In today’s global market, remote freelance professionals increasingly engage with international clients. This evolving landscape requires a strategic approach to managing and receiving international payments.

For freelancers, selecting the most suitable payment method is crucial to maximizing earnings, ensuring security, and maintaining work flexibility.

Understanding Remote Freelance Work

Understanding remote freelance work goes beyond the freedom to choose where and when you work. It involves delving into the financial aspects of freelancing, especially when dealing with international clients.

This career choice offers unparalleled flexibility, enabling individuals to engage in projects that resonate with their skills and interests, from design and development to writing and consulting.

As a freelancer on Upwork, you can design your career path, working with clients worldwide. For example, designers and developers can collaborate with clients from the US, Europe, Asia, and beyond to create various projects.

Whether you’re a seasoned professional or just starting, understanding the intricacies of international payments is key to a successful and financially stable freelance career.

Engaging with platforms catering to your needs can significantly ease the financial complexities of freelance work, allowing you to focus on creating, innovating, and expanding your global reach.

Expanding Your Freelance Opportunities

As the landscape of freelance work continues to evolve, professionals are presented with an unprecedented opportunity to expand their horizons. This expansion is not just about the variety of projects one can take on but also about the vast geographical scope these projects can cover.

The digital age has effectively shrunk the world, enabling freelancers to collaborate with clients across different continents from their homes. This global connectivity enriches freelancers’ professional experience and significantly enhances their earning potential.

As we delve deeper into the benefits of freelance work, we must recognize how access to global projects can transform one’s career, offering a pathway to a truly diversified and resilient freelance portfolio.

Access to Global Projects

With the world as your marketplace, freelance jobs provide access to various projects. Freelancers can work with clients from different countries, enjoying the diversity of work that comes their way. This global exposure enhances a freelancer’s portfolio and opens doors to lucrative opportunities.

Freelancers on platforms like Fiverr can access a global pool of projects and work with people from diverse backgrounds and locations. For example, you can offer your full-time services as a digital marketer to help clients in the US, UK, Australia, and beyond, enhancing your portfolio and opening doors to new opportunities.

Building a Diverse Skill Set

Freelancers can choose projects that challenge them and help build their skills. Whether a complex web development task or a creative graphic design project, every job adds to your experience and expertise. This continuous learning and development makes freelancing so appealing to many professionals.

Flexibility in Work Hours

One of the most significant advantages of working remotely is its flexibility. Whether you prefer to work full-time or part-time, freelancing allows you to set your schedule.

This flexibility is especially beneficial for those looking to balance work with other commitments or pursue multiple interests simultaneously.

There are many benefits to becoming an international or remote freelancer, but it is common to think about incoming international payments at last. As important as building your profile and portfolio and finding clients, you must find a good payment platform that won’t waste your earnings in fees and exchange rates.

Navigating Payment Platforms for Remote Freelancers

In the world of remote freelancing, selecting an ideal payment platform is a cornerstone for success. This choice greatly influences your freelance journey’s efficiency, security, and profitability.

Below, we explore essential factors that guide freelancers toward making an informed decision, ensuring they are well-equipped to choose a platform that aligns with their unique needs.

Ideal Payment Solutions for Freelancers

While traditional methods like wire transfers and checks linger, they’re marred by high fees and sluggish processing times.

Modern freelancers increasingly lean towards digital solutions for more efficient transactions, especially those working full-time. Here are some quintessential features you should look for in a payment platform:

- Multi-Currency Support: This feature is a boon for freelancers who work with international clients, enabling you to manage payments in various currencies and minimizing conversion fees.

- Instant Payments: Platforms offering immediate transfers are crucial for those looking for quick access to funds, ensuring that you don’t have to wait to get paid for your hard work.

- Low Transaction Fees: Opt for platforms with minimal fees for sending and receiving money to maximize your earnings. This is particularly important for those who work part-time and want to ensure their side hustle is as lucrative as possible.

- Enhanced Security: Opt for a platform that prioritizes security through rigorous KYC (Know Your Customer) processes to shield you from potential fraud. This is a critical aspect, especially when you’re dealing with a variety of clients and projects.

- User-Friendly Interface: The best platforms are those that save you time and hassle with an intuitive design and easy navigation, allowing you to focus more on work and less on administrative tasks.

What to Look for in a Payment Solution for Freelance Jobs?

Whether you are just starting out or looking to expand your freelance business, understanding and utilizing the right payment solutions can significantly impact your success and satisfaction in the freelance world.

Here’s a breakdown of the things to keep an eye on:

Transaction Fees: Maximizing Your Earnings

Transaction fees are a pivotal consideration when choosing a payment platform. These fees can vary significantly across platforms, directly impacting the net income of freelancers.

For instance, a freelance graphic designer working with clients across the globe must prioritize platforms that offer the lowest transaction fees.

This ensures that a larger portion of earnings from each project remains with the freelancer rather than being eroded by high fees.

Currency Exchange Rates: Securing the Best Value

For freelancers receiving payments in foreign currencies, the exchange rate offered by the payment platform is another critical factor.

Exchange rates fluctuate and can profoundly affect the final amount received. Platforms that provide competitive exchange rates ensure that freelancers receive the full value of their hard work.

Vigilance in monitoring exchange rates is necessary to prevent substantial losses in conversion, safeguarding the freelancer’s income.

Speed of Transaction: Enhancing Cash Flow

The speed with which payments are processed and made available is crucial for maintaining a freelancer’s cash flow.

Platforms offering swift transaction times are invaluable, as they help freelancers manage their expenses and maintain financial stability without unnecessary delays.

Accessing funds quickly is especially critical for freelancers who depend on prompt payments to cover operational and personal expenses.

Security Measures: Protecting Your Hard-Earned Income

In the digital age, the security of online transactions cannot be overstated. Freelancers must choose platforms with stringent security measures to protect their personal and financial information from unauthorized access.

The security of payment information is paramount for the freelancer’s peace of mind and maintaining trust with clients.

A platform’s commitment to security reflects its reliability and the freelancer’s professionalism, ensuring that both parties can focus on the work at hand without concerns about data breaches or financial loss.

Incorporating Best Practices into Your Freelance Business

To thrive in the global freelance market, it’s essential to adopt strategies that will streamline your payment processes:

Research and Compare

Spend time to find the best platform that aligns with your needs. Whether you’re a freelance designer or a writer, the right platform can significantly affect how you manage your finances.

As a freelancer, ask yourself, “What is the primary function I need from a platform?”

This could range from invoicing capabilities to client management. Also, consider if you are looking for a job or opportunities to work on projects that match your skills and interests.

Platforms vary greatly in terms of the services they offer and the sectors they cater to, so it’s crucial to find one that suits your own freelance niche.

Whether you work full-time or are just looking to do freelance work on the side, ensure the platform provides you with access to the types of jobs and clients you are most interested in.

Understand Fees and Exchange Rates

Being aware of all potential charges is crucial to avoid surprises. This knowledge will help you negotiate better rates and choose the most cost-effective platforms.

Freelancers should ask, “How will the fees and exchange rates affect my take-home pay?”

Understanding the cost of currency conversion and transaction fees is essential, especially for those working with international clients. When looking for a platform, consider how to get the most out of your money.

Even when widely used platforms exist, you don’t have to settle for the first option you find; compare fees across the board to ensure you’re making a financially sound decision.

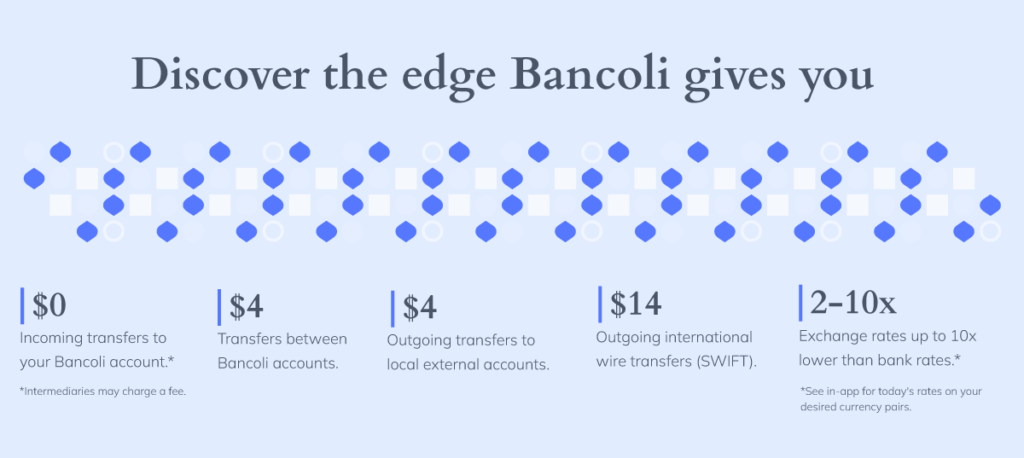

Check out Bancoli’s competitive fees and exchange rates that are up to 10x lower.

Secure and Flexible Payment Terms

Negotiating terms that guarantee timely payments is essential for maintaining financial security and optimizing cash flow.

As a freelancer, whether you’re juggling multiple projects or focusing on a single, large-scale initiative, establishing clear and flexible payment terms upfront can significantly impact your ability to manage finances effectively.

For projects, using escrow services can offer an extra layer of security, ensuring your earnings are safeguarded until the job is completed.

It prompts a crucial reflection: “What payment terms work best for my financial security and cash flow needs?”

Securing a contract with clear payment terms is a strategic approach to guarantee compensation for your efforts. Especially for larger projects, an escrow service acts as a third-party guarantor, providing you and your client peace of mind.

This becomes particularly vital for freelancers who rely on timely payments to support their livelihood and sustain a steady income.

Embrace Technology

Today, leveraging technology is non-negotiable for freelancers aiming to streamline their workflow and enhance efficiency. Digital invoicing and payment tracking tools are indispensable for freelancers managing a diverse clientele or multiple projects.

With an array of digital resources at your disposal, you can fine-tune your workflow, from scheduling and communication to invoicing and payments.

For freelancers who prize the flexibility to operate from anywhere, adopting technology not only aids in managing their business more effectively but also facilitates seamless connections with clients and collaborators worldwide.

Streamline Invoicing Work and Accelerate Cash Flow

For freelancers, every minute counts, and time spent on creative endeavors is infinitely more valuable than hours dedicated to administrative tasks such as invoicing and chasing payments.

This is where Bancoli’s innovative invoicing tool becomes invaluable. It revolutionizes the invoicing process by automating it, thus reducing the manual labor involved and significantly accelerating cash flow.

This tool allows you to schedule invoices in advance and present them professionally, complete with all necessary attachments, such as tax documents, work orders, quotes, contracts, or any other pertinent documents, to underscore your professionalism.

Moreover, this tool encourages early payments by offering discounts, benefiting both the freelancer and the client, ensuring a harmonious and mutually beneficial business relationship.

Bancoli’s platform exemplifies the seamless integration of technology into the financial aspects of freelancing, providing you with the tools necessary to secure payments, manage cash flow efficiently, and, ultimately, dedicate more time to your craft.

By embracing Bancoli, freelancers can access a suite of features designed to enhance their financial stability and operational efficiency, allowing for a greater focus on creating and delivering exceptional work to their clients.

Choosing Bancoli: A Smart Decision for Remote Freelancers

For remote freelancers, choosing Bancoli as your financial management platform is a strategic move that leverages your professional profile and ensures that your financial transactions are as efficient and secure as your work.

Bancoli’s Global Business Account is at the forefront of financial innovation, offering freelancers the unparalleled convenience of managing multiple currencies—USD, EUR, GBP, SGD, HKD, MXN, BRL, JPY, CNY, PHP, and INR—through a single account.

This multi-currency capability, combined with the ability to conduct cost-effective transactions in over 200+ countries, positions Bancoli as a superior choice for freelancers with a global client base.

Saving Time is Earning More Money in the Freelancing World

Choosing Bancoli means you’re not just selecting a payment platform; you’re opting for a comprehensive financial tool that supports your freelance business at every step.

With Bancoli, you can access a suite of invoicing and cash flow management tools designed to streamline your billing processes and accelerate your earnings.

These features allow you to present professional invoices, schedule payments, and even offer discounts for early payments, enhancing your cash flow and client relations.

Your Security is Our Priority

Moreover, Bancoli’s unmatched fund security ensures that your earnings are protected with the highest online safety standards.

This means you can focus on expanding your freelance career, ensuring your financial transactions are safeguarded against fraud and unauthorized access.

With Bancoli, you’re equipped with the best financial tools that outshine common options. These tools allow you to work from anywhere, access a global marketplace, and easily manage your finances.

Bancoli not only supports your professional growth but also ensures that your financial management is as robust and reliable as the quality of work you deliver to your clients across the globe.

In Conclusion

As a remote freelance worker navigating the complexities of international client work, choosing a payment platform is pivotal.

It directly influences your ability to maximize earnings, ensure transaction security, and maintain operational flexibility.

By evaluating key factors—transaction fees, currency exchange rates, processing speed, and security measures—you can make an informed decision that safeguards your income and supports your career’s growth.

This decision-making process, rooted in understanding and strategically assessing available options, is essential for optimizing your financial health and achieving long-term success in the freelance landscape.

Whether you’re a designer, writer, or developer, prioritizing these aspects will help you navigate payment challenges effectively, allowing you to focus on delivering exceptional work to clients across the globe.