Geographical borders no longer confine the world of commerce. Businesses of all sizes increasingly engage in international trade, offering their products and services to a broader customer base.

However, successful international transactions require careful consideration beyond product selection and logistics. Understanding the payment terms in global trade is essential for minimizing risks and ensuring smooth transactions. Choosing the most suitable payment method is crucial for ensuring a smooth and secure exchange of goods and funds.

Choosing a Method of Payment: What to Consider?

Selecting the optimal payment method in international trade requires a nuanced approach. Here are vital factors to consider:

Cost of Transfers (fees)

International transactions often involve intermediary banks and currency conversions, which can incur fees that range from a fixed amount per transaction (typically for wire transfers) to a percentage of the transfer amount (often seen with money transfer services). To avoid unexpected expenses, it is essential to compare the total cost of each international payment method.

Banks typically charge a fixed wire transfer fee ranging from $25 to $50 for international transfers, while money transfer services may charge a lower fixed fee but add a markup on the exchange rate, which can be around 1-3%.

Currency Exchange Rates

Currency fluctuations can impact the final amount received. Understanding how each method handles exchange rates is crucial for accurate pricing and profit margins.

Transaction Speed

International payments can take longer because of factors like bank holidays, currency conversions, differences in time zones, and the need for extra security checks to prevent fraud. Sometimes, the payment has to pass through multiple banks before arriving, which can also add delays.

Ease of Use and Accessibility

Certain international payment methods may require complex documentation or involve unfamiliar procedures. Consider the ease of use for you and the end customer or buyer.

Security and Risk Management

International payments expose the buyer and the seller to potential risks, such as fraud or non-payment. One such secure financial instrument is a letter of credit, which ensures payment is made under specific conditions, protecting both the buyer and the seller. Here are some particular examples to consider:

- Fraud: Due to their complexity and potential anonymity, international transactions can be more susceptible to fraud than domestic transactions. Cybercriminals could intercept payment details or create fake invoices.

- Non-payment: Depending on the chosen payment method, there’s a risk that the buyer may not be obligated to pay for the goods or services received. This can be a significant concern for sellers, especially when dealing with new or unfamiliar business partners.

- Delivery Risk: This risk applies to both buyers and sellers. The buyer may face a situation where the goods are never shipped after payment. Conversely, the seller may not receive payment after the goods are delivered.

Common International Payment Methods

Before making a decision, it’s crucial to have a solid foundation:

- Transaction Flows: Familiarize yourself with international payments, including currency conversion, potential intermediaries, and processing times.

- Regulations: Be aware of rules governing cross-border payments in the sender’s and recipient’s countries.

- Security: Prioritize secure methods of payment that comply with security standards to protect sensitive customer data.

1. International Payment Gateways (IPGs)

A key component of e-commerce platforms that facilitates online transactions between customers and businesses in different countries.

This digital portal authorizes and processes payments in multiple currencies, enabling businesses to conduct business quickly and expand globally.

How they work: These services function as secure processors, handling transactions for credit cards, eWallets, and other online payment methods.

Example:

Consider a U.S. company (importer) looking to buy inventory from a Chinese supplier (exporter). Traditionally, such purchases might involve payment through sending a check by mail or initiating a wire transfer. However, these methods can be slow and incur significant fees.

A payment gateway streamlines this process:

- Secure Online Checkout: The importer finalizes their order on the exporter’s website and selects a payment option through the payment gateway’s secure checkout portal.

- Multiple Payment Methods: The importer can choose their preferred payment method, such as an ACH transfer for more considerable sums or a credit card for faster processing.

- Multi-Currency Support: The payment gateway handles the conversion between the importer’s currency (USD) and the exporter’s currency (CNY), ensuring both parties receive the correct amount.

- Fraud Prevention: The gateway performs fraud checks to protect the importer and the exporter.

- Funds Transfer: Once authorized, the payment gateway securely transfers the funds from the importer’s account to the exporter’s account.

- Transaction Confirmation: Both parties receive confirmation of the successful payment.

Pros: Online payment gateways offer advantages, such as easy website integration and support for multiple currencies and payment methods. Features like fraud detection and recurring billing can simplify your operations.

Cons: Transaction fees and potential currency conversion fees typically range between 2% and 4%. Additionally, some industries or high-risk businesses may face limitations or be ineligible for certain payment gateway services.

2. Wire Transfers

Wire transfers are a fast and secure way to send money between people or businesses electronically. They are one of the most well-established payment methods for businesses, particularly in international trade.

How they work: Banks leverage secure networks like SWIFT to directly exchange funds between the sender’s and recipient’s banks to facilitate the transfer.

Example:

A company in France (importer) needs to pay a significant sum to a supplier in Germany (exporter) for a large machinery order.

Due to the high transaction value and security requirements, the importer might choose a wire transfer despite the slower processing time. The importer would initiate the transfer through their bank, specifying the exporter’s bank details and the agreed-upon amount. Once the transfer is complete, both parties will receive confirmation from their respective banks.

Pros: They are known for their security and reliability, making them suitable for transferring large sums of money.

Cons: Processing times can take several days, and fees tend to be high if you’re not using Bancoli.

3. Multi-Currency Accounts

A multi-currency account emerges as a pivotal tool for businesses aiming to thrive in the vast international marketplace. It is a unified platform that consolidates transactions in various foreign currencies, thereby streamlining global trade.

Providers: Banks and global fintech companies, like Bancoli.

How they work: Businesses can open a multi-currency account and deposit funds in their home currency or any supported foreign currency. The account allows them to:

- Receive International Payments: Clients can pay in their preferred currency, eliminating the need for currency conversion on the receiving end. This can save the business on conversion fees.

- Hold Balances in Multiple Currencies: Funds can be held in various currencies, allowing businesses to avoid foreign exchange fees when making payments to international suppliers or partners denominated in that currency.

- Make International Payments: Businesses can initiate payments to international vendors or partners in their local currency, streamlining the process and potentially reducing fees.

Example:

A clothing manufacturer in the US (exporter) sells garments to a retailer in Japan (importer). The exporter can use a multi-currency account to receive payments from the importer in Japanese Yen (JPY). This avoids the need for the importer to convert USD to JPY, potentially saving on conversion fees. The exporter can conveniently hold the JPY funds in their account or convert them to USD.

Pros: By holding balances in multiple currencies, businesses can avoid the often high fees associated with frequent currency conversions when receiving payments.

Cons: Some multi-currency accounts require minimum balance requirements to qualify for certain features.

4. Other International Payment Methods

Businesses can consider lesser-known options when receiving payments that offer advantages in specific situations, such as simplifying reconciliation or catering to international customers.

For instance, virtual business accounts can streamline the process by assigning a unique account to each transaction. Direct debit, popular in Europe, allows recurring payments directly drawn from a customer’s bank account.

Providers: Virtual Accounts, Direct Debit (SEPA), letters of credit, checks, and demand drafts.

How they work:

- Virtual Account: Assigns a unique account to each transaction, simplifying reconciliation.

- Direct Debit: Authorized recurring payments from a customer’s bank account (Europe).

- Letter of Credit: A bank guarantee to ensure payment for a high-value transaction, a complex process involving multiple parties.

- Checks and Demand Drafts: Due to slow processing, paper instruments used to withdraw funds from a bank account are less common.

Example:

Imagine a wholesaler of trendy clothing items experiencing rapid growth. They source garments from Asian manufacturers and sell them to North American and European boutiques. As their business scales, they must optimize their B2B payment processes to ensure efficiency, security, and timely cash flow.

As a growing fashion wholesaler, they expand, and managing invoices and payments becomes inefficient. Traditional checks delay cash flow, and options are needed for North American and European customers.

By implementing a strategic mix of payment methods from providers like Bancoli and traditional banks, the company can streamline reconciliation with virtual accounts, automate recurring payments with Direct Debit (Europe), ensure secure transactions with Letters of Credit, and offer alternative options like demand drafts. This comprehensive approach will improve efficiency, enhance cash flow, cater to a global reach, and mitigate risk.

Pros: Virtual accounts and direct debit (popular in Europe) can streamline reconciliation and cater to international customers.

Cons: Businesses can consider lesser-known options when receiving payments beyond the standard credit card and bank transfer methods. These alternatives can offer advantages in specific situations but come with drawbacks like potential integration costs, slower processing times, and limitations for online transactions. Additionally, vigilance for fraud prevention may be necessary.

Security Tips for International Payments

Conducting international transactions requires vigilance to safeguard your business from fraud and scams. Here are some security best practices:

- Use reputable providers: Partner with established financial institutions or payment service providers known for their security protocols.

- Verify recipient information before sending funds: Double-check account details and beneficiary names to avoid sending funds to the wrong party.

- Be cautious of unsolicited payment requests: Never send funds based on unexpected requests, primarily through email or phone calls.

Additional Tips

- Explore Niche Providers: Research providers specializing in specific regions or industries.

- Negotiate: Discuss fees and terms with potential payment providers.

- Stay Informed: Keep up with emerging payment trends and regulations.

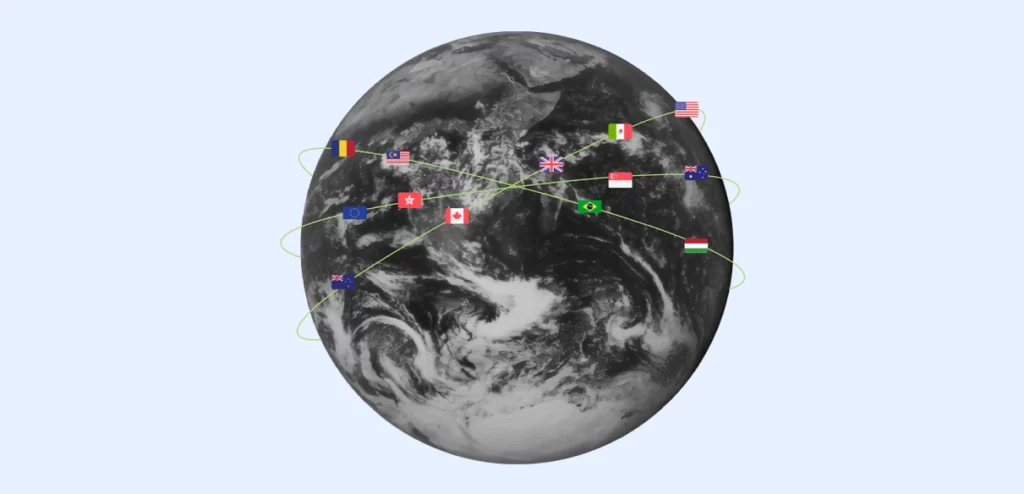

Bancoli: The Key to Payment in International Trade

Bancoli’s platform is designed for global reach. It facilitates transactions in over 200 countries worldwide, with dedicated account details for USD, EUR, GBP, MXN, CAD, AUD, HKD, SGD, NZD, PLN, and CNY.

Our GBA guarantees unparalleled funds protection using short-term U.S. Government Bonds for up to US$125 million per account holder, offering an unmatched level of security.

In Conclusion

Choosing the proper method for international payments involves balancing security, cost, speed, and ease of use.

Standard methods like international payment gateways (IPGs) and wire transfers offer a good mix of features, while multi-currency accounts can streamline foreign exchange management. Less common options like virtual accounts cater to specific situations but may require additional setup or involve complexities.

Frequently Asked Questions

1. What are some common challenges when choosing a payment method for international trade?

Selecting the correct payment method for international trade involves balancing security and convenience for both the seller (exporter) and the buyer (importer). Here are some common challenges to consider:

Risk of Non-Payment: Since international transactions involve parties across borders, one party may not fulfill their obligation. Exporters worry about buyers not paying after receiving goods, while importers fear sending payment for goods they might not receive.

Varying Regulations: International trade crosses legal jurisdictions with different regulations for money transfers, foreign currency exchange, and financial institutions. Understanding these complexities is crucial to avoid delays or unexpected fees.

Transaction Costs: International payments often involve multiple intermediaries, leading to various fees, including bank charges, wire transfer costs, and currency conversion charges.

2. What are the pros and cons of using International Payment Gateways (IPGs) for international transactions?

IPGs act as intermediaries facilitating secure online payments between international buyers and sellers.

Pros

- Convenience: IPGs offer a user-friendly platform for online payments, streamlining the checkout process for international buyers.

- Security: IPGs employ robust security measures to protect sensitive financial information during transactions.

- Multiple Payment Options: IPGs often integrate various payment methods, such as credit cards, debit cards, and local alternative payment methods, to cater to buyer preferences.

- Currency Conversion: IPGs can handle currency conversion, offering transparency and predictability for both parties.

Cons

- Transaction Fees: IPGs typically charge transaction fees, which can add to businesses’ overall costs, especially for smaller transactions.

- Limited Payment Methods: While offering various options, IPGs might not support all payment methods specific to a particular region.

- Dependence on Third-Party: Reliance on an IPG introduces another layer into the transaction, potentially causing delays or complications if issues arise with the platform.

3. What are other standard international payment methods besides international payment gateways (IPGs)?

Beyond IPGs, several established methods exist for international transactions:

- Cash in Advance: The importer pays the total upfront before shipping goods. It offers maximum security for the exporter but can be unappealing for the importer due to cash flow concerns and potential trust issues.

- Letters of Credit (LOCs): Formal document issued by the importer’s bank guaranteeing payment to the exporter upon meeting specific conditions, like proof of shipment. LOCs offer security for both parties but can be expensive and time-consuming to establish.

- Documentary Collections: The exporter sends goods and essential documents through a bank. The importer’s bank collects payment before releasing the documents, allowing the importer to inspect the goods before payment. This method offers some security but less than LOC.

- Open Account Terms: The importer receives the goods with a pre-determined period (usually 30-90 days) to pay. This benefits the importer’s cash flow but carries significant risk for the exporter.

4. What is a common advantage of using an international payment gateway (IPG) for online transactions?

- Easy website integration: IPGs can be easily integrated into an existing website.

- Support for multiple currencies and payment methods: Customers can choose their preferred payment method, often including credit cards, e-wallets, and ACH transfers.

- Security features: IPGs typically offer fraud detection and secure processing of transactions.