The digital business landscape has undergone a rapid expansion. Companies have increasingly turned to digital platforms as a contingency plan and a mainstay of their operational strategy.

This shift has brought with it a demand for robust and adaptable bank frameworks that meet the needs of an evolving digital economy. Traditional bank methods, often rooted in legacy systems, are evolving at an unprecedented pace to keep up with the burgeoning demands of this digital landscape.

Digital companies find themselves navigating a complex and dynamic financial ecosystem. The need for an efficient, secure, and scalable bank solution, including those backed by the Federal Deposit Insurance Corporation (FDIC), has become more critical than ever.

As digital services evolve, so do their bank needs, requiring a nuanced approach to financial management, payment processing, and capital allocation. This includes carefully selecting the appropriate account ownership category for their bank needs and ensuring that their bank partners can offer the stability and security guaranteed by FDIC insurance or above.

Understanding the Unique Needs of Digital Services

Digital service providers operate within a unique framework where agility and rapid response are key.

This sector encompasses various services – from digital marketing and software development to e-commerce and online consulting. Each of these domains comes with its own set of bank requirements related to their own financial operations.

One of the primary needs for digital services, especially those transcending geographical boundaries, is handling global transactions efficiently. The ability to manage multiple currencies and navigate the nuances of international financial regulations becomes imperative in this context. Banks must not only offer multi-currency accounts but also have a deep understanding of cross-border transaction dynamics. Furthermore, providing options like international debit cards can greatly facilitate these global transactions, offering a convenient and efficient way to access and use their funds across different countries.

The Importance of Swift and Secure Payment Methods

For digital businesses, the speed and security of payment methods are not just conveniences but necessities. In an environment where transactions occur 24/7 and across continents, the ability to transfer funds swiftly and securely is paramount.

Rapid access to payment methods enables digital businesses to create and maintain a fluid cash flow – a critical aspect for sustenance and growth. This is especially true for smaller businesses and freelancers who operate in the digital space, for whom any delay in payments can have significant repercussions.

Moreover, security in transfers and other services is equally important. Digital businesses are often at the forefront of cyber threats and financial fraud. Hence, banking solutions that offer advanced encryption, fraud detection mechanisms, and secure authentication processes are vital.

In handling international payments and transfers, the complexity multiplies. The need for seamless processing that ensures adherence to international compliance standards, reducing the risk of legal complications or financial losses due to currency fluctuations is also important.

The Role of Banking in Digital Media Expansion

The growth trajectory of digital media businesses is closely intertwined with the evolution of banking services. The right bank account and everyday banking tools are more than just necessities for this digital banking era; they are strategic assets for companies in the digital media space.

Digital media and technology companies, often at the forefront of digital engineering, require bank services that offer flexibility and adaptability to their irregular revenue streams. The integration of advanced digital technology in banking provides essential resources for real-time financial tracking and management. This is crucial for effective budgeting and forecasting in an industry that is as dynamic and rapidly evolving as digital media and technology.

Banks are increasingly offering specialized services to support the unique needs of digital media companies. From mortgage and financial advisory to investment opportunities and credit unions, these services can be pivotal in aiding the expansion and success of digital media businesses.

Choosing the Right Bank for Your Digital Business

For digital service SMBs, the choice of a bank partner should be aligned with their specific needs and business model. Given the unique challenges and opportunities, it’s important to consider various factors when selecting a financial institution.

1. Evaluating Needs of a Digital Business

A digital business often has distinct financial needs, ranging from receiving incoming transfers to managing international payments. The right bank should offer efficient and scalable services to the growing needs of a digital business. Factors like the ability to earn interest on deposits, or rewards from payments, the flexibility of account features, and the accessibility of online bank tools play a crucial role in this decision-making process.

2. Analyzing Additional Factors for Optimal Choice

Other factors that a digital business should consider include the stability and reputation of the financial institution, the availability of digital tools for financial management, and the capacity to provide personalized advice and support.

Bank partners should understand the nuances of the digital business landscape and offer results that cater specifically to its needs.

Moving forward, it’s essential to delve into the specific features that a digital business should look for in a bank. These features provide day-to-day convenience and strategic benefits crucial for the growth and sustainability of a digital business.

Essential Features in a Bank for a Digital Business

When a digital business evaluates bank partners, certain features are particularly beneficial. These features enhance the daily bank experience and provide strategic advantages.

Multi-Currency Support and Low Transaction Fees

Given the global nature of digital businesses, the ability to handle multiple currencies efficiently is paramount. Banks offering multi-currency support enable businesses to serve international customers easily. Moreover, low transaction fees are crucial for maintaining profitability, especially when dealing with cross-border transactions.

Comprehensive Banking Solutions

Agility in financial operations, expansive coverage, and multi-currency usability are essential. Digital businesses benefit from banks that provide customers with a combination of competitive fees and rates, robust funds and account security, and exemplary customer service.

Aligning with Digital Business Needs

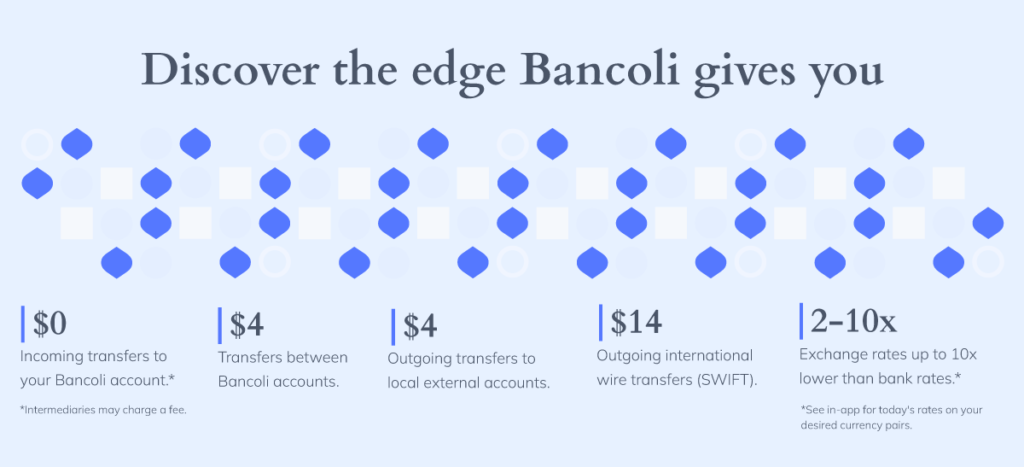

For instance, Bancoli caters specifically to digital businesses by offering features such as streamlined international payments, competitive rates for currency exchange, and enhanced security measures. Their services are designed to provide easy access to financing options, which is a significant benefit for SMBs looking to expand or manage cash flow effectively and faster.

Overcoming Multiregional Bank Challenges

The digital services industry, characterized by rapid innovation and a global clientele, often faces unique challenges in managing financial interactions across multiple regions. The right financial partner is crucial in navigating these complexities, ensuring that a digital business can effectively serve its multiregional clients.

1. Adapting to Diverse Financial Landscapes

One of the primary challenges is adapting to the diverse financial regulations and systems present in different regions. A financial institution that understands these variances can provide the necessary guidance and support, enabling digital service providers to operate smoothly in various areas.

This adaptability is essential not just for compliance but also for optimizing operational efficiency across borders.

2. Tailoring Solutions for Multiregional Needs

Integrating smart products and services tailored to the needs of a digital business operating in multiple regions is vital. This includes offering solutions catering to each market and user’s unique currency and transaction requirements.

By doing so, a financial partner can enhance the overall customer experience, making it seamless for the company to manage its finances regardless of the geographical spread of its clients.

Navigating International Transactions with Ease

The ability to easily navigate international transactions is a significant factor in maintaining a competitive edge and client satisfaction. A financial institution equipped to handle them can provide invaluable assistance.

Streamlining Cross-Border Financial Operations

Effective management of international transactions involves more than just transferring funds. It requires an understanding of currency fluctuations, transaction fees, and the timing of cross-border payments. For example, a financial institution with expertise in these areas can help streamline these processes by making transactions more straightforward and less time-consuming.

Enhancing Client Relationships Through Financial Agility

Being able to handle transactions rapidly and efficiently also directly impacts client relationships. When a digital business can manage international payments effortlessly, it reflects positively on its operational competence, strengthening client trust and enhancing the overall business reputation.

How Can Financial Institutions Help to Reduce Costs and Enhance Business Efficiency?

Efficiency and cost-effectiveness are crucial, especially when dealing with global transactions. The right financial partner can play a significant role in achieving these objectives.

Optimal Currency Management

Selecting the best currency pairs and doing invoices in the destination currency are strategies that can help reduce costs.

A financial institution that provides these services can assist companies and government, in avoiding unfavorable exchange rates and additional fees, thereby saving substantial amounts of money in the long run.

Smart Management of Rates and Fees

Being vigilant about rates and fees is another area where the right financial partner can provide significant benefits to brands.

A financial institution can help digital businesses reduce their operational costs by offering competitive rates and transparent fee structures. This is particularly important when managing global transactions, for example, where every percentage point saved can considerably impact the bottom line.

Ensuring Healthy Cash Flow in Digital Services

Maintaining a healthy cash flow is paramount for sustainability in the fast-paced digital business world.

Digital service SMBs face various unique challenges in managing finances, often requiring innovative strategies to stay ahead in the market. Leveraging the right financial tools and technology can unlock new value for these businesses, ensuring they meet the dynamic needs of their consumers.

Strategic Financial Management in the Digital Realm

For digital businesses, cash flow management is more than just tracking money; it’s a strategic endeavor vital for aligning with business operations and growth goals.

This is especially important in a sector where consumer expectations and industry trends are constantly evolving. For example, consider a digital marketing agency planning to expand. The agency’s financial team must ensure that incoming funds from clients and projects cover not only ongoing expenses like payroll and software subscriptions but also facilitate growth-related expenditures such as new technology investments or office expansion.

Effective cash flow management also means being prepared for shifts that can affect user preferences. Suppose the agency decides to introduce new resources in response to its demand. In that case, it must strategically plan these financial commitments, potentially considering options like short-term financing from banks.

This highlights the need for a flexible approach to managing finances, including judiciously planning for immediate expenses and future investments, like a mortgage for new office space or additional resources for expanding the team.

Leveraging Bancoli’s Digital Services for Cash Flow Efficiency

Bancoli offers a range of features specifically designed to support the cash flow needs of digital businesses. With tools that offer seamless transactions and automated invoicing, Bancoli helps digital service providers manage their finances more effectively.

This financial clarity and control level is vital for making informed business decisions and maintaining a healthy cash flow.

Features for Effective Cash Flow Management

Effective cash flow management is critical to running a successful digital business. The right bank ingredients and features can significantly affect how these businesses manage their finances.

Bancoli’s Comprehensive Cash Flow Management Features

Bancoli offers a suite of features tailored for digital services, which are instrumental in managing cash flow efficiently. These include:

- Automated invoicing: Ensuring that invoices are sent out and payments are received in a timely manner is crucial. Bancoli’s automated invoicing system streamlines this process, reducing delays in payment collections.

- Real-time financial tracking: Keeping a real-time track of financial transactions allows companies to monitor their cash flow closely, identifying potential issues before they become problematic.

- Flexible payment solutions: Bancoli provides flexible payment solutions that cater to the diverse needs of digital companies, facilitating smoother cash flow management.

Best Practices for Managing Working Capital

Managing working capital effectively is crucial for any digital business’s financial health and operational efficiency. Balancing receivables, payables, and inventory is key to maintaining a healthy cash flow.

Here are some detailed strategies and practices that can be particularly beneficial:

Efficient Receivables and Payables Management

Timely invoicing and collections

- Automated invoicing processes: Use automated invoicing systems to send out invoices immediately upon delivery of products. This ensures that there are no delays in billing, which can lead to quicker payment turnovers.

- Implement payment reminders and follow-ups: Establish a system for regular payment reminders and follow-ups. For instance, sending gentle reminders a few days before the invoice is due and immediate follow-up on past-due invoices can significantly improve collection times.

Smart payment terms with suppliers

- Leverage early payment discounts: Some suppliers offer discounts when making an early payment. Capitalize on these discounts to reduce costs, which can be more beneficial than the short-term benefits of delaying remittances.

- Extend payable times where possible: Negotiate longer payment terms with suppliers to keep the cash longer in your business. This can help in managing cash outflows without impacting relationships with suppliers.

Utilizing Technology for Working Capital Optimization

- Financial analytics tools: Use financial analytics tools to gain insights into cash flow trends, which can inform better decision-making regarding working capital management.

- Online banking: Utilize online banking for real-time visibility into cash positions. Many banks offer digital platforms that allow members to track and manage their finances effectively.

Leveraging Bancoli’s Global Business Account

Business boundaries extend beyond local geographies, so having access to a financial partner on site that understands and caters to global needs is crucial.

Bancoli’s Global Business Account emerges as a key solution for digital service SMBs, offering a range of features tailored to meet their unique international operational demands. This account is designed with the specific needs of digital businesses in mind.

Recognizing that these companies often handle transactions across various currencies and countries, the account offers an efficient, cost-effective way to manage global finances. This is particularly beneficial for SMBs in the digital sector, where agility and the ability to quickly adapt to market changes are critical for success.

Features of Bancoli’s Global Business Account Benefiting Digital Services

Bancoli’s Global Business Account comes with a suite of features that provide tangible benefits to digital services.

Multi-Currency Transactions and Competitive Rates

One of the standout features of Bancoli’s account is the ability to handle various accounts in multiple currencies. This is essential for international digital services, allowing them to deal with money in various currencies without incurring significant exchange rate losses.

Additionally, Bancoli offers competitive rates, ensuring that members get more value for their transactions.

Enhanced Security and Compliance

Bancoli’s Global Business Account provides robust security measures to protect financial transactions and ensure compliance with international banking standards, giving businesses peace of mind.

Simplifying International Finance Management

Our platform simplifies this process, making it easier to handle international finances efficiently. This includes easy tracking of multi-currency accounts, international deposits and remittances.

Support for Growth and Expansion

For digital service SMBs looking to grow and expand their operations, Bancoli’s account offers the necessary support. From facilitating international payments to offering insights into financial management, Bancoli helps businesses scale up their operations in a structured and secure manner.

Future Trends in Banking for Digital Services

As we move forward, the banking sector is poised for transformative changes and the introduction of new brands, many of which will significantly benefit digital service businesses.

These emerging trends go beyond mere technological advancements; they encompass a reimagining of the banking experience, including the role of the checking account, to meet the evolving demands of the digital world.

This evolution signifies a shift towards more adaptable and user-focused financial tools, essential for the agility and efficiency required in the digital marketplace.

Integration of Artificial Intelligence in Banking

Integrating artificial intelligence (AI) technology into banking systems is one of the most significant trends. AI’s immense potential to enhance the banking experience for digital service businesses and consumers.

From personalized financial advice to predictive analytics for better financial planning, AI can revolutionize how businesses and consumers interact with their checking accounts and overall financial management.

Case Studies: Success Stories in Digital Banking

The world of digital services is replete with examples of SMBs that have harnessed the power of strategic banking. Here are some examples that highlight the innovative use of financial tools.

Strategic Bank Partnerships

A notable example involves a digital marketing agency that partnered with a national bank to streamline its effectiveness. Initially struggling with managing payments to employees and contractors across different states, the agency leveraged the bank’s sophisticated pay systems.

Mitigating Risks and Securing Operations

A tech startup specializing in cybersecurity sought the expertise of a legal advisor and its banking partner to navigate the dangers associated with digital transactions.

By employing robust risk management strategies recommended by their bank, the company fortified its activities against a range of potential financial threats. Notably, the startup chose a bank partner that provided an extraordinary level of fund protection of 125 million USD. This level of security is 500 times higher than the typical protection available to the American people, significantly bolstering the trust and reliability perceived by its customers.

Conclusion: Building a Financially Agile Digital Business

The journey through the landscape of digital services and banking solutions reveals a clear narrative: the strategic choice of financial partners and services is not just a financial decision; it’s a crucial business move.

This includes considering the diverse offerings of state-chartered banks, which can provide specialized services that national banks might not. From leveraging the capabilities of various financial institutions to managing operational risks, the right choices in banking partners can profoundly impact a business’s agility, customer satisfaction, and overall success.

Incorporating tools into the business’s financial strategy, for instance, streamlines transactions and enhances the customer experience, contributing to the business’s agility.

When aligned with the company’s objectives and market demands, these choices can transform a digital business into a financially agile and competitive entity in the modern digital economy.