When launching a startup, establishing a business bank account with banks for startups is fundamental, influencing its trajectory significantly. This step is a financial formality and a strategic move in business banking that lays the foundation for growth and success in startup banking.

For startup leaders, understanding the importance of a dedicated business bank account is crucial in the landscape of banks for startups. It goes beyond managing transactions in startup banking; it’s about creating a distinct financial identity.

This is not just good business practice in business banking but a clear statement of professionalism and commitment, signaling to investors, customers, and partners the seriousness and legitimacy of the business through effective business banking strategies.

Navigating the Complex Financial Landscape with a Business Checking Account

Precise financial management in business banking is critical for any startup aiming to expand and scale, especially within banks for startups. A business bank account, particularly a business checking account, equips startups with tools and insights for managing business finances, anticipating financial needs, and harnessing growth opportunities in startup banking.

This aspect of business banking is essential for navigating the complex financial landscape of banks for startups.

Selecting the proper business bank account from banks for startups is like choosing a partner in your business journey, aligning with your vision, and supporting growth aspirations in the competitive world of startup banking.

It’s a decision shaping your startup’s financial future and propelling it toward its goals within the dynamic environment of banks for startups. A business checking account in this context is more than just an account; it’s an integral part of a digital banking platform that provides the backbone for managing business finances.

Essentiality of a Business Bank Account for Startups

For startups, having a dedicated business bank account is both a formality and a strategic step toward establishing a solid foundation for financial operations. It simplifies payment processing, accounting, and tracking expenses and revenues.

A business bank account is instrumental in legitimizing a startup, professionalizing financial operations, and instilling confidence in clients and partners, portraying the business as serious and established.

Can a Startup Work with any Bank?

Selecting the right banking partner from the best banks for startups is crucial, impacting beyond just storing money. A well-chosen banking partner from the best banks for startups is a valuable asset. This can significantly affecting its financial health, operational efficiency, and overall success in the financial services landscape.

Startups should carefully consider their financial needs, long-term goals, and industry challenges when selecting a bank from the best banks for startups that will be a true partner in their journey. This includes evaluating the bank’s business checking accounts, cash management account options, and other business banking features.

Financial Management and Growth

Whether opting for traditional banks or embracing digital banking solutions, the key is to choose a partner that aligns with your startup’s unique needs and aspirations, ensuring a solid foundation for financial success in an ever-evolving business landscape.

Access to tailored solutions: Traditional banks and digital-only banks may offer generic business products. Financial technology companies can provide integrated accounting software and specialized investment options designed explicitly for startups’ dynamic needs.

Competitive fees and rates: Both traditional banks and digital platforms from the best banks for startups can offer competitive fees. Digital platforms often have lower operating costs, translating to lower monthly fees for startups.

Financial guidance and expertise: Both traditional banks and digital platforms offer expertise. But, digital platforms often focus on access to online resources readily available for startups with a digital-first approach.

Operational Efficiency and Convenience

Startups must consider the efficiency of payments, the sophistication of financial tools, and the adaptability of banking services.

Streamlined payments: Both traditional banks and digital platforms offer solutions like digital banking and mobile wallets. Digital platforms often have integrated payment gateways and automated systems, streamlining processes for fast-paced startups in the financial services landscape.

Automated financial tools: Both traditional banks and digital platforms offer tools. But, digital platforms tend to specialize in real-time budgeting and AI-powered forecasting tools, which are valuable for data-driven decision-making.

Scalability and flexibility: Both traditional banks and digital platforms can adapt. Digital platforms are often built for rapid scaling and seamless integration with new tools and services.

Building Reputation and Trust

Positive banking relationship: Both traditional banks and digital platforms can enhance credibility. Digital platforms with innovative solutions and a modern image can mainly attract tech-savvy investors interested in startups.

Improved creditworthiness: Both traditional banks and digital platforms facilitate building credit. Digital platforms may offer faster reporting and easier access to credit monitoring tools, which benefits young startups.

Reduced risk and compliance: Both traditional banks and digital platforms prioritize security. Digital platforms often have enhanced cybersecurity measures and AI-powered fraud detection.

It’s not just about daily transactions; it’s about building a solid financial foundation and a positive credit history. By opening doors to future loans and investments essential for long-term growth and expansion.

Selecting the Ideal Bank Account for Your Startup

When launching a startup, one of the foundational steps in the financial services landscape is choosing a bank account. You’ll need a bank that supports startups, this way it can protect your business funds. These funds are the lifeblood of your business, especially for online-only businesses and tech startups.

The decision is critical in business banking, impacting how you manage your finances, so the right blend of features, fees, and flexibility from a financial technology company is a research time well invested.

What features to consider in a business banking for a startup?

As always, the best business bank account is the one that aligns with your business needs, for example, if your startup needs a business credit card, and business goals. At the same time, some features are common focus points for startups:

Security and Reliability: When evaluating a financial technology company, digital-only bank, or traditional bank, features like two-factor authentication, real-time alerts, and advanced encryption are crucial to safeguard your startup’s assets.

Effortless Online Banking: The best banks for startups understand that today’s fast-paced business environment demands efficient online banking solutions. A digital banking platform that allows you to manage finances quickly and easily from anywhere is essential.

Streamlined Transactions for Agile Business Operations: A bank that processes payments quickly is vital for ensuring smooth cash flow.

Multi-Currency Support: Multi-currency accounts for business banking are essential for startups engaging in international trade, eliminating the complexity of managing multiple foreign bank accounts and significantly reducing fees and foreign exchange rates.

Transparent Fees: It’s essential to know precisely what you’re paying for, helping you make informed financial decisions or what your financial expenses will be with more precision. Later in this article, we will explore fees and what to consider when looking for a startup bank.

To ensure a correct financial journey, your bank account from the best banks for startups must excel in each of these points, but there are other valuable features that many startup leaders value:

Seamless Integration to your Business Operations: Your banking services, ideally from a digital-only bank, must integrate smoothly with your existing business tools.

Streamlined Cash Flow Access: As a startup grows, access to cash flow from a cash management account becomes crucial. A bank offering enhanced and quicker access to cash flow, such as money market funds, can be a valuable partner.

Assistance and Customer Support: The speed at which startups operate makes it essential to have access and support from financial institutions.

Scalable Solutions: A startup bank that can scale its services to match your business needs, is ideal for a long-term partnership.

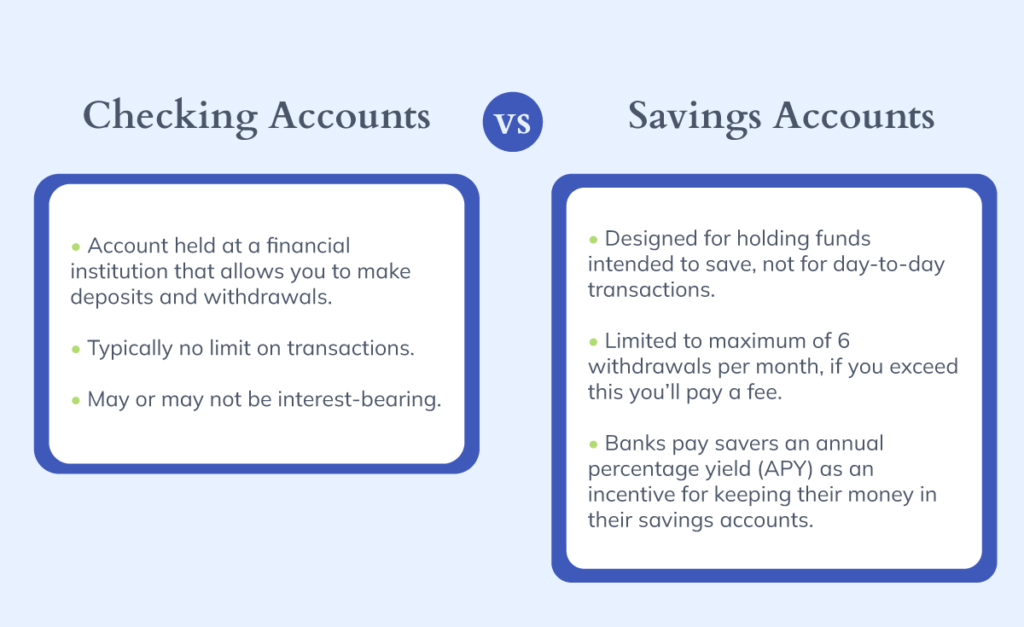

What are the differences between Business Savings Accounts and Business Checking Accounts?

In the dynamic world of startups, selecting the right type of business banking account is crucial for financial success and operational efficiency. Whether bootstrapped or venture-backed, startups must navigate their unique financial needs, balancing day-to-day transactions with long-term financial planning.

The cornerstone of this financial journey is often a business checking account tailored to handle frequent transactions and daily financial activities. This account is key to building business credit and managing business taxes.

Business Checking Account: Your Daily Operations Hub

Establishing a business checking account serves as a dedicated hub for day-to-day financial operations. This account, often found at the best banks for startups, acts as the heart of your business’s financial ecosystem, facilitating a seamless flow of funds to keep your operations running smoothly, including wire transfers and merchant services.

Here’s how a business checking account empowers a startup’s financial management:

Transaction Central: It readily accommodates a high volume of transactions, enabling you to efficiently receive customer payments, manage bill pay, and process payroll seamlessly. This emphasis on transaction frequency ensures that your business can conduct its financial activities without limitations.

Financial Ecosystem Management: Your business checking account, especially from FDIC-insured banks, provides a centralized platform for managing the essential monetary flows that underpin your startup’s growth. It is a comprehensive dashboard for tracking incoming revenue and outgoing expenses and maintaining a clear financial health overview.

Prioritizing Transactions Over Interest: Unlike savings accounts, which focus on earning interest, business checking accounts prioritize transaction flexibility and accessibility. This means you can confidently make frequent deposits, withdrawals, transfers, and payments without encountering limitations or penalties, ensuring your business can operate with financial agility.

Business Savings Account: Your Future Growth Vault

While the business checking account focuses on daily operations, a savings business account is a foundation for immediate financial security and long-term growth.

It becomes a platform for accumulating capital and building an emergency fund, ensuring businesses are well-prepared for future investments and unforeseen expenses.

This strategic tool is critical for maintaining smooth operations and facilitating scalability, blending financial security benefits and growth potential immediately.

Key services in savings accounts:

- Interest Accumulation: A business savings account enhances idle funds through competitive interest rates, contributing to your startup’s passive income.

- Goal-oriented Reserves: These are tailored for setting aside funds for specific objectives, such as technology upgrades, market expansion, or other significant investments.

- Emergency Funds: Offers a financial safety net, crucial for managing unexpected expenses, thus safeguarding your operational stability.

- Transaction Limits: Limiting monthly withdrawals promotes a savings culture, aligning with long-term financial goals and encouraging prudent financial management.

After exploring the differences between a bank’s business checking accounts and savings accounts, it’s crucial to delve into another common query: Can a startup use a personal account or “Not a Bank Model”?

A Personal Bank Account is Not Ideal for a Startup

Setting up a personal bank account might seem convenient due to its simplicity and ease of maintenance, but it’s generally not the ideal choice for startups.

Using a personal account for business transactions can lead to complicated tax scenarios and obscure the distinction between personal and business finances. Maintaining a clear demarcation is essential for streamlined financial management and staying compliant with legal and tax regulations.

For startup leaders, this separation is not just about organization; it’s a fundamental aspect of establishing a credible and professionally-run business.

The ‘Not a Bank’ Model

Emerging ‘not a bank’ financial institutions, primarily online, offer a compelling alternative. These entities often provide lower fees and more flexible account options, appealing to startups seeking cost-effectiveness and operational flexibility.

However, it’s crucial to note that while these options may offer innovation and agility, they might lack the comprehensive coverage and security features provided by traditional or digital banks, which are crucial for startups requiring reliable financial institution support.

Analyzing Fees: A Critical Consideration for Startups

When choosing a bank for your startup, the fee structure of business accounts is a pivotal consideration. Transaction fees, service charges, and monthly maintenance fees, often called monthly fees, can significantly impact a startup’s budget, especially considering the minimum balance requirement and potential overdraft fees.

For example, some banks might charge a high transaction fee for every processed check or electronic transfer, which could be burdensome for a startup regularly conducting numerous transactions.

Choosing the Right Account Type

This is where having two business checking accounts or a cash management account can be beneficial, offering different options for handling business expenses and wire transfers.

Navigating Various Service Charges

Service charges, such as fees for merchant services or using advanced payment services, can also vary widely among banks. Additionally, monthly maintenance fees can differ, impacting tech startups or online-only businesses significantly.

A bank might charge a relatively high monthly fee but waive minimum balance requirements, while another might have no monthly fee but a minimum balance requirement, higher transaction costs, and strict minimum balance rules.

Balancing Fees with Operational Needs

Therefore, it’s essential for startups to not only look at each fee in isolation but also consider how all the monthly fees will accumulate in their specific context depending on their needs and financial operations.

This includes considering the FDIC insurance coverage, which ensures that funds are FDIC insured, adding a layer of security, especially when looking to store maximum funds.

Startups should review and compare the fee structures of different banks to find the most cost-effective solution according to their needs. A startup with high transaction volumes might benefit more from an account with a higher monthly fee but lower transaction costs, mainly if it requires extensive wire transfers and merchant services.

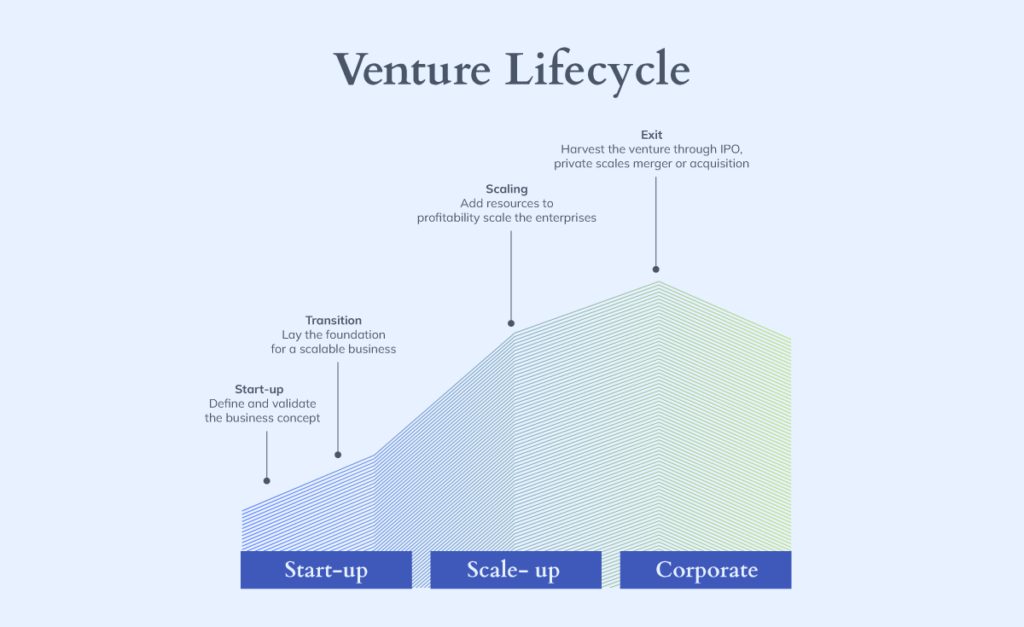

Tip: When comparing banks for startups, it will be helpful to review and analyze the fees according to your financial plan, considering the different stages of development and growth of the startup to define which financial institution will be able to give you more flexibility at each growth stage. This includes considering banks that offer local account details necessary for building relationships with venture capital firms or applying for business loans.

The Impact of International Transaction Fees on Startups

Managing international transaction costs is crucial for startups engaging with global partners and clients. Traditional bank transfer fees and exchange rates can substantially reduce the amount received, with fees often ranging between $10 and $35 and sometimes as high as $75 to $100. This is particularly significant for large transfers, where some payment services charge a percentage of the transaction amount.

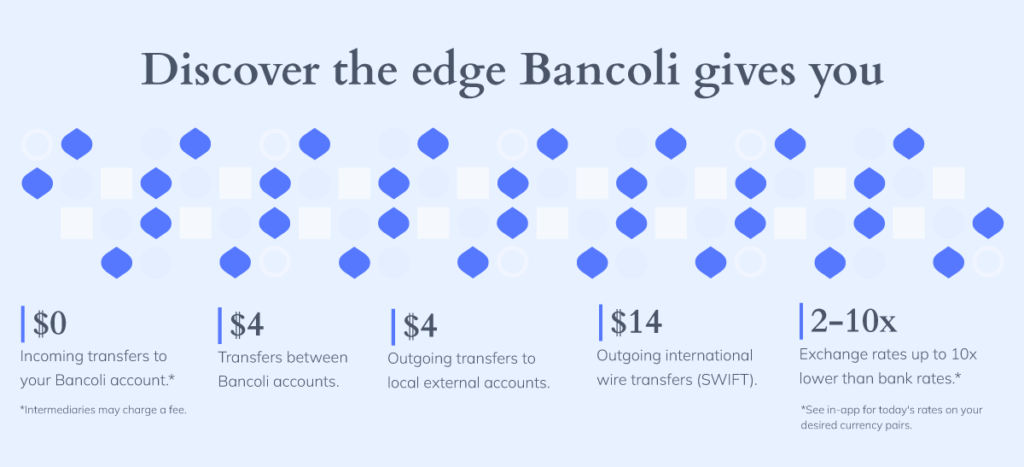

Bancoli addresses this challenge by offering competitive fees and exchange rates, which can be up to 10 times lower than those of other financial services. This cost-effective approach is beneficial for startups frequently engaging in international transactions.

By minimizing expenses associated with cross-border transfers, Bancoli helps startups optimize their financial operations and protect their capital, supporting their growth in the global marketplace.

Managing Finances with Banks for Startups

For startups, selecting the proper bank accounts is pivotal in creating a financial system that boosts cash flow and minimizes debt. This system sets the foundation for current operations and future expansion. This strategy is essential to ensure a startup’s financial health and sustain its upward growth trajectory.

Accelerating Cash Flow for Sustainable Growth

Efficient finance management, involving both immediate stability and long-term growth, is critical. A key aspect is accelerating revenue-based cash flow. Prompt payments reduce reliance on external funding, enhancing the startup’s financial profile.

Accelerating revenue-related cash flow bridges the gap between available funds and income, which is vital for sustainable growth. It builds a positive financial image, showcasing the startup’s ability to operate independently.

Strategic Financial Management to Avoid Debt

Another crucial strategy is to avoid heavy reliance on loans and credit. High-interest rates can significantly consume a startup’s cash flow, impeding organic financial growth.

Utilizing financial solutions that enhance and expedite cash flow is not merely a service but a necessary strategy for startups. These solutions allow startups to operate efficiently with revenue, avoiding debts that could hinder financial progress.

Optimizing Income and Expenditures

Generating and maintaining a steady cash flow is the cornerstone of a startup’s financial health. It involves creating a robust system with optimized income and well-controlled expenditures. This financial equilibrium is critical for startups, enabling them to focus on innovation and market expansion rather than financial constraints.

Building Positive Credit and Attracting Investment

Venture capital firms often favorably view startups with well-managed financials, including those utilizing money market funds and merchant services. Efficient management of business expenses and wire transfers is essential for tax preparation and to build business credit, which is crucial when applying for business loans or applying for investments.

Maximizing Your Startup’s Potential with a Business Checking Account

Previously, we mentioned the key services a checking account can offer a startup, but now we will see how it can maximize its potential in detail. Remember that this type of account facilitates smooth business transactions and is critical in strategic financial planning.

Centralizing Transactions and Streamlining Operations

A business checking account’s primary function is to centralize day-to-day financial transactions. This centralization is essential for processing customer payments, managing payroll, and handling bills efficiently.

Transaction fluidity ensures operational stability by enabling startups to conduct financial activities without limitations.

Tailored Banking Services for Startups

Customized banking services are vital for startups. These services extend beyond essential transaction management to include features like merchant services, which are crucial for managing transactions. Integrating these services with a checking account helps streamline payment acceptance and revenue management.

Cost-Effective Banking and Financial Growth

Cost management is integral for startups, and selecting a business checking account with minimal or no monthly fees is significant. Combining a business checking account with a savings account also creates a more efficient banking experience, aiding financial growth and tax savings.

Building Credit and Enhancing Fiscal Responsibility

A well-utilized business checking account is instrumental in building credit and enhancing fiscal responsibility. It also establishes a positive credit history essential for long-term success.

Leveraging Comprehensive Features for Sustainable Management

Tech startups, known for their dynamic business models, can benefit from leveraging the comprehensive features offered by business checking accounts. These accounts provide the necessary resources for startups to manage their finances effectively.

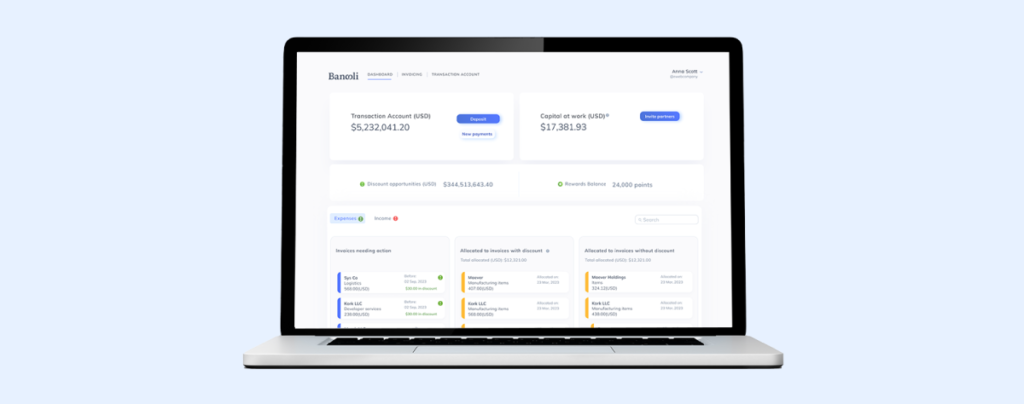

Effective Financial Organization for Startups

Proper financial management involves meticulously tracking all transactions, adhering to a budget, and saving receipts and records. Bancoli offers advanced digital solutions, including a user-friendly dashboard for effective record management, aligning with the needs of modern startups.

Utilizing Multiple Accounts for Clear Financial Management

Using multiple business checking accounts can clarify financial management, distinguishing between operational expenses and other funds. Maintaining separate personal and business bank accounts is crucial for protecting personal assets and providing financial clarity.

Bancoli’s dedicated multi-currency accounts offer startups the flexibility needed for international transactions and operations in multiple markets. This feature streamlines money management and simplifies dealing with foreign currencies.

Engaging with Bancoli brings tailored business banking features and solutions for startups, enhancing financial management capabilities and decision-making. Bancoli’s approach caters to the unique demands of modern startups, offering advanced digital banking platforms.

Utilizing a business checking account effectively is a strategic step toward a startup’s financial health and growth. Startups can ensure their financial management is efficient and aligned with their broader business objectives, paving the way for sustainable success and growth.

Bancoli: Revolutionizing Startup Banking

Bancoli stands out as a transformative force in startup banking, tailored to the distinct needs of emerging businesses. Its innovative approach and comprehensive services are reshaping how startups manage their finances, particularly globally.

Global Reach with Bancoli’s Global Business Account

Central to Bancoli’s offerings is its Global Business Account, which is designed for startups expanding locally and globally. This account can transact and hold funds in multiple currencies, including USD, EUR, GBP, HKD, and SGD.

Startups can also convert funds to JPY, CNY, INR, ILS, and PHP for payouts. Bancoli’s competitive fees and advantageous exchange rates make international payments more accessible and cost-effective.

Innovative Multi-Currency Invoicing and Cash Flow Management

Bancoli is an integrated financial solution that enhances its banking services with multi-currency invoicing tools and cash flow management solutions.

A standout feature that startups and businesses find incredibly convenient is Bancoli’s integrated invoicing tool. It accelerates cash flow by facilitating early payments from clients and reducing the need to think of credits and loans.

Enhanced Security and Insurance in the Post-Banking Crisis Era

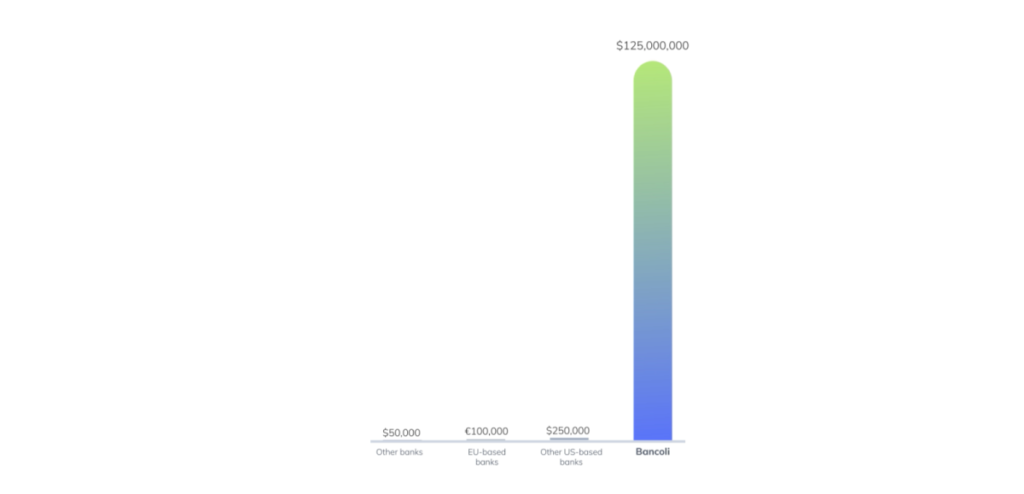

The banking crisis of 2023, highlighted by the failure of Silicon Valley Bank, Signature Bank, and First Republic Banks, underscored the crucial need for secure and well-insured banking solutions. In these uncertain times, funds insurance and immediate access to funds have become paramount concerns for users.

Bancoli, a pioneer in the banking industry, addresses these concerns by offering an innovative approach that extends beyond standard FDIC-insured accounts. Unlike traditional banking practices, Bancoli secures its deposits with short-term federal government notes, a strategy guaranteed by the U.S. Treasury.

This unique feature ensures immediate access to funds for Bancoli account holders, reinforcing the guarantee provided by Bancoli USD Custody. Each dollar is backed by another dollar, elevating the security beyond typical FDIC insurance limits.

Bancoli’s coverage, up to $125 million per account holder, is up to 500 times greater than that typically offered by U.S. banks under FDIC insurance and an astonishing 1,000 times more than the coverage provided by European banks. This translates to unparalleled financial security for startups, ensuring peace of mind even in the changing and unpredictable financial climate.

Bancoli’s Tailored Banking Plans

Bancoli distinguishes itself in the banking landscape by offering premium membership plans thoughtfully designed to cater to the expansive needs of growing businesses. These plans, available at three different monthly fee tiers, embody a commitment to providing top-tier banking solutions. Each tier is crafted to deliver an enhanced suite of features and services, ensuring that businesses at various stages of growth find the exact level of support and functionality they require.

At the forefront of Bancoli’s offerings, these premium plans represent the pinnacle of banking excellence, offering a range of benefits from increased transaction limits to advanced financial tools. They are particularly suited for businesses seeking a banking partner that can grow and adapt with them, providing the necessary resources for scaling up operations.

In addition to these comprehensive premium options, Bancoli also provides a free account plan. This plan is an excellent choice for startups, and small businesses focused on minimizing expenses while still accessing essential banking services.

Give your startup a financial hub that will help it grow, join Bancoli today.

Key Takeaways to When Choosing the Right Business Bank Account for a Startup

- Beyond transactions: A dedicated business bank account isn’t just for managing finances; it’s a strategic move that builds professionalism, legitimizes your business, and lays the foundation for growth and investment.

- Partner, not provider: Choose a bank that understands startups and aligns with your vision. Consider tailored solutions, fees, and expertise that support your specific needs and growth aspirations.

- Streamline operations: Digital platforms often offer advanced tools and automation for faster payments, real-time data, and seamless integration with your existing business tools.

- Build trust and reputation: Partner with a bank that offers secure services and innovative solutions, attracting tech-savvy investors and customers.

- Focus on features: Prioritize security, online banking ease, fast transactions, multi-currency support, and transparent fees. Bonus points for seamless integrations, cash flow access, and dedicated support.

- Savings for the future: Business savings accounts complement checking accounts, boosting your financial security and facilitating goal-oriented savings for future investments.

- Separate, not substitute: Avoid personal accounts and “not a bank” models for business transactions. Maintain clear financial separation for legal and tax purposes and build a credible, professionally-run image.

- Analyze fees strategically: Compare fee structures to find the most cost-effective solution based on your transaction volume and specific needs. Consider future growth stages and adjust your banking partner accordingly.

- Go global and save money: Manage international transactions efficiently with competitive fees and exchange rates.

- Cash flow is king: Prioritize revenue acceleration, fast-tracking payments, and minimize debt to build a solid financial foundation. Focus on optimizing income, controlling expenses, and generating a steady cash flow for sustainable growth.

- Maximize potential with checking: Centralize transactions, leverage tailored services like merchant accounts. Utilize cost-effective solutions to build credit, enhance fiscal responsibility, and manage finances effectively.

Frequently Asked Questions

1. Why is a business account essential for startups?

A business account is essential for startups for several reasons, which are crucial to their growth and financial management:

- Digital banking advantages: With the rise of digital-only banks and financial technology companies, business accounts now offer innovative solutions. These modern banking solutions are particularly beneficial for startups that operate in a fast-paced and digital-centric environment.

- Access to business-specific banking services: They provide access to services essential for business operations, like wire transfers and bill pay.

- Facilitates financial management: Typically they come with features tailored to business needs, such as higher transaction limits and accounting tools.

2. What are the main differences between checking and savings accounts?

A Business Checking Account is vital for startups, handling daily tasks like processing customer payments, managing bills, and payroll. It’s designed for frequent transactions, offering the necessary flexibility for startups’ operational needs.

On the other hand, a Business Savings Account focuses on long-term goals, aiding in financial planning and security. It’s vital for startups planning for future growth and boosting idle funds with interest. This account type is about strategic saving and financial preparation for the future.

3. What are the benefits of using a digital banking platform over a traditional bank for startups?

Digital banking platforms offer more specialized and flexible services than traditional banks, tailored to the dynamic nature of startups.

They provide innovative tools like integrated accounting software, automated payment systems, and advanced security features. These platforms often have user-friendly interfaces and enhanced accessibility, vital for startups in a fast-paced environment.

Bancoli’s Global Business Account features tangible benefits to startups. Such as robust security measures to protect financial transactions and easy tracking of multi-currency accounts and international payments.

4. What should startups consider when choosing between different types of accounts?

Startups should consider the operational needs of their business when choosing between different types of accounts. A business checking account is suitable for handling frequent transactions and day-to-day activities, while savings accounts help build emergency funds or save for future investments. Analyzing the fee structure, such as transaction and monthly maintenance fees. Looking for accounts with low minimum balance requirements are also important considerations.

5. What is FDIC insurance?

FDIC insurance, is a U.S. government protection for depositors against the loss of their insured deposits if an FDIC-insured bank or savings association fails. Each depositor is insured to at least $250,000 per insured bank, for each account ownership category.

This insurance covers various deposit accounts like checking and savings accounts, money market deposit accounts, and certificates of deposit (CDs). However, it doesn’t extend to investment products such as stocks, bonds, mutual funds, life insurance policies, or annuities.

The essence of FDIC insurance lies in offering depositors peace of mind, ensuring they don’t lose their money if their bank fails. It also contributes to the stability of the banking system by preventing bank runs. Importantly, this protection comes at no cost to depositors since banks pay premiums to the FDIC.