E-commerce or electronic commerce has emerged as a convenience and a cornerstone of modern retail. Its evolution from a novel concept to a fundamental business model reflects the rapid pace at which technology and consumer preferences have transformed the marketplace.

Initially, it began as a simple Internet exchange of goods and services. However, it has since matured into a complex ecosystem, encompassing various platforms, web services, payment methods, and logistics solutions.

This growth has not been without its challenges. As its operations expand, businesses face increasing operational hurdles, from managing global payments to ensuring seamless customer experiences.

Within a few decades, it has shifted from peripheral shopping channels to the primary retail mode for millions worldwide.

Fueled by technological advancements in mobile commerce, changing consumer habits, and the global expansion of internet access, e-commerce has democratized the retail industry, offering opportunities for small and large businesses to reach a global audience with unprecedented ease.

Understanding the Demand Planning Challenges

Predicting future customer demand is essential for e-commerce businesses to avoid stock issues and unhappy customers. However, analyzing the large amount of data needed to make accurate forecasts is a complex challenge.

Accurate demand forecasts can empower a business to optimize its production schedules, manage its inventory efficiently, and minimize waste, leading to improved profit margins.

As emphasized in a report by McKinsey, retailers employing advanced analytics, including demand forecasting, are outstripping their competition by an impressive 68% and counting.

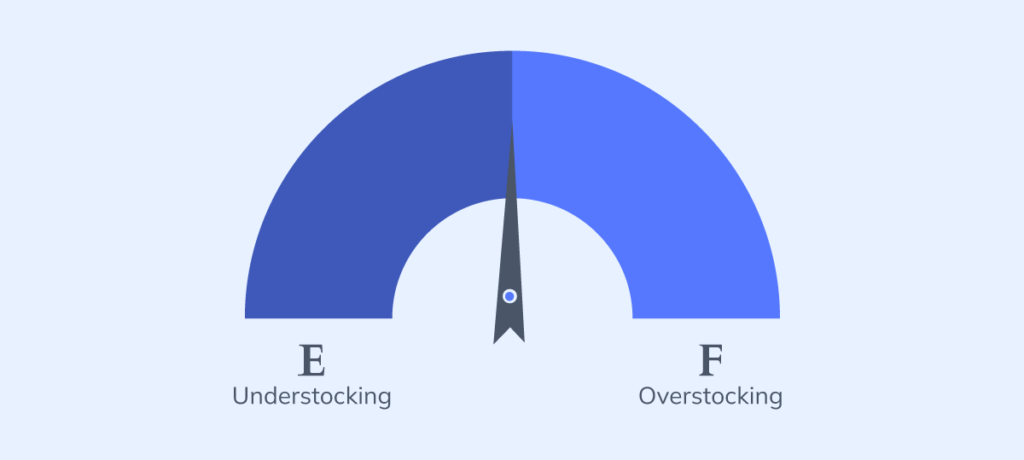

Consequences of Overstocking and Understocking

Failing to maintain optimal inventory levels can significantly impact your online store. Overstocking ties up cash and increases storage costs, while understocking leads to lost sales and frustrated customers.

Understanding these consequences is crucial for developing a successful inventory management strategy.

Overstocking

It is a direct consequence of forecasting too high. When businesses anticipate more demand than actually materialize, they end up with excess inventory.

This ties up capital that could be used elsewhere, such as marketing campaigns or product development, and increases overall operating expenses due to storage and warehousing costs.

Understocking

This is a result of the forecast being too low. This scenario can be equally detrimental, leading to supply problems throughout the distribution chain.

By understanding the consequences of overstocking and understocking, you can develop a data-driven inventory management strategy to optimize your online store’s stock levels. This will ensure a smooth flow of commerce transactions, maximize cash inflows, and contribute to your success.

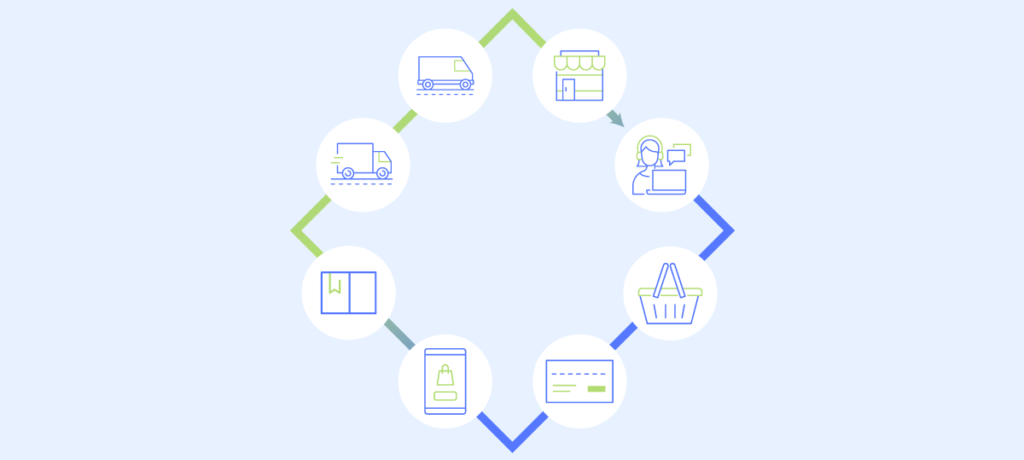

The Crucial Role of Order Fulfillment

Order fulfillment is vital to any online retail operation’s success. This process encompasses several key steps, from receiving an order to picking and packing items, shipping, and delivering the products to the customer.

Businesses utilize various distribution models to manage their order fulfillment process effectively.

Here are two common approaches:

- Direct Shipping: Stores maintain physical stock in stores or warehouses, allowing for direct shipping to customers upon order. This model offers faster fulfillment but requires investment in storage and inventory management.

- Drop Shipping: Stores sell products directly from suppliers without holding them in stock. Upon receiving an order, the store forwards it to the supplier, who then ships the product directly to the customer. This model requires lower initial investment but offers less control over product quality, shipping, and delivery times.

Both models present unique challenges and opportunities in managing inventory, shipping logistics, and customer expectations.

Customer expectations for delivery speed have significantly evolved, particularly influenced by the standards set by major players like Amazon.

According to insights from Eniture Technology, an astonishing 80% of consumers now expect same-day delivery, with a significant portion of younger consumers under 35 viewing it as almost a given.

Moreover, a majority are willing to pay extra for this convenience. This expectation has redefined the meaning of “fast delivery,” pushing an e-commerce business to adapt to these evolving demands to remain competitive.

Furthermore, a Supply Chain Management Review study highlights the growing customer expectations for next-day and even sub-same-day delivery.

The demand for same-day delivery is projected to grow by 21% annually through 2024. The study also notes that customers are increasingly unforgiving of retailers who fail to offer free shipping or return options, with more than 80% stating they would not return to a site after a single delivery failure.

Beyond the Cart: Addressing Payment Delays

Tackling payment delays within the supply chain is crucial as it can lead to operational challenges impacting various aspects of the business.

Payment delays can disrupt the coordination between retailers and suppliers, leading to inventory shortages or surpluses affecting sales and profitability.

When supplier payments are delayed, inventory replenishment may be held up. This delay affects the retailer’s ability to meet customer demand promptly, potentially leading to stockouts of popular products.

Payment delays within the e-commerce supply chain can lead to a cascade of operational issues, impacting online business in several areas:

Inventory Management

Effective inventory management is pivotal in maintaining a business’s cash flow and sustaining a positive cash flow within the dynamic retail landscape.

However, delayed payments to suppliers, a common issue in business-to-business transactions, pose significant cash flowing challenges:

- Stock Imbalances: Delayed payments can disrupt the supply chain, hindering suppliers’ production or ability to replenish stock promptly. The inability to meet demand frustrates customers and encourages them to spend money elsewhere, affecting the retailer’s bottom line and market position.

- Increased Warehousing Costs: Retailers face increased warehousing costs when holding onto unsold inventory, a direct consequence of stockouts or the reduced capacity of suppliers to maintain consistent stock levels. These elevated costs put additional pressure on the business’s cash flow, making allocating funds efficiently across operations challenging.

- Inaccurate Forecasting: Unreliable payment timelines exacerbate the difficulty of accurately forecasting demand, complicating optimizing inventory levels. This inaccuracy can lead to either overstocking or understocking—detrimental to a retailer’s financial health.

Fulfillment and Delivery

For an ecommerce company, the path to customer satisfaction significantly hinges on the efficiency of fulfillment and delivery processes. Delayed payments to logistics providers, a consequence of poor cash flow management, can severely disrupt these processes:

- Order fulfillment delays: When ecommerce sites delay payments to logistics partners, it often results in shipment delays. This mismanagement directly impacts delivery times, leading to customer dissatisfaction. The ripple effect of delayed fulfillment can tarnish the brand’s reputation, urging customers to seek alternatives for their needs.

- Increased shipping costs: E-commerce retailers grappling with financial management issues may find themselves in a position to opt for expedited shipping methods to meet delivery commitments. This decision, driven by the need to compensate for initial delays, significantly inflates business expenses, further straining the already tight cash flow.

- Order cancellations: Customers expect prompt delivery in today’s fast-paced retail environment. Delays, especially those not communicated effectively, can lead to frustration and impatience, resulting in increased order cancellations. This leads to immediate lost revenue and can deter future purchases, impacting the e-commerce store’s long-term revenue potential.

For e-commerce retailers, smooth fulfillment and delivery hinge on timely payments to logistics partners. By addressing the root causes of poor cash flow management, you can avoid these pitfalls and pave the way for success in the competitive online marketplace.

Financial Concerns: Navigating the Complex Terrain

Managing cash flows efficiently is paramount in e-commerce, particularly within platforms catering to the business-to-consumer model. E-commerce platform operators often juggle between paying bills, vendor invoices, payroll, and other operational expenses. Delayed customer payments can significantly disrupt this delicate balance, leading to negative cash flow situations that impact the retailer’s ability to maintain smooth operations.

- Cash Flow Disruptions: Unlike brick-and-mortar stores, where transactions are immediate, online sales sometimes face payment delays, directly affecting the retailer’s liquidity. This disruption can hinder their capacity to clear dues on time, including critical payments to suppliers and employees.

- Reduced Profitability: Operational inefficiencies arising from delays, order cancellations, and the necessity to opt for costlier shipping methods to meet delivery expectations can erode profit margins. Such financial strain limits the retailer’s ability to invest in growth or marketing strategies, ultimately affecting the bottom line.

- Damaged Supplier Relationships: Consistently delayed payments can strain relationships with suppliers. In the context where timely stock replenishment is crucial for maintaining inventory levels, jeopardized supplier relations can lead to less favorable terms or difficulty negotiating discounts, further compounding financial concerns.

Retailers must prioritize strategies for managing cash flows to mitigate these financial concerns. Adopting robust financial planning practices can help e-commerce sites ensure the sustainability of their operations, preserve supplier relationships, and maintain profitability amidst the challenges of the online retail landscape.

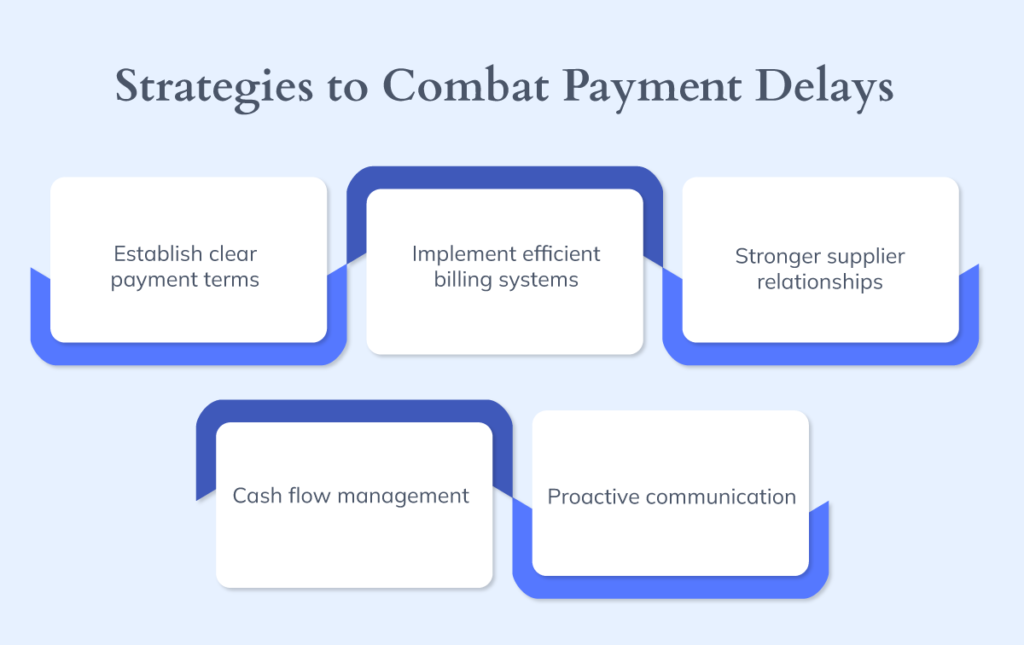

Proactive Strategies to Combat Payment Delays

While experiencing rapid growth in online shopping, many retail businesses face challenges managing cash flow due to payment delays.

These delays can have ripple effects, impacting your business operations.

1. Establish Clear Payment Terms and Early Payment Incentives

Transparent communication and well-defined payment terms are crucial for fostering healthy business relationships with suppliers and customers.

- Clearly outline payment terms: Include payment terms and due dates in contracts and invoices to ensure everyone involved is aware of expectations.

- Offer early payment discounts: Incentivize timely payments by offering discounts to customers or suppliers who pay early. This can improve your cash flow and encourage prompt payments.

2. Implement Efficient Billing and Payment Systems

Streamlined billing and payment processes are essential for maximizing efficiency and minimizing the risk of delays.

- Automate invoicing: Utilize automated invoicing software to send timely invoices and reduce human error.

- Integrate with online payment gateways: Integrate your online store with secure payment gateways to facilitate a seamless and secure payment experience for your customers.

3. Proactively Communicate and Follow Up

Open communication and timely follow-up can play a significant role in preventing and addressing payment delays.

- Send payment reminders: Send polite reminders to customers or suppliers approaching their due date. This can serve as a gentle nudge and encourage on-time payments.

- Offer dedicated customer support: Provide easily accessible customer support channels, such as email, phone, or live chat, to address any questions or concerns regarding payments promptly.

4. Leverage Technology for Improved Cash Flow Management

Technology is crucial in streamlining financial processes and enhancing cash flow management, encompassing consumer-to-business models and online marketplaces.

Streamlined Payment Processing

Adopting automated payment processing solutions streamlines the collection of customer payments and reduces manual work, directly impacting online stores in several ways:

- Reduced order processing times: Faster processing leads to quicker delivery and improved customer satisfaction.

- Enhanced transparency and security: Streamlined systems provide clear insights into cash flow, fostering trust with customers, vendors, and partners.

- Increased liquidity: Efficient cash flow management allows businesses to reinvest in operations, innovate, and expand, maintaining their competitive edge in the evolving online market.

Cash Flow Forecasting Tools

Utilizing cash flow forecasting tools empowers businesses to:

- Anticipate future cash inflows and outflows: This allows for proactive planning and financial management, ensuring sufficient funds to meet obligations and seize opportunities.

- Improve cash flow visibility: Enhanced transparency enables informed decision-making and helps address potential payment delays.

By leveraging technology and automating key processes, online stores can streamline operations, gain better visibility into their cash flow, and proactively manage their finances for long-term success.

5. Cultivate Strong Supplier Relationships

Building strong relationships with suppliers can be beneficial in managing payment delays:

- Negotiate favorable payment terms: Collaborate with your suppliers to negotiate mutually beneficial payment terms, considering factors like order volume and lead times.

- Explore supplier financing options: Explore financing options offered by some suppliers, which can provide additional flexibility in managing your cash flow.

These proactive strategies can help you combat payment delays, improve your cash flow management, and ultimately contribute to the success of your business.

Financial Tools for Managing Payment Delays

Global Business Bank Account

Bancoli’s Global Business Bank Account revolutionizes handling international transactions with multi-currency accounts, significantly reducing complexities and eliminating foreign exchange fees.

It offers a centralized system for streamlined payments to global suppliers, enhancing operational efficiency.

Additionally, this account provides improved visibility into cash flows, enabling real-time insights and informed financial decisions.

Cash Flow Management Tools

Cash flow management tools with automated forecasting enable precise cash flow projections and strategic planning to address potential bottlenecks. Scenario planning offers insights into various payment delay impacts, guiding the development of effective countermeasures.

Additionally, sophisticated budgeting and tracking functionalities optimize resource allocation, safeguarding against disruptions in cash flow.

Bancoli’s cash flow tools provide real-time insights, predictive analytics, and automated functionality, making checking your business’s financial health easier.

Revolutionizing E-commerce with Swift Payment Solutions

Managing cash flow is a critical challenge. Bancoli’s Global Business Account emerges as a revolutionary solution designed to optimize e-commerce operations’ cash flow.

This innovative tool allows retail and e-commerce companies to streamline their financial transactions and enhance efficiency globally by ensuring swift payment processing.

Efficient payment processing directly impacts an e-commerce operation by reducing administrative burdens, mitigating reputational risks, and boosting employee morale.

For a sector that thrives on the speed and reliability of transactions, Bancoli’s solution addresses the core needs of cash flow management, ensuring that businesses can maintain a healthy cash balance.

This strategic approach to managing and optimizing cash flow is instrumental in sustaining growth and competitive advantage.

Go Global, Simplify Local: Bancoli’s All-in-One Business Account

With its cutting-edge features, Bancoli’s Global Business Account stands out for retail sales. Instantaneous multi-currency transactions enable businesses to operate seamlessly across borders, making it easier to pay bills and manage accounts receivable without the usual delays.

The Global Business Account (GBA), is a multi-currency business banking account featuring currency accounts in 11 currencies: USD, EUR, GBP, MXN, CAD, AUD, HKD, SGD, NZD, PLN, and CNY. The GBA also facilitates payouts in 50+ currencies across 200+ countries with competitive fees and real interbank exchange rates.

The GBA includes a multi-currency invoicing tool with cash flow acceleration features. Security is ensured through military-grade encryption, multi-factor authentication, fraud monitoring, and protection for funds up to $125 million.

Takeaways: Paving the Way for E-commerce Success with Efficient Payments

Efficient payment processing is foundational to thriving in retail sales. It addresses cash flow management at its core, preventing cash flow issues that stifle growth.

Bancoli’s solutions offer a strategic advantage, helping businesses conserve cash and expand their reach in international sales and consumer-to-consumer markets.

Adopting advanced payment processing techniques is essential for operational efficiency, enabling sustainable growth and a competitive edge in the business landscape.

Sign up now and add efficient payment solutions for your business.

Frequently Asked Questions

1. What are the consequences of overstocking and understocking in e-commerce?

Overstocking

- Ties up cash that could be used for other purposes, such as marketing or product development.

- Increases storage and warehousing costs.

- May lead to having to sell products at a discount.

Understocking

- Leads to lost sales and revenue opportunities.

- It can damage customer satisfaction and brand reputation.

- It can disrupt operations and lead to stockouts of popular products.

How can e-commerce businesses improve their cash flow management?

- Establish clear payment terms and early payment incentives.

- Implement efficient billing and payment systems, such as automated invoicing and online payment gateways.

- Proactively communicate and follow up with customers and suppliers about payments.

- Leverage technology for improved cash flow management, such as automated payment processing and cash flow forecasting tools.

- Cultivate strong relationships with suppliers to negotiate favorable payment terms and explore financing options.

3. How do advanced payment solutions and financial tools help e-commerce and retail companies address operational hurdles associated with payment delays?

Advanced payment solutions and financial tools streamline international transactions, offering real-time insights into cash flow and bolstering security with integrated fraud prevention systems.

They enable instantaneous multi-currency transactions, customizable supplier payment terms, and detailed transaction reporting.

4. How can a cash flow spreadsheet help cash flow management in e-commerce?

A cash flow spreadsheet can track your cash inflows (e.g., customer payments, sales revenue) and cash outflows (e.g., supplier payments, operational expenses) over a specific period, such as a month or quarter. This allows you to:

- Monitor your cash balance. This will help you understand how much cash you have readily available at any given time.

- Identify potential cash flow shortages: By forecasting future inflows and outflows, you can anticipate potential shortfalls and make informed decisions about managing your cash flow, such as delaying expenses or seeking additional funding.

- Make better financial decisions: A clear understanding of your cash flow helps you make informed decisions about resource allocation, inventory management, and budgeting.

By regularly updating your cash flow spreadsheet and monitoring your cash balance, you can gain valuable insights into your e-commerce business’s financial health and make informed decisions to optimize your cash flow management.