Global markets are becoming increasingly volatile, leading to disruptions in supply chains. This makes it difficult for traditional supply chains to keep up with changing consumer demands. Manufacturing companies and their suppliers must move beyond ensuring their supply chains function and focus on building high-performance supply chains.

High-performing supply chains are agile, enabling them to adapt to changing circumstances. They also achieve end-to-end visibility for informed decision-making and foster a collaborative approach throughout the network.

Regular supply chains focus on stability and keeping costs low. High-performance ones, however, prioritize innovation, resilience, and anticipating market changes.

What is a High-Performance Supply Chain?

High-performance supply chains, also known as HPSCs, are strategically designed networks. These networks combine processes and technologies to maximize value for end customers and boost organizational competitiveness. Let’s explore some of the most relevant components in a HPSC.

Resilience in Supply Chain Management

Resilience is the supply chain’s ability to withstand major disruptions, such as natural disasters or geopolitical tensions. Normally it recovers rapidly, and adapt to emerge even stronger.

Effective supply chain management involves the deployment of resources of business processes to enhance the resilience of the supply chain.

This includes the ability to convert raw materials into finished products or services efficiently, despite unforeseen challenges. Ensuring the continuity of order management is paramount for companies looking to thrive in volatile markets. This allows them to maintain an uninterrupted flow of inventory.

Agility Through Advanced Logistics and Collaboration

In the supply chain, agility is key. It’s the ability to react quickly to changes in supply, demand, customer needs, and new market opportunities.

This level of responsiveness necessitates the integration of smart warehousing technology and collaboration with multiple partners. A well-designed supply chain model supports this agility, allowing for the seamless adaptation to changing industry demands.

Companies aiming for a competitive edge understand the importance of adapting logistics strategies quickly in response to market changes.

Scalability and the Importance of Flexible Operations

A scalable supply chain is one that can effortlessly adjust its operations, either increasing or decreasing its capacity. This allows the company to respond to market changes and growth.

With effective chain management, a company can flexibly adjust production volume, either increasing or decreasing output. This allows them to maintain efficiency and avoid excessive costs.

This involves strategic planning around the use of resources, inventory management, and the engagement of manufacturers.

Sustainability: Economic Profitability and Environmental Responsibility

Sustainability focuses on the dedication to both economic profitability and minimizing environmental and social impacts throughout the supply chain’s lifecycle.

Sustainable supply chain management prioritizes practices that minimize waste and optimize raw material usage. This includes implementing eco-friendly logistics solutions.

By doing so, it contributes positively to the environment and also aligns with increasing consumer demand for responsible business practices.

Customer-Centricity in Supply Chain Design

Customer-Centricity involves a deep understanding of customer needs and a focus on exceeding expectations in areas such as product availability, delivery speed, and customization.

This aspect of supply chain management emphasizes the importance of designing supply chains that are responsive to the end-user’s requirements.

It requires effective order management systems, the capability to swiftly convert raw materials into the final product or service, and a logistics network designed to deliver these products to the customer at a later date without delay.

Role of High-Performance Supply Chain Financing

Strong financial footing is essential for exceptional supply chain performance. This foundation can be achieved through advanced supply chain financing (SCF).

Traditional SCF focuses on optimizing working capital and streamlining payments. High-performance SCF, on the other hand, leverages cutting-edge technology to provide real-time insights beyond those basic functionalities.

This capability empowers financial managers to make informed decisions that bolster the supply chain’s agility and resilience. By fostering strong partnerships with key suppliers, high-performance SCF ensures the health of the financial supply chain. With this it maintains a steady flow of products or services without interruption.

This approach not only secures the necessary resources from manufacturers but also positions the financial supply chain as a strategic asset for the company.

With high-performance SCF, businesses can adapt quickly to changes in supply and demand, invest in innovation, and navigate the challenges of the industry more effectively.

Challenges Hindering Optimal SCF Performance

Even with the best intentions, many businesses, including those involved in supply chain management and supply network activities, face obstacles that prevent them from fully optimizing their supply chain financing (SCF). Some of the most prevalent challenges include:

Working Capital Constraints

Traditional supply chains, including typical supply chain models, often lock up working capital, putting a strain on a company’s ability to invest in growth initiatives or respond quickly to market opportunities with competitive products and services.

Insufficient cash flow, crucial for managing supplier relationships and converting raw materials into final products, can also increase vulnerability to supply chain disruptions affecting manufacturers, distributors, and end users.

Outdated Financing Methods and Lack of Technology Adoption

Many companies, across various supply chains, still rely on manual processes, legacy systems, and a limited understanding of the latest financing options.

This lack of tech integration hinders real-time visibility into cash flow dynamics and limits the ability to make data-driven financing decisions, impacting supply chain performance.

Siloed Decision-Making and Poor Supplier-Buyer Collaboration

When finance, procurement, and supply chain teams operate in isolation, financing decisions lack the strategic perspective to maximize supply chain performance.

Furthermore, a lack of trust and information sharing between buyers and suppliers, critical parties involved in supply chain activities, creates inefficiencies and hinders the exploration of mutually beneficial financing arrangements.

Finance stakeholders play a pivotal role in overcoming these challenges. By recognizing the interconnectedness of supply chain health and financial performance, they can champion collaborative initiatives, technology adoption, and innovative financing solutions.

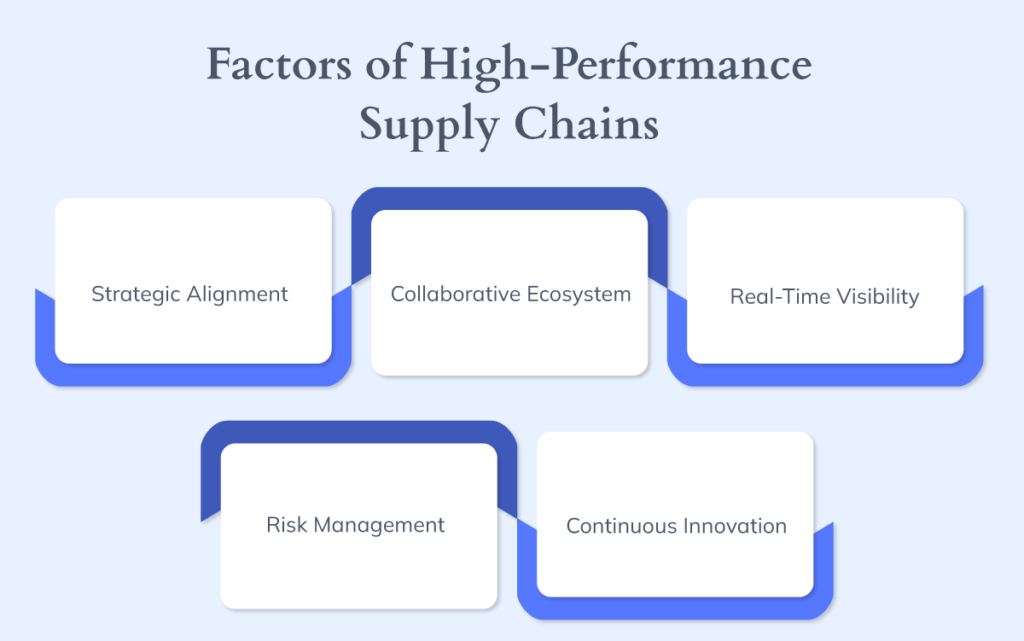

Key Factors of High-Performance Supply Chains

High-performance supply chains (HPSCs) serve as strategic amplifications of a company’s overarching objectives, spotlighting the critical role of supply chain management (SCM). Several defining features distinguish these advanced networks:

- Strategic Alignment: Beyond mere operational frameworks, HPSCs are deeply integrated with a company’s strategic vision. They leverage supply chain models and SCM methodologies to harmonize with the company’s wider goals, with key performance indicators (KPIs) directly reflecting these objectives.

- Collaborative Ecosystem: HPSC’s foundation lies in the strength of its partnerships. These ecosystems drive mutual benefits by fostering a culture of trust and open communication with suppliers and customers. This synergy enhances delivery and product quality, expands market share, and compresses product development timelines.

- Real-Time Visibility: Leveraging cutting-edge analytics, HPSCs ensure transparency across the supply chain. This level of insight is pivotal for preventing disruptions and optimizing performance, embodying the essence of adept supply chain management.

- Risk Management: Vigilance against potential setbacks—from logistical hiccups to global crises—is integral. Through early detection and strategic planning, HPSCs maintain their resilience, ensuring they can always meet customer needs. Tools like Bancoli’s KYV verification help to simplify and make this critical task efficient.

- Continuous Innovation: Contentment with the status quo is foreign to HPSCs. Constantly looking for novel technologies and methodologies, HPSCs are at the forefront of innovation, continuously refining and evolving their practices, helping the manufacturing industry to transform.

The Building Blocks of a High-Performance Supply Chain

Building a high-performance supply chain demands a strategic approach.

This requires thoughtful investments in technology that empower data-driven decision-making, building a skilled team that thrives on analysis and collaboration, nurturing a culture that embraces innovation, and ensuring financial agility that allows the supply chain to respond to opportunities and overcome challenges.

Technology Adoption

Integrated technologies like supply chain analytics, predictive modeling tools, and automation support data-driven decision-making and streamline operations, essential for managing complex supply networks and manufacturing processes.

Talent Development and Organizational Culture

An effective supply chain relies on a workforce with the skills to analyze data, and manage risks across different functions. Investing in attracting, developing, and retaining these talented individuals is vital for successful supply chain processes.

A culture that embraces innovation, efficiency, and collaboration across all levels of the organization is crucial for the success of supply chain activities and the overall business.

This approach ensures that every member of the organization contributes to its success. It fosters an environment where continuous improvement and innovation are not just encouraged but are integral.

Financial Agility

Embracing high-performance supply chain financing solutions to optimize working capital, mitigate financial risks within the supply chain. Therefore, it enables strategic investments for growth and resilience is crucial for business success.

Measuring Supply Chain Performance

The true measure of a supply chain’s effectiveness extends beyond operational functionality. This is gauged by its consistent delivery of value and fulfillment of customer demand.

An effective approach to assessing supply chain performance encompasses more than known metrics. It involves a comprehensive evaluation of performance indicators that afford businesses a complete understanding of their supply chain’s capabilities.

Through diligent monitoring of these metrics, organizations can discern areas necessitating enhancement, strategically allocate resources, and, in doing so, transform their supply chain into a high-caliber operation.

- Delivery Performance: Measures such as a perfect order fulfillment rate and delivery cycle time provide valuable insights into how well customer expectations are met.

- Inventory Management: Balancing stock levels to meet demand without overstocking is crucial, with metrics like inventory turnover ratio and days of supply helping gauge inventory efficiency.

- Cost Management: Tracking all costs associated with the supply chain, including procurement, transportation, warehousing, and inventory carrying costs, is essential for identifying areas for cost optimization and enhancing supply chain performance.

- Agility and Responsiveness: The ability of the supply chain to adapt to disruptions or changing market dynamics is critical, with lead time variability and response time to customer inquiries serving as good indicators of agility.

- Collaboration and Visibility: Assessing the strength of partnerships with suppliers and the level of information transparency within the supply chain is vital for effective supply chain management, impacting the overall success of the company and its ability to meet customer demand and manage costs effectively.

- Sustainability: Environmental and social responsibility are increasingly important aspects of supply chain performance. Track metrics like carbon footprint of transportation and ethical sourcing practices to measure your sustainability efforts.

Integrating Key Terms into High-Performance Supply Chain

High-performance supply chains (HPSCs), the integration of various terms such as supply chain management, supply chain processes, food supply chain, and others, is essential.

These terms represent the vast components and considerations necessary to create and maintain a supply chain that meets customer demands.

- Supply Chain Management (SCM): Encompasses the strategic planning and management of all activities involved in sourcing, procurement, conversion, and logistics management. SCM also involves the crucial task of coordinating and collaborating with channel partners, which can be suppliers, intermediaries, third-party service providers, and customers.

- Supply Chain Processes and Activities: Include managing supplier relationships, order management, process management, and converting raw materials into finished products that meet customer demand.

- Supply Chain Performance: Measures such as customer satisfaction, lower costs, improved efficiency, and increased visibility are vital metrics for assessing the effectiveness of a high-performance supply chain.

- Supply Chain Disruptions: Identifying potential disruptions, such as natural disasters or geopolitical tensions, and planning for resilience and quick recovery is a hallmark of high-performance supply chains.

- Supply Chain Visibility and Analytics: Provide the necessary data and insights to effectively manage the supply chain, anticipate customer demand, and make informed decisions.

Supply Chain Financing Strategies

High-performance supply chain financing goes beyond basic optimization. Expert supply chain professionals can leverage sophisticated SCF methods to gain a competitive advantage, boost efficiency, and increase supply chain resilience with robust strategies.

Dynamic Discounting Models

Traditional supply chain financing involves suppliers receiving early payments on their invoices in exchange for a discount. Dynamic discounting goes further by offering a sliding scale where discounts vary depending on how early payment is made.

This provides both buyers and suppliers with greater flexibility in managing their cash flow needs. Additionally, dynamic discounting platforms often integrate with other financial tools. This can streamline the entire process and providie valuable real-time data on working capital metrics.

This approach is beneficial for supply chain management, allowing companies to manage supplier relationships more effectively. It can also improve efficiency, and cut costs within the supply network.

Risk Assessment and Mitigation

Incorporating risk assessment tools into SCF decisions is essential for maintaining the financial health along the supply chain.

Different SCF platforms offer features to analyze supplier financial data, track market trends, and identify potential disruptions. By proactively assessing risk factors, more informed financing decisions can be made, helping to efficiently implement strategies to mitigate financial vulnerabilities.

Global Supply Chain Financing Considerations

When dealing with international supply chains, factors like currency fluctuations, regulations, and trade complexities come into play.

Specialized SCF solutions can help navigate these challenges. This includes financial solutions that support multicurrency accounts, like Bancoli’s Global Business Account, enabling cross-border transactions.

At the same time, understanding local regulatory requirements and working with partners who have regional experience is crucial for successful global SCF implementation.

This global perspective is essential for companies operating in different supply chains, enabling them to efficiently manage the logistics of converting raw materials into a final product or service for the final destination, while having better visibility on inventory, costs, and industry regulations.

Bancoli: Your Partner for Achieving a Global High-Performance Supply Chain

For businesses ready to transition from good to exceptional in their supply chain operations, Bancoli and its Global Business Account, coupled with its cash flow management and electronic invoicing features, provides a seamless, efficient, and globally-oriented financial backbone.

Unmatched Multicurrency Financial Agility

Bancoli’s Global Business Account stands as a cornerstone for businesses striving for a high-performance supply chain. Its multicurrency account holds USD, GBP, EUR, SGD, and HKD, supporting payouts in BRL, JPY, CNY, PHP, and INR. Bancoli addresses the challenges of currency fluctuations and cross-border transactions head-on.

Efficient and cost-effective global transfers have become a reality, enabling businesses to navigate the complexities of international supply chains.

Enhanced Cash Flow Management

Bancoli’s innovative cash flow management tools offer a real-time overview of financial positions, crucial for making informed decisions swiftly.

This feature aligns perfectly with the dynamic needs of a high-performance supply chain.

Streamlined Electronic Invoicing

Bancoli revolutionizes the invoicing process by offering advanced electronic invoicing capabilities. These features not only refine payment procedures but also bolster operational efficiency.

More than just an efficiency upgrade, this approach enhances collaborative partnerships with essential suppliers. It plays a pivotal role in maintaining their financial stability and ensuring a steady supply chain flow. Bancoli’s integration into the supply chain financial (SCF) landscape exemplifies how innovative financing solutions can underpin a high-performance supply chain.

Conclusion

In an increasingly volatile global market, high-performance supply chain financing is a strategic lever that drives competitive advantage.

High-performance SCF unlocks significant liquidity and improves overall financial health by optimizing working capital, strengthening financial positions across your supply chain, and building a more resilient network.

Supply chain and finance experts should thoroughly evaluate their current SCF programs with a focus on the advanced strategies discussed above, seeking opportunities to enhance efficiency, mitigate risk, and adapt to the unique demands of global trade.