In the retail sector, the smooth operation of supply chains critically hinges on the efficiency of financial transactions between suppliers and retailers. This relationship is foundational, as it ensures that products move swiftly from production lines to store shelves, meeting consumer demand promptly.

The link between retail suppliers and financial efficiency cannot be overstated; the lifeline sustains inventory flow, dictates stock availability, and ultimately shapes customer satisfaction levels.

Stock Availability in Retail Business: Beyond Well-Stocked Shelves

Stock accessibility is a fundamental aspect of retail business operations. It transcends the mere presence of sufficient inventory to satisfy immediate consumer demand, embodying the anticipation of market trends, comprehension of customer preferences, and the assurance of an uninterrupted supply chain from manufacturers to retail outlets.

This process entails sophisticated coordination among various segments of the retail operation, including purchasing, logistics, and financial transactions.

Achieving optimal stock accessibility within retail establishments involves more than just the assurance of well-stocked shelves. It addresses a spectrum of elements that cater to an ever-evolving and exacting consumer base.

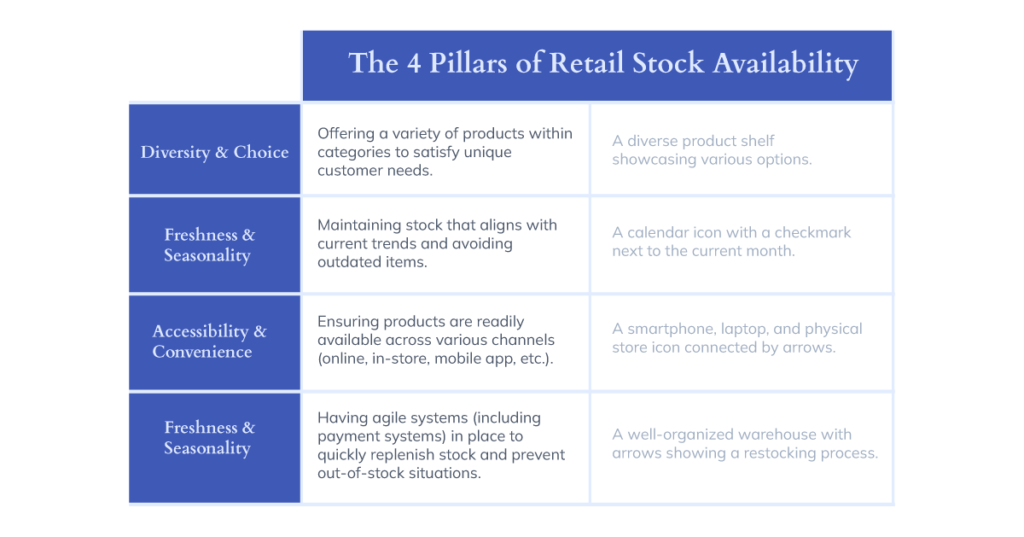

Let’s explore four key dimensions that go beyond the surface:

Diversity and Choice: The Power of Options

Contemporary consumers demand a selection that aligns with their distinct needs and preferences.

For instance, a retail store’s commitment to stock diversity can be seen in its apparel section, where it offers jeans in multiple styles, colors, and sizes, enabling customers to find items that precisely fit their requirements.

Freshness and Seasonality: Aligning with Trends and Seasons

Retailers must adapt their inventory to reflect current consumer interests, seasonal changes, and market dynamics.

A sporting goods retailer, for example, must ensure the latest fitness equipment is available, just as a grocery store should offer seasonal produce to meet customer expectations.

Moreover, aligning with trends and seasons goes beyond simply offering the right products at the right time; it’s about creating an engaging shopping experience that connects with consumers’ lifestyles and values. Seasonal promotions, themed displays, and targeted marketing campaigns can enhance this alignment, driving foot traffic and boosting sales.

Accessibility and Convenience: Prioritizing Omnichannel Availability

Today’s retail customers value flexibility and convenience, necessitating retailers to ensure product accessibilitycross multiple platforms. This includes maintaining robust online platforms, offering mobile purchasing options, and providing in-store pickup services.

A prime example of this strategy in action can be seen in the fashion retail industry. Consider a scenario where a customer finds a piece of clothing online but prefers to try it on in-store before making a purchase.

Retailers that have successfully implemented an omnichannel strategy make this possible by ensuring that their inventory is synchronized across all channels. This enhances the shopping experience by offering flexibility and convenience and significantly boosts customer satisfaction and loyalty.

Efficient Restocking: The Art of Seamless Replenishment

The significance of timely restocking cannot be overstated. Effective inventory cycle management requires precise demand forecasting, prompt supplier communication, and agile logistics.

Advanced technological solutions can facilitate this process, minimizing storage costs and maximizing shelf space utilization.

For example, a high-tech electronics store operating both online and brick-and-mortar outlets must adeptly manage its inventory to keep up with the rapid innovation and release cycles of gadgets.

By employing predictive analytics and real-time tracking systems, the store can accurately forecast demand for upcoming product releases and manage its inventory levels to avoid overstocking or understocking situations.

This level of precision in demand forecasting allows for the seamless replenishment of stock, aligning inventory levels with anticipated sales surges during new product launches or seasonal promotions.

Unlocking Stock Availability: The Power of Prompt Payments

While mastery of the four dimensions we’ve explored paints a good picture of the retail industry, true inventory availability depends on more than just internal planning. The efficiency of payment processes emerges as a critical element, ensuring that financial operations seamlessly support the unimpeded flow of goods through the supply chain. This aspect of financial operations holds immense power in shaping the smooth flow of goods and, ultimately, customer satisfaction.

Consider the scenario where the rhythm of stock management is disrupted by the jarring effects of payment delays. Suppliers, wary of extending credit without end, give precedence to retail establishments that consistently honor their financial obligations. This preference can culminate in stock shortages and barren shelves, undermining the retail store’s promise of diverse and accessible offerings.

The repercussions of such delays are far-reaching, eroding customer loyalty and diminishing trust in the retail brand. Conversely, diligent payment practices cultivate robust supplier relationships, securing access to the latest, high-demand products. Moreover, efficient financial management liberates capital for investment in inventory diversification and enhances omnichannel retailing, critical for business growth.

Emphasizing financial prudence amplifies the four pillars of stock availability and enables retailers to offer a gratifying shopping experience.

The Strategic Edge of Timely Payments in Retail

The essence of punctuality extends beyond simple time management, serving as a strategic asset. Retailers practicing efficient payment mechanisms witness a 20% acceleration in the receipt of goods from suppliers compared to their slower counterparts.

This efficiency translates into well-stocked shelves, mitigating the ‘out-of-stock’ scenarios that displease 73% of consumers. Beyond just averting inventory shortages, prompt financial settlements engender trust and guarantee preferential access to sought-after products, aligning with the latest market trends.

The Financial Toll of Payment Delays in the Retail Business

Payment delays can precipitate effects, not just on customer contentment but also on the financial health of the business. Exploring the tangible impact of tardy financial settlements unveils:

The Dilemma of Stock Shortages

Delayed financial commitments to suppliers slow down product deliveries, leading to the much-dreaded stockouts. This scarcity of desired items disappoints patrons and signifies foregone sales. Research indicates that, on average, retailers forfeit up to 5% of their potential revenue due to stock shortages. This translates into a substantial financial losses globally.

Customer Dissatisfaction and Brand Abandonment

In an era where consumer loyalty is paramount, encountering empty shelves can significantly deter customers, prompting 61% to switch allegiance to competing brands. Retailers cannot risk disappointing their clientele with stock unavailability caused by payment delays in a market brimming with alternatives.

The Stagnation of Business Capital

Procrastinated payments effectively immobilize crucial capital, which could otherwise be allocated towards strategic ventures such as enhancing omnichannel presence or refreshing inventory assortments. This stagnation of funds restricts business growth and innovation, impairing a retailer’s accessibility to adapt and offer dynamic shopping experiences.

Retail success hinges on efficient payment practices, which are the foundation for unlocking stock availability and enhancing the customer experience. By ensuring timely financial transactions, retailers can optimize their inventory levels, thus paving the way for sustained business success and customer loyalty.

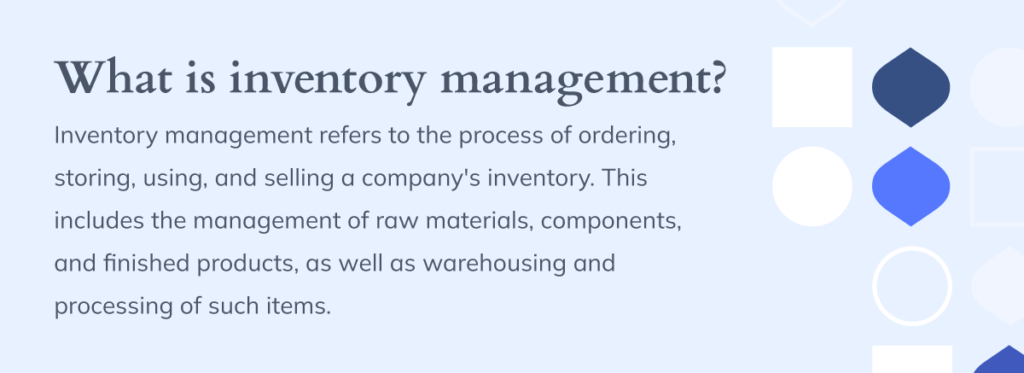

What is Inventory Management?

Inventory management is a systematic approach to sourcing, storing, and selling inventory—both raw materials (components) and finished goods (products).

Minimizing costs while maximizing profits is crucial; it involves the careful planning and execution of various functions such as ordering supplies, controlling inventory storage, and managing the amount of products for sale.

Inventory management includes controlling and overseeing purchases from suppliers and customers’ orders, maintaining stock storage and order fulfillment. Its main objective is to ensure that there is always enough inventory on hand to meet customer demand.

Effective inventory management allows retailers to reduce storage costs, increase sales, and improve liquidity. By implementing technology solutions, retailers can automate many aspects, from tracking stock levels and orders to forecasting future demand. This not only improves the accuracy of inventory records but also enhances the overall efficiency of the retail operation.

It gives retailers the insights needed to make decisions about what products to stock, how much to order, and when to reorder. It is a balance between minimizing product costs while ensuring enough inventory is available to meet customer demand—a simple formula to maximize profits.

Retailers can achieve a competitive advantage in the market by ensuring their store shelves are always stocked with the right products at the right time. Thereby it significantly improves the customer experience and drives business success.

Traditional Challenges in Inventory Management

Traditional inventory management refers to a collection of procedures and practices that companies implement to effectively manage the flow of items throughout their operations, from purchase and handling to storage and delivery. Optimizing the point-of-order process or changing buffer stock levels are two of the primary focuses of traditional inventory control.

Both of these strategies aim to resolve issues related to inventory management. However, at this time, this is not sufficient to meet clients’ requirements and the market swings.

The following is a list of the primary issues that are faced by traditional inventory control:

Overstocking and Its Implications

One of the primary challenges is overstocking. Holding more inventory than necessary can significantly increase storage costs and risk items becoming obsolete or depreciating in value. This increases carrying costs and ties up capital in unsold stock, affecting the retail establishment’s financial flexibility.

Complexity in Operations

Traditional methods can introduce complexity into inventory processes, making them cumbersome and time-consuming. Tasks such as manually tracking inventory levels and processing orders demand substantial effort and can lead to inaccuracies.

Visibility and Forecasting Challenges

A lack of visibility into inventory levels and customer demand is another significant issue with traditional inventory systems. This limitation hampers them to make informed decisions about their inventory, potentially leading to missed sales opportunities or excess inventory.

High Carrying Costs

The carrying costs associated with traditional management—such as storage, handling, and transportation—can erode profit margins.

Tracking Inventory Cycle Time

Effective management of the inventory cycle is critical for maintaining optimal stock levels. Traditional systems often lack the necessary tools for accurately tracking inventory movement, leading to challenges in managing inventory levels efficiently.

Inventory Cycle Disruptions

The impact of delayed payments on the inventory cycle presents significant challenges for both suppliers and retail companies, as underscored by a 2023 study highlighting a 12% extension in inventory cycle times.

This elongation in the inventory cycle not only ties up capital in unsold inventory but also significantly impacts suppliers’ financial health. This results in limiting their capacity to reinvest in production and innovation. Furthermore, this inefficiency exacerbates supply chain disruptions, making it increasingly difficult for retail stores to keep up with customer demand.

The inventory cycle time—the period required to convert stock into sales and then back into cash or receivables. It is crucial for maintaining liquidity and ensuring the availability of products.

When payments to suppliers are delayed, it results in an increased inventory cycle time, leading to a buildup of unsold goods. This scenario not only strains the financial resources of suppliers but also hampers the agility of retail stores to refresh their stock in line with evolving consumer trends and seasonal demands.

Strained Supplier Relationships

According to a 2022 NACM report, a critical challenge within the retail industry: over 60% of suppliers report tensions due to late payments from retail stores, impacting their ability to meet customer demand effectively. This strain disrupts the supply chain and influences suppliers’ willingness to prioritize retailers who maintain timely payment practices.

Consequently, retail stores facing such strained relationships may struggle with stock shortages, directly affecting their capacity to satisfy customer demand and maintain a competitive edge in the market. Ensuring prompt payments is thus essential for preserving the vitality of supplier-retailer partnerships and securing a reliable product supply to meet evolving customer needs.

Industry Benchmarks: Striving for Efficiency

Retail establishments should monitor key metrics like stock turnover rate and cash-to-cash cycle time to counter these challenges. These benchmarks are crucial for assessing operational performance and identifying improvement areas to secure a competitive benefit.

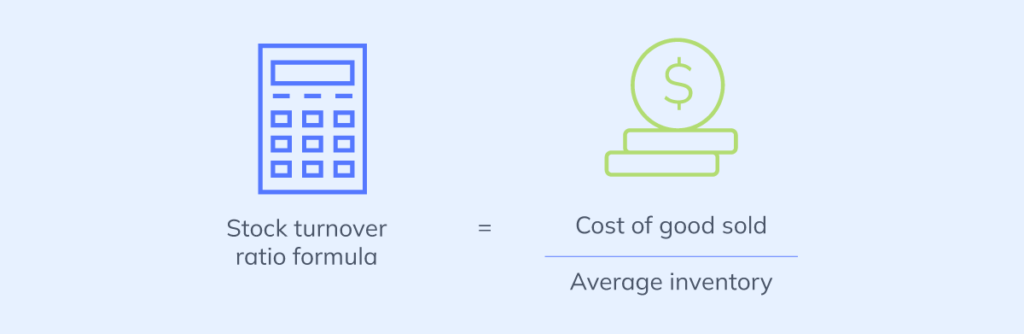

Stock Turnover Rate

Optimizing this rate can lead to reduced storage costs, improved cash flow, and higher margins.

The stock turnover rate, a pivotal benchmark for retail businesses, measures how often inventory is sold and replaced over a specific period.

A higher turnover rate signifies efficient stock control, indicating that a retail establishment effectively meets consumer demand without overstocking. To optimize this rate, retail suppliers must balance inventory levels meticulously, ensuring they have enough stock to satisfy customer needs while minimizing excess that ties up capital.

Achieving an optimal stock turnover rate can lead to reduced holding costs, improved cash flow, and higher margins, thereby offering a significant competitive advantage in the retail sector.

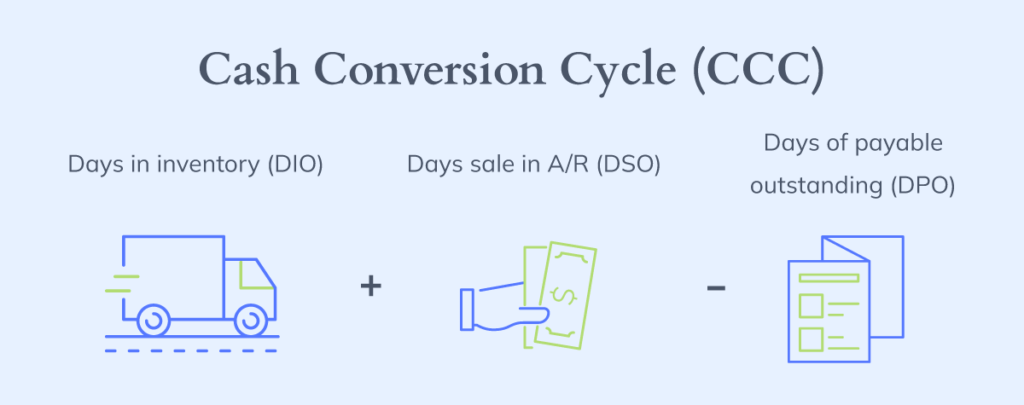

Cash-to-cash cycle

The cash-to-cash cycle time is another essential benchmark for retail suppliers, measuring the time span between outlaying cash for inventory from manufacturers and receiving payment from consumers.

A shorter cycle indicates a more efficient operation, which means the company quickly converts its investments into revenue.

Retail establishments can shorten this cycle by accelerating inventory turnover, reducing payment terms with suppliers, and ensuring prompt collection from customers. Enhancing the cash-to-cash cycle frees up capital, reinvests in growth opportunities more swiftly, and maintains a solid financial footing in a competitive market.

Strategies for Improvement

Effective management in the retail industry entails managing stock and optimizing the entire supply chain, from raw materials to finished goods. Retailers can enhance customer satisfaction and maximize profits by addressing these challenges through technological solutions and strategic planning.

To overcome the common challenges, they must adopt efficient strategies such as:

Implementing Technology Solutions

Modern software revolutionizes by simplifying complex processes and enhancing the visibility of inventory levels and demand forecasting. By leveraging these technological solutions, companies can streamline their operations, ensuring they have real-time data to make informed decisions.

Optimizing Supplier Relationships

For chain stores and those engaged in shopping online, the foundation of a successful inventory strategy lies in strong partnerships with suppliers. By cultivating these relationships, retailers ensure the timely replenishment of inventory, which is critical in avoiding stockouts or overstocking situations.

Accurate Demand Forecasting

Data analytics and forecasting tools empower retailers to predict customer needs accurately. This foresight allows for more precise inventory planning, ensuring that stores to have the right products in the right quantities.

Balancing Inventory Levels

Maintaining the delicate balance between minimizing stockouts to enhance customer satisfaction and optimizing money to avoid tying up unnecessary capital is a critical challenge.

Streamlining Processes

Investing in automated inventory and payment processing systems can halve the time required to complete financial transactions, ensuring suppliers are paid faster. This efficiency improves supplier relationships and enhances the overall supply chain’s fluidity.

Early Bird Gets the Stock

Taking advantage of early payment discounts can give wholesalers a competitive edge, securing priority product access. Bancoli’s platform enables businesses to take these opportunities by facilitating quicker payments, ensuring retailers can capitalize on discounts and strengthen their inventory positions.

Communication is Key

Transparent communication with suppliers about payment terms and potential delays is essential for building a foundation of trust and understanding.

By incorporating these strategies and leveraging Bancoli’s financial solutions, retail businesses can achieve advantage. This will eventually ensure to efficiently manage inventory, optimize operations, and meet the evolving demands of customers.

Swift Payments: Facilitating a Smooth Supply Chain

The efficiency of payment processes plays a crucial role in determining the agility of supply chains. The ability to conduct transactions swiftly is paramount for retail suppliers, ensuring that the flow of goods remains uninterrupted. This necessity has led to a growing appreciation for digital banking solutions catering to the retail sector’s complex financial needs. Such innovations stand as a testament to global commerce, where the speed of financial transactions directly impacts operational success.

Immediate access to funds is vital for suppliers to maintain a competitive edge. It enables them to swiftly respond to market demands by reinvesting in essential aspects of their business. This could range from procuring raw materials for uninterrupted production to expanding product lines in anticipation of consumer trends.

Improved Cash Flow

The acceleration of cash flow is instrumental in reducing inventory cycle times. This reduction means that the capital typically tied up in unsold inventory becomes available more quickly. It offers suppliers the financial flexibility to invest in areas that can drive business success. For instance, having the financial capacity to invest in emerging market trends solidifies a supplier’s market position. It can also enhance its ability to meet the evolving needs of retail partners and, ultimately, the end consumers.

Early Payment Discounts

Quick settlements are not just about efficiency; they also open the door to enhanced profitability through early payment discounts.

This benefit is twofold: it incentivizes retailers to prioritize payments to these suppliers, fosters stronger business relationships, and provides a competitive edge to suppliers in a market where margins are often thin.

In essence, the capacity for quick settlements transforms the payment process from a routine operational task into a strategic financial tool that can be leveraged for greater profitability.

Consistent Stock Availability

At the heart of the retail industry’s success is maintaining consistent stock availability, ensuring that consumer demands are met promptly. Enhanced liquidity, facilitated by Bancoli’s swift payment solutions, is instrumental in achieving this goal. With the financial agility afforded by immediate access to funds, suppliers can manage their inventory with unprecedented precision, reducing the risk of stockouts and overstock situations.

This capability ensures that retail shelves are always stocked, which is critical for maintaining customer satisfaction and loyalty. Moreover, the assurance of timely deliveries strengthens the supplier-retailer relationship, as it builds trust and reliability in the supply chain.

Bancoli: The Platform Powering a Faster Flow of Funds

Bancoli emerges as a pioneering financial platform designed to power a faster flow of funds globally. By focusing on real-time transactions and efficient cross-border payment solutions, Bancoli addresses the nuanced needs of modern businesses. Our platform ensures that financial operations are no longer bottlenecks but growth accelerators.

Bancoli also facilitates supplier partnerships by providing efficient payment solutions. This allows to have quicker settlements of accounts payable, which in turn can strengthen supplier trust and reliability.

Real-time Transactions

Real-time transactions eliminate the traditional waiting periods associated with banking operations. This allows companies to streamline their cash flow management, reduce financial uncertainty, and plan more accurately. This immediacy enhances operational efficiency and significantly improves trust and reliability between trading partners.

Multi-Currency Support

The facility to manage cross-border payments efficiently is crucial. Bancoli’s platform excels in this domain through its robust multi-currency support. This feature simplifies the complexities associated with international transactions. It offers businesses the flexibility to send and receive payments in USD, EUR, GBP, SGD, and HKD, as well as the ability to convert funds to JPY, CNY, INR, ILS, and PHP for payouts without incurring exorbitant exchange rates or hidden fees.

Multi-currency support is more than a convenience; it’s a strategic advantage. It enables any business to operate seamlessly in international markets, minimizing financial friction hindering expansion or complicating supplier relationships.

By offering competitive exchange rates and transparent fee structures, Bancoli ensures that businesses can maximize their profitability while maintaining the agility to adapt to currency fluctuations.

Takeaways and Final Thoughts: Embracing Efficiency and Profitability

The journey of retail suppliers in today’s market underscores the pivotal role of fast payments in sustaining an efficient supply chain. As the backbone of the retail sector, the smooth operation of supply chains is intrinsically linked to the swift and seamless execution of financial transactions.

This dynamic interplay ensures that products timely move from production lines to store shelves. It directly impacts stock availability and, by extension, customer satisfaction.

Bancoli’s GBA emerges as an innovative solution tailored for retail suppliers, embodying the essence of digital innovation. Our platform not only champions the cause of real-time transactions but also brings the strategic advantage of handling cross-border payments.

Moreover, introducing early payment discounts through quick settlements exemplifies a win-win scenario, amplifying supplier profitability while fostering stronger business relationships. The ripple effects of enhanced cash flow extend to consistent stock availability, ensuring that supply chains operate without disruption and retail shelves remain well-stocked, ready to meet the dynamic demands of the consumer base.