The Critical Role of Commercial Bank Accounts

In the business world, having a secure and efficient financial management system is crucial. This is where commercial bank accounts come into play. They’re not just repositories for business funds but vital tools that drive daily operations, streamline transactions, and offer a wide array of services tailored to ease the financial management burden.

Commercial bank accounts serve as an economic catalyst, connecting clients and suppliers, and stimulating economic growth. However, like with other financial instruments, understanding their main characteristics is key to maximizing your commercial account and helping your business thrive.

What Is a Commercial Bank Account?

Businesses use commercial accounts to facilitate secure and efficient financial transactions. These transactions can range from payroll processing to managing operational expenses.

Unlike personal accounts, commercial accounts offer enhanced services such as merchant services, business loans, and customized customer support to meet specific business needs. However, these accounts often incur higher fees due to the additional benefits and services they provide.

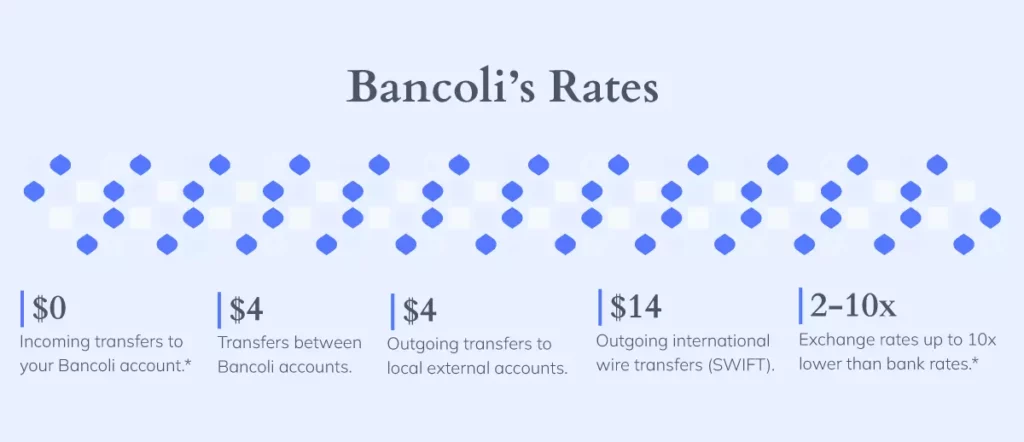

Bancoli’s Global Business Account presents a compelling solution for businesses seeking competitive global foreign exchange (FX) rates. This offering empowers businesses to plan their international wire transfers effectively while enjoying substantial savings on transaction fees.

Unlike many other financial institutions, Bancoli adopts a unique approach for its outgoing international transfers (SWIFT), offering a fixed cost structure. In contrast, conventional practices often entail transaction fees calculated as a percentage of the transferred amount. As the transferred sum increases, so does the associated fee. This feature makes Bancoli a remarkably cost-efficient choice that enhances the financial well-being of businesses.

Services Offered by Commercial Banks: More Than Just Accounts

Financial institutions go beyond just offering simple checking and savings accounts. They present a wide array of services designed to cater to the diverse needs of businesses.

Advanced features like unmatched fund security, supply chain financing solutions, and cash flow management tools are some of the specialized offerings that accommodate companies’ intricate financial operations.

Beyond these, such institutions often offer other services, such as multi-currency accounts for efficient cross-border transactions, integrated e-invoicing for seamless financial operations, and Know Your Vendor features for increased business transparency.

Each of these features fulfills a specific financial function, ensuring that businesses can easily navigate the complexities of modern financial landscapes.

Opening a Commercial Bank Account: The Basics

Businesses must follow a specific process to open a commercial bank account. They must provide essential information, including the company’s legal name, tax identification number, and details regarding its legal structure. Additionally, to verify the authenticity of the business, personal identification and, in some cases, a business license or other relevant documentation may be needed.

Although rigorous, this process is designed to guarantee security, validate the business’s legitimacy, and offer the bank a holistic understanding of your business’s operations.

Traditionally, businesses must open separate accounts in each currency’s country to manage transactions. However, the advent of multi-currency accounts has streamlined this, allowing businesses to operate in multiple currencies from one online platform, enhancing the efficiency of international operations.

The Pros and Cons of Commercial Accounts

Commercial bank accounts offer various advantages that can greatly benefit businesses of all sizes. The advantages are manifold, from easy access to funds and the ability to accept credit card payments to an extensive range of additional banking services.

Yet, it’s worth noting that these benefits can be further optimized by selecting low-cost business banking solutions.

The contemporary financial scene allows businesses to benefit from bank accounts and financial systems that charge minimal to zero fees. This can include negligible account fees, no minimum balance requirement, and other business-friendly stipulations, adding more value to the banking experience.

Thus, while traditional banking models pose challenges like account fees and balance requirements, businesses can steer towards more economical yet robust alternatives. Such alternatives ensure that the advantages outweigh the potential drawbacks, enabling businesses to make the most out of their commercial accounts.

Revolutionizing Business Accounts with Bancoli

The complex landscape of commercial banking can be daunting. Still, a practical solution consolidates the perks of traditional commercial accounts while incorporating advanced financial technologies—the Global Business Account offered by Bancoli.

Global Reach and Multi-currency Accounts

Unlike traditional commercial banking systems, Bancoli’s Global Business Account has multi-currency capabilities, saving businesses significantly on conversion costs and transaction fees. It enables transactions in over 25 currencies across more than 200 countries, making it easier to perform international payments. Compared to traditional banks, Bancoli emerges as a far superior alternative due to its competitive fees for international payments.

Invoicing Made Effortless

Bancoli’s e-invoicing feature ensures your invoices are sent directly to clients’ bank accounts, thereby reducing the risk of ending up in spam folders. With its unique guaranteed invoice feature, Bancoli takes invoicing to the next level, promoting secure future receivables and eliminating the need for third-party payment providers.

Enhanced Security

A noteworthy feature of Bancoli is the unrivaled fund security it offers. Bancoli ensures an unmatched level of fund protection, safeguarding up to US$125 million per account holder. This level of security exceeds what FDIC-insured bank accounts and traditional European banks provide, offering peace of mind and trustworthiness for Bancoli clients.

Conclusion: A New Era of Commercial Banking with Bancoli

Commercial bank accounts undoubtedly play a crucial role in managing business finances. However, with Bancoli’s Global Business Account, your business financial management can reach new heights. By merging traditional benefits with state-of-the-art financial solutions, Bancoli provides a streamlined platform for effective finance management.

Bancoli offers competitive rates and a rich suite of services tailored for international businesses. With features like multi-currency accounts, e-invoicing, and robust fund security, Bancoli represents an ideal choice for businesses aiming to excel in the global marketplace.