Discover how Bancoli’s Global Business Account boosts Canadian SMBs’ success in a post-pandemic world by simplifying cross-border transactions.

It’s safe to say that we’ve entered a post-pandemic era. Businesses around the world are stabilizing and long-delayed projects are back on track. Yet the process of change is never-ending – the only constant is change. Disruption often comes from within, with AI being the latest trendy development.

Some things, however, remain constant. Canadian small and medium-sized businesses (SMBs) prove that international business is a resilient typology, designed to maintain core functions regardless of changing circumstances.

In the global business landscape, the prevailing sentiment is one of opportunity and strategic foresight—being ready for whatever lies ahead. While the future may hold uncertainty and potential hurdles, there is an unprecedented sense of receptiveness towards reimagining the concept of cross-border business. True to form, the fintech industry is leading the way, offering a range of solutions and features designed to address pain points and help businesses succeed. Let’s take a look at the case of Canadian SMBs.

Despite the pandemic, Canada’s economy has been growing since late 2021. According to the 2023 Canadian Economic Overview Report, the economy “is now 103% of its pre-pandemic size, marking the fastest recovery of the last four recessions.” Behind this achievement, the Canadian government’s pandemic response plan strengthened businesses’ financial strategies, underpinning the robust economic performance we’ve seen.

Even with this growth, Canadian SMBs have faced challenges when it comes to international banking. Fortunately, with the launch of our Global Business Account (GBA) in Canada we are helping to streamline international payments. Bancoli’s GBA simplifies cross-border transactions by offering a multi-currency account and providing businesses with the essential tools for seamless international banking.

Understanding multi-currency accounts

Managing foreign currencies, exchange rates, and fees can make keeping track of your business’ money across different countries challenging. However, with the advent of multi-currency accounts, managing your funds across borders has become much easier.

What is a multi-currency account?

A multi-currency account is a bank account that allows its users to hold multiple currencies in a single account. By streamlining cross-border transactions management and exchange, these accounts are particularly useful for SMBs and solopreneurs frequently engaging in international transactions.

How do multi-currency accounts work?

An account with multiple currencies provides the account holder the ability to deposit, withdraw, and exchange funds in different currencies without having to constantly convert between them. This simplifies international banking processes and helps reduce currency conversion fees associated with traditional banking methods. In addition, it can provide users with the flexibility to hold or exchange currencies based on fluctuating exchange rates, potentially saving them money in the long run.

Benefits of Doing International Business with Multiple Currencies in a Single Account

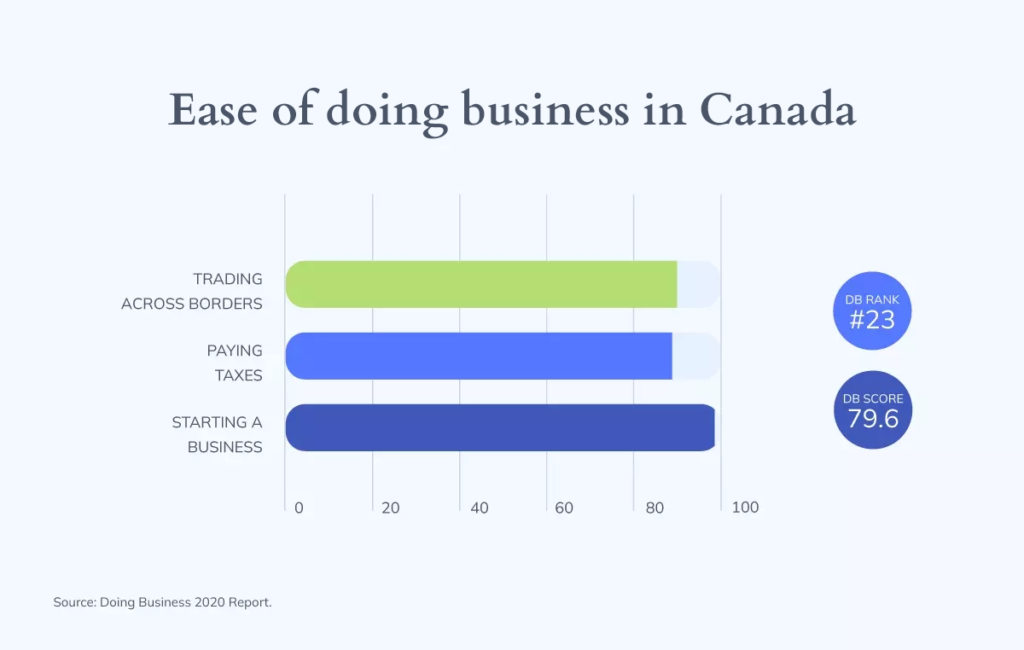

With an overall general score of 79.6, Canada ranks 23rd out of 190 in the Doing Business 2020 report, which classifies countries on the ease of doing business. The top scores were achieved in the areas of starting a business, trading across borders, and paying taxes. This proves that international business is becoming increasingly important for companies of all sizes and industries. Especially those looking to expand their operations and reach new markets.

Some of the benefits of conducting international business with multi-currency through a single account include:

1. Access to a broader customer base

Access to a broader funnel of potential clients leads to increased sales and overall growth. In addition, to facilitate smooth and efficient transactions in the global market, many businesses are using accounts with multiple currencies.

2. The ease of doing business across borders

Using local details to send and receive payments from clients and suppliers is faster, easier, and more convenient than traditional methods. This eliminates the constant necessity of currency conversion and mitigates the risks associated with unfavorable exchange rate fluctuations and supply chain disruptions.

3. The potential for cost savings

When dealing with international suppliers or clients, businesses often face high fees and unfavorable exchange for cross-border transactions. By holding multiple currencies in a single account, businesses can minimize these costs and make transactions more cost-effective. This increased efficiency can lead to higher profit margins for the company and a more competitive position in the international market.

4. Improve cash flow management

Timely access to funds is critical to ensure seamless operations and achieving long-term success. By holding and managing multiple currencies in one bank account, companies can more accurately forecast their cash flow, meet their obligations on time, make well-informed and strategic decisions, strengthen relationships with business partners, and improve the overall financial performance while reducing risks.

The benefits of doing business internationally are multiplied when using a multi-currency account. By streamlining cross-border transactions, minimizing costs, and improving cash flow management, businesses, particularly SMBs, can enhance their competitive edge in the global market and drive significant growth. As international business continues to expand and evolve, the use of an account with multiple currencies will become increasingly important for businesses looking to succeed in the global economy.

Bancoli Global Business Account: Empowering Canadian SMBs

The Global Business Account (GBA) offers a range of features that make it easier for Canadian SMBs to manage their international transactions, including:

- A multi-currency account with local details for USD and EUR, saving on conversion fees and transaction costs. With FX costs as low as 0%.

- Streamlined international payments, supporting transactions in over 20+ currencies across 200 countries, making it easy to send and receive payments to and from almost anywhere, facilitating international expansion.

- A streamlined invoicing process with automation to reduce the risk of human error, ensure timely payments, and improve supplier relationships, contributing to a business’s supply chain financing.

- Excellent customer support, platform features such as 2FA, and KYV/KYC verification.

- A cash flow feature that combines invoicing and immediate liquidity by generating guaranteed invoices while expediting payment processing. This cutting-edge method empowers businesses to boost cash flow, secure receivables, and reduce expenses, all without relying on loans or credit.

- Access to lower fees for international payments compared to other market solutions, providing Canadian SMBs with highly efficient and cost-effective transactions.

Conclusion

Multi-currency accounts offer a convenient and cost-effective solution for Canadian SMBs. Particularly, allowing them to streamline cross-border transactions, reduce costs, optimize cash flow, and expand their businesses globally.

That’s where a platform like Bancoli comes in. With comprehensive services for Canadian SMBs, including global payments, invoicing, cash flow acceleration, and banking in one solution, Bancoli is committed to simplifying international banking.

Unlock your business potential with a versatile Global Business Account to gain a competitive advantage and fuel growth in the ever-expanding international market. Opening a GBA is easy and can be done anywhere you have internet access.