In B2B payments, the challenges are as varied as the industries themselves. From digital services to manufacturing, commodities, and retail, each sector grapples with unique hurdles in managing B2B transactions.

Central to these issues are inefficiencies of manual processes, the costs of credit, and the imperatives of timely and secure payments. This exploration, grounded in data, probes the specific B2B payment challenges and unveils industry strategies to overcome them.

Understanding the Domino Effect in B2B Payments

The complex world of business-to-business payments spans multiple industries and affects companies in unique yet interconnected ways.

While these challenges may differ from business to business, the underlying mechanisms and their ripple effects are strikingly similar, creating a domino effect that impacts the entire business ecosystem.

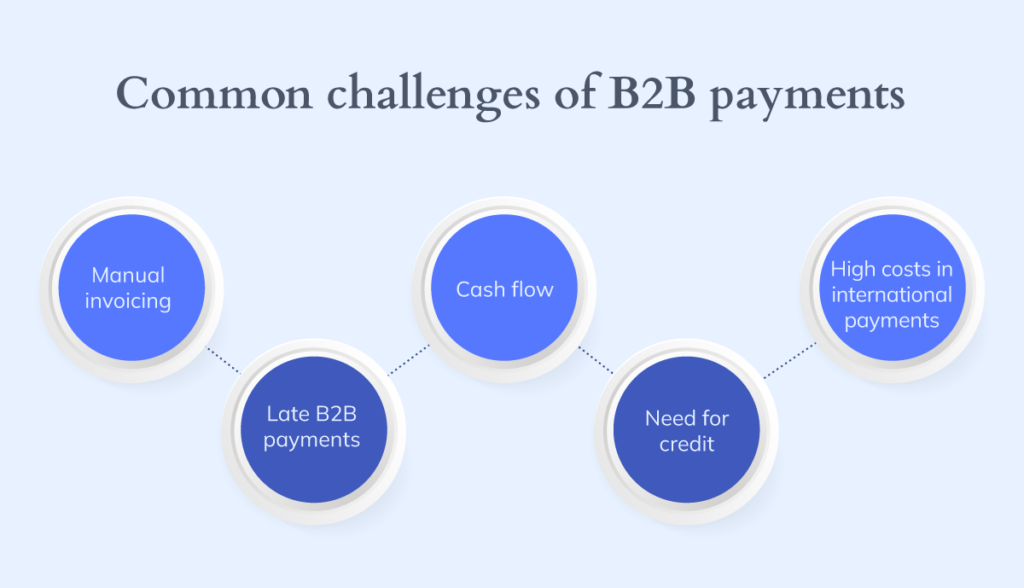

What are the most common B2B payment challenges?

- Manual invoicing: Prone to human error, manual invoicing can lead to billing inaccuracies and lost invoices, draining resources and complicating the B2B payment processes.

- Late B2B payments: Stemming from invoicing inefficiencies, late payments disrupt supply chain cash flow, causing delays that ripple through supplier networks.

- Cash flow: Affected liquidity compromises a business’s financial health and ability to meet obligations, often leading to reliance on emergency funds or short-term loans.

- Need for credit: To counteract cash flow issues, businesses may resort to credit, incurring additional costs and potentially worsening financial stability.

- High costs in international payments: International transactions bring significant fees and fluctuating exchange rates, increasing operational costs and impacting profit margins for businesses accepting global B2B payments.

These points will be explored in detail in the context of four industries: digital services, manufacturing, commodities, and retail, providing insights into how B2B payment challenges uniquely affect each sector and what strategies can be employed to navigate these complexities.

The Ripple Effect of B2B Payment Challenges

B2B payment challenges are not isolated issues; they resonate through the entire business ecosystem, creating a ripple effect that impacts various nodes and processes. When one company in a supply chain experiences inefficiencies in payments, the repercussions can extend far beyond its operations.

Similarly, when a business adopts efficient B2B payment methods and processes, it not only streamlines its accounts payable and receivable processes but also influences the financial health of its partners. This adoption can lead to a network-wide shift towards more transparent and reliable B2B payment processing, fostering a more robust and resilient commercial environment.

Manual Invoicing: The Silent Cash Flow Killer

Manual invoicing is a widespread concern across various industries, posing significant challenges to businesses of all sizes. Remarkably, 29% of small and medium-sized businesses (SMBs) identify manual invoicing as their primary issue, highlighting the critical need for automation.

The Cost of Inefficiency in Digital Services

Manual invoicing is more than an administrative hurdle in the digital services sector—it’s a barrier to progress and innovation. Manual invoicing procedures can significantly hinder operations for businesses in this sector, where agility and speed are vital.

Tech startups, for instance, often spend over 10 hours a week on manual invoicing, leading to direct labor costs and constrained liquidity as capital gets tied up in accounts receivable. This situation emphasizes the importance of transitioning to automated invoicing systems, a move that’s become essential for survival in today’s fast-paced digital economy.

Automated Invoicing: A Necessity for Digital Payments

The shift towards automated invoicing and digital payment methods, ACH payments, credit card payments, and wire transfers, is transformative for businesses reliant on B2B transactions. The move to electronic funds transfers (EFTs) enables companies to avoid the complexities and expenses associated with traditional wire transfers, paving the way for more efficient business operations.

Impact on the Digital Services Industry

In the digital services industry, prolonged invoicing processes have far-reaching consequences, potentially leading to a 15% reduction in project turnover rates. With 29% of SMBs in the sector citing manual invoicing as a critical issue, it’s clear that these practices are not just tasks but significant barriers to growth and efficiency. The average tech startup, losing around 10 hours weekly to manual invoicing, faces increased labor costs and extended payment cycles, impacting their financial health.

Furthermore, 25% of SMBs in digital services are concerned about slow transaction confirmations, which can severely disrupt project timelines. Efficient digital payment platforms and streamlined payment methods are essential in an industry where time efficiency is paramount, as delays can have cascading effects on project completion and client satisfaction.

Manufacturing Challenges: Time Is More Than Money

In the manufacturing sector, 46% of businesses identify manual payment reviews as a significant barrier, reflecting the broad impact of time efficiency on operations. Delays in payment processing, often due to manual invoicing and inefficient payment methods, disrupt supply chains and critical production timelines.

Consider the automotive parts industry, which relies heavily on the just-in-time (JIT) model. Delays in B2B payments, whether from slow processing or extended payment cycles, can lead to substantial financial losses, often reaching thousands of dollars. Beyond monetary costs, these delays damage client trust and reliability, crucial in industries where reputation is as essential as product quality.

The impact is more pronounced in sectors like electronics manufacturing, where margins are often below 5%. Inefficiencies in invoicing can decrease overall profitability by 2%, a significant figure in a margin-sensitive industry.

Reaffirming this issue, 46% of manufacturing businesses cite the negative impact of manual payment reviews on production and revenue. Furthermore, 35% acknowledge that lengthy payment processes are significant obstacles, particularly in JIT-dependent sectors, where delays can cause extensive production disruptions.

To address these challenges, manufacturers are increasingly adopting digital payment solutions and electronic payments. These B2B payment advancements streamline processes and expedite funds and wire transfers, enhancing cash flow balance. The shift to digital payment platforms helps manufacturers minimize risks associated with manual methods, safeguarding financial stability and maintaining competitiveness in the global marketplace.

Commodities Trading: The Domino Effect of B2B Payment Delays

In commodities trading, where markets like oil have slim margins, efficient B2B payment processes are crucial.

Delays in invoicing can prevent traders from seizing profitable opportunities in this fast-paced sector. For instance, invoicing delays in a US $1 million trade could result in a US $5,000 daily loss, considering a 0.5% opportunity cost. Over time, these inefficiencies significantly affect liquidity.

Improving invoicing efficiency by just 1% could boost annual liquidity by US $1 million, underscoring the need for effective cash flow management. Additionally, 28% of SMBs cite the lack of real-time financial insight as a major challenge affecting strategic decisions in commodities trading.

Efficient digital payment solutions are essential, including quick wire transfers and online payments. These platforms expedite business transactions, maintaining competitiveness in a market where timing is critical.

Retail’s Reliance on Rapid Transaction Cycles

In the fast-paced e-commerce sector, transaction speed and digital payment efficacy are crucial. A mid-sized e-commerce platform managing 500 daily transactions can find manual invoicing labor-intensive. Each invoice takes about three minutes to process, adding up to 25 extra work hours per week. This amounts to around $1,000 weekly or $52,000 annually in labor costs, assuming a $40 hourly operational cost.

This significant investment in manual invoicing could be better directed toward enhancing marketing or customer service, which are vital for business growth and customer satisfaction. With typical profit margins of 3-5% in retail, a 10% increase in invoicing efficiency could boost net margins by 0.5%.

Moreover, nearly 27% of retailers struggle with cash flow visibility, often needing a comprehensive view of their finances. This can lead to inventory management issues and lost sales opportunities, underlining the importance of efficient, transparent digital payment methods in the retail industry.

Have you considered the amount your business might needlessly spend on manual invoicing processes and how these funds could be more effectively used?

Embracing Automation for Future-Proofing Cash Flow

Industries are increasingly turning to automation and integrated financial solutions to overcome these challenges. In many cases where recurring payments are part of the business entities negotiation, the manual invoicing process can be an excellent opportunity for automation.

Here are some efficiency rates different industries have obtained from invoicing automation:

- Digital services firms are implementing AI-assisted invoicing tools, reducing manual entry time by up to 70%.

- In manufacturing, automated payment systems are improving cash flow by as much as 30%.

- Retailers adopting e-invoicing solutions are able to reduce processing costs by nearly 60%.

Bancoli’s invoicing feature notably helps reduce invoicing operations significantly, including accelerated cash flow features, demonstrating the advantages of automation in financial management.

Late Payments: The Ripple Effect of Invoicing Inefficiencies

The effects of late B2B payments stemming from manual invoicing processes underscore the need for efficient, automated invoicing solutions to maintain operational continuity, client satisfaction, and financial stability.

Digital Services: Project Delays and Client Dissatisfaction

In the digital services industry, delays in B2B payments, often caused by invoicing inefficiencies, can lead to significant project setbacks. This ripple effect of late payments undermines client satisfaction and retention.

For example, a software development firm grappling with delayed B2B payments might have to postpone project deliveries, risking their service level agreements and reputation. Streamlining the payment process, possibly through digital payment solutions, is crucial for maintaining project timelines and client trust.

Manufacturing: Supply Chain Disruptions and Production Halts

The manufacturing sector is particularly vulnerable to the repercussions of late B2B payments. Inefficiencies in manual invoicing can stall the receipt of payments, impacting a manufacturer’s ability to compensate suppliers promptly.

This disruption can lead to production halts, especially in industries like automotive manufacturing that rely on just-in-time production models. Implementing efficient payment methods, such as electronic payments or digital payment platforms, can help mitigate these disruptions.

Commodities Trading: Missed Market Opportunities and Liquidity Issues

For commodities traders, the timeliness of B2B payments is critical. Delays caused by invoicing errors can result in liquidity constraints, hindering the ability to capitalize on market fluctuations.

Even minor payment delays can mean missed opportunities and reduced profitability in this high-stakes industry. Adopting speedy payment processing systems and leveraging multiple payment methods can be pivotal in maintaining market positioning and profitability.

Retail: Inventory Mismanagement and Cash Flow Strain

In the retail industry, especially in e-commerce, late payments can severely impact inventory management and cash flow.

Retailers depend on consistent cash flow to manage stock levels effectively. Delays in B2B payments, due to invoicing errors, can lead to either understocking or overstocking, affecting sales and customer satisfaction.

For instance, an e-commerce business may miss critical sales opportunities due to insufficient stock, a direct consequence of delayed payments. Integrating digital payment options and utilizing efficient payment solutions like Bancoli can significantly alleviate these challenges.

Bancoli’s Solution to Late B2B Payments

Bancoli effectively addresses late B2B payments with innovative invoicing and cash flow management tools. These tools streamline and automate the invoicing process, significantly reducing errors and delays. This efficiency incentivizes clients to prioritize early payments, fostering robust business relationships and improving cash flow.

By ensuring prompt B2B payments, Bancoli’s system lessens the reliance on credit, cutting down on associated costs and financial risks. Overall, Bancoli’s comprehensive approach bolsters financial stability and enhances client satisfaction while minimizing credit dependence. This is particularly true across key industries like digital services, manufacturing, commodities, and retail, where clear cash flow insights are vital for informed decision-making and effective strategizing.

Healthy Cash Flow: The Key to Avoiding Credit Dependency

Streamlining B2B payments is not just a financial aim; it’s a strategic necessity yielding tangible improvements in productivity, profitability, and competitive positioning.

By embracing technological solutions and revising payment methods, businesses can convert time management challenges into opportunities for strategic growth.

Cash Flow Clarity: The Financial Forecasting Advantage

As industries strive to adapt to the ever-evolving economic landscape, the integration of advanced financial tools becomes not just a competitive edge but a fundamental component of operational stability and success.

Achieving clarity in cash flow is crucial for businesses to meet strategic goals and sustain growth in volatile markets.

A recent survey highlights that 28% of SMBs view cash-flow visibility as a significant challenge, emphasizing the importance of precise financial forecasting. This is particularly true across key industries like digital services, manufacturing, commodities, and retail, where clear cash flow insights are vital for informed decision-making and effective strategizing.

Accelerating Value in Digital Services

In the digital services industry, swift execution is essential for maintaining quality and ensuring customer satisfaction. Efficient cash flow is critical in this context.

A significant challenge identified by 25% of SMBs is delayed B2B payment confirmations, which impact not only financial liquidity but also the entire lifecycle of a project. This can erode client trust and damage the service provider’s reputation.

For instance, a web development firm facing payment delays might see a 30% increase in project completion times. This delay reduces the firm’s ability to take on new clients and poses a risk of losing up to $20,000 USD in potential revenue per project. Crucially, such delays can also affect client retention, impacting long-term revenue.

This highlights the crucial link between timely B2B payments and maintaining a healthy cash flow. In digital services, where speed is a key success metric, managing B2B payments is vital. Timely financial transactions ensure operational stability and foster client trust, key to sustained growth and market presence.

Digital service providers, from software developers to marketing agencies, rely on predictable cash flow for operational funding and growth investments. The Digital Services Index indicates that late B2B payments can increase operational costs by 10-20%, significantly impacting cash reserves. With a clear financial overview, firms may experience growth opportunities and avoid stagnation.

Just-in-Time and Cash Flow: Navigating Manufacturing Efficiency

In manufacturing, where just-in-time (JIT) delivery systems are essential, timely payments are critical. Delayed B2B payments, a significant issue for 35% of businesses, can disrupt these systems and hamper cash flow management.

Delays can have a domino effect, with a machinery manufacturer, for example, facing up to US $10,000 per hour in operational costs during downtime.

The Manufacturing Institute and Deloitte’s 2019 report highlights the importance of efficient payment processing. It emphasizes that in manufacturing, time efficiency directly impacts financial outcomes.

Delays not only mean lost time but can translate into considerable financial losses. For a mid-sized manufacturer using JIT, B2B payment delays can cause production slowdowns, leading to weekly losses of about US $50,000.

Efficient payment processes are crucial for manufacturers to maintain uninterrupted production, minimize costly delays, and sustain a healthy cash flow. This reduces reliance on credit and safeguards the financial health and stability of the business.

Moreover, the Manufacturing Financial Statistics Bureau notes that delayed payments can increase a manufacturer’s costs by up to 25%, particularly in JIT systems.

A delay of just 24 hours can disrupt the supply chain, causing production and shipment delays, leading to contractual penalties and strained buyer relationships. Therefore, managing cash flow timing is about operational efficiency and maintaining a competitive and financially stable manufacturing business.

Commodities Trading: Navigating Timely B2B Payments for Enhanced Cash Flow

In the fast-paced commodities industry, efficient B2B payments are crucial for financial stability and capitalizing on market opportunities. A 2020 Commodities Industry Association survey underscores the profound impact of payment timing on profitability. Slow payments can result in an average opportunity cost of 5% per transaction, significantly affecting traders’ ability to exploit market conditions and impacting annual profits and liquidity.

B2B payment delays can cause missed opportunities and erode competitive advantages, often pushing traders towards costly credit solutions. Streamlining payments is thus vital for sustaining liquidity and financial agility, enabling traders to manage funds effectively and maintain market competitiveness.

A Commodities Market Council study further highlights the sector’s sensitivity, indicating that a 1% price change in grain can impact a trader’s margin by up to 15%. In such a volatile market, real-time financial insight is critical for a trader’s success, as even slight fluctuations can substantially affect profitability.

This emphasis on efficient payment processes is key to ensuring a trader’s financial health and long-term viability in the ever-changing commodities market.

Streamlining Retail Payments for Enhanced Cash Flow

In the retail sector, healthy cash flow is crucial, particularly with the challenges of slow B2B payments. Retailers, often operating on lean inventory systems, are vulnerable to the negative impacts of B2B payment delays. These delays can cause significant stock shortages, affecting sales and revenue.

The National Retail Federation reports that leading retailers may see up to an 8% reduction in monthly sales due to inventory shortages caused by delayed B2B payments. This disrupts operational efficiency and forces retailers to consider credit options, further straining their financial health.

Timely B2B payments are essential in retail for more than just inventory maintenance; they protect businesses from unnecessary reliance on credit and help preserve cash flow. Effective payment processes and prompt settlements with suppliers are crucial for preventing stock shortages and maintaining consistent sales. Aligning payment cycles with inventory demands enables retailers to manage resources efficiently, key to ongoing business growth and stability.

Retailers face unique cash flow visibility challenges, directly impacting inventory management. Instances of overstocking or understocking can lead to a 5-10% loss in sales. This challenge is significant for medium-sized retailers, potentially translating into substantial revenue loss.

27% of SMBs report difficulties managing inventory effectively due to a lack of visibility of cash flow. This issue hampers their ability to respond to consumer demand and take advantage of peak shopping times.

Strategizing for Cash Flow Across Sectors

Each industry must manage B2B payments efficiently to maintain cash flow and reduce credit dependence.

Credit Costs from Late B2B Payments: The Silent Threat to Profitability

Businesses in various sectors struggle with credit needs due to cash flow issues caused by late B2B payments. Delays in receiving payments create cash flow gaps, pushing businesses to rely on credit for financial support. While credit offers short-term relief, it challenges managing associated costs. Strategies to address these include negotiating better rates, exploring alternative financing, or using technology to speed up B2B payments.

Digital Services and Credit Fees

Managing credit costs is crucial in the digital services industry, where global, instant, and secure payments are the norm.

Credit fees, particularly those from currency conversions, can significantly lower net revenue for providers like SaaS companies and marketing agencies.

Manufacturing and Credit’s Impact

For manufacturers, credit fees not only affect profit margins but also impact li. When extending credit to distributors and retailers, manufacturers aim for long-term ROI but often need more working capital due to accumulating credit costs. For example, a manufacturer with a US $5 million annual turnover can lose US $150,000 in working capital with just a 3% credit cost, affecting their capacity for investment in research, development, or production expansion.

Commodities Trading: High Credit Costs

In commodities trading, where margins are tight and turnover quick, even a 2-5% credit fee can have a considerable impact. A trading company with US $10 million in transactions could incur up to US $500,000 in credit costs at a 5% rate, significantly affecting financial outcomes.

Retail: Credit Costs vs. Sales Growth

Retailers, including those in the e-commerce sphere, face the challenge of balancing credit offerings with profit margins.

Credit fees, concerning 43% of SMBs, can substantially reduce profits. A medium-sized electronics retailer, for instance, could lose between US $60,000 to $100,000 in earnings on US $2 million in annual sales due to credit costs ranging from 2-5%.

Managing Credit Costs Across Industries

Actively managing credit costs is vital for all businesses for day-to-day operations, long-term profitability, and financial health. Across industries, a strategic approach to credit management is key to enhanced profitability and success.

How Do International Payments Costs Impact B2B Payments?

A wire transfer is usually the preferred payment method for any international business, but every operation may represent very high processing costs, including fluctuating exchange rates and high transaction fees.

These challenges can impact profitability and operational efficiency, necessitating cost-effective and efficient international payment management strategies for both large and small businesses.

Digital Services: Currency Conversion Fees and Competitive Pricing

- Wire transfers are a norm for global transactions in the digital services industry.

- Currency conversion fees can significantly cut into net revenues.

- Balancing these payment costs while maintaining competitive pricing is a major challenge for businesses like SaaS providers and digital marketing agencies.

Manufacturing: Disruptions in Global Supply Chains

- International wire transfers are integral to the manufacturing sector’s global supply chain.

- High costs and delays in B2B payments can interrupt production schedules.

- Manufacturers manage these payment costs to maintain profitability and ensure the timely delivery of essential materials.

Commodities Trading: Impact of Transaction Fees on Margins

- The commodities trading industry operates with quick turnovers and slim profit margins.

- High costs in international wire transfers, such as transaction fees, directly affect these slim margins.

- Effective managing these costs is vital for traders to seize market opportunities and remain competitive.

Retail: Challenges in Managing Inventory and Pricing

- Retailers with international operations face challenges in managing the costs of cross-border transactions.

- These costs can influence inventory management and affect overall pricing strategies.

- Retail businesses must implement cost-effective international payment methods to sustain profitability and cater to customer demands.

Bancoli: Empowering Businesses Master B2B Payment Challenges

Bancoli emerges as a pivotal player in the dynamic world of B2B payments, offering innovative solutions tailored to meet the diverse requirements of business-to-business transactions across various sectors.

Through its integration of cutting-edge cash flow management tools, Bancoli is dedicated to bolstering efficiency and slashing transactional costs for companies of all sizes.

Revolutionizing Manual Invoicing

Bancoli’s state-of-the-art invoicing tools empower businesses to seamlessly create and schedule invoices, significantly reducing human error.

Ideal for managing recurring payments, these tools ensure that invoices consistently reach the correct mailbox, thus enhancing reliability and minimizing manual errors associated with traditional payment processing.

Tackling Late Payments

Bancoli’s invoicing feature includes options for early payment discounts, a strategic move to incentivize buyers and fortify commercial relationships.

This innovative approach ensures that your invoices are prioritized in clients’ payment schedules, promoting timely B2B payments and fostering consistent financial flow.

Reducing the Need for Credit

By implementing automated invoicing and advanced cash flow features, Bancoli substantially decreases the reliance on credit and loans.

This approach enables healthier financial management and stability, crucial for businesses navigating the complexities of digital payments and wire transfers.

Cutting Costs in International Payments

Bancoli offers competitively low rates and fees, dramatically undercutting those typically associated with traditional financial institutions.

The platform’s Global Business Account is a versatile financial hub, featuring a 5-in-1 multicurrency business bank account that supports USD, GBP, EUR, SGD, and HKD.

This robust offering is particularly advantageous for businesses engaged in international transactions, enhancing profit margins and operational efficacy.

Bancoli transcends the role of a mere platform; it is a transformative partner for businesses aspiring to excel in the global marketplace.