Introduction to Warehouse Operations in the Retail Ecosystem

Warehouse operations are a crucial component of the retail ecosystem. They act as dynamic centers where goods and services are received, stored, and sent to their next destinations.

The efficiency of these operations directly influences the fluid movement of products from manufacturers to end consumers, showing the essential role warehouses play in bridging the gap between production and consumption.

The significance of warehouses in the retail supply chain cannot be elaborated. They represent vital junctions facilitating the flow of goods.

Effective warehouse management has a broad spectrum of activities. This includes seeing stock levels, order fulfillment processes, and the management of returns.

A key component of optimizing warehouse operations lies in selecting an inventory system that meets the demands of your business. This strategic choice is instrumental in streamlining processes and ultimately ensuring that products reach consumers in a timely manner.

What is the Best Right Inventory Management System?

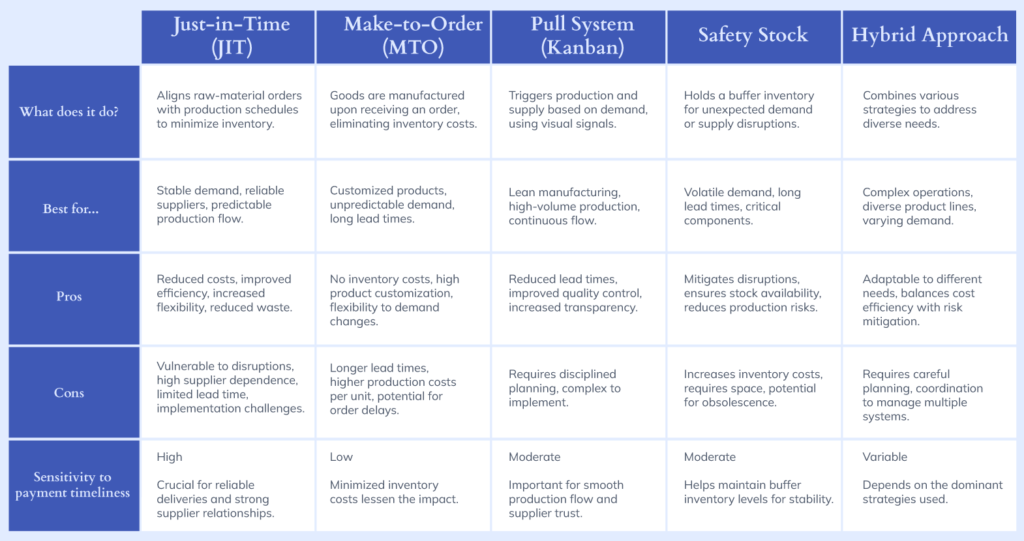

Selecting the optimal system for managing inventory is a vital decision that hinges on a business’s market demands.

Let’s explore some of the most commonly used inventory systems, their key differences for your business.

Just-in-Time (JIT) Inventory System

Just-in-Time, or JIT, reduces stock levels by organizing materials are received just as they’re needed. It’s best for companies with consistent demand, dependable suppliers, and a smooth production flow.

JIT offers significant advantages, including decreased costs, improved operational efficiency, greater flexibility, and waste reduction. However, it presents challenges like susceptibility to supply chain issues, trust on suppliers, short lead times, and complex setup processes.

Adopting JIT needs a focus on punctual supplier payments to secure reliable material delivery and foster strong supplier ties. This method not only lowers costs but also supports uninterrupted operations by minimizing risks.

JIT emphasizes enhancing supplier relationships, making negotiations for better terms. Strategic sourcing, coupled with cloud technology, increases supply chain transparency, helping meet customer demands and stay ahead.

Incorporating practices like cross-docking optimizes JIT by minimizing storage needs and accelerating product distribution. Companies can thus maximize customer value by using supply chain data for strategic decision-making, refining supplier interactions, and ensuring the consistent availability of materials, sidestepping the pitfalls of conventional stock control methods.

Make-to-Order (MTO) System

The Make-to-Order (MTO) or Made-to-Order system, often supported by a cloud-based software system, means products are developed only after receiving confirmed customer orders, thereby eliminating the costs associated with carrying inventory.

By leveraging cloud-based software systems, businesses can enhance supplier relationship management (SRM) and segment suppliers. It can help to improve relationships and manage SRM challenges more effectively.

Advantages of the MTO system include the elimination of inventory costs—adding significant value by reducing financial burdens. This system enables high levels of product customization, showing the immense value of understanding customer needs and delivering tailored services.

The MTO approach may result in longer lead times and higher production costs per unit, alongside the potential for delays in order fulfillment. Utilizing data from cloud-based software systems can provide insights into production processes and help refine cross-docking operations.

The sensitivity to timely payments is lower since inventory costs are minimized. The value of keeping strong supplier relationships remains high to ensure the availability of necessary materials and services.

Pull System (Kanban)

The Pull System, often associated with Kanban, triggers production based on downstream needs, making that components are available when needed. This system, ideally integrated with a cloud-based software system for optimal efficiency, is well-suited for lean manufacturing environments, high-volume production, and processes needing continuous flow.

Benefits include reduced lead times, enhanced quality control, and increased process transparency—all pivotal values in today’s competitive market. However, it demands disciplined production planning and can be complex to implement.

The integration of supplier relationship management within this framework is crucial, as it aids in smoothing out any potential hiccups that might arise from the supply side, reinforcing the importance of timely payments.

Timely payments play a central role in keeping a smooth production flow and trust with suppliers. By analyzing data collected from various stages of the Pull System process, businesses can predict more accurately when supplies will be needed, thus optimizing cross-docking strategies to minimize storage time and costs.

In this context, the sensitivity to timely payments is moderate, highlighting the significance of solid supplier relationship management. The using of data doesn’t just stop at predicting supply needs; it extends to enhancing the overall value delivered to the customer by making that every component is available when it’s needed, without unnecessary delays or excess inventory.

Safety Stock System

Maintaining a buffer inventory, or safety stock, of critical items is pivotal for businesses to manage unexpected demand spikes or supply chain disruptions, directly impacting warehouse operations and customer satisfaction. This approach is especially beneficial in scenarios characterized by volatile demand, long lead times, or when managing critical components crucial to production processes.

The adoption of a cloud-based software system for inventory management can significantly enhance this process, offering real-time visibility into inventory levels and facilitating strategic planning.

By adding such systems, businesses can not only calm disruptions and ensure stock availability. They can also manage inventory carrying costs and space requirements in distribution centers, effectively reducing the risk of production halts.

The sensitivity to timely payments, underscored in this context, highlights the importance of efficient supplier relationship management. Prompt and accurate financial transactions fortify trust between businesses and their suppliers, further enabling the reduction of costs through negotiated terms and improved supply chain efficiency.

Hybrid Approach

A hybrid inventory system combines various strategies to cater to different product types, lead times, and demand patterns.

It’s best for complex operations that manage diverse product lines and experience varying demands. This approach offers the flexibility to adapt to specific needs while balancing cost efficiency with risk reduction. However, it requires meticulous planning and coordination to manage multiple inventory systems effectively.

The Crucial Link Between Financial Flow and Warehouse Efficiency

Financial flow, especially through timely payments to suppliers, is crucial for the smooth running of warehouse operations. These payments guarantee a consistent material supply, essential for uninterrupted production and fulfilling customer demands.

In systems like Just-in-Time (JIT) and Make-to-Order (MTO), which minimize stock or produce goods based on specific orders, the importance of solid supplier relationships is even more pronounced.

For JIT, reducing inventory levels relies on precisely timed deliveries, which are dependent on a company’s financial stability to timely supplier payments. These practices bolster supplier confidence, encouraging them to make deliveries on schedule.

Alternatively, strategies such as Safety Stock, which involves keeping extra goods to handle unexpected supply chain issues, adopt a different financial approach. Here, prompt payments help maintain necessary buffer stock without affecting the company’s finances.

Efficient financial management aids in avoiding stockouts, keeping production steady, and assuring continuous customer satisfaction with reliable product availability.

Furthermore, the introduction of cloud-based software in warehouse and supply management has strengthened the connection between financial transactions and operational productivity. These platforms provide instant insights into stock levels, financial commitments, and seller performance.

Merging financial processes with supply management enables more precise cash flow forecasting, aligns payments with restocking schedules, and improves terms with suppliers. This seamless integration not only optimizes operations but also minimizes the costs related to unnecessary stock accumulation or rush orders.

The Pull System, or Kanban, highlights how integrating financial practices with demand-driven production can smooth material flow and reduce delay risks. The importance of timely payments here is moderate, reflecting the need for a balance between financial prudence and operational flexibility.

Hybrid models, incorporating aspects of JIT, MTO, Safety Stock, and the Pull System, show the nuanced management of finances within warehouse operations. These approaches require flexible financial tactics to support the differing needs of each strategy effectively.

Impact on Warehouse Operations and Inventory Management

Financial disruptions significantly strain warehouse operations, manifesting in several challenging scenarios.

Imagine a warehouse of a major distributor of electronics facing financial disruptions due to delayed payments from its clients. This situation creates a ripple effect, impacting various aspects of their business processes, warehouse operations, and stock management.

Stockouts and Missed Deliveries

This warehouse experiences delayed payments from several big clients, leading to an inability to pay their sellers on time. This delay halts production and limits the restocking abilities of new electronics, leading to stockouts.

Consequently, when there’s a surge in demand for the final product, the warehouse can’t fulfill numerous orders. Customers, left frustrated, turn to competitors, resulting in significant revenue losses and customer dissatisfaction.

Inefficient Space Utilization

With the slowed influx of new products, the warehouse’s inventory stagnates, causing staff to constantly rearrange existing stock of older electronics models to make space for the few incoming shipments.

This juggling act, akin to playing ‘warehouse Tetris,’ leads to operational inefficiencies. Workers spend more time moving items around than processing outgoing orders, which significantly reduces overall productivity and disrupts the workflow.

Operational Bottlenecks

The financial strain at the warehouse also leads to delayed payments to shipping partners, causing shipments to move slowly and new stock to trickle in far slower than usual.

Furthermore, the warehouse’s investment in equipment like high-speed forklifts and automated conveyor systems doesn’t yield the expected returns. The underutilization of this equipment, due to the reduced flow of goods, affects the warehouse’s overall return on investment and operational efficiency.

Financial Challenges and Their Broader Implications

The financial well-being of a warehouse directly influences its operational efficiency. This leads to interruptions in financial stability leading to both immediate and enduring consequences.

For a mid-sized warehouse dealing with consumer goods, these financial challenges extend far beyond mere numbers. It can also affect every aspect of its operations.

Cash Flow Crisis

A mid-sized warehouse in consumer goods finds itself in a precarious position due to delayed payments from key customers.

This financial shortfall significantly hampers day-to-day operations, affecting the ability to pay sellers and warehouse workers and even impacting payroll. The resulting supplier hesitancy to deliver essential goods introduces inefficiencies and bottlenecks within the supply chain.

For instance, when a principal seller of kitchen appliances pauses shipments over outstanding invoices, the warehouse faces a dire shortage, disrupting business continuity and the steady flow of inventory items.

Increased Carrying Costs

Compounded by these payment delays, the company grapples with a glut of unsold inventory. This includes seasonal items like heaters and snow blowers, which are now out of demand.

This overstock not only inflates storage costs, as additional square foot space is required but also drives up insurance costs.

Efforts to sell goods at lower prices become a forced strategy to reduce financial strain rather than a tactical business decision, affecting the warehouse’s bottom line.

Strained Supplier Relationships

The financial turbulence leads to tense relationships with the warehouse’s supplier base. Chronic delays in payments make it challenging to negotiate favorable terms or secure timely deliveries.

For example, a key electronics goods supplier, wary of past payment issues, might be reluctant to extend the previous credit terms. This reluctance severely impacts the warehouse’s procurement focus, complicating the restocking of in-demand items such as smartphones and laptops.

Consequently, the warehouse misses crucial sales opportunities, especially during peak shopping periods, underscoring the vital connection between financial management and the ability to meet customer demands.

Consequences of Delayed Payments

Delayed payments in the supply chain significantly impact inventory management, affecting both operational efficiency and financial health. These delays lead to stockouts and overstocking, each with distinct consequences for the retail sector.

A National Retail Federation (NRF) study highlights that 51% of retailers experienced stockouts last year, resulting in an average sales loss of 4%. This not only affects immediate revenue but also erodes customer loyalty and damages brand reputation as recurring and new customers turn to competitors when faced with empty shelves.

On the other hand, McKinsey & Company points out the challenges of overstocking, which ties up capital in unsold inventory, increases storage costs, and raises the risk of obsolescence. This situation burdens retailers financially, with capital stuck in dormant stock, escalating storage fees, and the potential for products to become obsolete.

Stockouts:

- Stem from the imbalance where demand outstrips supply due to tardy replenishment.

- Lead to direct sales losses and potentially chip away at customer loyalty, as shoppers seek alternatives.

- Impose long-term scars on brand esteem and customer faith, elements pivotal for business prosperity.

Overstocking:

- Though occasionally strategic (e.g., for seasonal surges, promotions, or as a buffer against supply chain hiccups), routinely results in capital ensnared in dormant inventory, escalating storage charges, and the hazard of obsolescence.

- Triggers operational hitches, including cluttered warehouse spaces and inefficiencies in order fulfillment processes.

- Exacerbates financial strain by locking up liquidity and may strain customer relations when popular items face stockouts, curtailing opportunities for business growth or diversification.

The key to effective inventory management demands a nuanced approach—keeping adequate stock levels to satisfy demand while sidestepping the traps of overstocking. Achieving this hinges on adept demand predictions, streamlined operational methodologies, and forward-looking strategies aimed at reducing the changes of supply and demand.

Strategic Responses to Financial Challenges

The role of efficient warehouse operations, including the strategic use of distribution centers and delivery vehicles, becomes crucial. Implementing practices like cross-docking could offer some relief by minimizing the need for extensive storage and expediting the movement of goods.

Moreover, winning better visibility into the supply chain and streamlining basic steps in the procurement process are essential, albeit time-consuming, tasks.

These efforts aim to bolster business continuity, ensuring the timely of purchase orders and having a steady supply of services and value to customers.

To reduce these challenges, warehouses must adopt strategic planning and management practices:

- Optimizing Inventory Levels: Implementing robust inventory management systems helps maintain optimal stock levels, reducing extra storage costs and insurance fees.

- Building and Maintaining Strong Supplier Relationships: Regular communication and collaboration with sellers are essential in finding together beneficial solutions and having a healthy supply network.

- Leveraging Financial Management Insights: The 2022 Warehousing Education and Research Council (WERC) study highlights that efficient financial management is crucial in having smooth warehouse operations and keeping healthy seller relationships. Warehouses adopt digital strategies to control these financial challenges and maintain operational efficiency.

Optimizing Inventory Balance: Turning Challenges into Opportunities

Achieving the perfect balance in inventory is akin to striking gold. It’s a dynamic process, balancing between the risks of overstocking and the perils of stockouts.

This balance, however, is not just about keeping safety stock. It also hinges on the efficiency of payment systems, streamlined operations, and well-crafted strategies.

By focusing on these pivotal areas, warehouses can transform potential challenges into promising opportunities for growth, stability, competitive advantage, customer experience and operational excellence.

Advantages of Efficient Payment Systems in Warehousing

Implementing efficient payment systems is a cornerstone of seller strategy for achieving operational excellence. These systems bring many benefits, ranging from real-time procurement to optimized inventory control, and play a crucial role in building blocks fostering strong supplier relationships.

Real-Time Procurement and Its Benefits

One of the most significant advantages of an efficient payment system is facilitating real-time procurement.

This approach allows warehouses to respond to inventory needs, purchasing stock exactly when it is required. The benefits are:

- Reduced inventory expenses: By purchasing goods only as needed, warehouses can significantly reduce costs associated with holding excess inventory.

- Enhanced responsiveness: Real-time procurement enables warehouses to be more agile and responsive to market demands.

- Improved liquidity: With funds not tied up in unnecessary inventory, warehouses can enjoy improved balance. This allows for more flexibility in operations and investments.

Optimized Inventory Control through Integration with Warehouse Management Systems

When integrated with warehouse management systems (WMS), efficient payment systems can lead to highly optimized inventory control.

This integration ensures that financial transactions are aligned with physical stock movements, providing a holistic view of warehouse operations. Such synchronization leads to:

- Accurate inventory tracking: Real-time updates on inventory levels ensure that stock levels are always accurate, preventing discrepancies that can lead to operational hiccups.

- Data-driven decisions: The combined financial and inventory data enable warehouses to make informed decisions based on current market trends and historical data, improving overall inventory management.

- Reduced human error: Automating payment and inventory processes minimizes the risk of human error, leading to more reliable and efficient warehouse operations.

Strengthening Supplier Relationships with Timely Payments

Timely payments, facilitated by efficient payment systems, strengthen seller relationships, and are integral in the Supplier Relationship Management (SRM) process. Consistently meeting payment deadlines fosters trust and reliability and improves seller relationships, which are essential for:

- Negotiating better terms: Suppliers are more likely to offer terms and discounts to warehouses with a history of timely payments.

- Ensuring consistent supply: A strong relationship with sellers guarantees a more consistent and reliable supply of goods.

- Building long-term partnerships: Reliable payment practices lay the foundation for long-term partnerships with sellers. These practices leads to mutual benefits and growth opportunities.

Operational Benefits of Streamlined Payments for Warehouse Operations

Implementing streamlined payment systems in warehouse operations is a powerful tool for enhancing overall operational efficiency and customer satisfaction. By ensuring timely and efficient financial transactions, these systems contribute significantly to various facets of warehouse management:

Operational Efficiency and Inventory Management

Streamlined payments directly boost operational productivity by ensuring prompt inventory replenishment and effective seller coordination. This leads to minimal disruptions due to stock shortages, enabling a smooth flow of operations.

Additionally, integrating automated payment processes significantly reduces the administrative burden, allowing staff to focus on essential operational tasks. This minimizes holding costs and reduces wastage and obsolescence, leading to cost optimization and maximized return on investment.

Reliable Product Availability and Enhanced Customer Experience

Adopting efficient payment systems ensures consistent product availability, which is pivotal in meeting customer expectations and presumptions and avoiding stockouts. As a result, warehouses can fulfill orders more rapidly, translating into faster delivery times and a positive customer experience.

By maintaining a reliable stock level and ensuring seamless order processing, warehouses build customer trust. This eventually leads to fostering long-term business relationships and loyalty.

Strategies for Smoother Sailing in Warehouse Operations

- Clear communication: Establish clear payment terms with sellers and customers, outlining due dates and potential late fees. Open communication is key to managing expectations and saving misunderstandings.

- Technology to the rescue: Utilize inventory management software and supply chain visibility tools to track stock levels. Real-time data can help in proactive decision-making.

- Building trust and collaboration: Foster strong relationships with sellers and customers. Work together to solve payment challenges and explore alternative financing options when needed.

- Diversify payment options: Offer a variety of payment methods to cater to different preferences, like credit cards, bank transfers, or spend money on delivery for local and international customers. This can improve payment speed and customer convenience.

- Embrace efficient payment tools:

- Global Business Accounts: Leverage multi-currency accounts to streamline international transactions, eliminate foreign exchange fees, and expedite payments to global sellers.

- Automated Payment Systems: Implement automated invoicing and payment reminders to reduce manual tasks, minimize delays, and improve cash flow predictability.

- Supply Chain Finance Solutions: Explore factoring or trade finance options to bridge temporary cash flow gaps and soften risks associated with long payment cycles.

By uniting these strategies, warehouses can navigate the choppy waters of payment delays and ensure smoother sailing in their operations.

A proactive approach coupled with efficient payment tools can significantly improve cash flow and foster stronger relationships.

Bancoli’s Global Business Accounts: Streamlining Warehouse Transactions

Bancoli Global Business Account offers companies a tailored solution specifically designed to streamline warehouse transactions.

Our innovative solution is crafted with warehouses’ unique needs in mind, highlighting ease and reliability in financial dealings.

Our GBA is more than a banking solution; it’s a strategic tool designed to empower warehouse operations; here’s how it stands out:

- Real-time transaction: Bancoli’s GBA offers real-time processing of financial transactions. This feature is crucial for warehouses that require immediate funding for inventory procurement, ensuring no delay in restocking and keeping optimal inventory levels.

- Global reach solutions: Understanding the global nature of supply chains, our all-in-one solution is equipped to handle a 6-in-1 multicurrency business bank account that supports USD, GBP, EUR, SGD, and HKD and conversions to JPY, CNY, INR, ILS, and PHP on payouts. This streamlines transactions in both global and local currencies.

- Automated payments: Our platform automates invoices, reducing the reliance on manual processes and lowering human error. This invoice automation ensures that payments are executed efficiently, consistently, and without unnecessary delays.

- Cost-effective transaction fees: Bancoli offers competitively low rates and fees, dramatically undercutting those typically associated with traditional financial institutions.

- Enhanced security: Bancoli’s USD Custody protection integrates advanced security measures, including ID verifications, two-factor authentication (2-FA), and selfie checks, establishing a high standard for secure, efficient, and dependable online banking. Our fund protection surpasses traditional U.S. FDIC insurance by 500 times and European bank insurance by over 1000 times, offering unparalleled financial safety.

Takeaways: The Future of Warehousing: Embracing Payment Innovations

Warehouse operations stand at a critical juncture where adaptability is beneficial and essential. The rapidly changing demands in retail necessitate agile, responsive, and technologically advanced warehouses.

This adaptability is where Bancoli’s value becomes evident. It offers efficient payment solutions that align perfectly with the needs of modern warehouse management and the customers evolving expectations.

Bancoli’s Global Business Account provides real-time processing, automated invoicing, and multi-currency support. It also addresses common challenges like payment delays and cash flow management.

This financial agility and control level is crucial for warehouses to quickly adapt to market changes, maintain efficient inventory levels, and foster robust supplier relationships.

This transformation is vital for keeping the equilibrium of supply and demand in retail, ensuring seamless flow of products from manufacturers to end consumers, and ultimately contributing to the thriving retail sector.

Augmented by innovative payment solutions, warehouses and distribution centers are pivotal in enhancing the supplier relationship management process and approving the complex network of retail stores.

Frequently Asked Questions

1. How can improving warehouse operations enhance customer satisfaction?

Streamlining warehouse operations ensures accurate and timely order fulfillment, reducing errors and delays. Using barcode scanners for properly labeled inventory minimizes mistakes, while keeping safety stock prevents stockouts, keeping customers satisfied with reliable service.

2. What strategies can businesses adopt to improve cash flow through warehouse management?

Improving cash flow involves minimizing excess inventory to free up cash, automating processes to reduce staffing costs, and quickly turning overstock into cash. Streamlined procurement and inventory management, such as just-in-time systems, also enhance cash flow by reducing unnecessary storage costs.

3. Can optimizing the supply chain cut costs?

Yes, optimizing the supply chain significantly cuts costs by negotiating better supplier terms, combining shipments, and adopting just-in-time inventory to minimize storage expenses. These efforts contribute to lean operations and align with broader business goals.

4. What are the benefits of selling goods internationally, and its impact on warehouse operations?

Selling internationally expands market reach and increases revenue. It requires adapting warehouse operations for international shipping, such as securing compliance with labeling and packaging regulations. While there are initial costs, the long-term revenue growth from global markets can significantly enhance business profitability.