Multiple business bank accounts can be a game-changer for many business owners, whether small or large. They allow for better organization, separation of finances, and easier cash flow management. With multiple accounts, you can keep your personal and business finances separate, making tracking expenses, income, and savings easier.

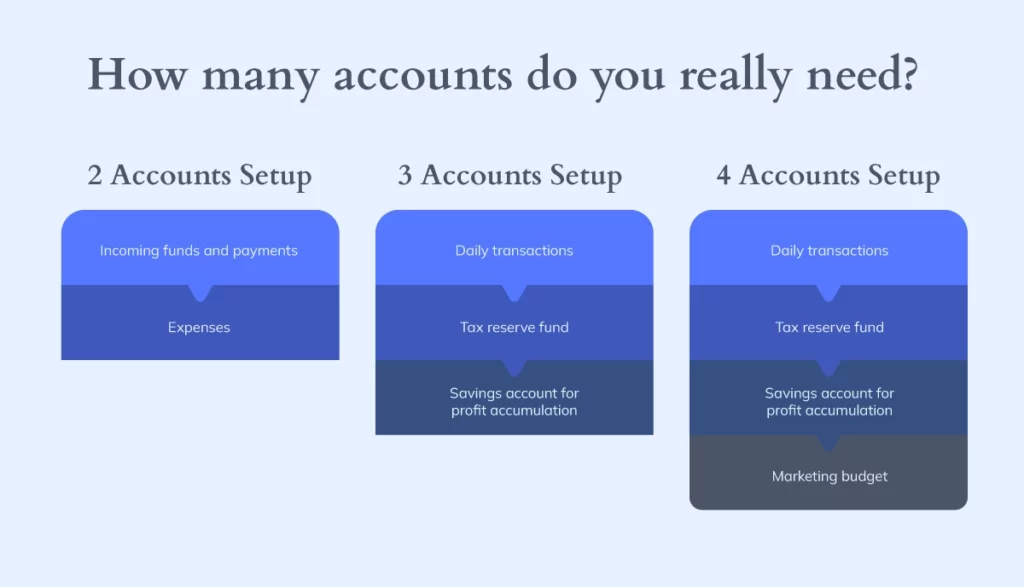

Many business owners wonder, “How many business accounts should I have?” The answer depends on your business’s size and operational needs. While maintaining at least one business bank account is fundamental for business expenses, having multiple business checking accounts can help your business be better financially organized. However, a consolidated approach with a multi-currency account can reduce the need for multiple checking accounts.

Benefits of Having Multiple Accounts

Having multiple business bank accounts offers several benefits, including:

- Improved organization: Different bank accounts account for different expenses, income, and savings, which help you keep track of your finances more efficiently. This segmentation allows easier tracking and reporting, making financial management less cumbersome.

- Better cash flow management: Multiple bank accounts allow you to allocate funds for specific purposes, such as payroll, taxes, and emergencies. This targeted allocation ensures you always have the necessary funds for critical expenses.

- Increased security: A separate account for specific fund use can provide a backup in case one account is compromised by hackers or scammers. This diversification reduces the risk of a single point of failure in your financial system.

- Easier tax preparation: Keeping separate accounts for expenses and income makes preparing tax returns and claim deductions easier. This organization simplifies the process of gathering financial data for tax filings.

- Earn interest: Opening multiple savings accounts can help you earn interest on your funds, which can add up over time. This can benefit businesses with significant cash reserves, allowing idle funds to generate additional income.

Importance of Effective Management

While having multiple business bank accounts can be beneficial, managing them effectively to avoid potential pitfalls is essential. Here are some key points to keep in mind:

- Monitor transactional activity and account balances regularly: Regular monitoring helps prevent errors and detect fraudulent behavior early. Staying on top of your accounts ensures you can promptly address any issues.

- Set up alerts and notifications: Use your bank’s alert system to stay informed about account activity and avoid exceeding transaction limits. Alerts provide real-time updates, helping you manage cash flow more effectively.

- Assign responsibility: Designate specific team members or employees to manage different accounts and ensure accountability. Clear roles and responsibilities help maintain order and prevent oversight.

Managing Multiple Business Bank Accounts

Managing multiple business accounts can be daunting. Understanding the different requirements and fees associated with various financial institutions is crucial. A streamlined approach to account management can significantly improve efficiency, cost savings, and overall business growth.

Financial management often involves maintaining multiple bank accounts for businesses of all sizes. This can improve the organization and provide clearer visibility into fund management.

Common scenarios include:

- Domestic Operations: Businesses often maintain multiple checking accounts for payroll, taxes, operational expenses, and sometimes marketing budgets. These divisions help allocate resources and avoid mixing funds, but they increase administrative complexity.

- International Operations: Cross-border businesses need business bank accounts in different currencies to handle regional payments, navigate varying banking regulations, and address exchange rate fluctuations.

Logistical Challenges

Maintaining multiple accounts, while helpful in organization, introduces various challenges:

- Administrative costs: Adding more accounts requires more time and resources for reconciliations, monitoring, and compliance tasks, which can quickly escalate.

- Fragmented cash flow data: With accounts spread across institutions and currencies, gaining a comprehensive view of cash flow is harder, which can slow and inaccurately inform strategic decision-making.

- Increased risk of errors: As more accounts require precise record-keeping, the chances of miscategorizing transactions or missing important deadlines increase exponentially.

Imagine a mid-sized e-commerce company operating in the US, EU, and Asia. Each region requires different accounts for handling local currency transactions, tax payments, and supplier payments.

With over 15 accounts across various banks, the finance team spends significant time reconciling balances, calculating exchange rates, and ensuring tax compliance—a process that could be simplified through consolidation.

Traditional vs. Consolidated Bank Account Management

Businesses typically adopt one of two approaches to account management:

Traditional Approach

The traditional approach involves opening a business checking account to manage business finances separately from personal finances. This strategy offers segmentation and control, but it comes with drawbacks:

Introducing multiple business checking accounts can further aid in tracking expenses and preparing for tax payments effectively.

- Administrative Complexity: Managing several accounts across different banks creates inefficiencies in monitoring balances and performing reconciliations.

- Higher Fees: Each account often has maintenance fees, transaction costs, and minimum balance requirements.

- Manual Processes: Without integration tools, transaction tracking and reporting become labor-intensive.

Consolidated Approach

The consolidated approach streamlines operations using a single platform with sub-accounts for various purposes or currencies. This model:

- Centralizes Management: Businesses can monitor balances and transactions for all accounts in one place.

- Reduces Costs: Consolidating into fewer accounts minimizes fees and eliminates redundancies.

- Enables Automation: Many platforms offer tools for automating recurring payments, currency exchanges, and tracking cash flow.

Use Case: Small Business with Cross-Border Sales

- Traditional Setup: A US-based small business with European and Asian clients has separate USD, EUR, and GBP accounts. Every payment involves manual currency conversions, delayed processing, and transaction fees.

- Consolidated Setup: With a multi-currency account, the business holds balances in multiple currencies, avoids conversion fees for receiving payments, and seamlessly transfers funds between currencies as needed.

Global Banking Challenges and the Multi-Currency Account Solution

For businesses operating internationally, several key challenges arise when operating multiple business checking accounts:

- Currency Management: Frequent currency conversions can lead to profit losses due to unfavorable exchange rates and high conversion fees. Holding balances in multiple currencies can mitigate this, but traditional business checking accounts may not offer such flexibility.

- Regulatory Compliance: Each country imposes different regulations on cross-border payments, tax reporting, and anti-money laundering measures. Navigating these rules can lead to errors and penalties without a unified system.

- Payment Delays and Liquidity: Cross-border transactions often experience delays, especially with intermediary banks, which can affect cash flow and supply chain operations.

Multi-currency accounts provide a comprehensive solution to address these challenges. They allow businesses to easily open multiple business accounts, manage business-related transactions, and maintain multiple checking accounts for different currencies. This setup helps business owners streamline their cash management, avoid unnecessary fees, and ensure adequate funds management and availability.

For small business owners, maintaining a business savings account alongside multi-currency business checking accounts can be advantageous for setting aside funds for emergencies or long-term goals, earning interest, and enhancing financial planning.

By opening multiple bank accounts, businesses can better manage payroll, allocate business funds, and integrate accounting software for efficient money management. This approach reduces the need for more than one account per currency with different financial institutions, avoiding the complexity of managing multiple checking accounts.

Bancoli’s Global Account: The Only Business Account Your Business Needs

The Bancoli Global Business Account (GBA) is a multi-currency business checking account designed to streamline financial management. It simplifies transactions and enhances cash flow control, catering to the needs of business owners, whether they are small business owners or managing international business operations.

The GBA gives you access to 11 currencies (USD, EUR, GBP, MXN, CAD, AUD, HKD, SGD, NZD, PLN, and CNY), allowing you to open multiple accounts effortlessly. Each currency account functions as a business checking account tailored to specific needs.

For instance, you can begin with one checking account in USD to handle local transactions. You might open a second checking account in EUR to manage European payments as your business grows. This system reduces complexity, making it easier to organize your finances and track cash flow without the burden of managing other accounts or multiple platforms.

The GBA also includes tools designed to enhance efficiency and support growth. Its multi-currency invoicing feature lets you send invoices in any supported currency, ensuring faster and more convenient payments from global clients. Additionally, the cash flow acceleration tool improves liquidity by ensuring funds are available when needed.

Security is a key focus. The GBA uses military-grade encryption, multi-factor authentication, and fraud monitoring. With fund protection of up to $125 million per account holder, you can trust that your finances are safe.

Conclusion

One common question business owners often ask is: “How many bank accounts should I have?” The answer depends on the size and needs of your business. Having dedicated accounts based on your financial operations is convenient, but having multiple bank accounts can be overwhelming, and Managing multiple business checking accounts doesn’t have to be overwhelming.

Transitioning to a consolidated platform like the GBA can simplify operations while reducing fees and administrative complexity. The flexibility to organize each business checking account for specific purposes—like payroll, tax reserves, or an emergency fund—ensures clarity and control over finances.

With Bancoli’s Global Business Account (GBA), you can start with your first business account in the currency you use most frequently, such as USD. As your operations expand, opening multiple checking accounts for other currencies, such as EUR or GBP, makes managing international transactions easier.

Whether you’re a small business managing domestic transactions or a larger operation handling multiple currencies, adopting a streamlined, all-in-one solution aligns your financial structure with your growth goals. The GBA makes it possible to open multiple accounts effortlessly, helping you stay organized and focus on what truly matters—growing your business.