Are you seeking a hassle-free method for sending money to the USA from the UK? Navigating the complexities of international transactions demands a clear understanding of the process.

Whether it’s for a SMB or you’re a solopreneur, understanding the nuances of transferring funds is crucial. In this comprehensive guide, we unravel the complexities of sending money from the UK to the USA, providing you with a practical, step-by-step approach. From exploring the most efficient transfer method to unraveling the potential fees and regulatory considerations, this guide is your go-to resource for seamless and optimized money transfers across the pond.

The Landscape of GBP to USD Transactions

Understanding these international money transfers’ typical scenarios requires insight into the various options available for sending money across borders. Knowing the exchange rates, fees, and transfer methods is pivotal in making informed decisions, and choosing cost-effective transfer methods is a high priority. Here’s a breakdown of the primary channels:

- Traditional bank transfers: Transferring money through banks often offers security and reliability. However, it might come with higher fees and less favorable exchange rates, impacting the final amount received by the recipient.

- Global money transfer services: Specialized money transfer services provide competitive rates and lower fees than traditional banks; Bancoli offers seamless global payments in 25+ currencies and benefits from competitive global FX rates on every transaction.

- Online payment platforms: They facilitate international transactions but might involve higher currency conversion fees.

Challenges and Costs in UK-USA Transactions

Sending money abroad to the USA from the UK has unique challenges that can impact transfers’ cost and delivery time. These challenges are critical to avoiding pitfalls and minimizing fees when sending funds overseas.

One major factor is the fluctuating exchange rate between the British Pound (GBP) and US Dollar (USD). With two different currencies, transfers are subject to daily changes in the forex market. This variability in exchange rates can mean your pounds are worth more or less daily when converted to dollars.

Transaction fees charged by banks and money transfer services must also be accounted for. Many UK banks process international wire transfers for £25-£40 or more per transaction. These fees quickly add up, especially for recurring payments.

Time delays can also affect UK-to-USA transfers. International wires often take 3-5 business days to settle, while debit/credit transactions may hold funds for several days. This can cause problems for businesses reliant on predictable cash flow and payments.

Swift and Secure: Transferring Funds from the UK to the USA

You might wonder “how fast will my money move from the UK to the USA?“

This used to be a very long process, but with the improvements in technology, such as the internet and fintech solutions, it is now far safer and more convenient than ever.

The process is now completed using something called a wire transfer. A wire transfer electronically transfers money from one account to another, using a network of banks or transfer agencies to move your money from the UK to your recipient’s bank account.

Sending money via the SWIFT (Society for Worldwide Interbank Financial Telecommunications) system, applies to the USA. This system links thousands of banks and financial institutions, allowing you to send money quickly and securely.

Global Business Account: A Solution to International Transfer Woes

Navigating international transfers, especially between the UK and the USA, has challenged many businesses. Bancoli’s Global Business Account offers a seamless solution, alleviating the complexities often associated with international transactions. With a focus on convenience and efficiency, this bank account has transformed how businesses manage their cross-border payments.

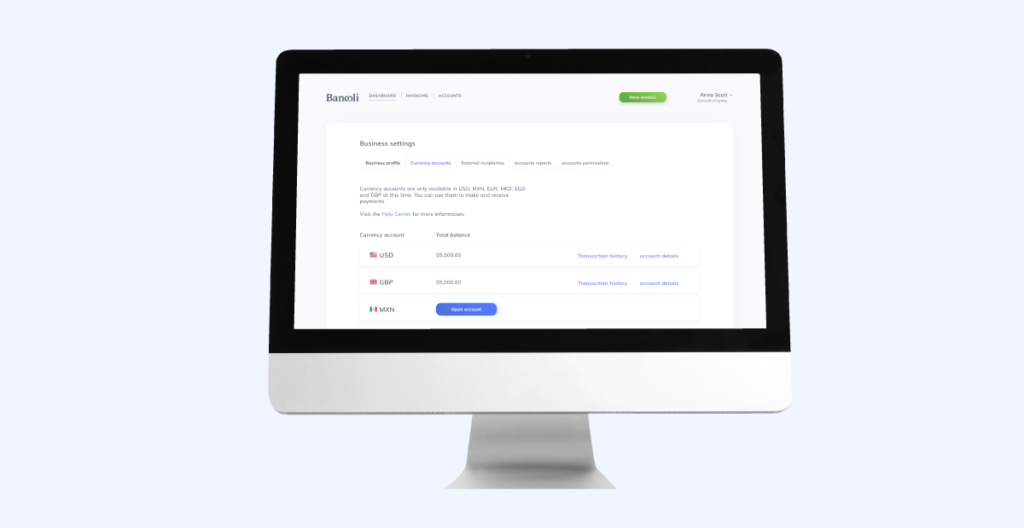

The GBA is a multi-currency business bank account that holds GBP and USD, making transactions between the UK and the USA more efficient and convenient.

Opening a GBA (Global Business Account) allows you to make payments between businesses across 200+ countries in minutes. Our key features include:

- Bank globally with your GBP, USD, EUR, HKD, and SGD account details.

- Send and receive payments across multiple regions and currencies with ease and security.

- Benefit from competitive global FX rates and minimal fees on every transaction.

- Issue, schedule, and automate tasks with ease while streamlining your cash flow with the assistance of Bancoli AI.

Efficiency, Convenience, and Security with Bancoli

Security is a top priority for Bancoli, so all of your transactions and funds are safe with us. Your funds will be stored in Bancoli USD Custody and are backed up to a maximum of $125 million per account holder.

Also, our business account uses elevated protection combined with cutting-edge security features like ID verifications, 2-FA, and selfie checks, setting the industry benchmark for secure, efficient, and reliable online banking and unmatched fund protection.

Why Transfers Between Global Business Accounts are Optimal

One of the most substantial benefits of using the GBA (Global Business Account) while operating multiple currencies is saving on conversion fees and transaction costs.

Global banking has become increasingly important and demands a more flexible and efficient approach to cross-border transactions, transforming accounts with multiple currencies into essential financial tools. Some of the numerous benefits an account with various currencies offers are:

- Effortless cross-border transactions

- Competitive currency conversion rates

- Investment diversification and risk mitigation

- Global market access and investment potential

Obtaining a Global Business Account: A Quick Guide

Opening a Global Business Account (GBA) is simple; you can sign up for free and create your account. Once the business verification process is completed, the Bancoli GBA is available to all registered Bancoli.

Once your account is verified, your Bancoli Global Business Account will offer currency accounts with local details for USD, EUR, GBP, HKD, and SGD to send and receive international payments with lower transaction fees than any other solution on the market. It will also include all the tools you need to easily and securely manage your business’s payments globally.

Setting Up a GBP Currency Account in Your GBA

Once you have registered in Bancoli, completed your verification process, and been approved, you will have access to your USD currency account. Our next step is to add a GBP account to your GBA. This is a simple step; you’ll only need to click the open account button and have your first active GBP currency account.

The Advantage of Allocating Funds to Your GBA

One of the many benefits of your GBA is that by allocating your funds to a USD account, the cost-effectiveness of Bancoli’s fee structure for incoming funds is low compared to other ones in the market. Bancoli is the most convenient international payment platform for scaling your business globally. With a GBA, you can have the following:

- 24/7 access: Access your funds in multiple currencies and manage all your financial and business needs remotely in a single space.

- More convenience: A GBA is invaluable if you’re a business owner traveling frequently or your company has customers in different countries.

- Easy global payments: Simplify cross-border transactions, save on fees, and benefit from competitive global FX rates.

- Go global: Increase your business’s visibility and availability internationally with a GBA and minimize the risk of loss in your industry.

- Diversify investments: Access global and significant currencies and markets to mitigate currency risk and safeguard your portfolio against market instability.

- Accelerate cash flow: Issue, schedule, and automate invoices and payment reminders with Bancoli’s cash flow acceleration tools..

- Protect assets: Protect your business assets with Bancoli’s industry-leading fund protection, utilizing short-term US Government Bonds for up to US$125 million per account holder.

In Conclusion

Sending money to the USA from the UK will no longer be a problem with Bancoli’s Global Business Account. This multi-currency account offers innumerable benefits for those frequently engaged in international business and investors aiming to broaden their portfolios and seize global investment opportunities.

With its streamlined international transactions, currency exchange benefits, diversification and risk management advantages, and access to worldwide investment possibilities, the GBA is ideal for anyone looking to broaden their financial horizons.