SMBs in the US and Mexico are vital to the economy, driving innovation and creating substantial job opportunities. Despite their pivotal role, small and Medium-sized Businesses (SMBs) often need help with financial challenges that can curtail their growth. By tapping into innovative financial solutions, SMBs can effectively surmount these difficulties, unlocking their potential and fueling economic growth.

The Economic Powerhouse: SMBs in the US and Mexico

In the US, SMBs form an economic powerhouse. They account for 99.9% of all businesses, employ over 60 million workers, generate 44% of GDP, and half the approximately $370 billion in overall tech spending. Simultaneously, in Mexico, SMBs—also known as PyMEs—contribute to more than 52% of the GDP and provide more than 70% of the country’s jobs, forming an essential part of the country’s economic landscape. This contribution reflects the pivotal role of SMBs and PyMEs in both countries’ economic growth, job creation, and technological advancement.

Challenges and the Ideal Vision for SMBs

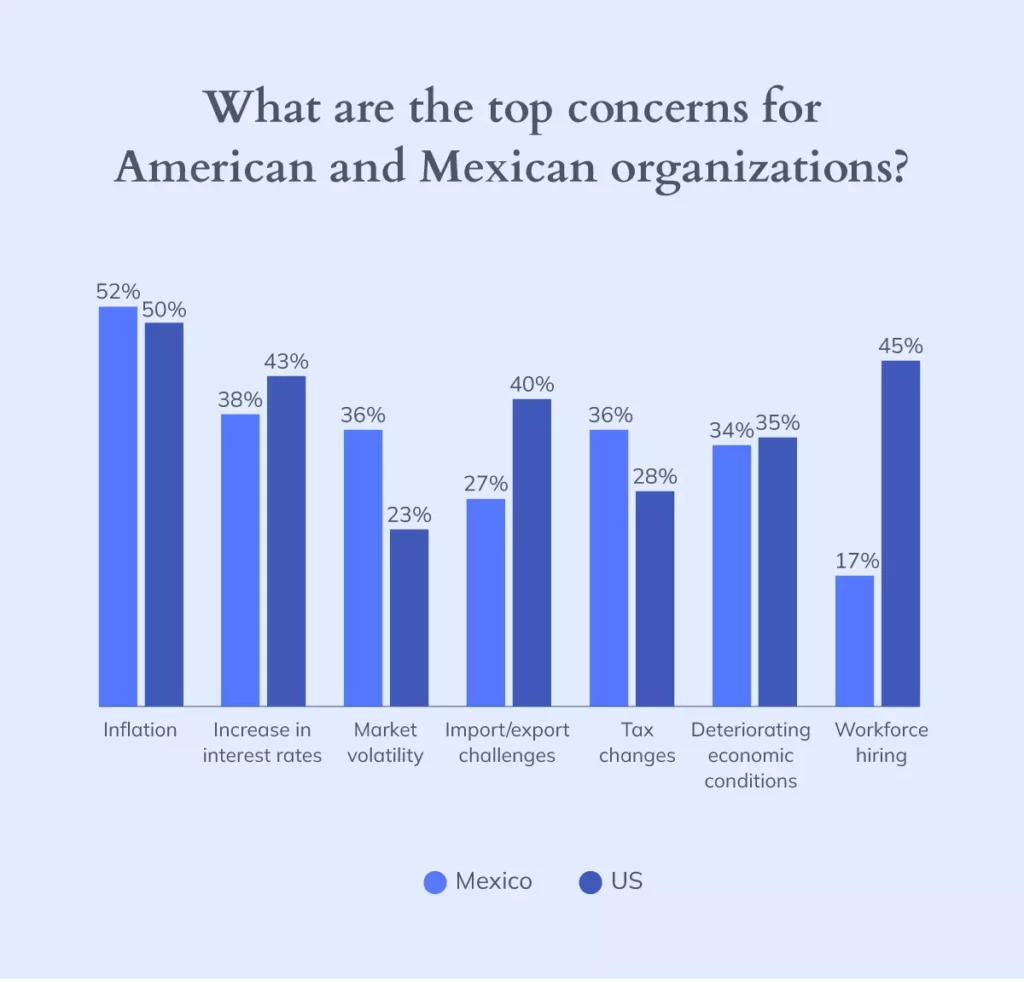

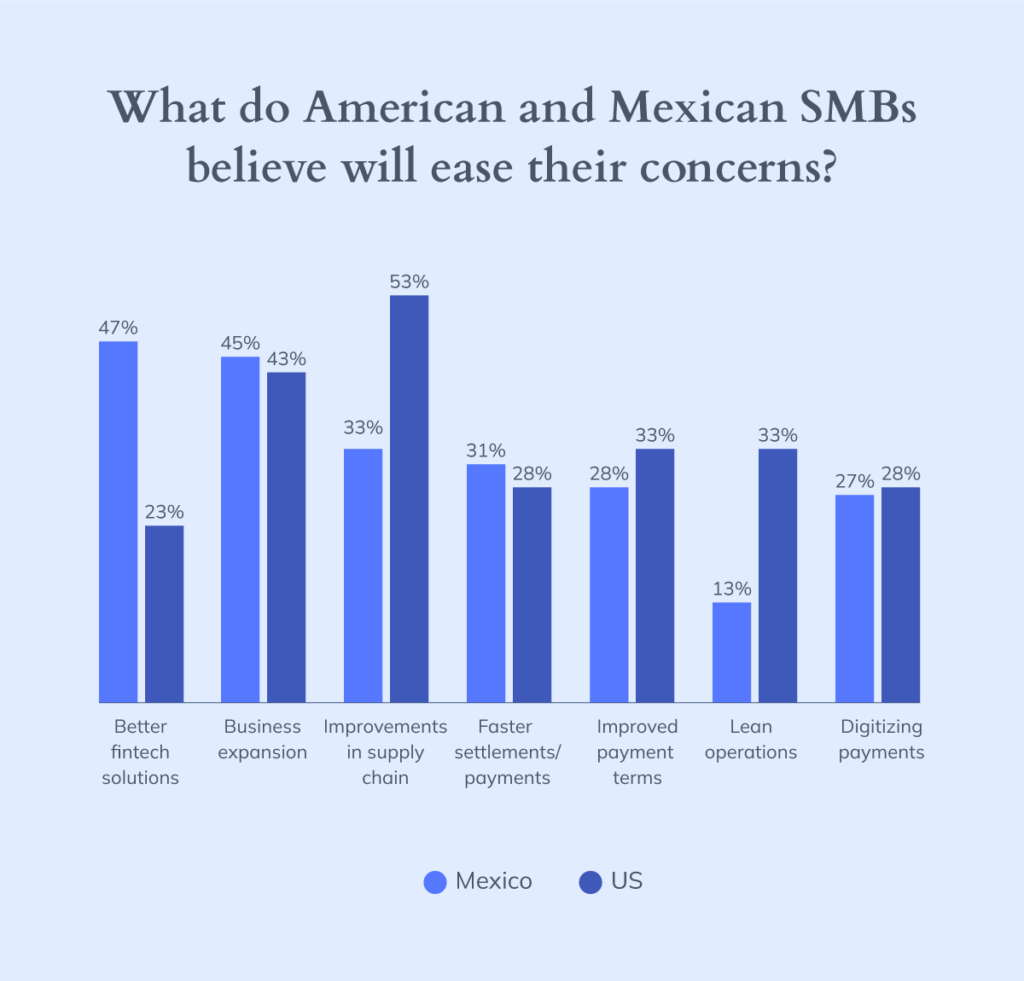

SMBs struggle with two persistent issues – access to capital and cash flow management. Inadequate financing often hampers their ability to launch new ventures or expand existing ones. The intensity of these challenges is further amplified due to specific issues confronting SMBs across different regions. For instance, in the US, the key concerns revolve around inflation, workforce hiring, and increase in interest rates. Meanwhile, in Mexico businesses worry about inflation, increase in interest rates, market volatility, and tax changes. However, with access to necessary resources—including capital, technology, and talent—an ideal environment for SMBs could be established.

In this vision, SMBs have the tools to streamline operations, bolster cash flow, and make strategic growth investments. Further, with supportive measures from larger enterprises and governments, SMBs can overcome obstacles and thrive, contributing even more significantly to the economy.

Bancoli: Crafting the Ideal Ecosystem for SMBs

Enter Bancoli, a platform designed to make this ideal vision a reality. Bancoli’s Global Business Account provides SMBs with an array of features to manage their finances more efficiently. Its multi-currency feature simplifies international transactions, saving SMBs from expensive conversion fees.

Bancoli also tackles the cash flow challenge head-on with an efficient invoicing feature and AI-driven cash flow management tools. With Bancoli, SMBs receive recommendations that help them achieve better financial health, specifically concerning cash flow and payments.

Overcoming Challenges with Bancoli

When liquidity management becomes a struggle, Bancoli comes to the rescue with its Bancoli USD Custody, ensuring robust fund security. Its supply chain financing solutions help SMBs improve supplier relationships, maintain cash flow, and grow steadily—transforming challenges and concerns into opportunities.

Conclusion

The economic growth of the US and Mexico depends significantly on the prosperity of SMBs. While these businesses face various challenges, with Bancoli’s support, they can efficiently navigate financial obstacles.

Bancoli is committed to enabling these businesses to reach their full potential by providing a robust, cost-effective, and comprehensive financial solution designed for their unique needs.