A multi-currency account is an essential tool for businesses. It allows companies to thrive in the large international marketplace. This financial solution is a unified platform. It consolidates transactions in various foreign currencies.

Consequently, it greatly streamlines global trade for everyone. Multi-currency accounts serve as a financial passport for businesses of any size. They simplify cross-border transactions significantly. This allows companies to expand their operations and customer base with superior ease.

This article explains how these accounts enable businesses to access international markets. Furthermore, they reduce the challenges associated with currency conversion fees. They also simplify the cumbersome management of multiple foreign currencies.

What is a Multi-Currency Account?

A multi-currency account is a modern banking solution. It enables both individuals and businesses to manage a range of currencies seamlessly. This versatile account allows users to receive, transfer money, and maintain balances in multiple foreign currencies.

Consequently, it effectively eliminates the need for constant currency conversions during sales transactions. This type of account is an ideal solution for freelancers and solopreneurs. It is also perfect for businesses of all sizes, from SMBs to large corporations. These accounts are designed for international operations.

By offering local account details for various regions, they help businesses. This allows them to pay international suppliers and vendors in their preferred currency. This easily avoids unnecessary conversion costs and friction.

How are Multi-Currency Accounts Different from Regular Business Bank Accounts?

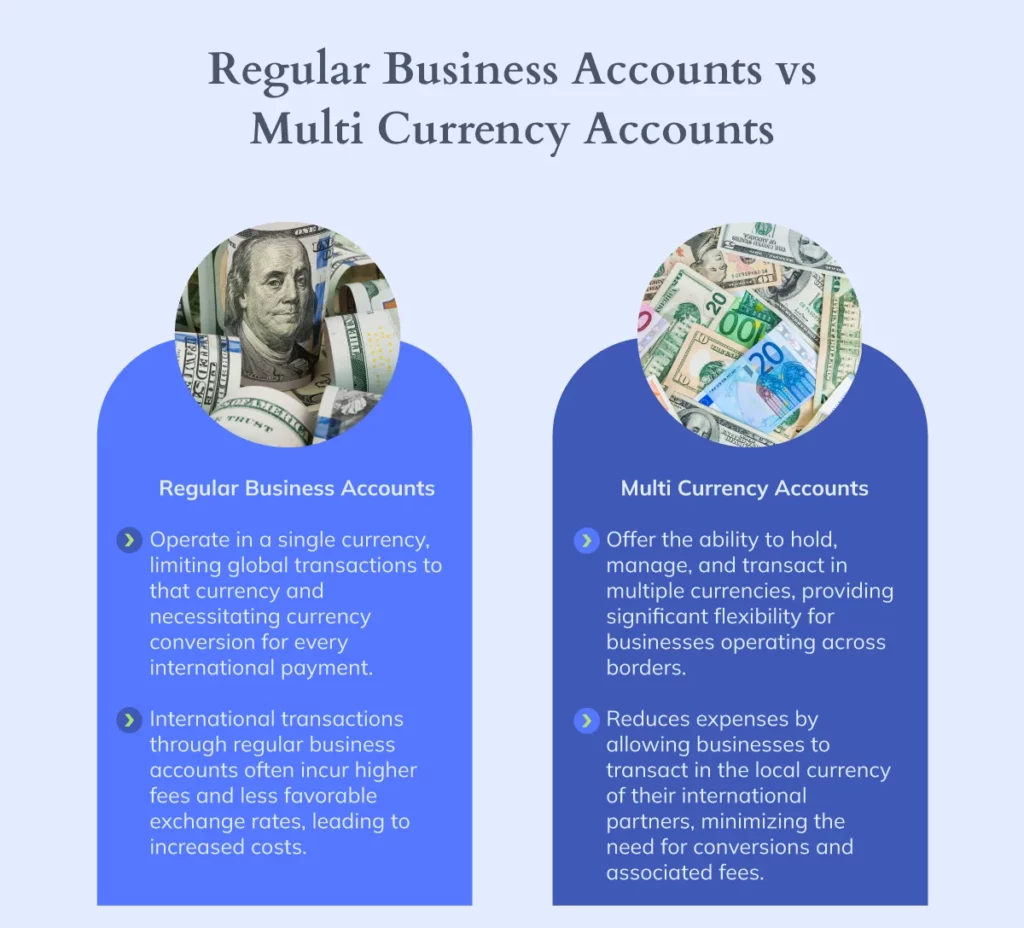

These business accounts represent a significant evolution. They differ greatly from traditional business bank accounts. They offer unparalleled flexibility and efficiency for businesses operating on a global scale.

Traditional accounts limit transactions to your home currency only. They require currency conversion for every international deal. However, multi-currency accounts allow businesses to bypass these costly and time-consuming conversions entirely.

This key capability facilitates immediate access to funds in the required currency. It also provides a vital hedge against fluctuating exchange rates. Ultimately, this may safeguard your hard-earned profits.

The transparency and cost-effectiveness of this system are clear. Managing multiple currencies in a single unified account can significantly reduce operational overheads. This helps improve overall financial planning.

What are the Differences Between Foreign Currency Account and Multi-Currency Accounts?

The distinction between these two account types is their capacity to handle multiple currencies. A foreign currency account is tailored for transactions in a single foreign currency. This makes it ideal for individuals or businesses that deal predominantly with one foreign market.

Conversely, a multi-currency account is designed for those who navigate numerous different currencies simultaneously. This versatility is crucial for businesses engaged in international trade across many countries. It enables them to easily hold, send, and receive funds in multiple currencies. All these transactions happen within just a few clicks on a single, streamlined account.

What Features Can You Expect from an Account Supporting Multiple Currencies?

The features of a multiple currency account, like Bancoli’s Global Business Account, extend far beyond basic currency management, offering a comprehensive suite designed to enhance global financial operations for businesses.

Hold multiple currencies

Multi-currency accounts simplify financial management by enabling businesses to hold, manage, and transact in various currencies from a single account. This feature eliminates the need for multiple currency-specific accounts, making it easier to conduct business across borders.

Currency exchange

Multi-currency accounts offer the flexibility to convert currencies directly within the account at competitive exchange rates. This capability allows businesses to benefit from more favorable rates compared to traditional bank conversions, effectively reducing the cost of doing business internationally.

International payments

Businesses can receive and send money globally with a multi-currency account. They can do this without the hefty fees typically charged for cross-border transactions. This feature is especially advantageous for businesses that regularly deal with international suppliers.

Using Bancoli’s USD account allows payouts to over 30 currencies. Customers benefit from Zero FX Fees within their monthly allowance. This enables more cost-effective and efficient payment processes globally.

Real-time Exchange Rates

Access to live exchange rates is essential. It enables businesses to make informed decisions about when to optimally convert currencies. This can potentially maximize their returns on currency exchanges. This real-time information enables businesses to respond quickly to market fluctuations. It helps safeguard their critical international financial transactions.

Local Receiving Accounts

Multi-currency accounts provide named local bank details. These details include unique account numbers or virtual IBANs. This allows businesses to easily receive payments in foreign currencies. It functions as if they possess a local bank account in that specific region.

This essential feature significantly enhances the ability to trade globally. It simplifies the payment process for international clients greatly. This also helps build essential trust and credibility in foreign markets.

How Does a Multi-Currency Account Work?

Multi-currency accounts streamline the process of managing global finances by providing a unified platform for handling various currencies.

Here’s how they work in practice:

1. Open an Account

To get started, businesses select a financial provider that offers multi-currency bank accounts. The setup process involves completing verification requirements, which typically includes providing business details and documentation.

2. Deposit Funds

Once the account is approved, businesses can deposit funds in their chosen currency denomination. If you already hold funds in other currencies, you can easily convert these into your account’s base or any other currency your account supports.

3. Hold Currencies

Multi-currency accounts allow businesses to store money in multiple currencies simultaneously. This capability is particularly useful for firms that engage in frequent global transactions. It enables you to hold and manage funds in the currencies of your key markets.

For instance, Bancoli empowers businesses to manage funds effectively through dedicated USD and EUR accounts. This capability simplifies financial operations significantly. It also helps in mitigating potential currency fluctuation risks proactively.

4. Make and Receive Payments

Multi-currency accounts streamline global transactions, allowing businesses to send and receive payments in various currencies through one account. This eliminates the need for multiple foreign accounts, simplifies global payments, and ensures funds are credited in the respective currency.

5. Exchange Currencies

Account holders can quickly convert currencies within their accounts. These conversions are always done at competitive rates. You can perform manual conversions at your discretion as needed. Alternatively, you can set up automatic conversions based on pre-defined criteria.

Bancoli’s Global Business Account makes these transactions more economical for everyone. The competitive fees and rates offer cost-effective solutions for global transactions.

When Should You Choose a Multi-Currency Account?

A multi-currency account becomes indispensable when managing everyday expenses across different countries. They are especially useful for those who have to conduct business in multiple countries. They help you save on currency exchange fees and manage all your international transactions in one place.

This flexibility can be observed directly in your bank statement, showing transactions in various currencies, thus providing a comprehensive view of your international financial activities.

Multi-currency bank accounts serve as an all-in-one solution for businesses engaging in global commerce.

These accounts also simplify receiving payments from overseas customers, holding foreign currency reserves for future use, making international investments, and strategically managing the impact of currency fluctuations.

How Does Bancoli Addresses Multi-Currency Account Challenges

Bancoli provides comprehensive solutions to the typical challenges encountered with multi-currency accounts, ensuring businesses can navigate the global market with confidence:

- Exchange rate fluctuations: Bancoli offers advanced tools and analytics readily available. These effectively manage and mitigate the impact of currency value changes. Consequently, this helps protect your account balance.

- Security risks: Bancoli prioritizes the critical security of your funds. It is a US-qualified custodian for all security mentions. Their state-of-the-art security measures include military grade encryption, two-factor authentication (2FA), and continuous fraud monitoring. This rigorous system ensures unparalleled and constant protection.

- Management complexity: Understanding complex currency markets is now made easier with Bancoli’s platform. It offers immediate insights and hedging strategies to simplify financial management greatly. This means you can manage your money without needing extensive financial expertise.

- Fees: Bancoli stands out for its transparent and competitive fee structure, clearly detailing monthly charges, transaction fees, and exchange rate margins, helping businesses forecast costs accurately and avoid unexpected expenses.

Through these focused solutions, Bancoli covers all essential aspects of managing a multi-currency account efficiently, allowing businesses to focus on growth rather than financial intricacies.

Who Can Have a Business Multi-Currency Account?

Business multi-currency accounts often extend their offerings to non-residents. This makes them a perfect financial solution for global movers and expats. They are also ideal for immigrants whose citizenship differs from their country of residence. They work well even if the business is registered elsewhere.

Choosing the Best Multi-Currency Business Account

When considering a multi-currency business account, look for several critical elements. These ensure the account meets your international business operations efficiently. Here are the essential features and benefits that such an account should reliably offer:

- Wide Range of Currencies: Ensure the current account also supports multiple foreign currencies. This is necessary to facilitate smooth global transactions.

- Low or No Minimum Balance: Look for accounts that do not require a high minimum balance. This offers your business more valuable flexibility.

- Comprehensive Global Account Information: This is essential for seamless online banking functionality across different global regions.

- Ease of Access: Prioritize accounts with robust and highly reliable online and mobile banking features.

- Transparent Fee Structure: Carefully evaluate all transaction and currency conversion costs. Also check the maintenance fees for the account itself.

- Adaptability to Business Needs: The account chosen should align perfectly with your international business goals. It must also support your specific financial management requirements.

Your Next Financial Passport: Global Business Account

Bancoli comprehensively covers all the crucial elements. This sets a new standard in global business banking solutions. Bancoli’s platform is specifically designed for global reach.

It successfully facilitates transactions in over 85 countries worldwide. It provides dedicated account details for core currencies such as USD and EUR. This means a company can seamlessly manage supplier payments. They can also invoice clients and handle operational expenses.

All of this is done from a single, unified account interface. This essential feature reduces the heavy administrative burden of managing multiple foreign accounts. Furthermore, it optimizes cash flow by minimizing fees and taking advantage of favorable exchange rates.

Conclusion

A multi-currency account is essential for modern businesses. It streamlines international payments, significantly reducing conversion fees.

Such a unified platform simplifies managing multiple foreign currencies in a single, secure place. Holding foreign funds helps companies mitigate currency fluctuation risk. Therefore, adopting a multi-currency solution is key to sustainable global expansion.

Frequently Asked Questions

What currencies can I manage with a multi-currency account for my business?

Different multi-currency accounts support different currency ranges. When you select Bancoli’s Global Business Account, you gain access to dedicated business bank accounts in both USD and EUR. This core currency support simplifies global transactions. It enables businesses to operate internationally without needing multiple foreign bank accounts, saving both time and money.

Can non-residents open a multi-currency bank account for their business?

Yes, non-residents can typically open a multi-currency bank account for their business operations. This is contingent on the financial institution’s specific policies and regulatory requirements. These accounts are especially beneficial for non-resident business owners. They simplify managing multiple currencies on a single platform for international trade.

Is my money safe in a multi-currency account?

Account security is a top priority for reputable financial technology providers. For instance, Bancoli is a US Qualified Custodian for all relevant security mentions. Your funds are protected using industry best practices. These measures include military grade encryption, two-factor authentication (2FA), and continuous fraud monitoring. Always choose a provider with robust security protocols.

How do I get Zero FX Fees on international payments?

Financial solutions like Bancoli offer a way to get zero FX fees. Specifically, using Bancoli’s USD business account, you can make payouts to over 30 currencies worldwide. These payouts benefit from Zero FX Fees within your available monthly allowance. Always confirm the terms and the scope of the monthly allowance provided.

How does a multi-currency account help with currency risk?

A multi-currency account allows you to hold foreign currencies immediately upon receipt. This removes the immediate pressure to convert funds to your home currency. By holding funds, you can choose a more favorable exchange rate in the future. This strategy helps businesses hedge against sudden, unfavorable currency fluctuations.