Free checking business accounts can shimmer like a hidden oasis, promising respite from the oppressive burden of monthly fees.

But is this oasis a mirage or a genuine haven for cost-conscious entrepreneurs? This guide aims to equip you with the knowledge and discernment to navigate the labyrinth of business checking accounts, separating the shimmering facade of “free” from the tangible benefits that truly matter.

Unmasking the “Free” Label: Unveiling the True Cost of Business Checking Accounts

The allure of a “free business checking account” often captivates the attention of many business owners. This apparent haven promises a refuge from the mounting costs of managing business financials. Yet, thorough scrutiny is essential before embracing such offers, especially concerning a business checking account.

Despite the absence of monthly maintenance fees in many free business checking accounts, many expenses dwell beneath, potentially undermining the business funds.

This exploration will give you critical insights to dissect elements to consider in business checking accounts, steering you towards a choice that genuinely resonates with your financial requisites.

Transaction Fees: Understanding the Cost of Financial Mobility

Navigating the intricate business banking world, particularly when assessing business checking accounts, requires a keen eye for hidden costs. Beyond the enticing label of “free business checking accounts,” there exist layers of expenses that can stealthily erode your financial stability.

These costs, often overlooked in the initial excitement of opening a business account or choosing a basic business checking option, can significantly impact your enterprise’s financial trajectory.

- Per-transaction charges: Each deposit, withdrawal, or online transfer in your business bank account might attract a fee. While seemingly negligible individually, these can cumulatively impact your financial health. A monthly fee that covers the services might be a better option in this case.

- Tiered fees based on volume: Growing businesses often find the transaction fees in their business checking account escalating with their success, paradoxically punishing their progress. Recurring costs, especially regarding international transfers, can add up.

- Monthly limits for free transactions: Some basic business checking accounts offer a quota of fee-free transactions, but breaching this threshold triggers additional costs, ensnaring businesses in a cost spiral.

The “free” business checking account has hidden costs in all these cases.

Impact on Diverse Business Needs

In the dynamic landscape of modern commerce, businesses face many challenges, particularly when navigating the intricacies of business checking accounts.

These business accounts, often a cornerstone of financial operations, can profoundly impact various business activities. The transaction costs associated with business checking accounts, especially in contexts like international trade, can have far-reaching effects.

For any business, managing these fees is critical to financial sustainability and growth. The impact of transaction fees can be magnified for businesses engaging in:

- International trade: A large, mid-size, or small business engaging in global trade might find the wire transfer fees in their business checking account significant, usually ranging from $10 to $35, but sometimes as high as $75 or even $100 per transaction.

- Evolving transaction volume: An expanding small business might grapple with increasing fees in their business checking account under tiered structures.

- Global commerce initiatives: For businesses venturing globally, competitive exchange rates and efficient international payment processing are essential to minimize transaction costs.

Finding a Transparent Path Forward

Whether you’re looking for a free business checking account, a basic business checking account, or a more comprehensive business bank account, understanding the nuances of transaction fees and monthly maintenance fees is essential.

Businesses must scrutinize the details of their accounts – from the monthly service fee to the terms of customer payments – to ensure they align with their operational needs.

Finding a clear business checking account is critical to keeping business finances separate and well-managed.

- Clear fee structures: Transparent fee schedules in a small business checking account without hidden costs are crucial. They eliminate surprises and enable informed decision-making, especially when dealing with monthly fees and fees that apply to transactions.

- Transactions within reasonable limits: Free transactions within designated volumes in business checking accounts provide flexibility. This is particularly important in a small business checking account where controlling operational expenses is vital.

- Competitive exchange rates: Minimizing FX (foreign exchange) costs through favorable conversion rates enhances profitability.

An example to illustrate the impact of fees

Imagine a furniture manufacturer sourcing materials from various countries. Operating under a traditional business checking account with a 3% FX spread, a $10,000 shipment could incur a $300 hidden cost plus transfer fees, a significant burden for any mid-size or small business.

Additionally, transaction costs for each supplier payment under such business bank accounts could further erode their margins. In contrast, switching to Bancoli brings several benefits:

- FX rates 2-10 times lower than regular banks: The $10,000 shipment now incurs only $10-$30 in FX fees under Bancoli, a stark contrast to the monthly fees plus high FX rates typical in even the best business checking accounts.

- Multi-currency accounts in USD, EUR, GBP, SGD, and HKD: This feature is particularly beneficial for businesses managing international transactions, where maintaining business funds in different currencies is crucial. It eliminates the need for frequent conversions, a common pain point in standard business checking or business interest checking accounts.

By optimizing your financial infrastructure with Bancoli, you can navigate the complexities of wire transfers and international payments.

Questions to Ponder:

- What is your average monthly transaction volume? Can you accommodate per-transaction charges, or do they significantly affect your profitability?

- Do you know the per-transaction charges that may apply to each deposit or withdrawal in your business bank account? How might these fees cumulatively affect your business’s financial health?

- Does your basic business checking account have a limit on free transactions?

- How does this transaction limit exceed and impact your operational costs?

- How do high wire transfer fees in your current business checking account affect your expenses when involved in international trade?

- How do exchange rates and international payment processing fees in your business checking accounts affect profitability?

Minimum Balance Requirements: Understanding the Trade-Offs

Another trade-off in “free” business checking accounts is minimum balance requirements. Maintaining a specific minimum balance in your account ensures a certain activity level and helps banks comply with regulatory requirements.

Understanding the Potential Implications

Here are some key points to consider regarding minimum balance requirements:

- Impact on Cash Flow: High minimum balances can restrict access to your own funds, potentially hindering unexpected expenses.

- Penalty Fees: Failure to maintain the minimum balance can trigger penalty fees, and add to your financial burden.

- Administrative Effort: Monitoring your balance and adjusting your cash flow to meet the minimum requirement can add additional administrative work.

Exploring Additional Options

For businesses prioritizing flexibility and control over their cash flow, alternative options may be preferable:

- Accounts without minimum balances: These accounts offer greater freedom in managing your funds but may come with other fees.

- Premium plans: Some platforms offer premium plans with higher transaction limits while potentially requiring minimum balances.

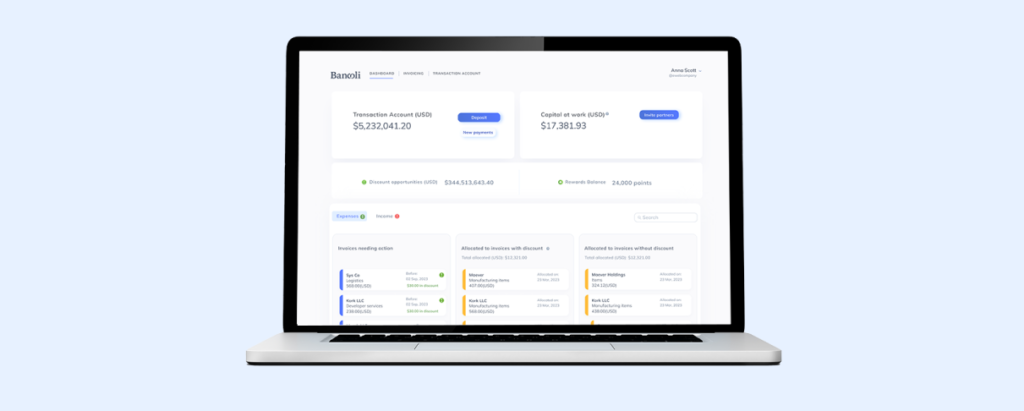

Bancoli’s Membership Plans: Extensive Value Beyond the Account

Bancoli emerges as a robust banking solution, offering a spectrum of membership plans tailored to unlock your full financial potential.

Let’s delve into the extensive value proposition concealed within Bancoli membership plans and unveil the exciting horizons opened by its premium membership plans, including the opportunity to waive monthly fees with Bancoli Reward Points.

Premium Plans: Unlocking Enhanced Control and Growth Potential

Bancoli’s premium plans offer a compelling financial solution for businesses seeking to navigate the international financial landscape.

Imagine establishing dedicated business account details in USD, EUR, GBP, HKD, and SGD, streamlining cross-border transactions and minimizing friction within your global financial operations.

Premium plans unlock the ability to create multiple business accounts within the same currency, fostering unparalleled financial organization and clarity. Separate operating expenses from investment funds, categorize income by project or team, and gain insights into your financial performance. This level of control empowers strategic decision-making and optimizes cash flow management.

Unveiling the Value-Added Features of Bancoli Premium Plans

Having the right financial tools can make all the difference for any business. Bancoli’s premium plans offer advanced features designed to streamline financial management, boost efficiency, and foster growth.

Invoicing automation and personalization

Break free from the manual monotony of repetitive invoicing. Bancoli allows you to configure recurring invoices for regular clients, with automatic generation and delivery at predetermined intervals. This ensures timely billing, facilitates prompt payments, and optimizes your receivables process, freeing up your resources for more strategic endeavors.

Customizing your invoices can elevate your professional image and enhance client engagement. Upload logos, company files, or XML data to create invoices that cater to individual client needs. This personalized approach can foster stronger relationships and potentially expedite payment cycles.

Bancoli Reward Points

Earn points from eligible transactions and utilize them to offset fees, access exclusive discounts, or unlock other valuable benefits. By aligning financial activity with tangible rewards, Bancoli incentivizes cost-efficient practices and adds another layer of value to your membership.

Verified business badge: Building trust and differentiation

Stand out from the competition with a prominent verified business badge displayed on your profile. This credential, authenticated by rigorous compliance checks, is a powerful trust signal attracting new business opportunities.

Enhanced security and flexibility

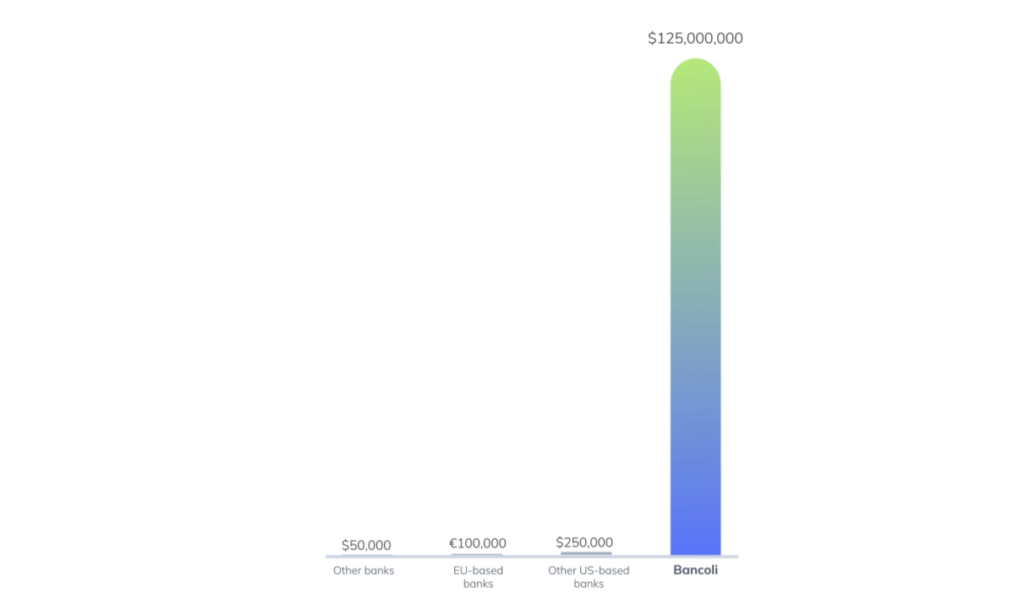

As you upgrade your plan, you unlock a higher Bancoli USD Custody amount of up to 125 million dollars, granting you greater peace of mind and increased flexibility when managing larger financial sums. This caters to businesses experiencing significant growth or requiring higher transaction volumes.

Compare the Bancoli membership plans and select the one that best suits your business needs.

Understanding the Trade-Offs: Weighing Value Against Cost

When selecting tools for your business finances, seeing immediate cost savings and potential hidden costs is crucial. Choosing a solution based on a “free” attractive tag without evaluating its feature set can lead to unforeseen inefficiencies and, ultimately, a higher overall cost.

Focus on Value, Not Just Price

Limited financial solutions often trap businesses in a cycle of:

- Time tax: Manual tasks like invoicing and cash flow tracking suck up hours you could dedicate to core activities. Bancoli’s all-in-one solution, features, and automation reclaim that precious time.

- Operational drag: Inefficient processes lead to errors, delays, and missed opportunities. Bancoli’s robust features and real-time insights empower agility and informed decision-making.

- Safety and security: Business finances can be exposed to risks like fraud, data breaches, and compliance issues. Bancoli’s advanced security protocols offer peace of mind, ensuring your financial data and transactions are secure and trustworthy.

Finding the Optimal Solution: Aligning Features with Your Needs

Choosing the correct business checking account involves thoroughly evaluating your business size, operational complexity, and future growth aspirations.

Startups and small businesses, often with more straightforward financial requirements, might find a basic business account sufficient to meet their needs. This option provides essential services without the complexity of more advanced accounts, making it a suitable choice for businesses at the beginning stages of their journey.

Investing in a more feature-rich account early on can be a strategic decision for businesses anticipating rapid expansion. A more advanced account paves the way for seamless scaling, avoiding the need for future disruptions or transitions.

Choosing a business account that aligns with present and future needs can ensure a smoother path for business growth.

The Evolving Landscape of Business Banking

While traditional brick-and-mortar banks remain a trusted option for many businesses, their offerings may not perfectly suit the needs of today’s dynamic and digitally driven entrepreneurs.

Let’s take a balanced look at some potential considerations when evaluating bank options, focusing on factors like branch accessibility, technological capabilities, and overall convenience.

Limited Branch Access: Potential Bottlenecks for Growing Businesses

Although the architectural magnificence of historical bank buildings imbues a sense of charm, the practical accessibility of physical branches, especially in the context of a brick-and-mortar bank, may not consistently align with the operational requisites of businesses that require:

- Geographically dispersed teams: Frequent travel to distant branches for basic banking services can be time-consuming and unproductive for businesses. An online banking solution with global reach can be more efficient.

- Dynamic work locations: In today’s remote-friendly world, entrepreneurs and freelancers may operate from various locations, further highlighting the limitations of relying solely on physical branches.

- Rapid growth: As businesses expand, managing financial tasks through limited branch access can become increasingly cumbersome and inefficient, potentially hindering agility and growth.

Explore Solutions that Prioritize Convenience and Agility

To keep up with business financial needs in the global marketplace, businesses are turning to alternative banking solutions that prioritize convenience and digital agility beyond merely looking for a business checking account:

- Fintech platforms: Modern fintech platforms offer user-friendly online banking interfaces, 24/7 customer support, and seamless integration with popular business tools, often providing a more streamlined and efficient experience.

- A global network of partner banks: Some platforms provide access to a network of global payment solutions, allowing businesses to deposit and withdraw funds or access banking services through convenient locations, even while traveling.

- Advanced financial features: Look for platforms that offer features tailored to your specific business needs, such as efficient global wire transfers, multi-currency accounts, invoicing tools, or cash flow management dashboards.

Aligning Your Needs with Available Options for a Better Fit

As mentioned, the ideal business banking solution should seamlessly integrate with your specific needs and operating style. Carefully consider factors like:

- Frequency of branch visits: Do you require regular in-person banking services, or do you value the flexibility of digital online banking to move funds into your business checking account?

- Technological needs: Which features are essential for streamlining your business’s financial operations and enhancing efficiency? What are the security features that protect your business accounts and funds?

- Growth aspirations: As your business expands, will the chosen platform adapt to your evolving needs, provide scalability, and give you a business advantage?

Navigating the Business Banking Landscape: Exploring Options for Diverse Needs

The world of business checking accounts presents a diverse ecosystem, catering to various needs and preferences. Understanding the different options available is crucial for making informed decisions about your financial management. This goes beyond just opting for a free business checking account. Here’s a breakdown of some prominent categories:

Online-Only Banks: Embracing Digital Efficiency for Cost-Conscious Businesses

Online-only banks have emerged as strong contenders in the market, attracting tech-savvy businesses with their focus on technological advancement and cost-effectiveness. Key characteristics include:

- Minimal Fees: These banks often have no monthly fee, very flexible monthly fees, and minimal transaction charges. This is a significant benefit, especially for businesses mindful of maintaining a minimum balance or concerned about a high minimum deposit. They are ideal for any budget-conscious large or small business, startup, and freelancer looking to avoid the typical minimum opening deposit associated with traditional banks.

- Seamless Digital Experience: User-friendly, streamlined online platforms offer convenient access to checking account management, real-time transaction tracking, and seamless payment functionality. This boosts operational efficiency, simplifies wire transfers, and enhances the overall experience of managing a business checking account.

- Organic Integration: Seamless integration with standard financial business processes such as invoicing can further streamline workflows and reduce manual data entry. This saves valuable time and resources, making it a viable option for those seeking an efficient business checking solution without the constraints of monthly fees or a high minimum opening deposit.

Traditional Bank Free Tier Options: Balancing Familiarity with Conditional Benefits

Established brick-and-mortar banks also offer “free” tiers within their tiered account structures, providing an alternative path for businesses seeking familiar access. Common features include:

- Conditional fee waivers: The monthly fee can be waived if you meet specific criteria in these tiers, such as maintaining a minimum balance, placing a minimum opening deposit, or exceeding a specific transaction volume.

- Physical branch network: The comfort and security of physical branches remain a crucial benefit of traditional banks, particularly for businesses with frequent cash deposits or requiring in-person consultations. This can be especially important for those not yet ready to transition to online-only checking accounts, but several online-only banks like Bancoli have dedicated support teams.

- Established reputation: For risk-averse businesses, traditional institutions’ long-standing history and brand recognition can offer an added layer of trust and stability in their business checking account choice. At the same time, ensuring that the online bank you’re exploring complies with banking regulations, has a good funding structure, and has security features can be the technical guarantees you need.

Finding the Right Fit: Aligning Your Needs with Available Options

Choosing the ideal business checking account ultimately aligns your specific needs and preferences with the available options. Carefully consider the following factors:

- Transaction Volume and Cash Deposit Frequency: Assess your average transaction volume and how often you require cash deposits. This assessment is vital as it can impact the suitability of online-only options, especially if a monthly fee applies or if a certain minimum deposit is required.

- Technological Preferences: Evaluate your comfort level with mobile banking and the importance of cutting-edge digital features in decision-making. This is particularly relevant for businesses considering the shift from a traditional checking account to an online-only platform.

- Growth Aspirations: Consider your future financial needs and whether the chosen account, be it a traditional checking account or an online-only option, can scale with your business’s growth and expanding complexity. This includes considering factors like minimum opening deposits and the flexibility of monthly fees.

By analyzing your specific needs and comparing the different categories and examples presented, you can decide on the business checking account that best suits your unique financial landscape.

How to Open a Business Checking Account with Bancoli

Ready to streamline your finances and empower your business with Bancoli’s powerful features? Opening your Bancoli business account is quick and easy. Here’s what you need to know:

Sign-Up Process

- Visit Bancoli.com and click the sign-up button to register for your business checking account.

- Enter your name and email address, and choose a password. Then verify your email to continue.

- Tell us about your business: Select your country, enter your business name, and create a unique handle.

- Confirm your request with a verification code sent to your email.

Complete the Verification Process to Access your Business Checking Account

Many banks request an application process to open a business checking account. In Bancoli, this is the business verification process.

Verification builds trust and security within the Bancoli network, enabling full functionality like managing funds and transactions. While verification is mandatory for these features, you can still start invoicing immediately after signing up.

Understanding the Business Verification Process

Completing Bancoli’s business verification process is mandatory. It ensures compliance with banking regulations and verifies your business identity, whether you register as a business or a solopreneur.

Bancoli’s Business Verification Step-by-Step:

- Complete the Sign-Up process as described above. Then, log into your account.

- On the Bancoli dashboard, click the “Open Bank Account” button to initiate verification.

- Provide documentation requested based on your business type and location. This may include proof of address, business formation documents, tax identification numbers, etc.

- Secure your account after verification, and you will receive a notification on your application status over the following days.

Bancoli: Streamlining Global Finance for Business Growth

Businesses of all sizes require seamless global banking solutions to compete and thrive. Traditional banking often falls short, with its monthly maintenance fees and limited reach.

Bancoli, a fintech platform, is designed to break down these barriers and empower businesses to navigate the global financial landscape easily. It offers an alternative to the typical business checking accounts.

Embrace Effortless Global Transactions

Say goodbye to the complexities of international banking and the high monthly fees often associated with business checking.

With Bancoli’s secure network of partner banks spanning 200+ countries and over 25 currencies, you can transact with confidence and efficiency. Hidden fees in your wire transfers or cumbersome processes will no longer impede your global business operations.

Simplify Multi-Currency Mastery

Bancoli eliminates the headaches of managing multiple currencies with dedicated currency accounts in USD, EUR, GBP, SGD, and HKD. This approach offers clear visibility into your global cash flow, avoiding the hassle of conversion charges typically found in traditional checking accounts.

With Bancoli, you have multiple checking accounts and a dedicated business checking account for each currency without a minimum balance requirement.

Boost Operational Efficiency and Gain Financial Insights

Bancoli empowers you to streamline your financial operations and make informed decisions, all without the monthly maintenance fee of a standard checking account.

Generate professional invoices, track outstanding payments, and automate reminders directly within your account. Real-time dashboards and intuitive reporting tools provide powerful insights into your cash flow, enabling you to optimize resource allocation and stay ahead of financial challenges.

Unparalleled Security and Peace of Mind

Bancoli prioritizes ensuring the security of your finances. We offer insurance on eligible deposits up to a remarkable $125 million per account holder. This level of protection significantly surpasses what is typically offered by standard banks, being 500 times greater than the insurance usually offered by US-based banks and 1000 times greater than the insurance commonly provided by European banks.

This security starkly contrasts traditional free checking accounts’ monthly maintenance fee and minimum deposit concerns. Operate confidently, knowing your finances are safeguarded by industry-leading security measures, including military-grade encryption and multifactor authentication.

More Than Banking: A Holistic Financial Partner

Bancoli understands that financial needs extend beyond just banking, so we are a comprehensive financial partner.

We empower businesses of all sizes to operate more efficiently, navigate the global marketplace with confidence, and unlock their full potential, moving beyond the constraints of traditional business checking and free checking accounts.