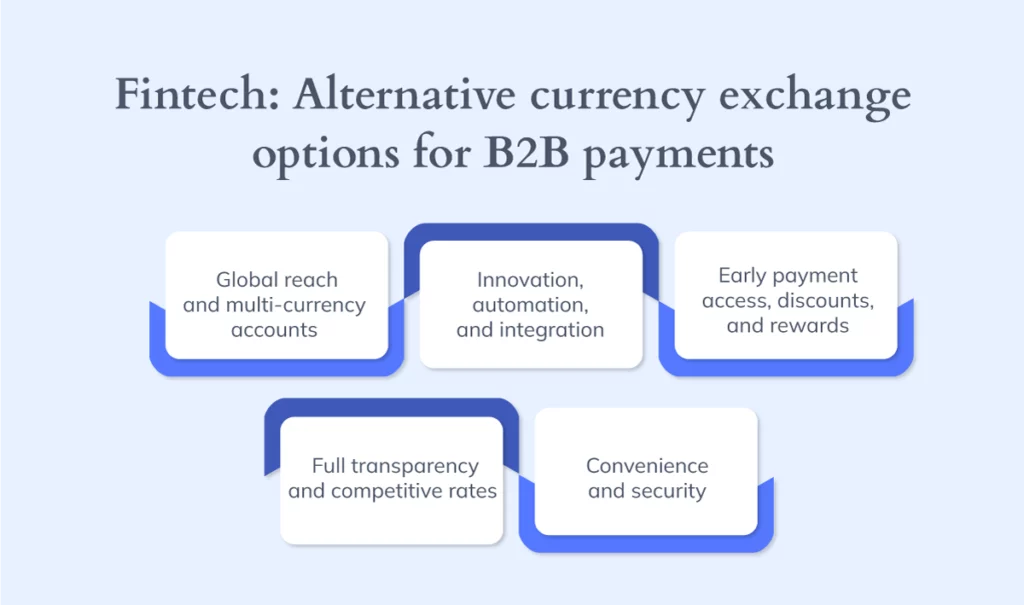

Fintech Platforms: Alternative Currency Exchange Options for B2B Payments

Fintech platforms have emerged as an effective alternative for B2B international payments, providing businesses with a streamlined option compared to conventional banking processes. The benefits encompass:

Global reach and multi-currency accounts

A platform supporting worldwide transactions is a game-changer in a global economy. Bancoli’s Global Business Account operates in more than 200 countries and supports over 25 currencies, making it a convenient choice for businesses with international operations.

Full Transparency and Competitive rates

The ability to compare rates for B2B payments and access competitive exchange rates is critical. Bancoli offers low fees and competitive exchange rates, adding value to your B2B transactions and keeping your bottom line healthy, providing businesses with cost transparency and enabling informed decision-making.

Innovation, Automation, and Integration

Fintech platforms include integration capabilities that allow businesses to streamline their processes. Bancoli’s automated invoicing, payment reminders, and cash flow management tools can significantly reduce late payments, improving overall cash flow management.

Unlocking Early Payment Access, Discounts, and Rewards

Having funds readily available is crucial for daily business operations. Bancoli incentivizes prompt payments with early payment access, discounts, and rewards, improving cash flow and enhancing financial health.

Convenience and Security

Security is paramount when dealing with sensitive financial information. Bancoli’s user-friendly platform and robust security measures (2FA, unmatched fund backing, and Know-Your-Vendor (KYV/KYC) verification) offer a convenient and secure currency exchange experience.

Conclusion: Traditional Banks or Fintechs?

In this global economic climate, while familiar, banks may not be the best place to conduct cross-border B2B transactions. This has prompted a strategic shift towards fintech platforms that offer transparency, efficiency, and profitability in managing international payments. A solution like Bancoli is favored for its robust platform and empowering businesses to take control of their financial management and enhance cash flow operations.

Bancoli’s unique features and benefits offer a compelling case for businesses to rethink their payment methods to save more on international payments—including access to competitive transaction costs in rates and fees.